-

Quintet Group

Choose your location

- DE

- Contact Us

Choose your location

Menu

-

What we do

Passing on WealthBy thinking about legacy planning now, you can make sure your wealth is passed on to the people and causes close to your heart.

- Insights

-

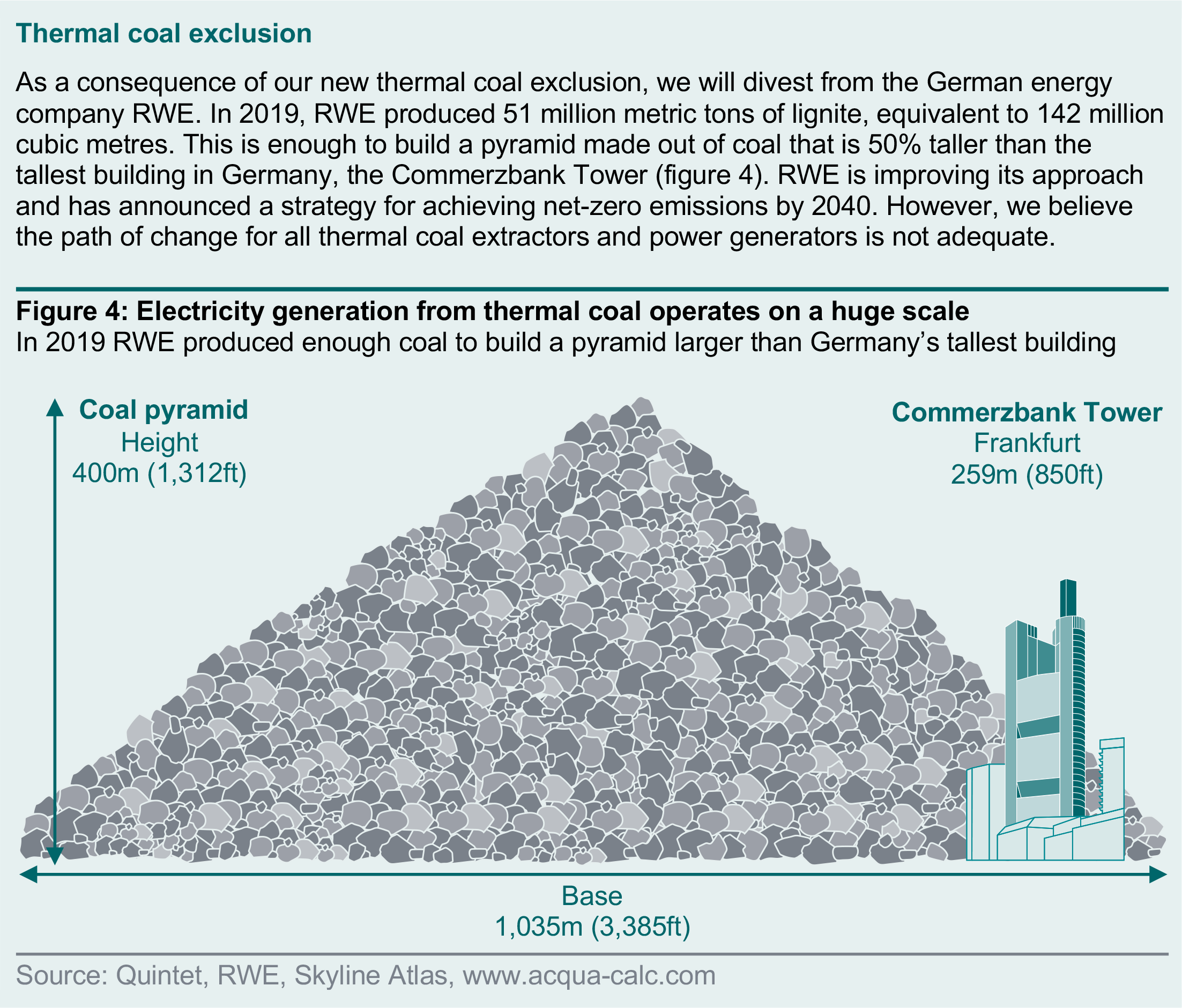

Sustainability

- Sustainability

- Why sustainability matters

- Embracing sustainability in our practices

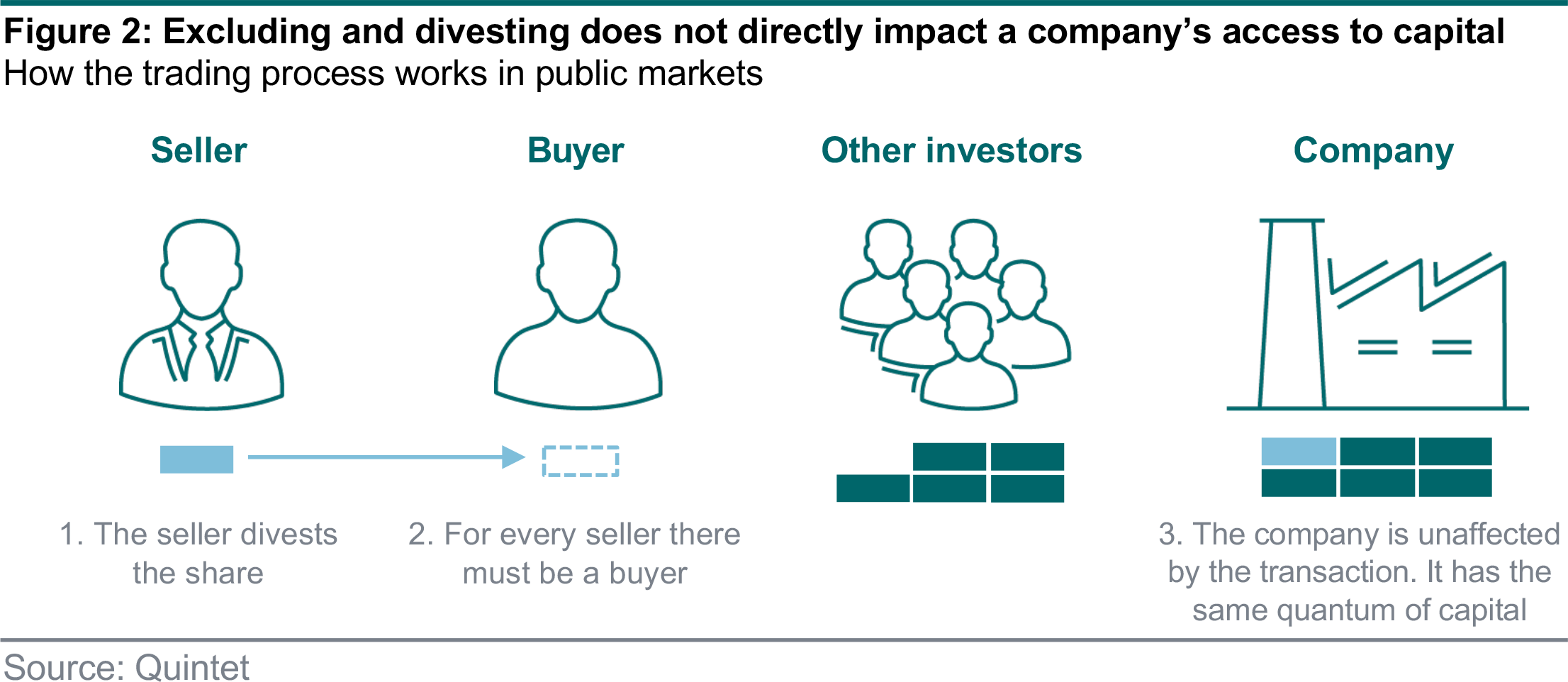

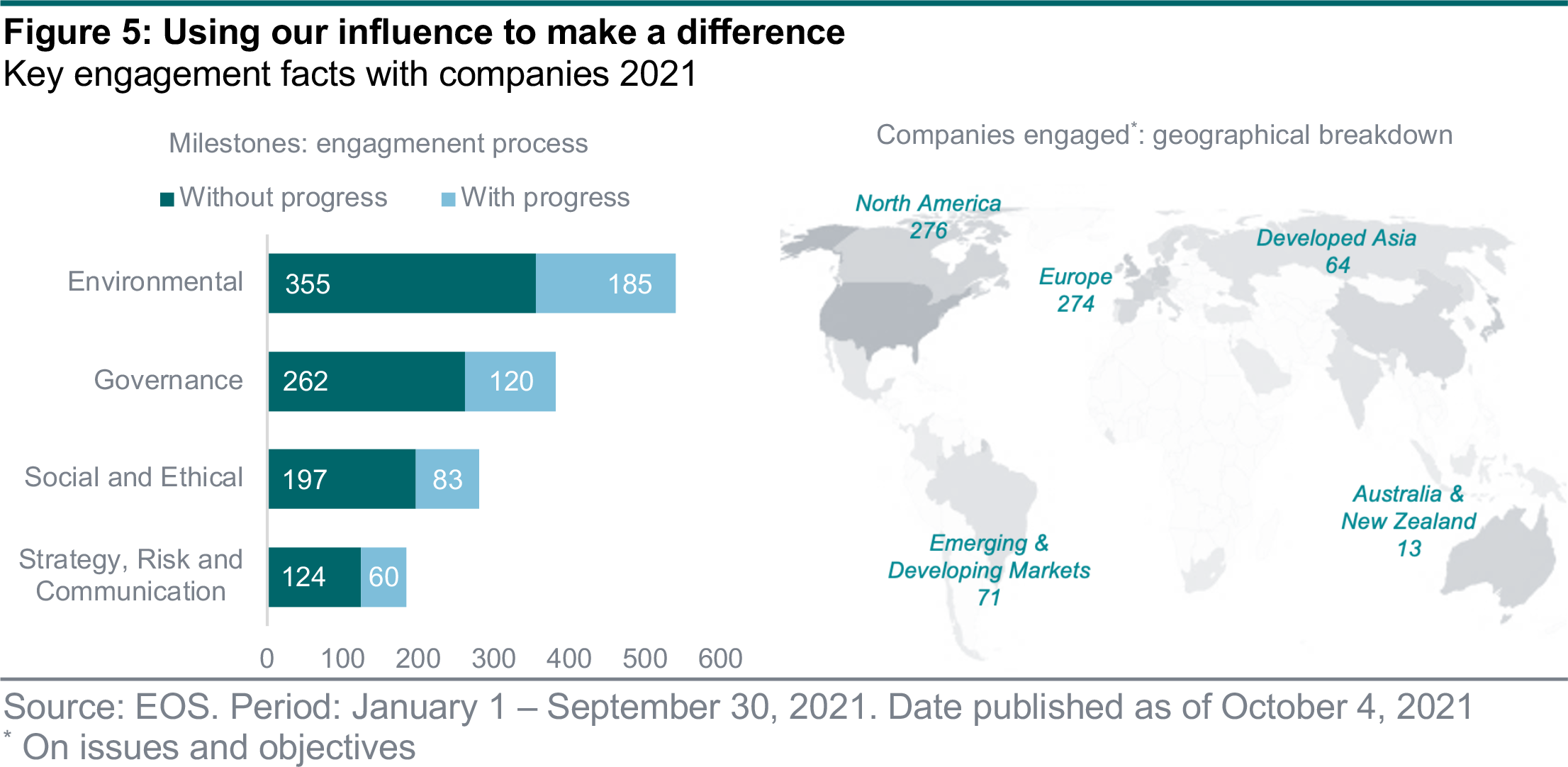

- Active Ownership

- Our journey towards corporate sustainability

Active ownership to help activate changeChange what you don’t like. Invest in what you do. That’s what we believe.

-

About us

Quintet 2023 net profit rises to €46.9 millionPositive 2023 financial results, including a full-year net profit of €46.9 million, up from €18.1 million in 2022.

-

Careers