WHY WE STAY INVESTED

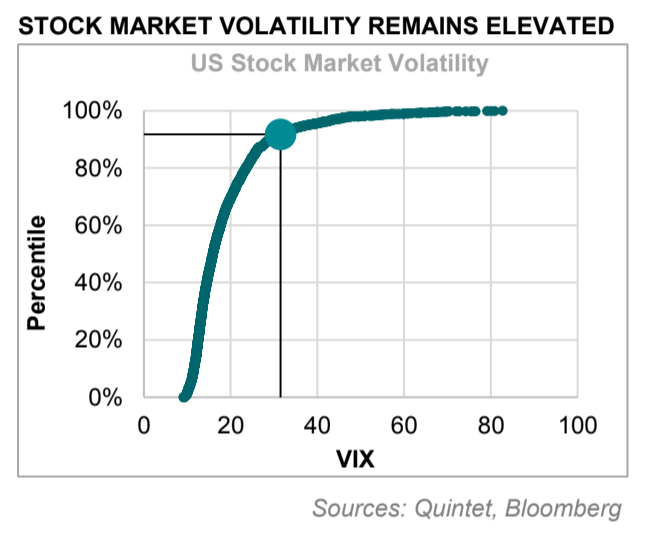

There’s no shortage of worries for investors at the moment, as shown by the recent gyrations of tech stocks and the fact that stock market volatility remains higher than more than 90% of the observations in our database. These concerns range from a variety of political risks now approaching – such as the US elections and the Brexit negotiations – to a sense that the perceived “disconnect” between buoyant risk markets and a more sluggish economy is finally beginning to close, with markets catching up with a more challenging reality.

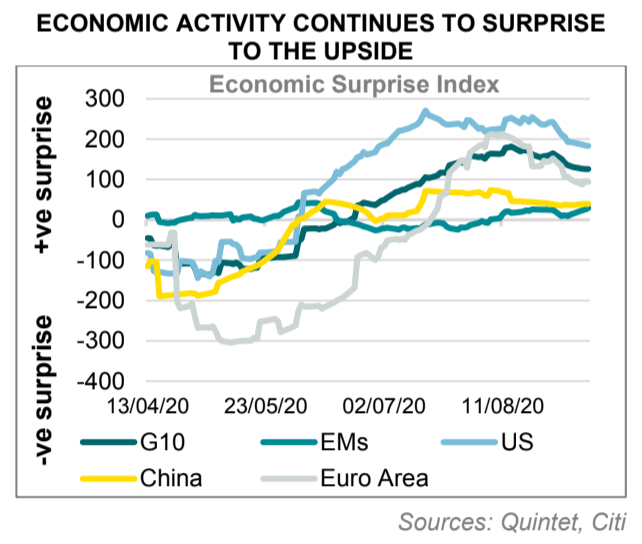

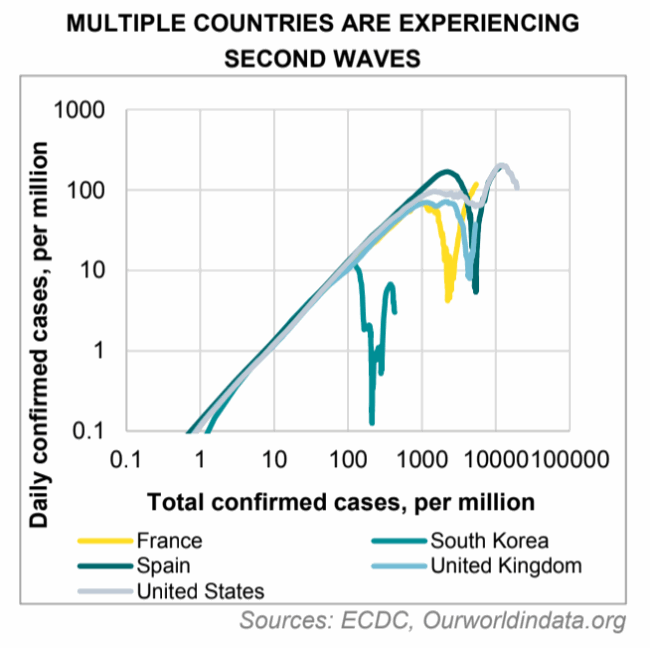

Our view differs in several respects. First, we believe our U-shaped macro outlook is on track, underpinned by the combo of monetary/fiscal stimulus feeding through and medical research eventually delivering a solution to deal with Covid-19 – with progress in sight over the next few months. The data continues to surprise to the upside, although forecasts are adjusting to better-than-expected figures and the initial snapback in growth will likely prove difficult to maintain.

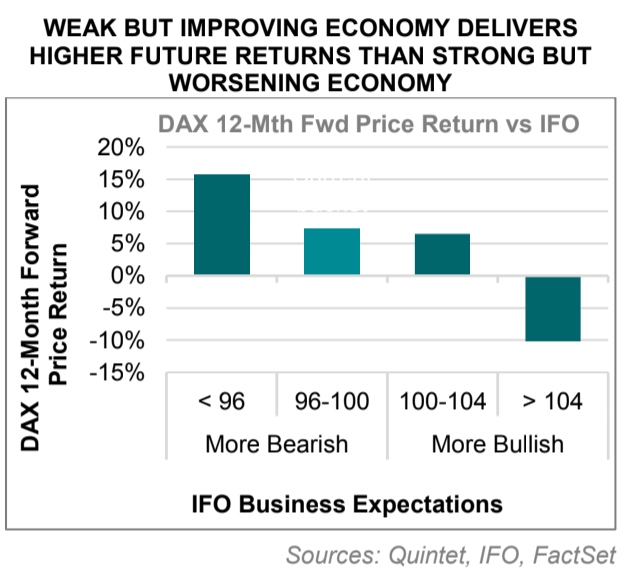

These positive macro surprise trends also support earnings expectation trends, which are showing positive revisions and therefore recovering. Financial markets are forward-looking and influenced more by the coming change to growth than the current level of growth. So, for market participants, the economic improvement, even if from a weak starting point, is more important than the actual level of activity.

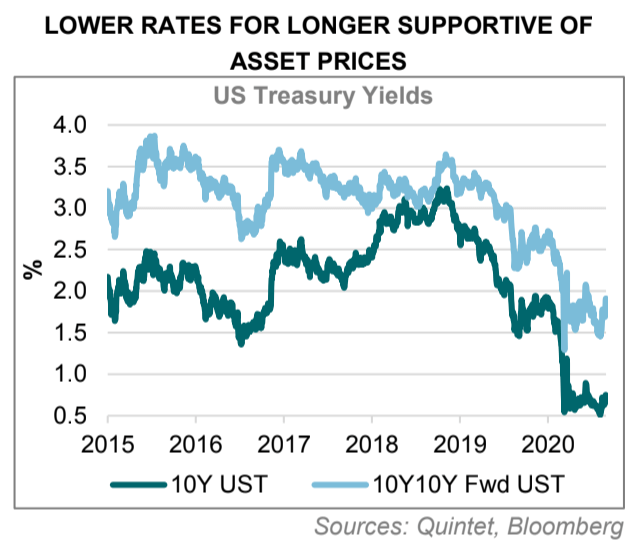

The second point has to do with one of the key long-term legacies of the Covid-19 pandemic: very high debt levels across the world. Coping with such an unprecedented economic and fiscal burden requires governments being able to fund at affordable costs. The response of central banks turned out to be the typical one: negative real interest rates across the yield curve for a long time.

It’s unsurprising to us that markets now expect US Treasury yields to stay very low well into the 2030s. Whether this approach creates consumer price inflation over the medium term is an open question. But lowering the discount rate applied to risk assets is likely to boost their present value. Therefore, a likely outcome is asset price inflation.

One of the unusual things about this crisis is how uncertainty is distributed over time. Typically, the further out into the future one looks, the more uncertain the outlook becomes. However, it’s now the other way around: although the timing of a medical breakthrough is hard to forecast, this upside scenario does exist and becomes more likely as time goes on. This is important because major crises tend to be buying opportunities for long-term investors who look through near-term “despair”.

Once Covid-19 is contained, the economy is likely to shift from its current economic “repair” phase to outright “expansion” – as activity resumes more fully. This is why we remain invested in financial markets, and within our equity exposure continue to seek structural themes that benefit from strong secular trends that are likely to be rewarded over the longer term.

OUR TACTICAL ASSET ALLOCATION IN A NUTSHELL

Tactically, our asset allocation is moderately overweight risk, combined with select portfolio diversifiers:

- Overweight equities, with a preference for US markets (via our overweights to the technology and healthcare sectors) and emerging market (EM) equities – also in line with our weak US dollar call, which should benefit US exporters and EMs.

- Overweight credit, with a preference for euro high yield and EM sovereign hard currency bonds.

- Overweight select portfolio diversifiers, namely gold, US Treasuries and the Japanese yen.

- Underweight core sovereign markets, such as euro government bonds and UK gilts.

WHAT’S IN THE PRICE?

Of course, our investment strategy won’t work if the market were overly optimistic about the macro outlook and it’s now correcting to catch up with a more sluggish pace of growth than expected earlier. However, we don’t think this is the case.

Here’s why:

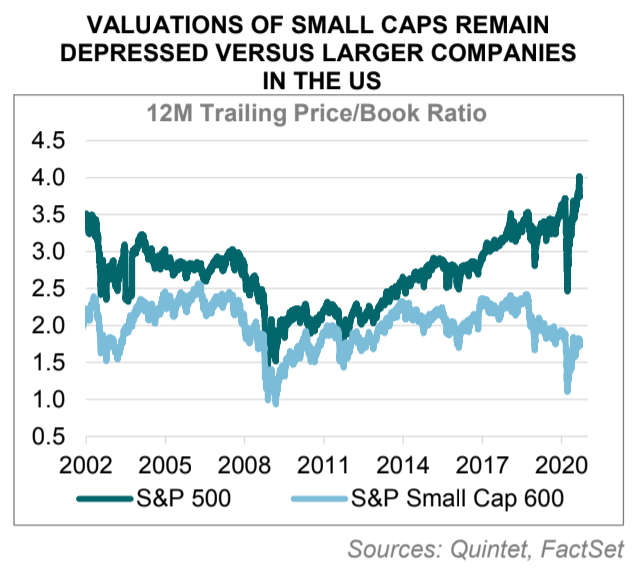

If markets were pricing in a V-shaped economic recovery, then demand for smaller, more cyclical businesses should be strong. But this isn’t happening. Rather, markets seem rather sceptical across all time horizons. For example, valuations for mid-caps versus large, global companies are below average. Similarly, low-quality stocks remain cheap versus high-quality stocks, and arguments like these do apply also for value versus (our currently preferred) growth stocks and for cyclicals versus defensives.

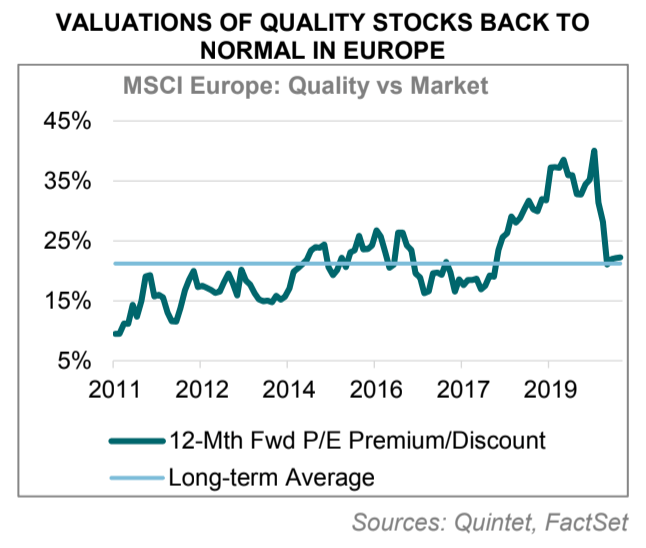

These dynamics are mostly playing out in the US. This is because the composition of its equity markets – which enjoy a far greater weighting to technology and healthcare – is very different from the composition of GDP. The Covid-19 crisis has accelerated the shift to digital from physical, supporting companies that typically exhibit high margins, low capex and higher long-term growth rates. The difference between equity market and GDP composition, and the equity market’s “overweight to the winners” from Covid-19, partly explains the apparent “disconnect” between strong equity markets and the economic data. In Europe, where the technology sector is much smaller, quality stocks relative to the overall market appear valued in line with the long-term average.

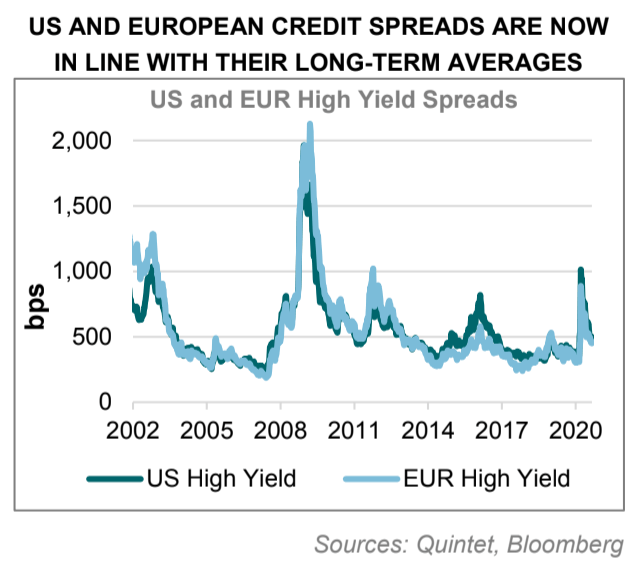

Credit spreads have tightened from the worst of the crisis, both in the US and Europe. However, we think that the discount for lower-quality credit instruments should be lower if markets were really expecting a solid comeback in growth, while they’ve simply come down to average levels. The spread tightening, directly for investment grade and indirectly for high yield, likely reflects the quality and quantity of monetary stimulus – which is very large and partly providing direct support to credit markets – along with its fast speed of deployment and central-bank commitment to continue for a long time.

DE-RISKING NOT A GOOD STRATEGY RIGHT NOW

Our analysis doesn’t deny that there are risks and uncertainties out there. We’ve written extensively on the upcoming US elections, trade tensions and emerging markets, just to name a few. However, we believe in managing these risks in the context of well-diversified portfolios – and via a robust research process – rather than looking in one dimension at risk-on versus risk-off or riskier assets versus cash.

If de-risking means shifting investment strategy on a high- frequency basis depending on market gyrations, we would caution against such an approach. To the extent that we believe our understanding of the market drivers is on track – as we do currently – we focus on risk-adjusted returns over the medium to longer term, for three reasons.

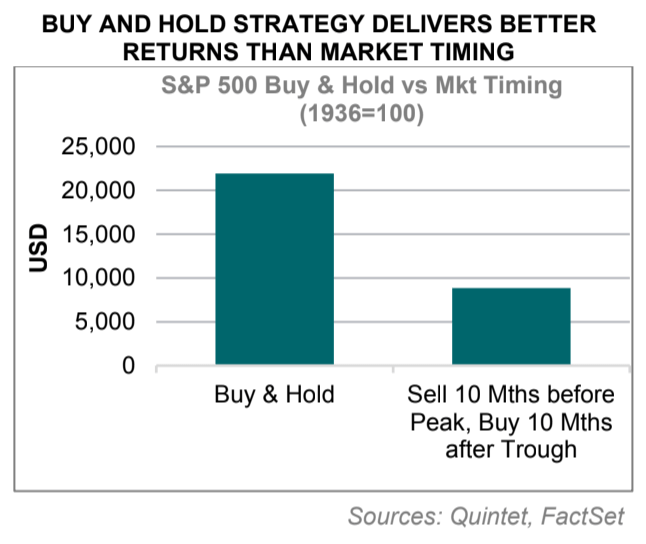

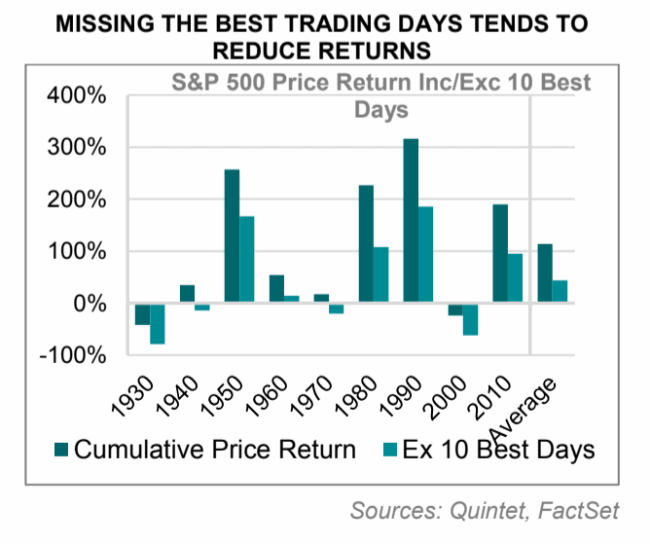

First, timing the market can be detrimental to long-term returns for investors. A buy-and-hold investor would significantly outperform an investor that sold its portfolio 10 months before a peak, and repurchased 10 months after the lows.

Second, onaverage, investors that missed the 10 best days in a given decade would have seen 70% lower returns over the course of that decade. Almost one-third of the best days, historically, have tended to take place in the first two months of a bull market.

Third, while time series are shorter for European markets relative to the US, taking Germany as an example it looks as if stock returns are often worse when the macro datais good but weakening, and they tend to be better when the data is still weak but improving.