Markets briefly bolstered by US data, China disappoints

It wasn’t obvious from the solid figures on job growth, but we’ve got more signs that the US labour market is indeed cooling. The unemployment rate rose to 3.9%, the highest reading since January 2022, while wage growth, job openings, and job quits slowed. This combination of data supported markets. Equities rose across the board, with the S&P 500 and Nasdaq making new highs again before some profit-taking late on Friday limited overall gains. Bond prices also rose (as yields fell), and the US dollar fell. Elsewhere, Chinese and Hong Kong shares underperformed amid investor scepticism about China’s ambitious growth target for 2024, given the lack of structural reforms.

We expect central bank cuts in June

The European Central Bank (ECB) unsurprisingly left its policy rates unchanged but cut its growth and inflation forecasts. In addition, ECB President Christine Lagarde admitted that “we will know a lot more in June” (in terms of economic data). Lagarde also said that the ECB will likely not wait until inflation is at 2% before cutting rates, opening the door to a June cut. The US Federal Reserve (Fed) Chairman Jerome Powell reiterated that the central bank still needs more confidence before lowering borrowing costs “at some point this year”. We maintain our view that both the ECB and the Fed will start bringing down interest rates in June. We’re forecasting four 25 basis point cuts throughout 2024. For the ECB, that’s equivalent of reducing from 4.50% to 3.50% and for the Fed, reducing to the 4.25% to 4.50% range. We think markets reflect this outlook too now, which was one of the reasons why we reduced our exposure to European government bonds in February. We now prefer European investment-grade bonds, which are offering higher yields.

Revising gold forecasts

Gold surged to an all-time high last week despite an unchanged fundamental outlook. Previously, expectations of lower interest rates supported gold, which doesn’t pay interest. However, its rise was limited by the turnaround in market expectations for quick rate cuts. In the meantime, central bank demand for gold increased, especially from China. Data from the People’s Bank of China and Switzerland’s gold exports data has shown skyrocketing trade from Switzerland to China (and Hong Kong). We think gold has some upside given the surge in demand, but seems to be almost entirely reflect in prices, given that fundamentals haven’t really changed. To reflect the rise in prices, we adjusted our forecasts to USD2,150/oz for 2024, a rather marginal change taking into account gold price volatility. In our asset allocation, we’re tactically neutral gold.

Beware of inflation surprises this week

Consumer and producer price indices for February in the US will take centre stage (Tuesday and Thursday, respectively) as the Fed looks for compelling reasons to cut rates. Overall, we continue to expect a slowdown in inflation, although the path to target could still be somewhat bumpy.

Heading towards a Biden-Trump rematch

Unsurprisingly, incumbent US President Joe Biden and former President Donald Trump dominated the Super Tuesday races (statewide nominating party contests) and are now marching towards a rematch in November. The market impact has been muted so far, with investors focusing on upcoming interest rate cuts and earnings results. However, the unveiling of the candidates’ campaign promises and the evolution of polls could move markets in the coming weeks and months.

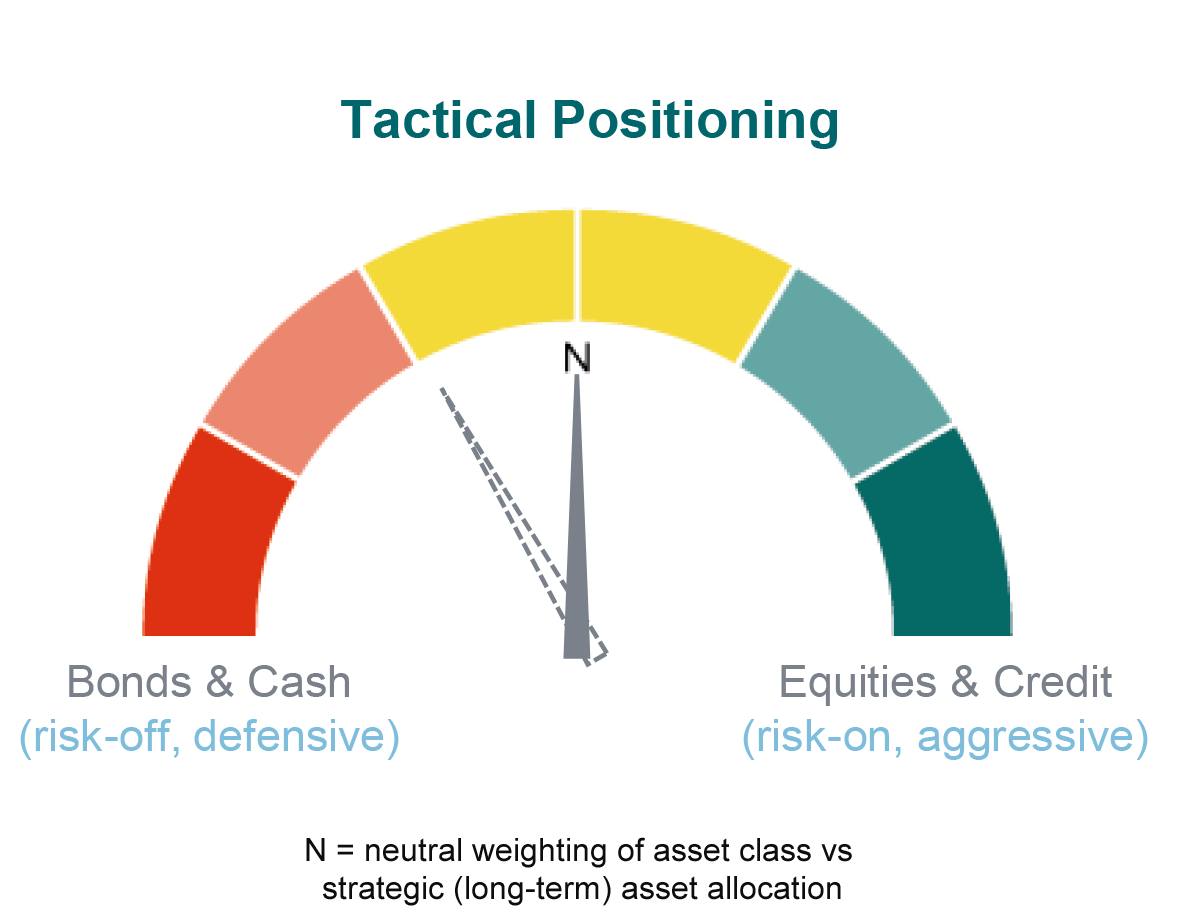

Staying balanced

For about a year and a half, we’ve held fewer equities and more bonds in portfolios compared to our long-term strategy. In February, given better US economic prospects and interest rate cuts from mid-year, we brought both back to neutral. As such, we increased our equity holdings and reduced bonds.

For a detailed overview of our allocation in flagship portfolios, please visit our latest Counterpoint.

Data as of 08/03/2024.