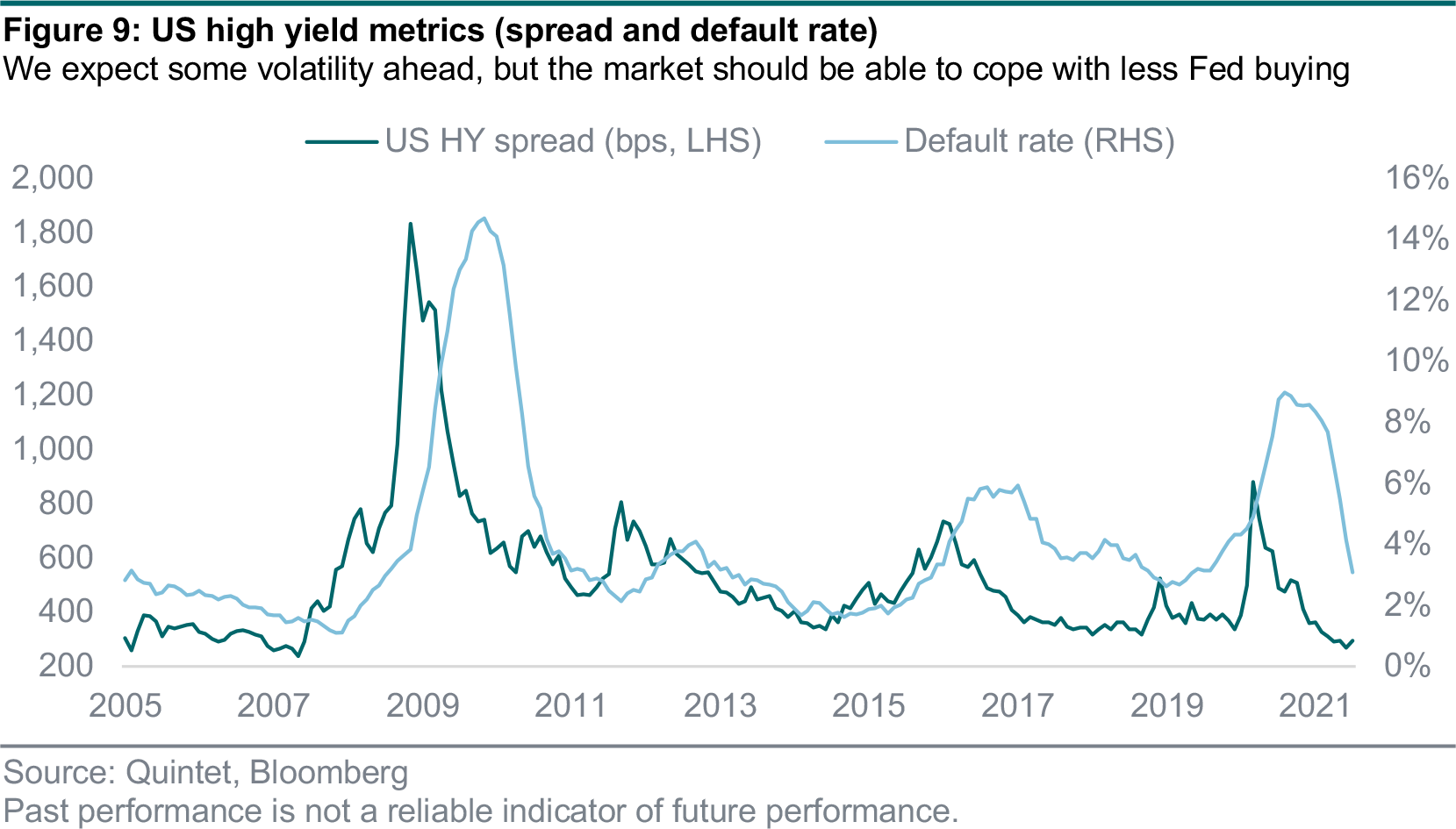

There are plenty of reasons to see the glass half full rather than half empty. In our view, there’s no specific argument leading to a huge selloff in the credit market. But, even if we don’t expect credit spreads to widen substantially, we expect much more volatility ahead. Moreover, despite positive fundamentals and technical factors, spreads have very limited potential for further tightening as well. We should be in a range-bound period until the end of the year, with relatively resilient high yield markets.

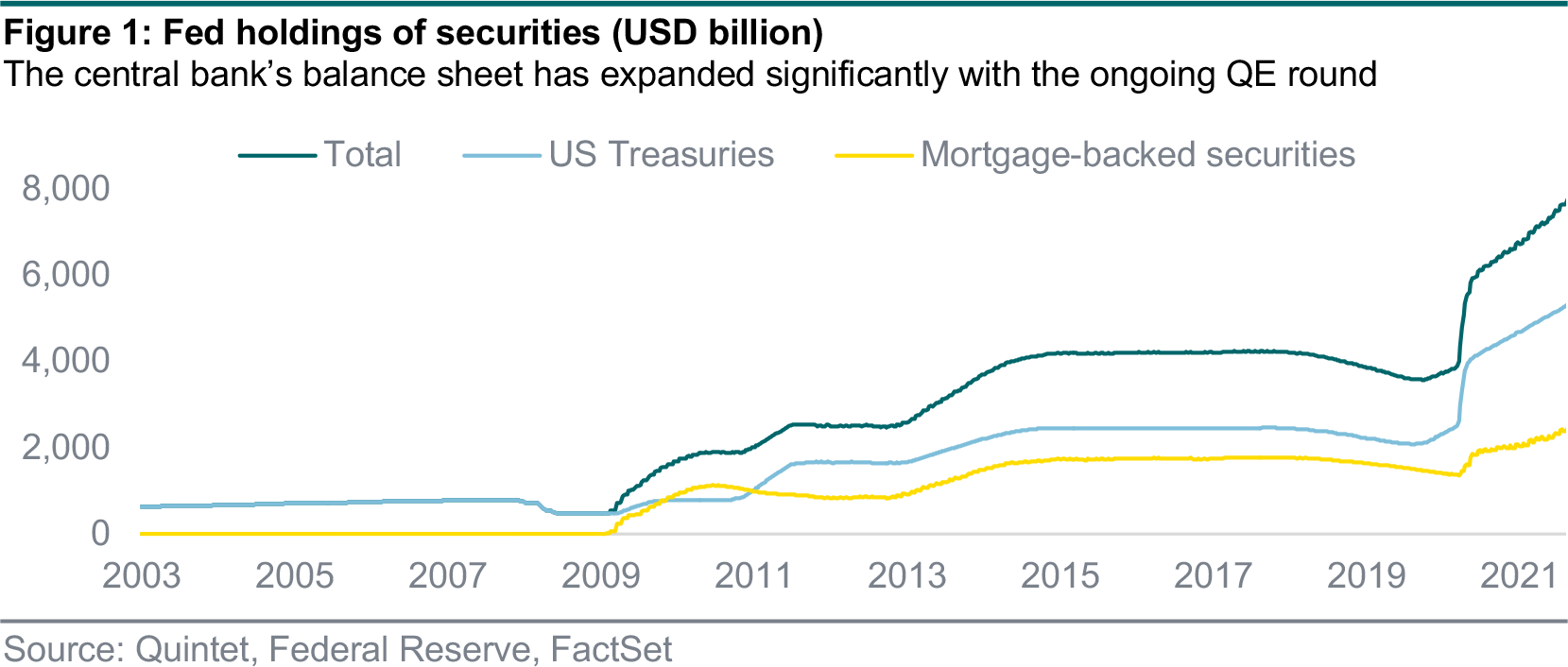

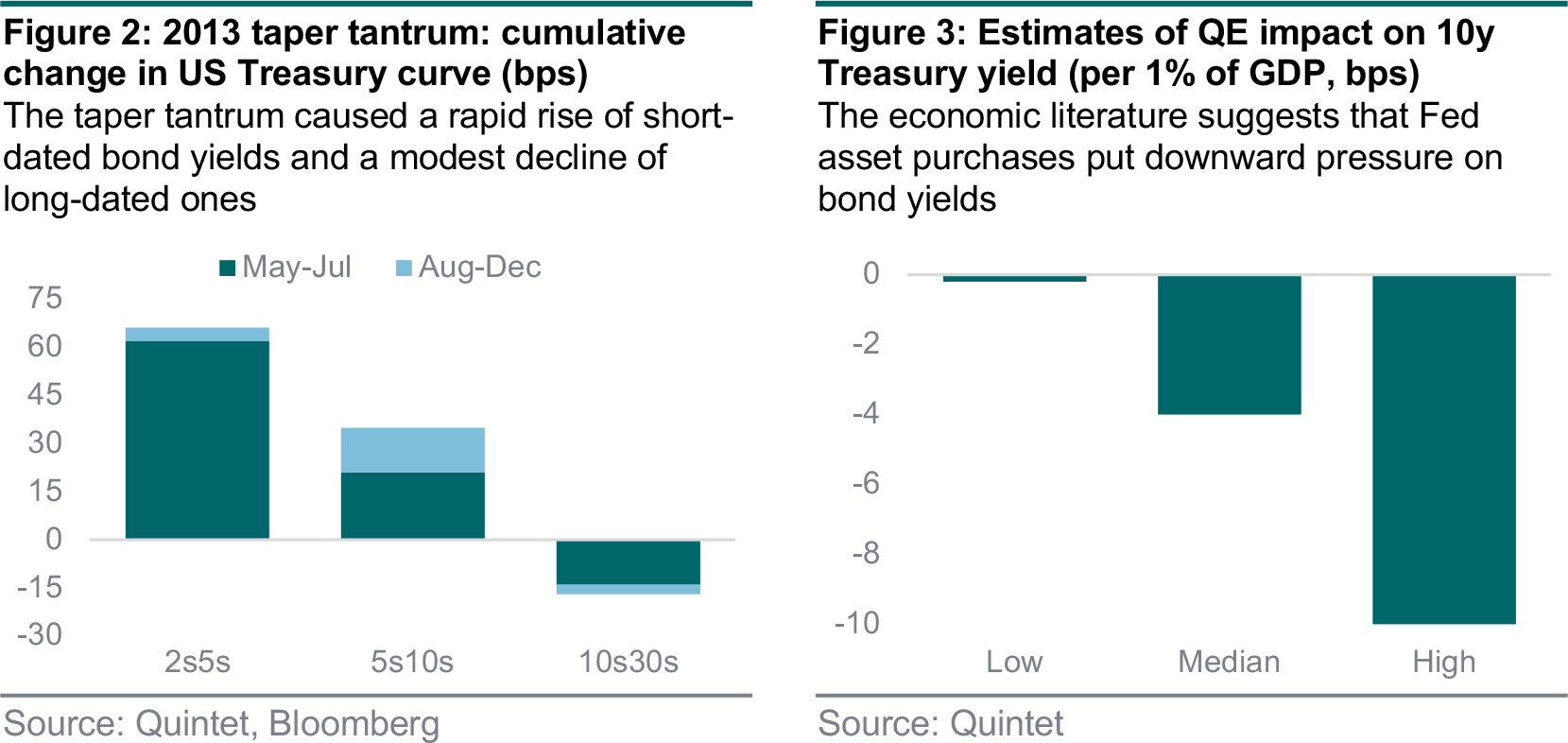

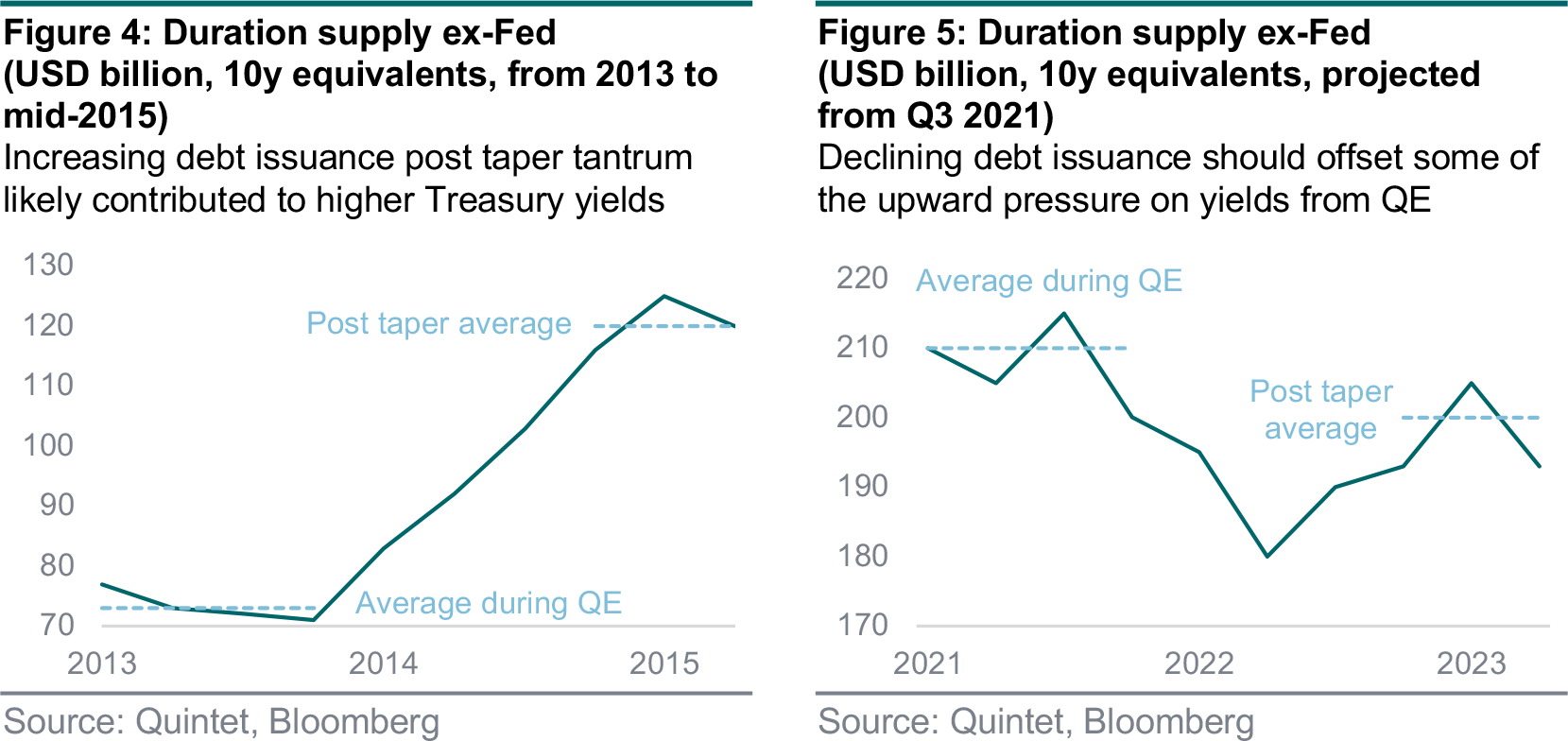

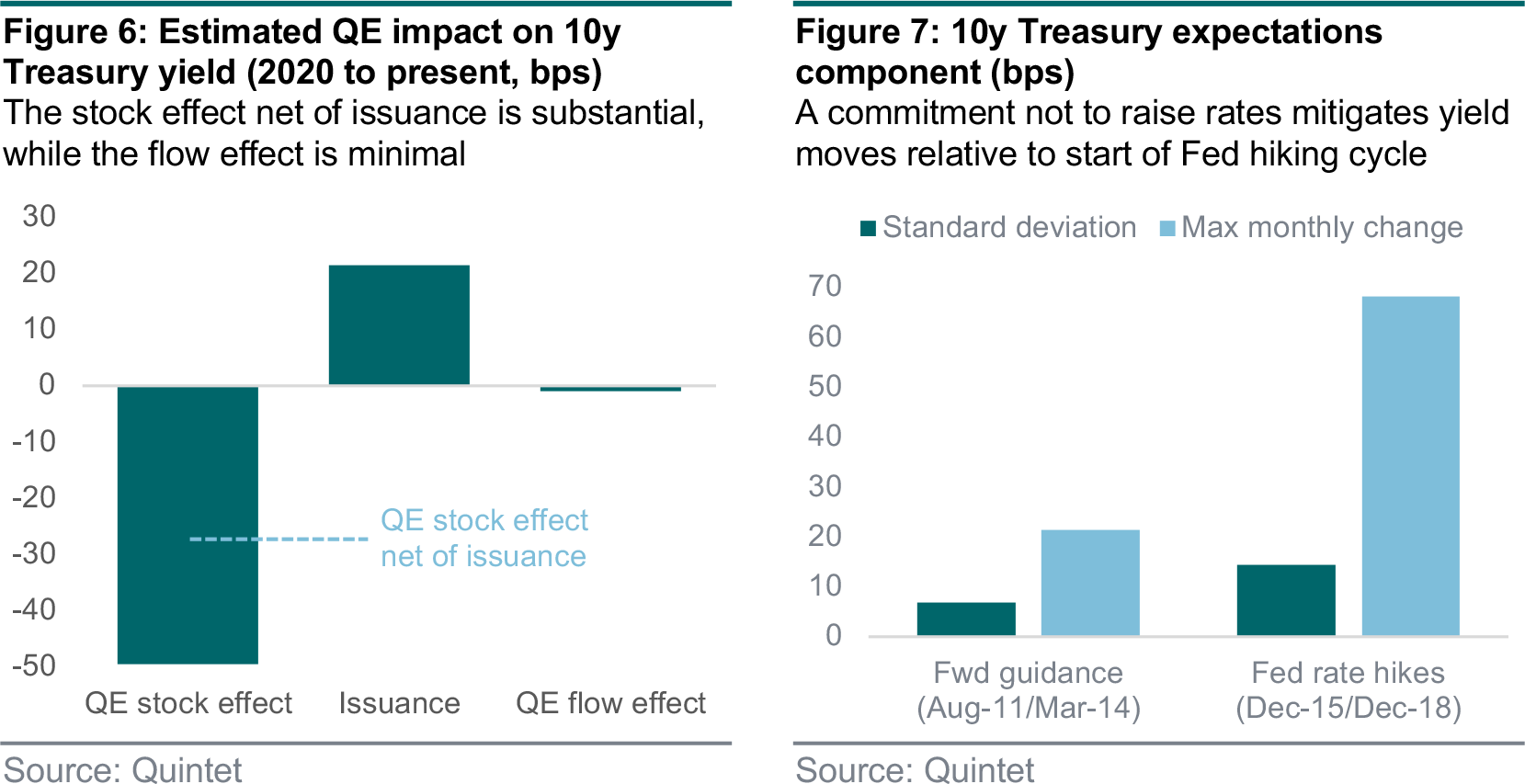

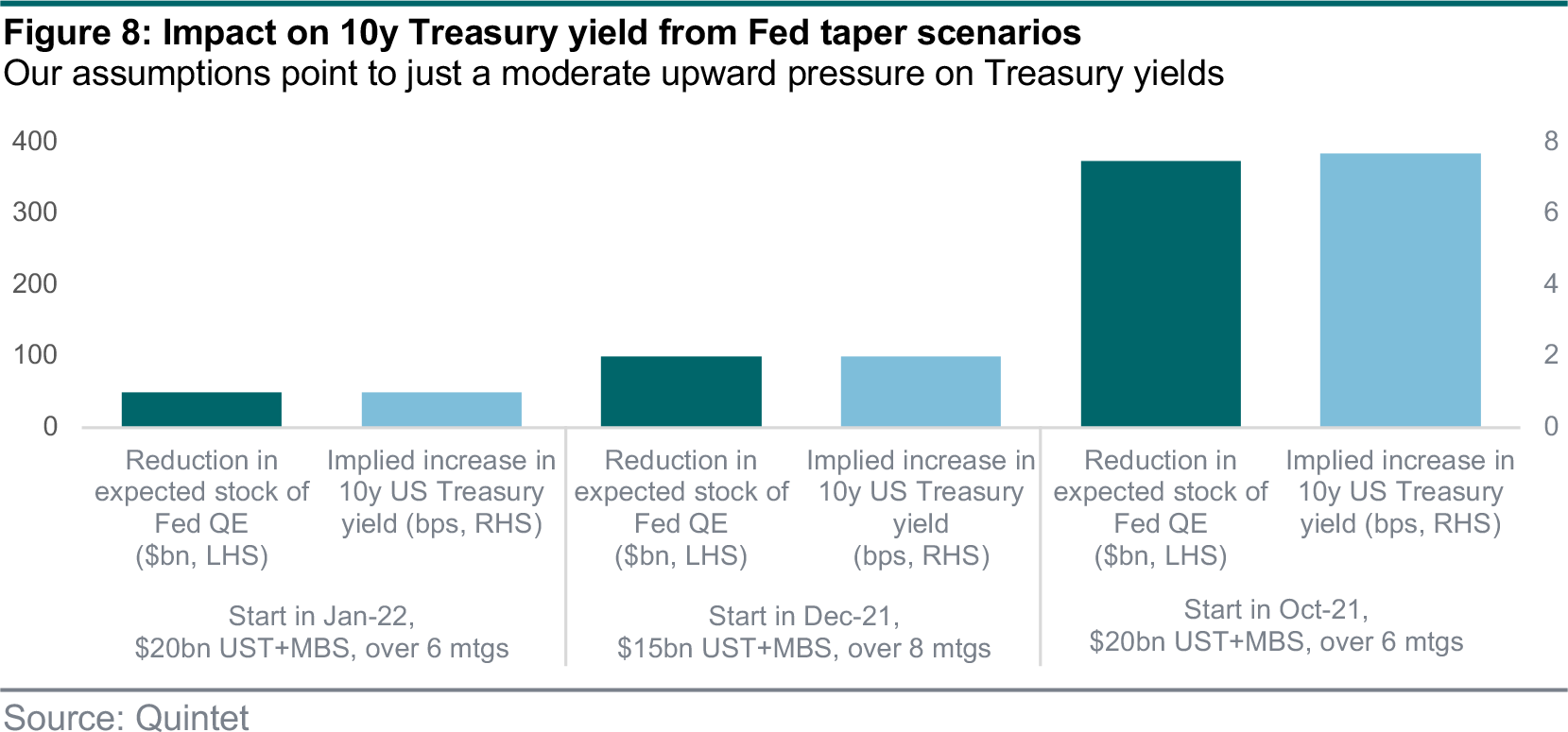

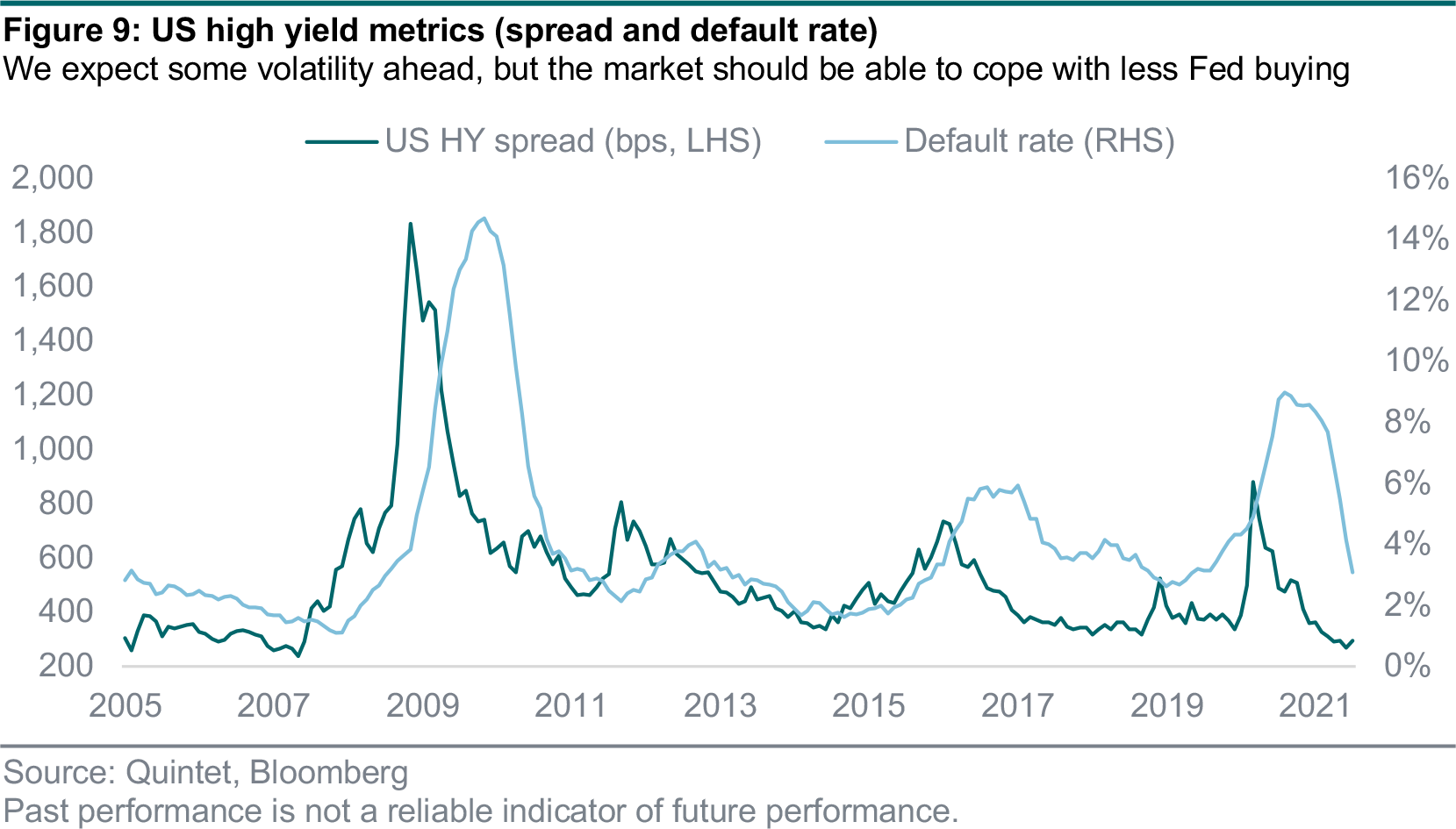

Tapering doesn’t mean ending central bank support. Rather, it’s the gradual slowing in the pace of large-scale asset purchases. This means the Fed is likely to continue to buy (via reinvestment) and support the economy. In contrast to 2013, when Bernanke (then Fed Chair) gave the first signal that a taper was forthcoming, the Fed has been preparing markets with frequent and more targeted communication to avoid a taper tantrum.

Corporate balance sheets have improved. Companies issuing US high yield debt have reduced leverage much more impressively than those issuing investment grade debt, despite experiencing a much larger decline in EBITDA (earnings before interest, taxes, depreciation and amortisation) during the Covid-19 crisis and similar EBITDA growth since. Most investment grade companies have decreased net leverage due to relatively high cash levels, but it’s too early to exactly know what they will do with their large cash positions – especially if potentially attractive M&A opportunities were to emerge.

High yield companies’ EBITDA fell dramatically in the third quarter of 2020, while the fall in investment grade came the next quarter. However, credit markets have been quite resilient, partly thanks to the stimulus measures put in place by the US government, so the impact of the declines in both revenues and EBITDA turned out to be quite manageable (given the circumstances).

Additionally, the pain was relatively short-lived: during the first quarter of 2021, EBITDA growth rebounded. That volatility is rather normal in the high yield segment, which is smaller, less diversified, and often with a high weight in cyclical sectors – implying a lower rating.

One reason for this trend is the evolution of the US high yield universe. Following the defaults of the past year or so, quite a few of the most highly leveraged names have been removed while, at the same time, more than USD 260 billion of ‘fallen angel’ paper has increased the overall quality of the index. The global corporate default rate has now returned to pre-pandemic levels. And the number of corporate defaults remains low this year, reflecting strong economic activity and abundant market liquidity (figure 9). We expect this trend to continue over the coming months, likely resulting in ultra- low default rates.

It’s not only fundamentals that are supporting the market – some technical factors are too. Issuance levels are robust for investment grade credit and at record-high levels for high yield. Issuers have anticipated that the Fed may taper its asset purchases, and so they have frontloaded their issuance plans, leading to lower supply for the rest of the year.

The Fed’s bond-buying programme is quite different from the ECB’s, which bought a large part of the market as well but not as much as the Fed – which opened the door to high yield ETFs and fallen angels. The Fed also had the benefit of an ‘announcement effect’ rather than just purchasing actively in the broad market.

Of course, valuations are tight for both markets, but we don’t expect a huge selloff as long as our macro scenario stays constructive. For us, the main driver of much higher spreads isn’t tapering, but renewed and long-lasting lockdowns in key countries, inflation fears, trade tensions and geopolitical instability. Even though we incorporate some of these factors into our baseline, they remain tail risks.