Interest rates in the eurozone have been falling gradually since the 2008 financial crisis and are now at record lows. As a result, investors are looking for opportunities to earn higher returns in the fixed income markets. While the post-pandemic recovery makes it challenging, the banking sector still has something to offer, especially in the lower tier segment.

Valuation attractiveness of subordinated and AT1

If the economic environment improves in 2021, cyclical sectors like financials should benefit from the rebound in activity when vaccines allow lockdown measures to ease and life begins to return to the way it was before the pandemic.

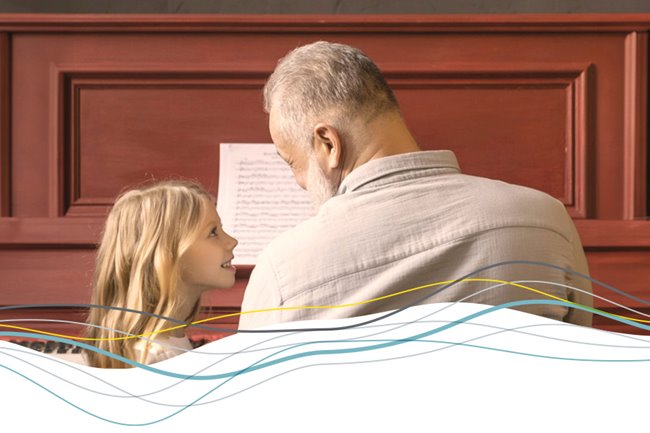

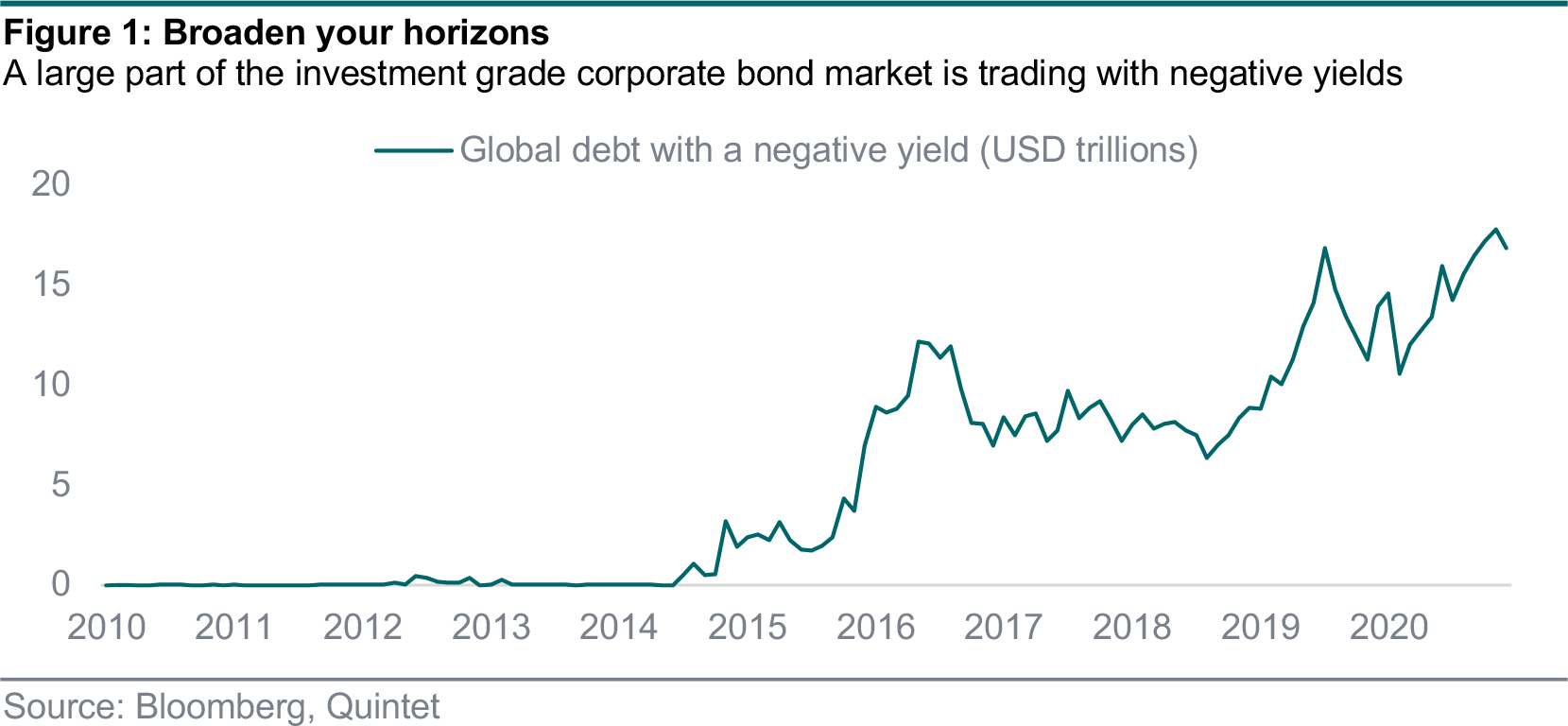

As well as an improving economic backdrop, the financials sector should also benefit as investors search for higher yields. The mood in investment grade corporate bond markets is likely to be optimistic in 2021, helped by the European Central Bank’s (ECB) asset-purchase programme. However, we believe investors need to broaden their horizons because a huge part of the credit market is trading with a negative yield (figure 1).

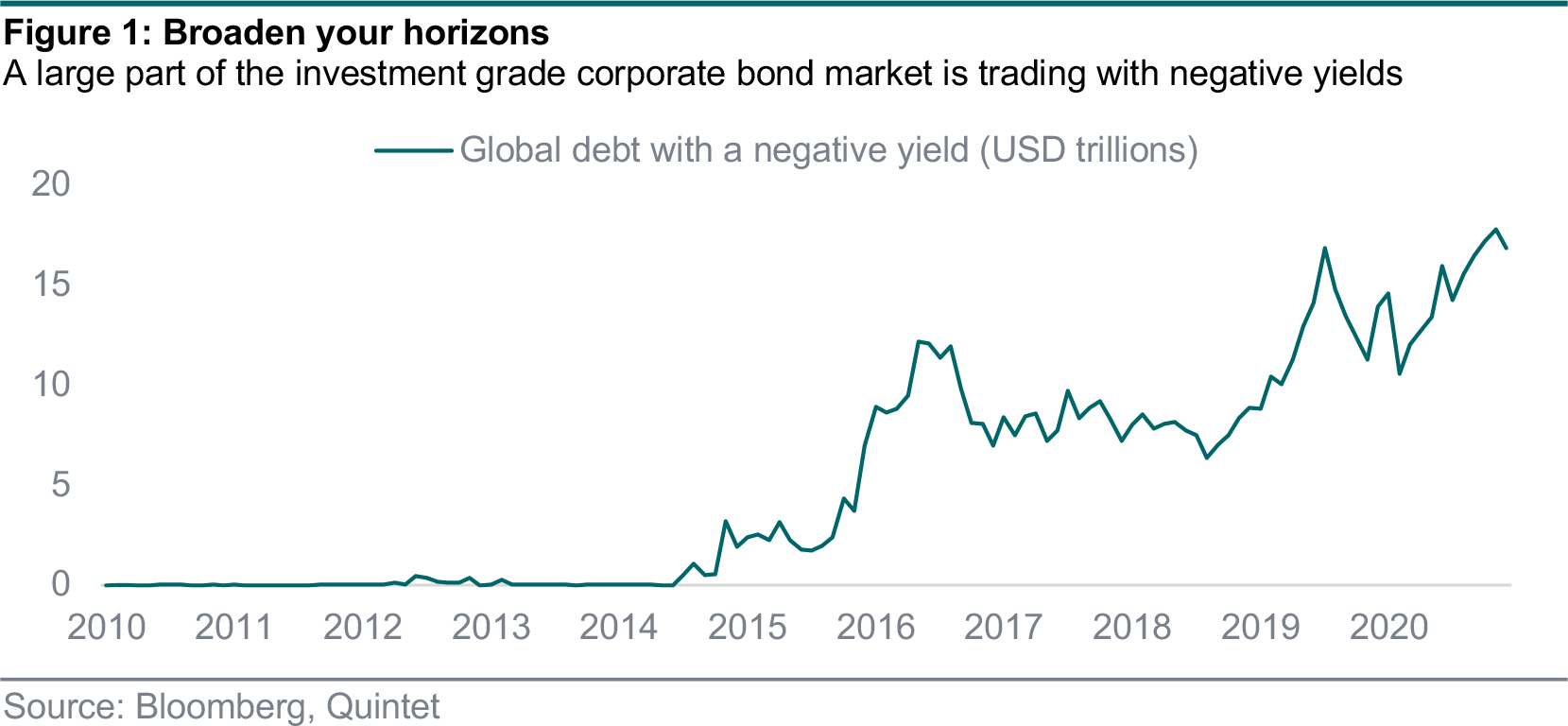

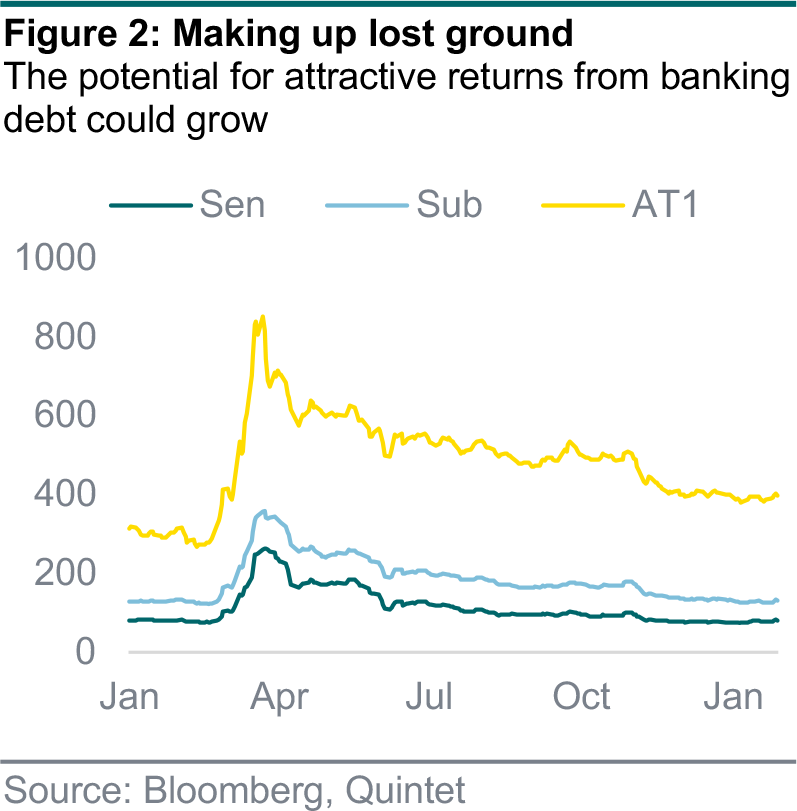

European senior bank debt spreads are already back to their early 2020 levels, and similar to non-financial corporate bonds. However, there is room for additional spread tightening for subordinated bank debt and additional tier 1 contingent convertibles (AT1s) as they make up lost ground (figure 2). AT1s and subordinated bonds have recovered 77% and 93% respectively compared to pre-crisis tightening. Even if the potential for subordinated debt compared to AT1 is more limited, we still consider it an opportunity as carry is also supportive.

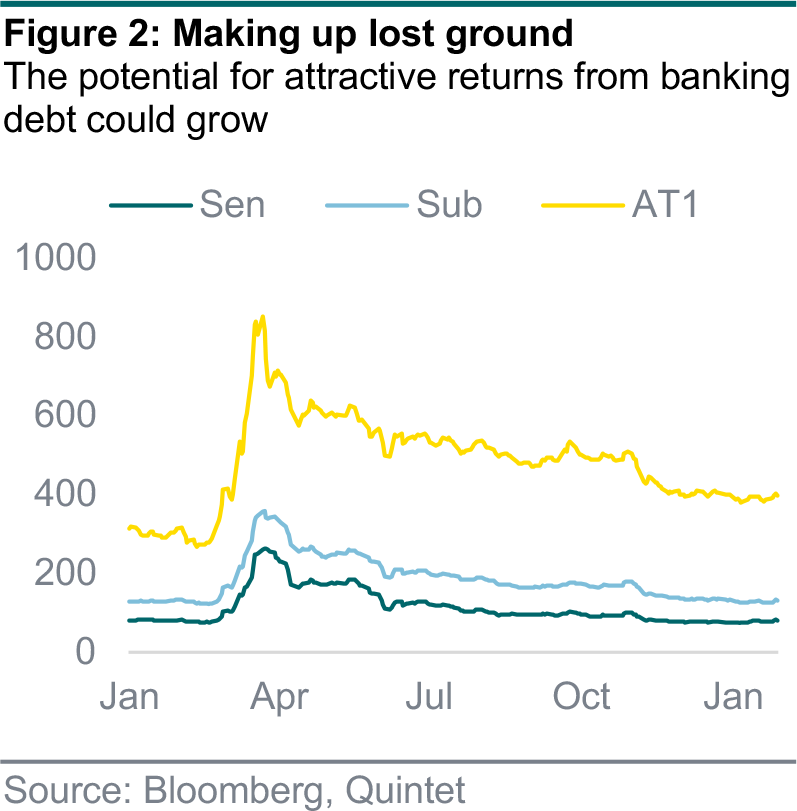

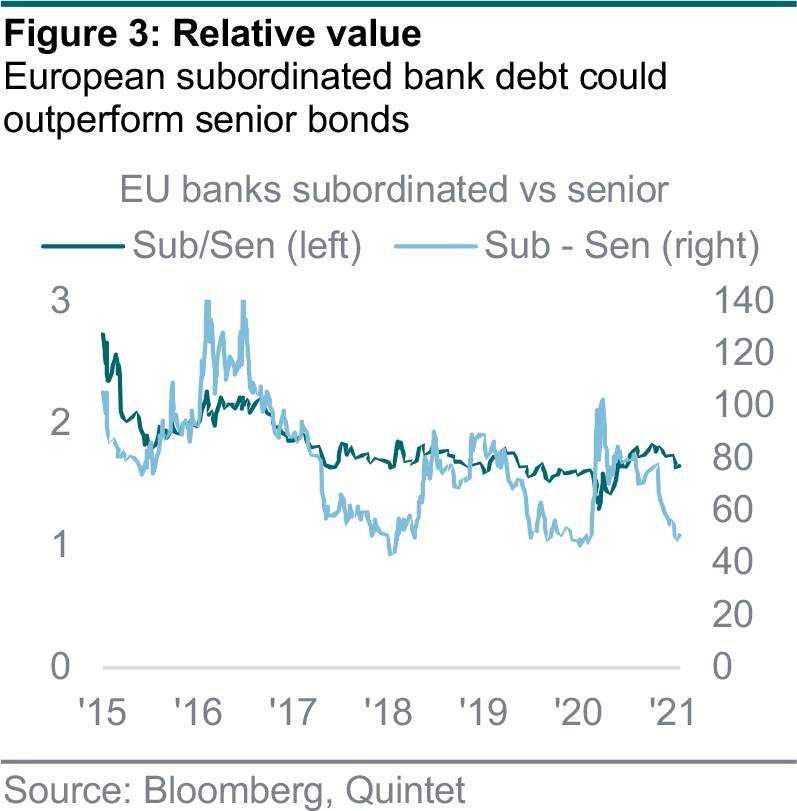

The valuation of subordinated debt and AT1s compared with senior debt reinforces this view (figure 3). The subordinated/senior debt ratio highlights room for subordinated bonds to outperform.

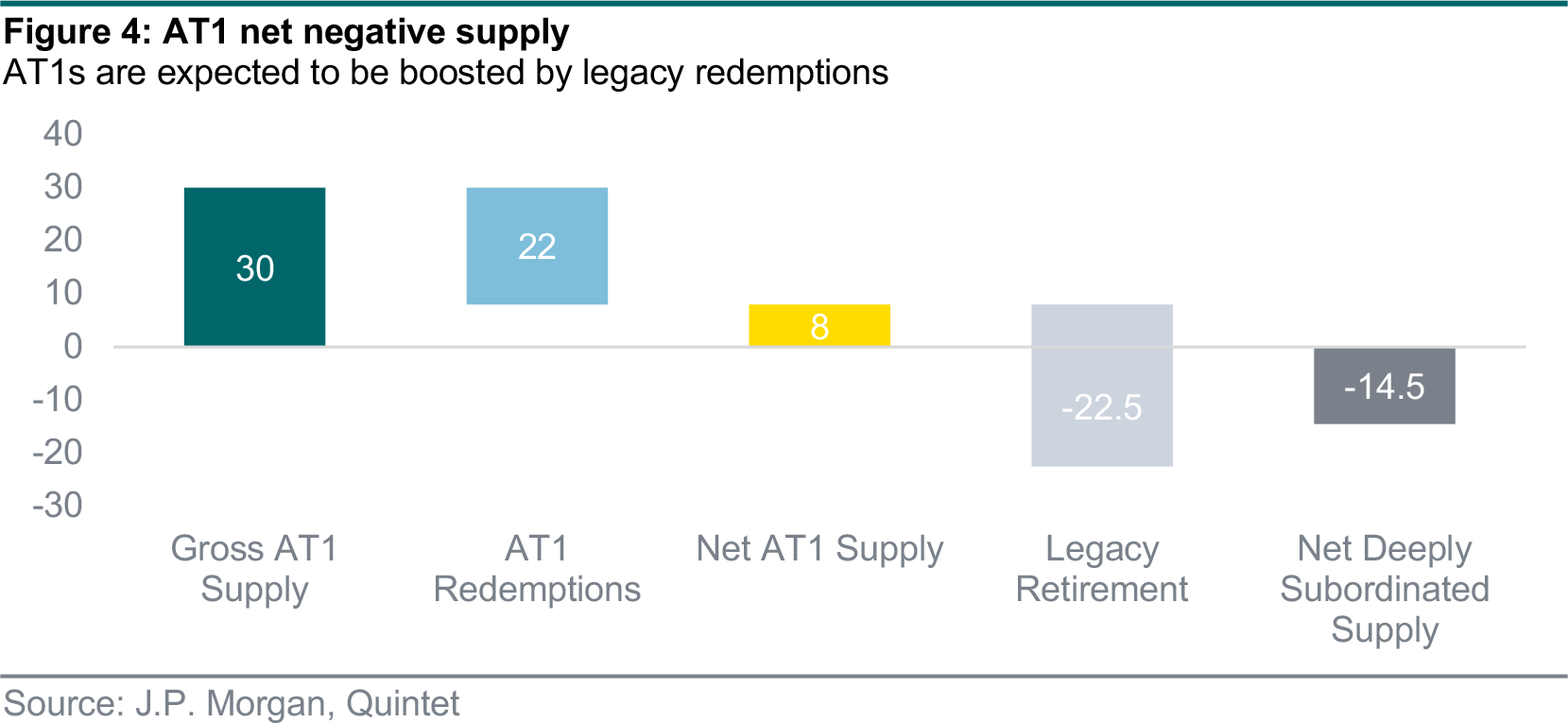

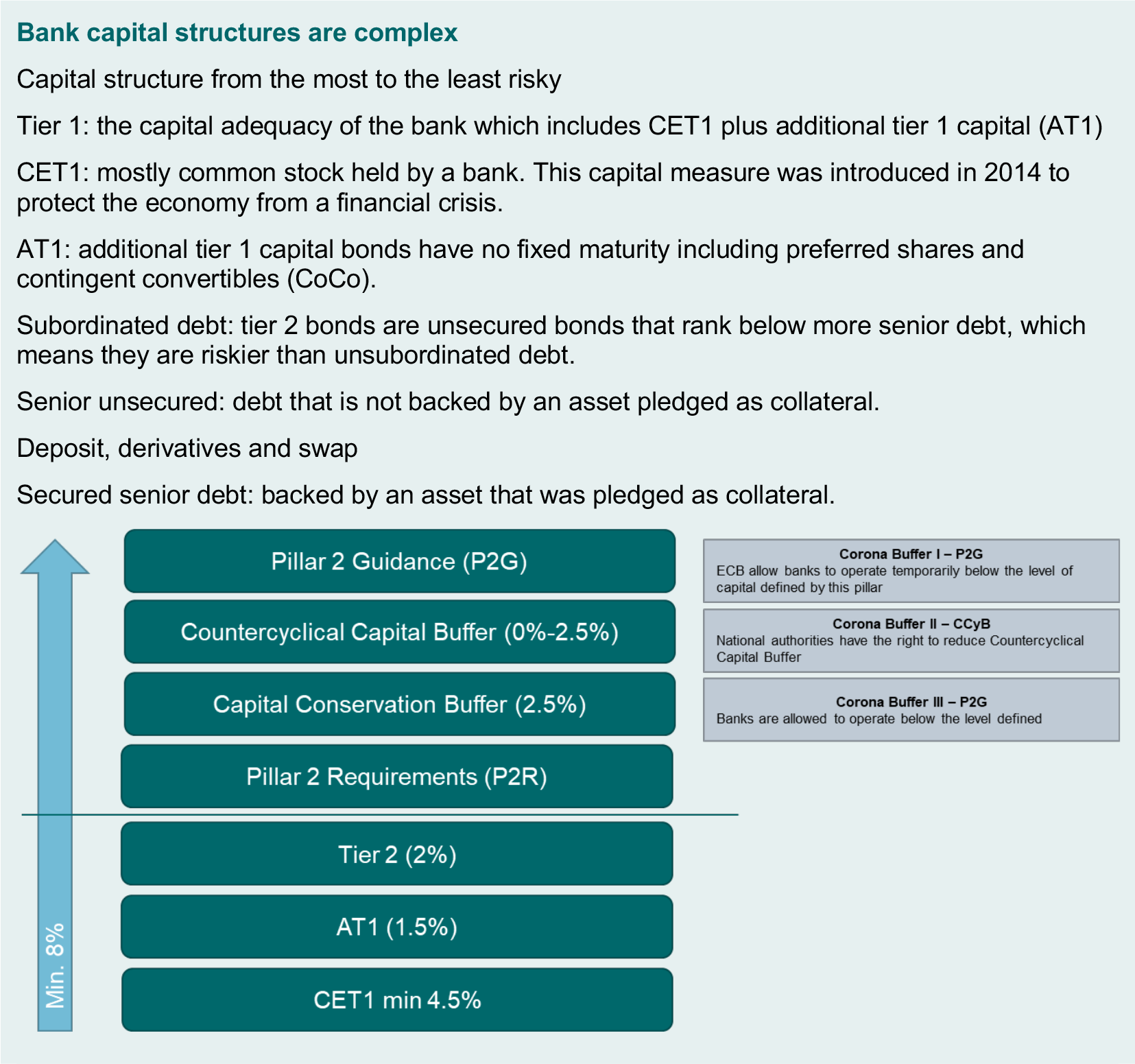

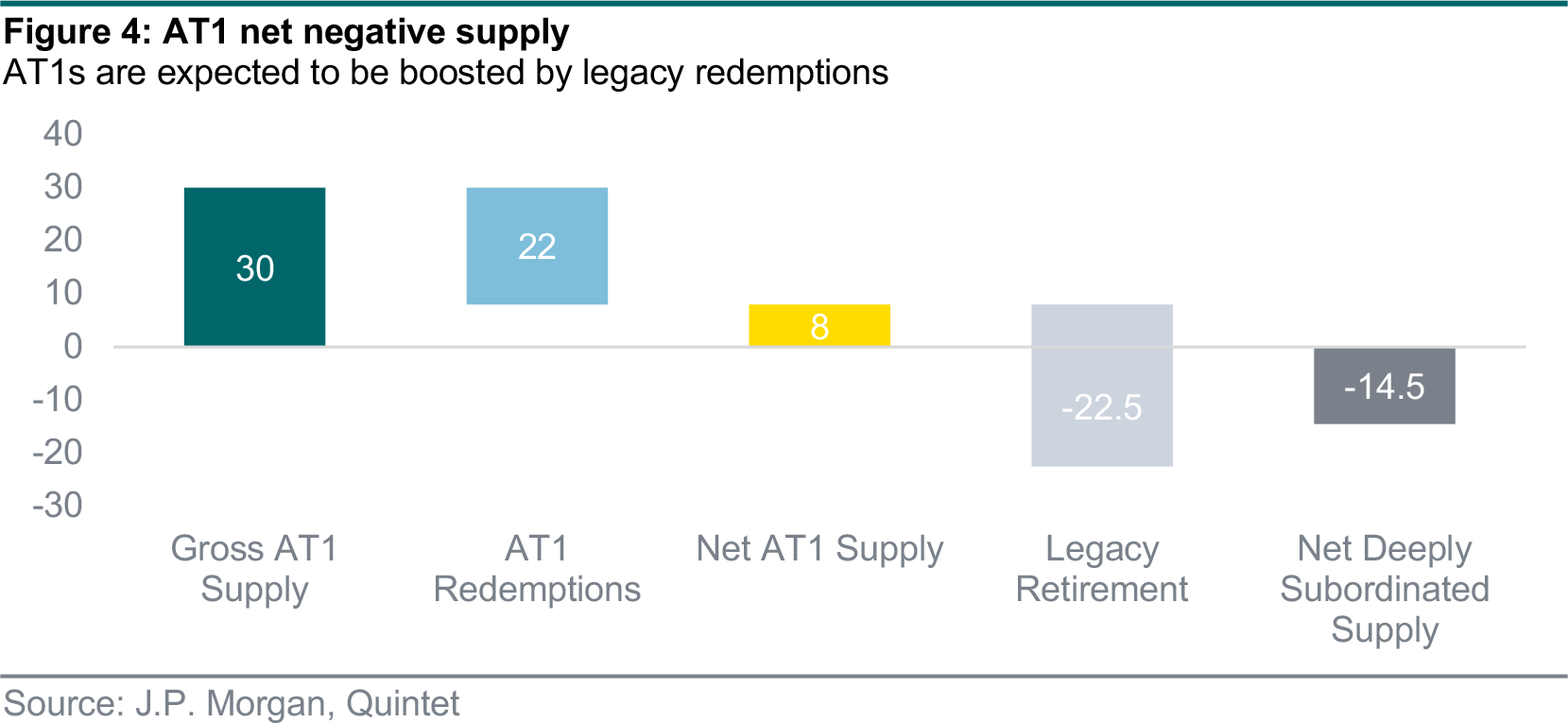

AT1 is a specific asset class that raises many questions for investors. They are subordinated bonds with a higher priority on the capital structure than equity but lower than other creditors. Early in the crisis, concerns about the potential conversion and the probability of non-call risks have been addressed to reassure the market. Indeed, as we enter the last year of the transitional arrangements for legacy capital instruments (generated during Basel II), AT1 should be supported by this technical factor as investors have to redeploy redemption proceeds.

Consequently, European banks’ subordinated bonds and AT1s represent an attractive risk/return opportunity supported by the expensiveness of the broad corporate market and their specific valuation attractiveness on a relative basis. Besides, this valuation aspect is corroborated by healthy banking fundamentals.

European banks are in good shape

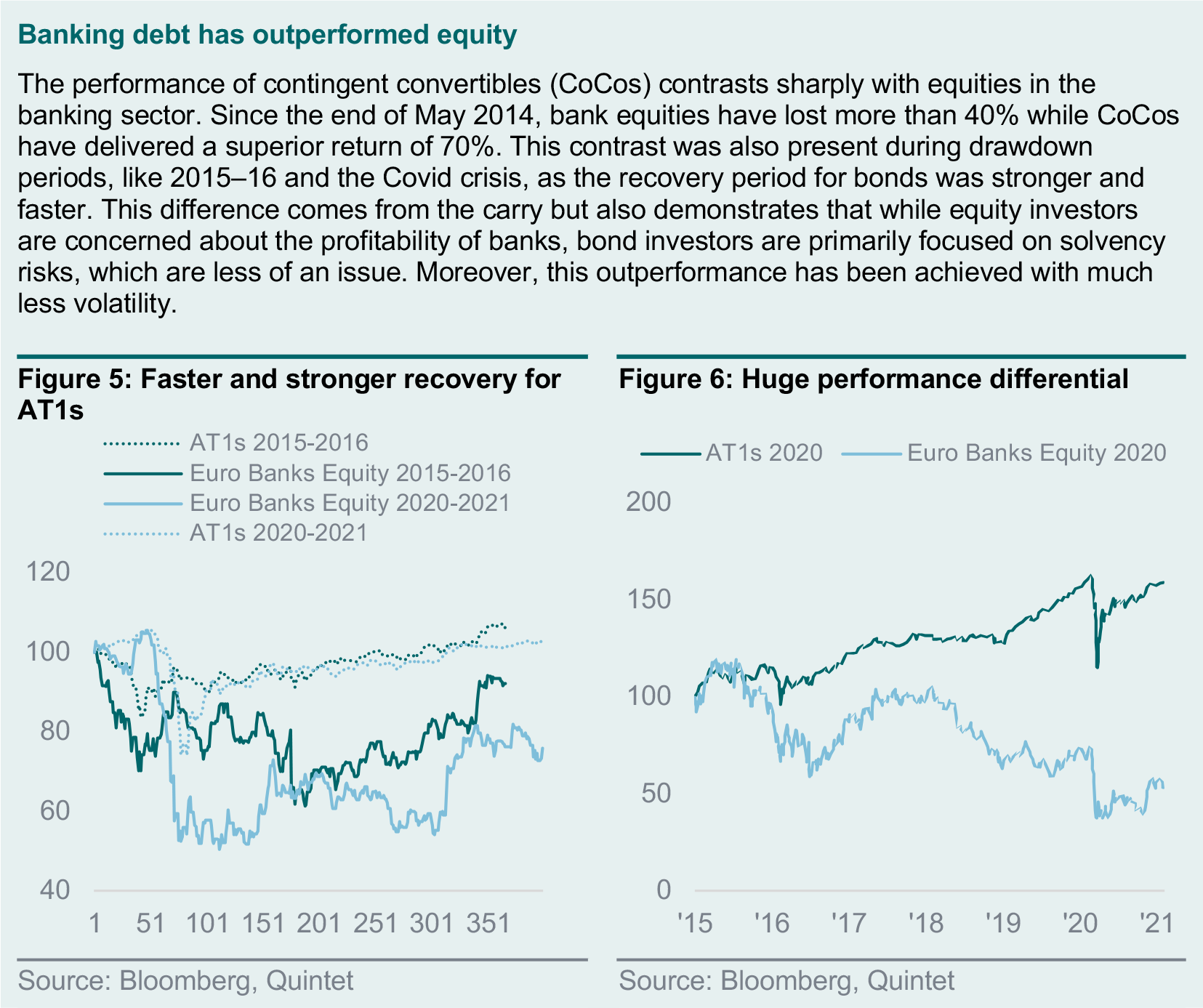

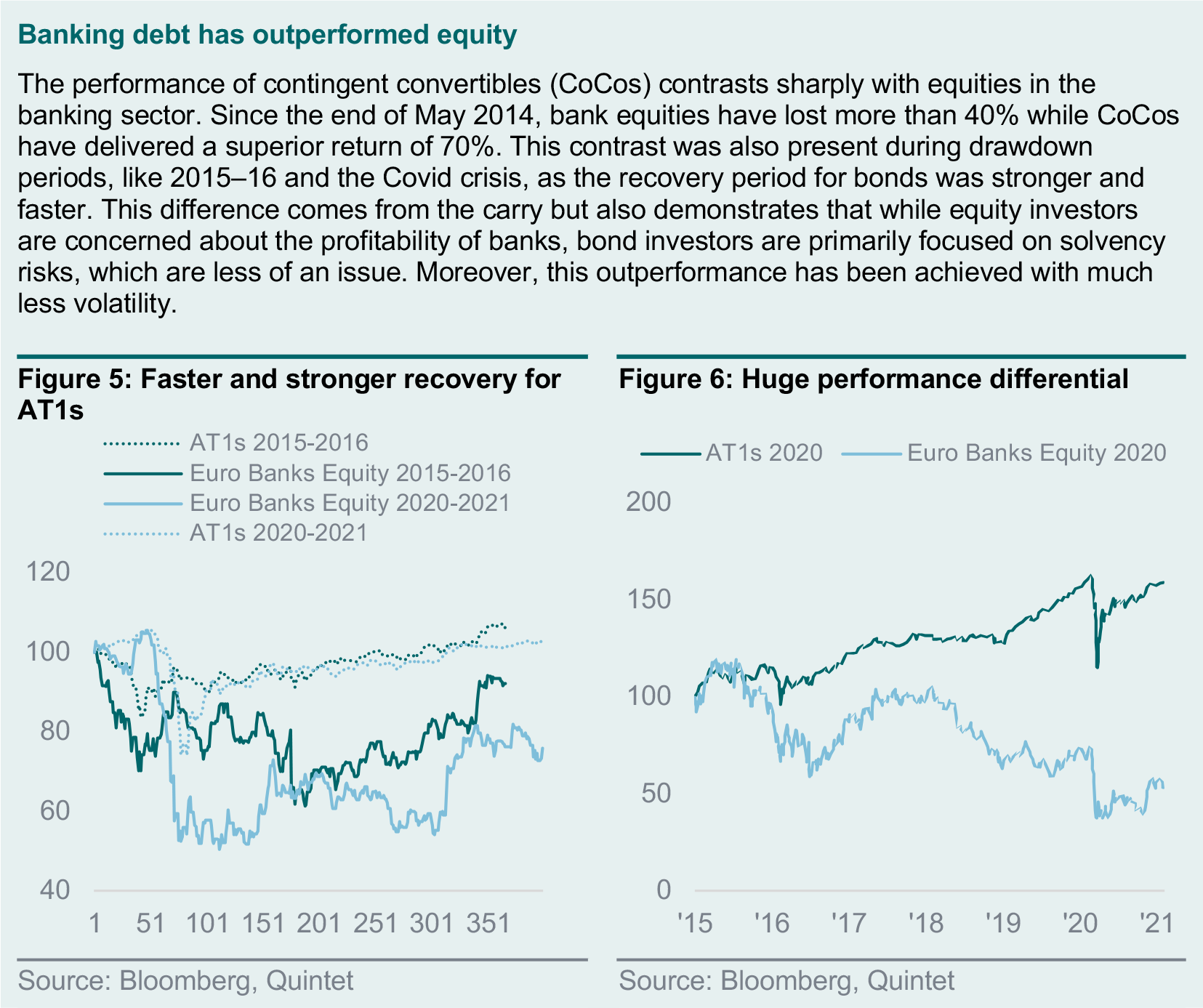

When looking at the very poor performance of shares in the European financials sector in 2020, we could have a global negative perception of European banks and their capacity to rebound from the crisis. However, from a bondholder perspective, they are in good shape to manage the consequences of the crisis thanks to their long-term thinking.

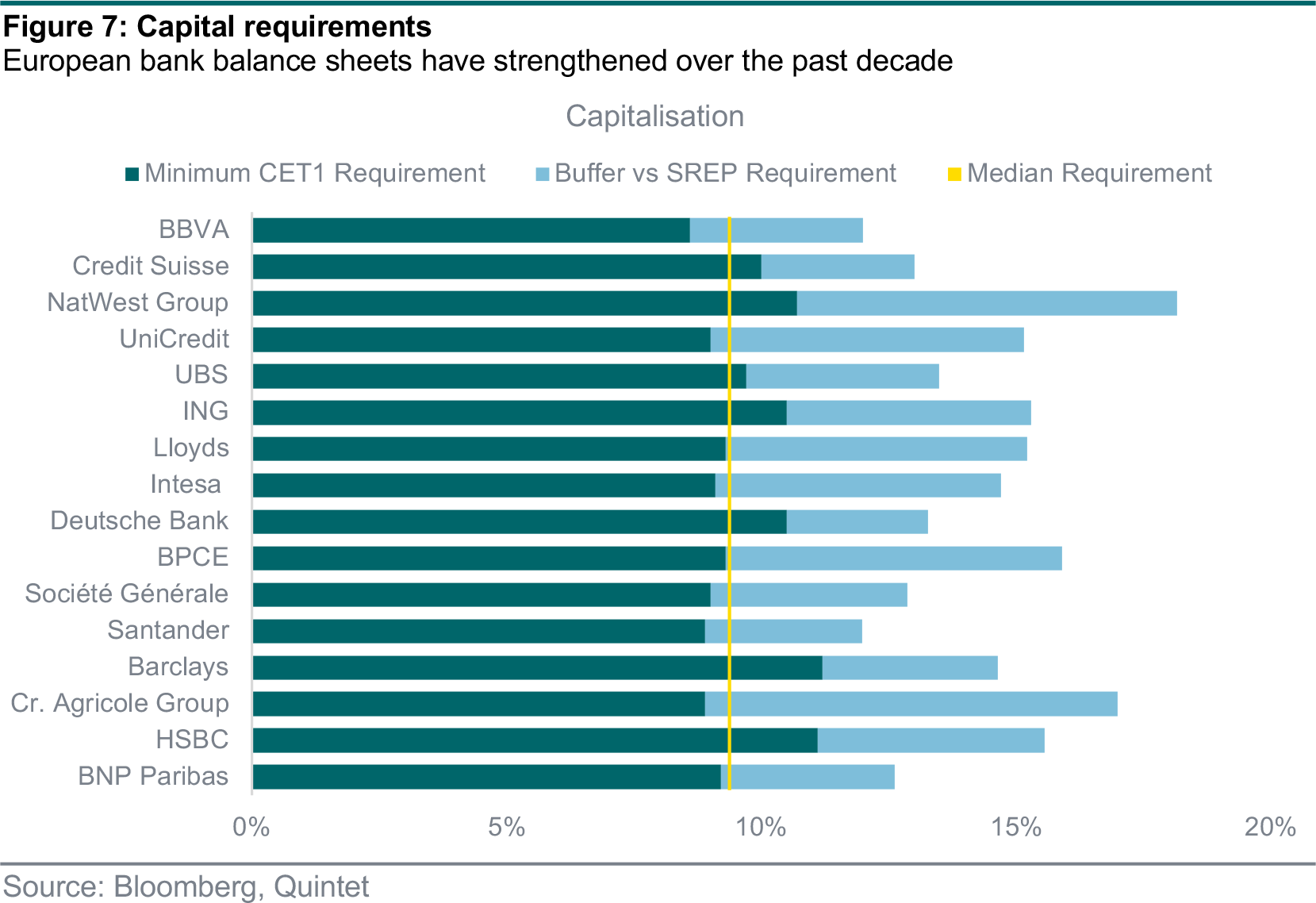

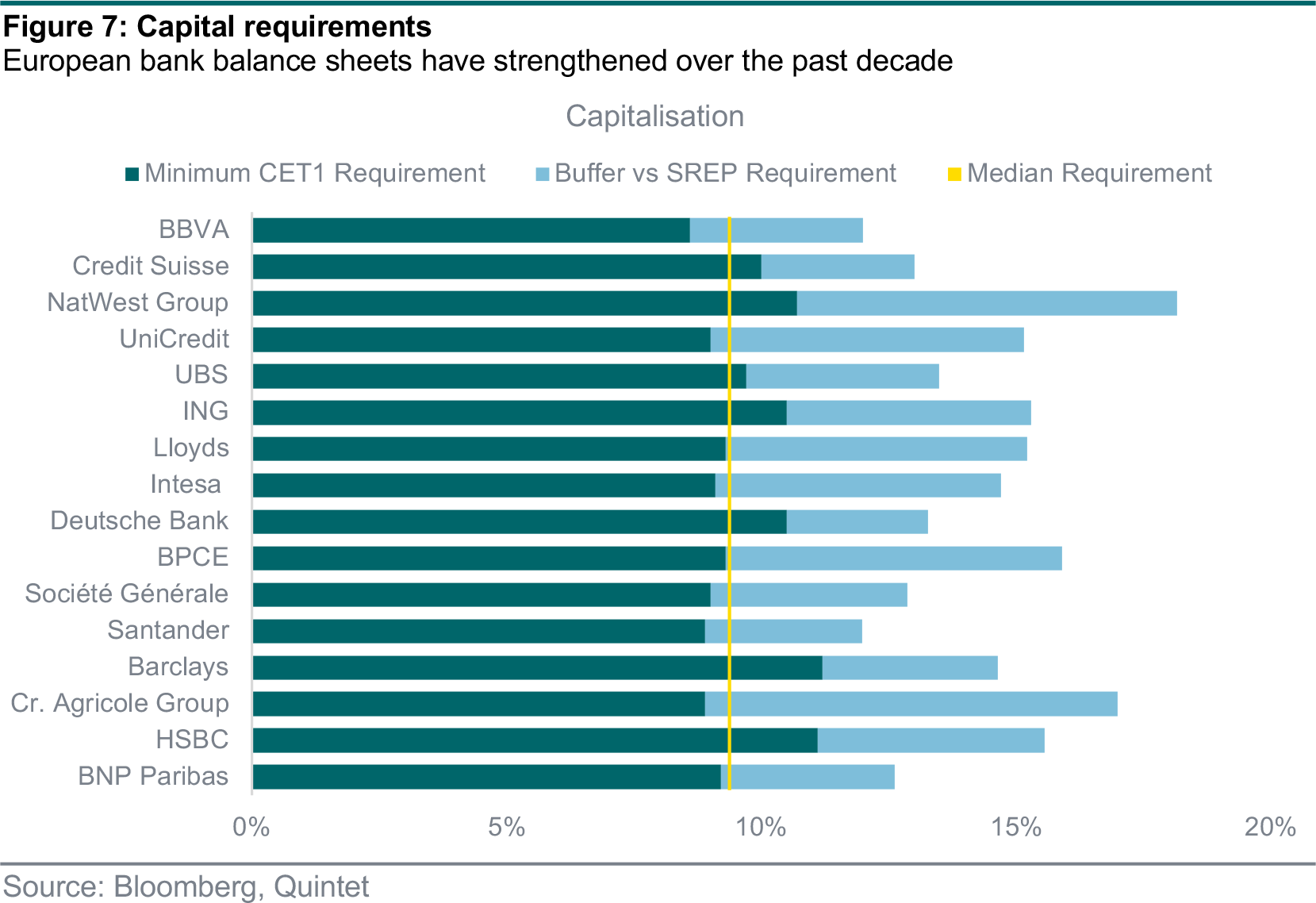

Since 2008, the regulatory requirements imposed by authorities have strengthened the balance sheet of European banks. The efforts of the banking system and the reforms translated concretely into better liquidity positioning and stronger capital profiles (large CET1 buffers) (figure 7).

The weak spot is on the profitability side, where low rates have been putting pressure on interest margins for a long time. However, banks continue to tackle the issue by activating the levers at their disposal – strict cost management and restructuring measures – when deemed appropriate. This approach has already led to many M&A deals – especially in Southern Europe, such as Intesa/Ubi Banca and CaixaBank/Bankia) – and to a higher concentration of participants in the sector.

At this stage, most deals are domestic owing to cross-border hurdles and substantial economies of scale. The timing for M&A is particularly good as the poor equity performance of targeted companies in 2020 enables the recognition of badwill for the buyer (as equity value is lower than accounting net asset value).

The evolution of non-performing loans (NPLs) is another indicator closely followed by the market. The expectations cloud the outlook for banks slightly, as their level will undoubtedly increase with the progressive withdrawal of government support and the consequences of the crisis in the real economy (such as unemployment and loan impairments). However, while reversing from a recent favourable trend, we do not expect NPLs to run out of control, especially as banks have already front-loaded provisions for loan losses in 2020. Moreover, the European Commission has specified its strategy to support the risk associated with the four following objectives:

- the further development of the secondary market of “distressed” assets to lighten balance sheets;

- the reform of European legislation on company insolvency;

- the creation of so-called national “bad banks”; and

- the establishment of precautionary measures to ensure the continuous financing of the real economy.

This example is one aspect of the way the regulation broadly supports banks and limits the risks associated with the crisis. Indeed, European banks can count not only on their strong fundamentals, but also on the unfailing support of European institutions.