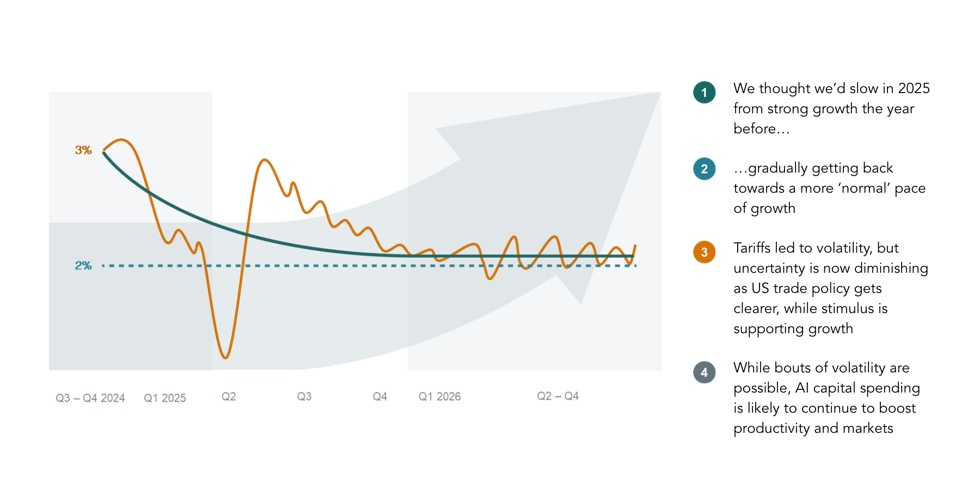

2026 begins on firmer ground than many feared. The recession that many expected in 2025 never materialised. Fiscal stimulus, falling interest rates and steady policy support have helped markets recover even as global politics and trade remain complex. A more predictable rhythm of US-China negotiations and reduced trade uncertainty have also contributed to the recovery.

Beneath the surface, the world is shifting to a more fragmented multi-polar landscape. This regional fragmentation is fuelling competition for key technologies and supplies, while ageing populations and rising sovereign debt keep funding costs higher than before. These forces imply wider divergence in outcomes and less predictable market relationships, making differentiation across asset classes and geographies more important than ever.

In our 2026 Counterpoint Investment Outlook, we share our views on global capital markets, economic dynamics and the themes shaping portfolios today.

Download the full outlook to explore our views and strategies for the year ahead

Daniele Antonucci

Daniele Antonucci is a managing director, co-head of investment and chief investment officer at Quintet Private Bank. Based in Luxembourg, he jointly chairs the investment committee, owning decision-making and performance outcomes. As head of research, Daniele oversees the investment strategy feeding into portfolios and the teams of specialists across asset classes and solutions, ranging from macro, fixed income and equities to funds, alternatives, and structured products and derivatives. He leads the network of chief strategists, communicating the house view on the economy and markets to financial advisors, clients and the media.

Prior to joining Quintet in 2020 as chief economist and macro strategist, Daniele served as chief euro area economist at Morgan Stanley in London. He completed the High Performance Leadership Programme at Saïd Business School, University of Oxford, holds a master’s degree in economics from Duke University and graduated from the Sapienza University of Rome. Featured in The Economist and Financial Times and often quoted in the generalist press, he’s a published author in finance and economics journals and investment magazines, a frequent speaker on CNBC and Bloomberg TV, and an ECB Shadow Council member.

Our View of the Year Ahead

We believe growth is likely to remain positive in 2026 as trade uncertainty fades and stimulus supports demand.

While volatility may persist, AI-driven investment and lower rates create opportunities for long-term investors.

4 Forces Shaping 2026

#1

Lower Trade Uncertainty

US trade policy is clearer, reducing volatility and supporting global growth.

#2

Lower Interest Rates

Central banks are cutting rates, easing financial conditions and boosting confidence.

#3

Higher Fiscal Stimulus

Governments are spending more on infrastructure, defence and tax cuts, sustaining demand.

#4

Higher AI Capital Spending

AI investment is accelerating, driving productivity and creating new opportunities.

This document is designed as marketing material. This document has been composed by Quintet Private Bank (Europe) S.A., a public limited liability company (société anonyme) incorporated under the laws of the Grand Duchy of Luxembourg, registered with the Luxembourg trade and company register under number B 6.395 and having its registered office at 43, Boulevard Royal, L-2449 Luxembourg (“Quintet”). Quintet is supervised by the CSSF (Commission de Surveillance du Secteur Financier) and the ECB (European Central Bank).

This document is for information purposes only, does not constitute individual (investment) advice and investment decisions must not be based merely on this document.

Whenever this document mentions a product, service or advice, it should be considered only as an indication or summary and cannot be seen as complete or fully accurate. All (investment) decisions based on this information are at your own expense and at your own risk. It is up to you to (have) assess(ed) whether the product or service is suitable for your situation. Quintet and its employees cannot be held liable for any loss or damage arising out of the use of (any part of) this document. All copyrights and trademarks regarding this document are held by Quintet, unless expressly stated otherwise. You are not allowed to copy, duplicate in any form or redistribute or use in any way the contents of this document, completely or partially, without the prior explicit and written approval of Quintet. See the privacy notice on our website for how your personal data is used (https://group.quintet.com/en-gb/gdpr).

The contents of this document are based on publicly available information and/or sources which we deem trustworthy. Although reasonable care has been employed to publish data and information as truthfully and correctly as possible, we cannot accept any liability for the contents of this document.

Investing involves risks and the value of investments may go up or down. Past performance is no indication of future performance. Any projections and forecasts are based on a certain number of suppositions and assumptions concerning the current and future market conditions and there is no guarantee that the expected result will ultimately be achieved. Currency fluctuations may influence your returns.

The information included is subject to change and Quintet has no obligation after the date of publication of the text to update or inform the information accordingly.

Copyright © Quintet Private Bank (Europe) S.A. 2025. All rights reserved. Privacy Statement