How should investors think about cryptocurrencies in general and bitcoin in particular? Are they an alternative form of money, an asset such as a commodity, an emerging technology or perhaps a speculative bubble?

- Rather than with money, bitcoin and cryptocurrencies more broadly tend to have more in common with commodities and currencies – typically they're much harder to value than cashflow-producing instruments such as equities and bonds.

- Institutional inflows into bitcoin have increased lately – a sign of wider acceptance. And the endorsement for certain types of payments and transactions, both from regulators and private-sector firms, supports blockchain and other technologies over the longer term.

- However, some of the increase in institutional participation appears speculative in nature. Futures markets may point to frothy positioning, and there are signs that speculation by retail investors is an additional factor driving the price of bitcoin.

- Millennials using bitcoin as an 'alternative' means of exchange is supportive too. But some features of cryptocurrencies that might make them 'attractive', such as their anonymity, are also features that are likely to attract additional government scrutiny and regulation.

- Bitcoin's high volatility makes it poorly suited as a substitute for money in a broad sense. It would likely need to come down significantly to foster near-universal use. And prices would probably need to become less correlated with those of risk assets.

- One potential and often overlooked disruptor of cryptocurrencies (the way we know them today) is central banks: they may seek to address some of the current drawbacks or adopt alternative technologies and throw their weight behind an official digital currency.

- This is not to say that the price of bitcoin can't continue to rise as the network becomes more widely adopted. But, over the longer term, there's an inherent contradiction between cryptocurrencies as high-return assets and stores of value relative to goods and services.

The efforts of tech companies to promote payment systems via cryptocurrencies are front-page news. Central banks are developing digital currencies of their own and regulators are looking at the implications. When thinking about all this, it’s useful to start with the functions of money. First, it serves as a medium of exchange. Second, it’s used as a common unit of account for the value of goods and services. Third, it’s a store of value to preserve purchasing power (figure 1).

Bitcoin is a decentralised, peer-to-peer network that allows for the proof and transfer of ownership without the need for a trusted third party. The unit of the network is bitcoin, or BTC. The bitcoin network was conceived in 2008 and launched in 2009 by a programmer(s) who used the pseudonym Satoshi Nakamoto and whose identity remains uncertain.

The network is based on people around the world called ‘miners’ using computers to solve complex mathematical problems in order to verify a transaction and add it to the blockchain – a massive and transparent ledger of each and every bitcoin transaction maintained by the miners. The first to verify is rewarded with bitcoin. There is a finite amount of bitcoin that can be produced and, as more bitcoin is created, the mathematical computations required to create more become increasingly difficult. Bitcoin can be traded or used to buy goods and services.

There is no central authority that oversees bitcoin. While regulation is evolving, the difference with the way we think about money such as the national currency is that it’s legal tender in practically every country (while bitcoin isn’t). Legal tender is anything recognised by law as a means to settle a public or private debt or meet a financial obligation, including tax payments, contracts and legal fines or damages. A creditor is legally obligated to accept legal tender towards repayment of a debt. And a central bank is typically mandated to maintain price stability.

There are five approaches to value cryptocurrencies:

- Total addressable market: The most popular approach to value cryptocurrencies is to estimate their addressable markets and compare that estimate with their current market capitalisation.

- The equation of exchange (MV = PQ): This approach borrows from traditional models of valuing currencies and is based on the assumption that a currency’s value is related to the size of the market it supports and to its velocity as it moves through that market.

- Cryptocurrencies as a network: An alternative method is based on an application of Metcalfe’s law, a popular theory in technology that states that the value of a network is proportional to the square of the number of participants. Basically, the network’s value grows as more users are added.

- Cost of production: The theory holds that cryptocurrencies, just like any commodity, are subject to traditional pricing challenges on the supply side. Miners – the computers that process transactions and are rewarded with the underlying cryptocurrencies – spend fiat money to produce each marginal cryptocurrency, through both energy and hardware expenditures.

- The stock-to-flow model: This states that, say, bitcoin’s price is a reflection of its scarcity and that scarcity can be measured by the stock-to-flow ratio – the relationship between the value of the outstanding amount of bitcoin and the amount of new bitcoin being produced each year.

Rather than with money, bitcoin and cryptocurrencies in general have more in common with commodities and currencies than with cashflow-producing instruments, such as equities and bonds.

Valuation frameworks for commodities and currencies tend to be sketchier than traditional discounted cashflow analysis is for equities or interest and credit models are for bonds.

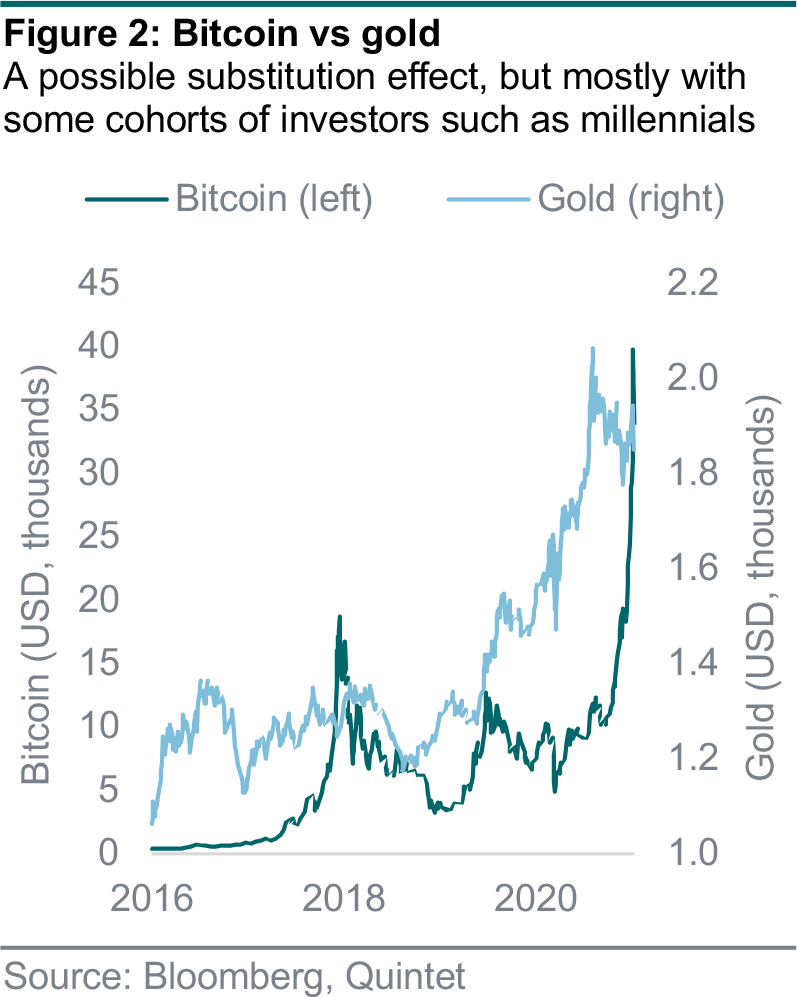

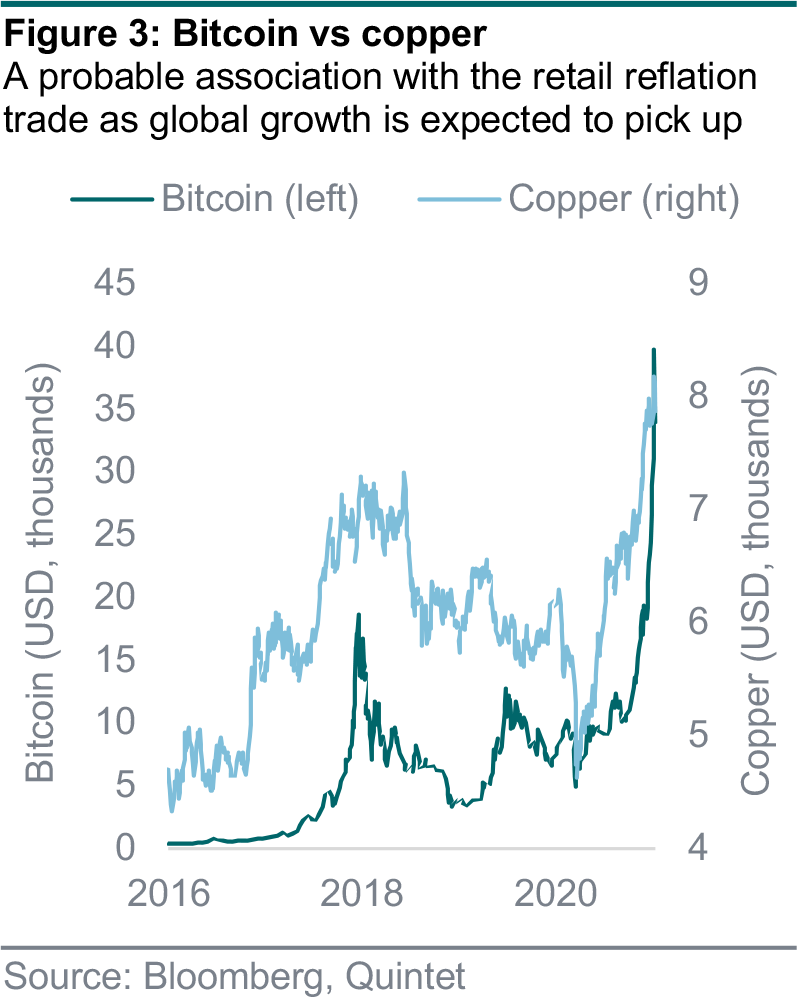

Gold’s recent underperformance versus real rates and the dollar has left some investors concerned that bitcoin could gradually replace gold as the inflation hedge of choice (figure 2). While some substitution may be occurring for some cohorts of investors (such as millennials), we don’t see bitcoin’s rising popularity as an existential threat to gold’s status as the ‘currency of last resort’. Since the depths of the first lockdown, bitcoin’s rise has closely tracked that of copper – a key proxy for global growth (figure 3). In our view, bitcoin has partly been associated with the retail reflation trade recently, while gold is a defensive asset aimed at long-term real capital preservation.

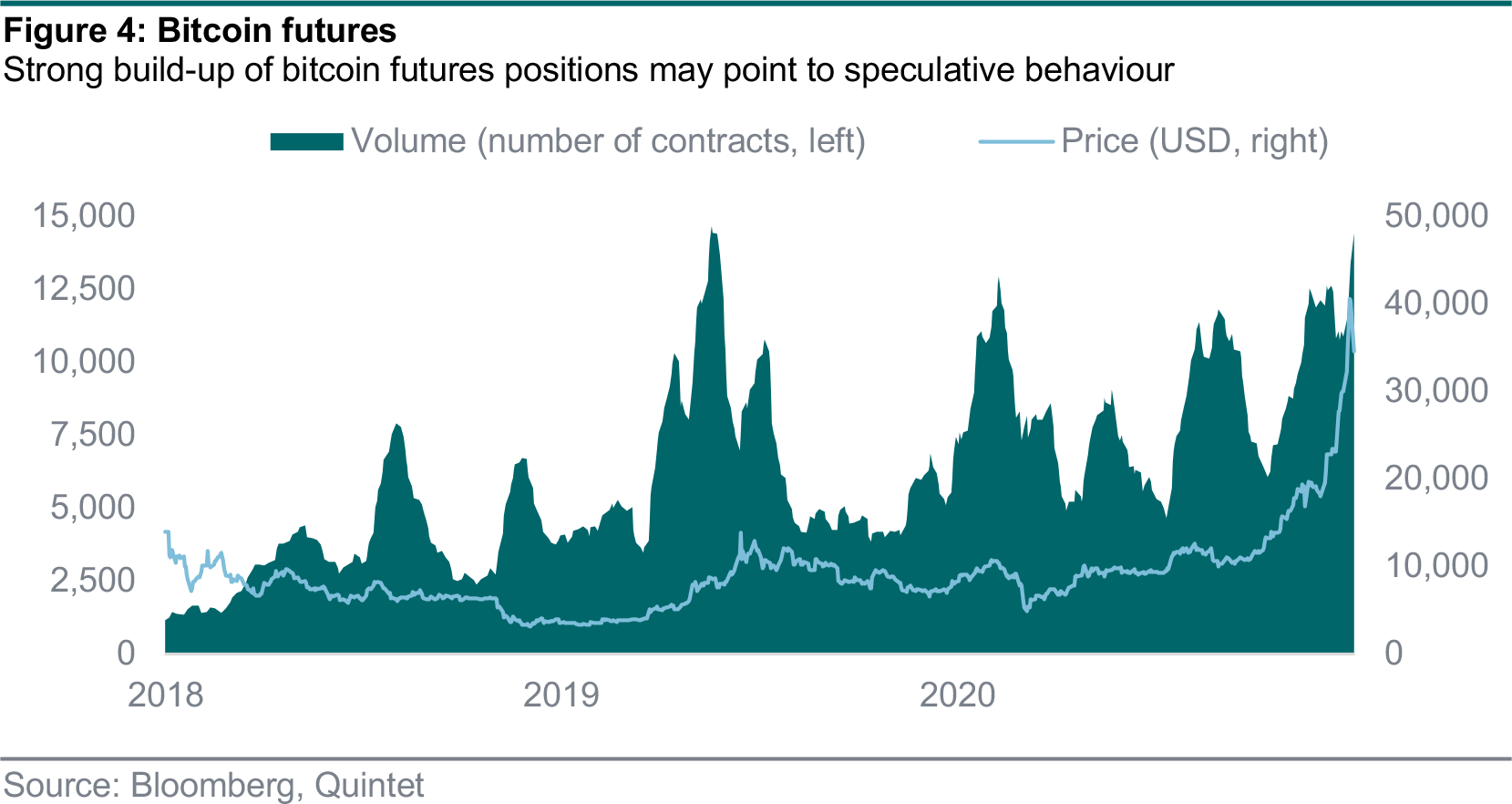

There’s little doubt that institutional inflows into bitcoin are what distinguishes the past few quarters from earlier periods. Taking the Grayscale Bitcoin Trust as an example, many institutional investors are only allowed or prefer to invest in bitcoin in fund format for regulatory or other reasons. However, it’s wrong to view all these institutional flows of the past year or so as entirely driven by long-term investors. Some of these flows reflect speculative investors. The frothy positioning in Chicago Mercantile Exchange (CME) bitcoin futures could be one manifestation of this speculative institutional flow (figure 4). Bitcoin futures, the preferred vehicle of speculative investors, saw a sharp increase in open interest in recent weeks and months. That said, the CME Commitment of Traders report, which shows a large negative net position of hedge funds, doesn’t necessarily mean that they have a negative view on bitcoin. This could represent carry trades to take advantage of the futures premium versus spot bitcoin.

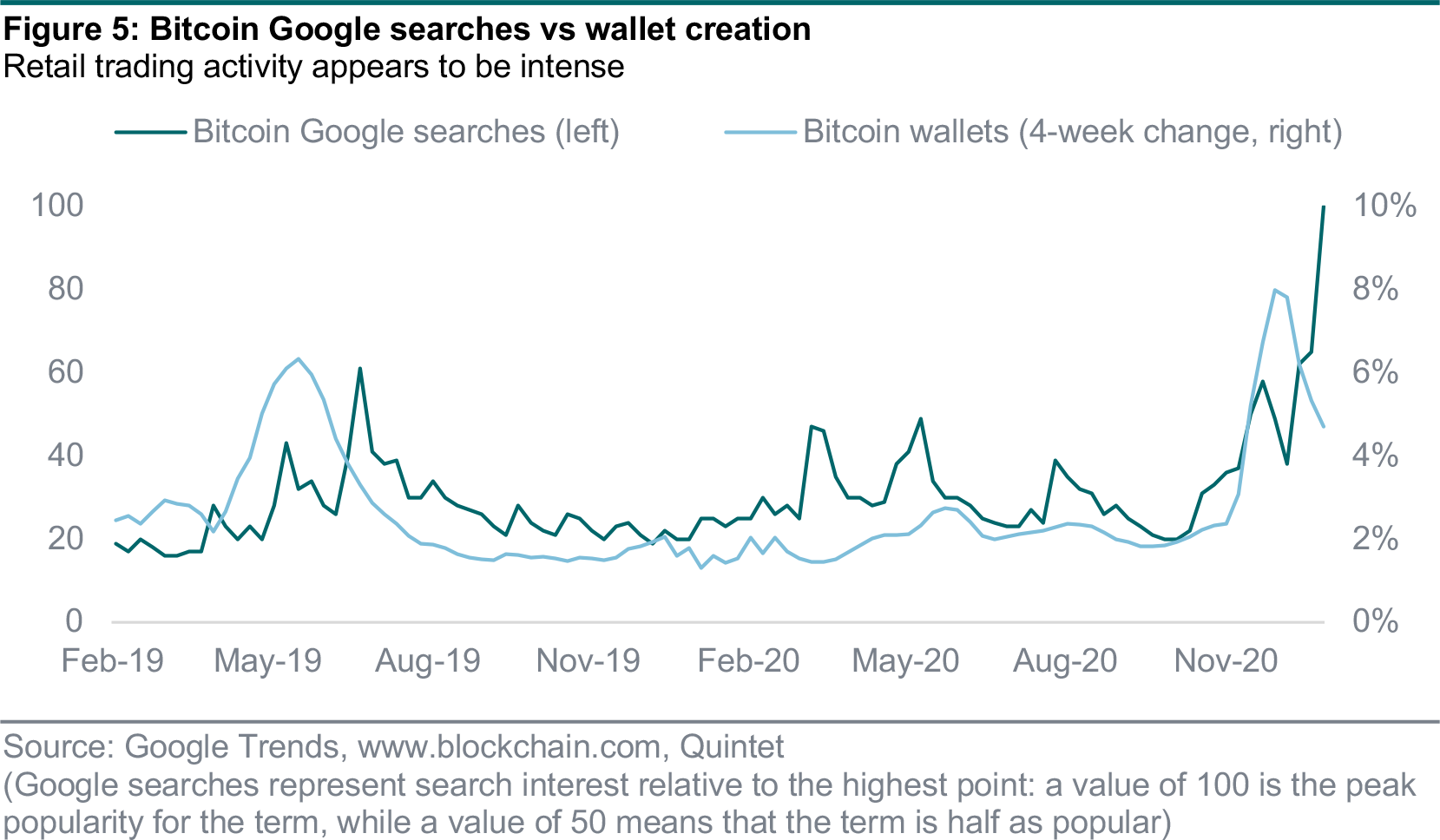

Moreover, bitcoin prices are correlated with Google search volumes. This may suggest a significant retail investor participation in this market. To be clear, the evidence isn’t unequivocal (and neither is it entirely retail-driven). For example, looking at the correlation between bitcoin wallets and Google searches, it appears that wallet creation tends to accelerate before pickups in Google searches for bitcoin – not after (figure 5).

However, it may well be that speculative behaviour affects both wallet creation and retail activity and/or that they all reinforce each other. Some, admittedly rather tentative, evidence is that the acceleration in wallet creation in 2019 did coincide with a period of rising bitcoin prices – from $5,000 to $8,000 within a month. It’s the same for early December 2020 – following a new price high in early November, the subsequent four weeks saw large increases in wallet creation and the price shooting even higher.

Bitcoin’s ascent started receiving corporate support via Square (a payments platform) and MicroStrategy (a software provider) in recent months. The recent endorsement by PayPal is another big step towards corporate support for bitcoin, which could facilitate, and perhaps enhance, the increased appetite from millennial investors for bitcoin as an ‘alternative’ means of exchange. However, in practice, bitcoin and other digital currencies face significant practical hurdles to their adoption as outside forms of money, and many of their possible benefits come with significant drawbacks.

First, some features of cryptocurrencies that might make them competitive with alternative stores of value are also likely to continue to attract government scrutiny. In particular, the anonymity of many cryptocurrencies. As such, it would be surprising if the ongoing growth in their popularity did not eventually result in even greater regulation and/or central banks adopting the same or an alternative technology and throwing their weight behind an official digital currency.

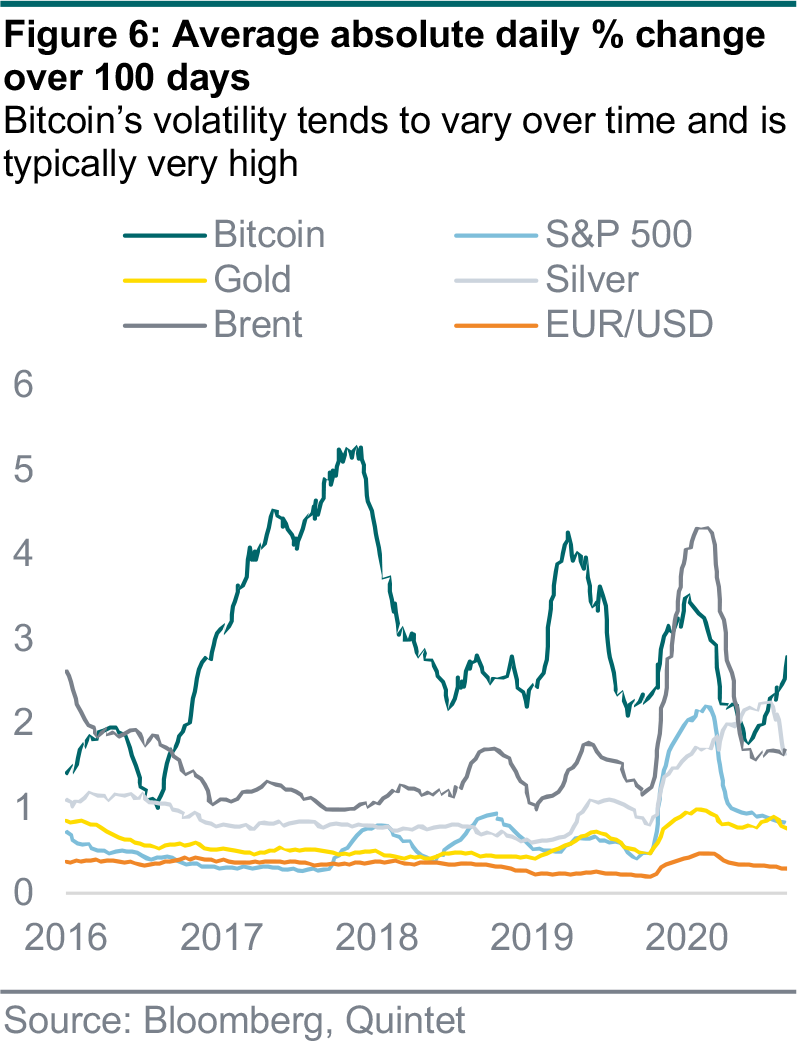

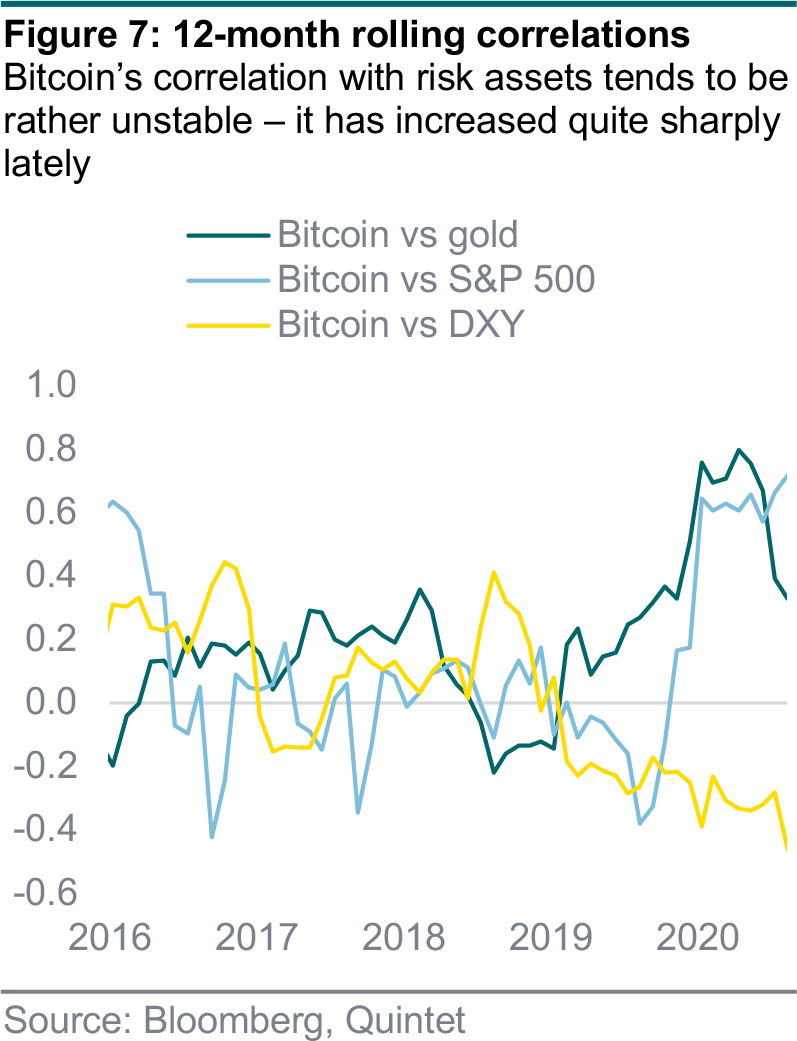

Second, bitcoin’s volatility makes it poorly suited as a substitute for money in a broad sense (figures 6 and 7). Considering cryptocurrencies more in general, volatility would likely need to come down significantly (either naturally, as the market matures, or through the widespread adoption of different types of cryptocurrencies, likely central bank-backed and designed to better stabilise purchasing power via supply adjustments) before we see broader adoption. This process would also be facilitated by the price of cryptocurrencies becoming less correlated with risk assets.

At this stage, not only is the volatility of bitcoin much higher than that of other risk assets. It also varies to a greater extent from period to period. There’s nothing so volatile – apart from Brent oil prices, and just for one relatively short-lived period. Precious metals and major currencies, which tend to be rather volatile, are much less so than bitcoin. What’s more, the correlation with the S&P 500, which is rather unstable too, has increased significantly over the past year or so.

Third, if we think about them as money or at least quasi-money, cryptocurrencies should have low expected returns in the long run, despite their high returns recently. We may be tempted to assume that long-run cryptocurrency returns should be equal to, or perhaps slightly below, growth in global real output – a number in the low single digits. Therefore, cryptocurrencies (again, if they were to graduate into a new form of money) should be thought of as low/zero return or hedge-like assets, akin to gold or certain other metals.

This could still mean that prices continue to increase at a faster rate while the use of cryptocurrencies becomes more widespread. An analogy might be the value of a biotech company that comes up with a new drug and registers a patent, which eventually becomes a generic. Another way of saying this is that there’s an inherent contradiction between cryptocurrencies as high-return assets on the one hand, and stores of value relative to goods and services on the other.

So could bitcoin succeed as a form of money? In theory, yes, if it proves to be more useful than the alternatives – in terms of facilitating transactions at a lower cost. In practice, however, these gains look small, at least in developed market economies. Transaction costs are relatively low, exchange rates and price inflation are broadly stable, precious metals can be used for portfolio diversification, and governments place few restrictions on holding foreign currency or foreign assets.

As things stand, it looks as if day-to-day transactions using bitcoin still face a number of hurdles, as the network can only handle a limited number of transactions per second (versus tens of thousands for a centralised payment network such as Visa). Rather, bitcoin could complement cross-border transfers and large transactions, given higher speed and lower cost.

The Office of the Comptroller of the Currency (OCC), which is one of the cornerstones of US banking regulation, has recently approved the use of stablecoins for the settlement of financial transactions by banks. (Stablecoins are cryptocurrencies designed to minimise the volatility of the price relative to some ‘stable’ asset or basket of assets.) The OCC guidance clears the way for banks to participate in independent node verification networks (INVN) and use stablecoins to conduct payment activities and other bank-permissible functions.

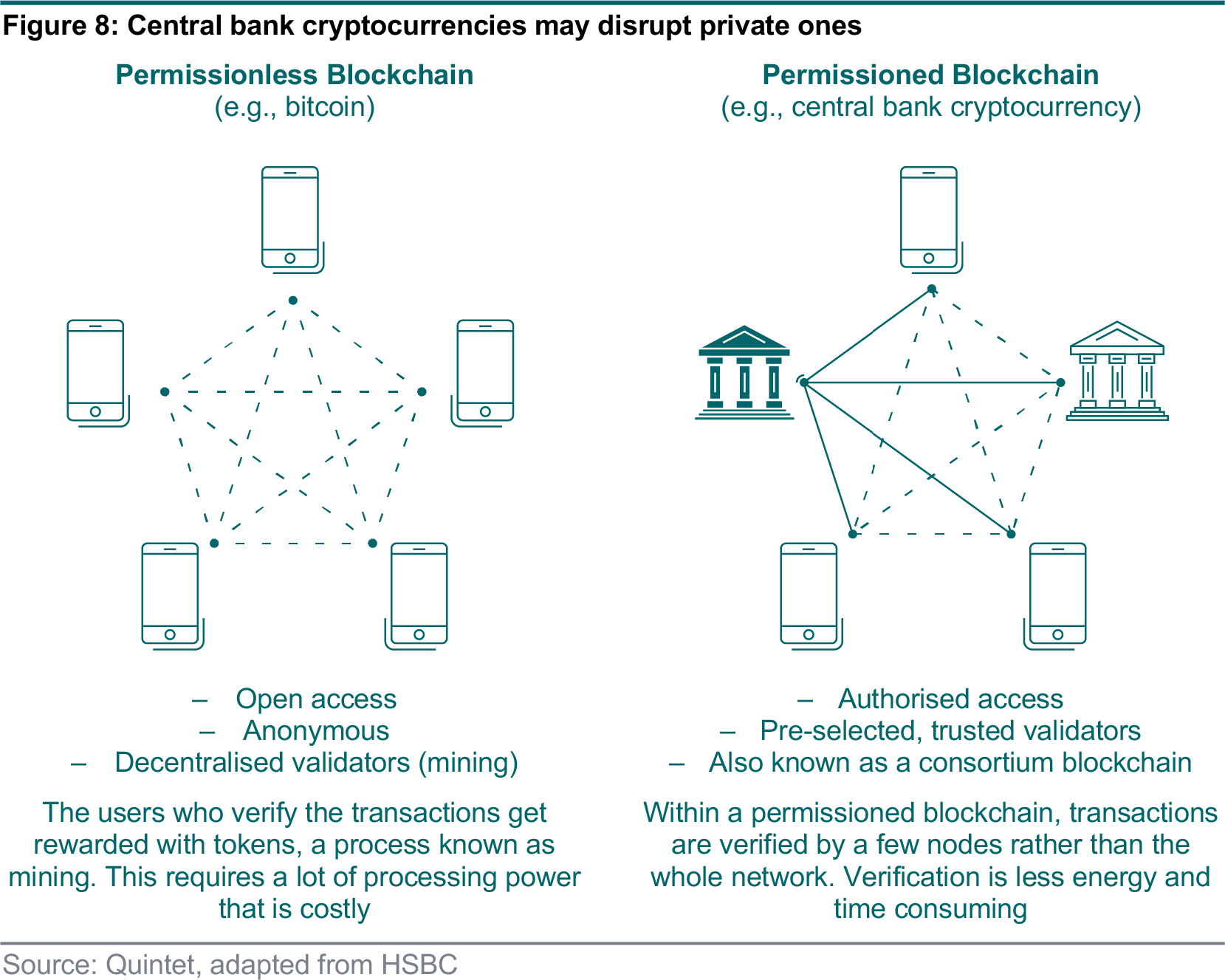

This means that, in the US, a national bank or federal savings association may validate, store and record payment transactions by serving as a node on an INVN. Likewise, a bank may use INVNs and related stablecoins to carry out other permissible payment activities. While the OCC’s approval added to the surge of investor interest in cryptocurrencies, the guidance doesn’t cover decentralised assets like bitcoin. Rather, the lifting of perceived restrictions is linked to regulatory-approved bank-issued coins and central bank digital currencies (figure 8). The main difference between a central bank cryptocurrency (CBCC) and a private cryptocurrency like bitcoin is that a CBCC is a claim on the central bank, while a private cryptocurrency is just an asset. The issuing central bank would have the ability to control the money supply – whereas in bitcoin’s case there’s a predetermined maximum supply of the cryptocurrency.

A CBCC should have all of the properties of cash that, say bitcoin, does not – being a widely accepted means of payment, a stable price and a store of value. Therefore, the main difference is that a central bank cryptocurrency would likely have to be permissioned rather than permissionless. Within a permissionless blockchain, anyone can opt in to validate transactions (by mining) within the network. This makes the process slow and energy intensive. A permissioned blockchain may be able to process payments more quickly, allowing the network to increase speed and capacity, but giving up some other features such as independence and flexibility.

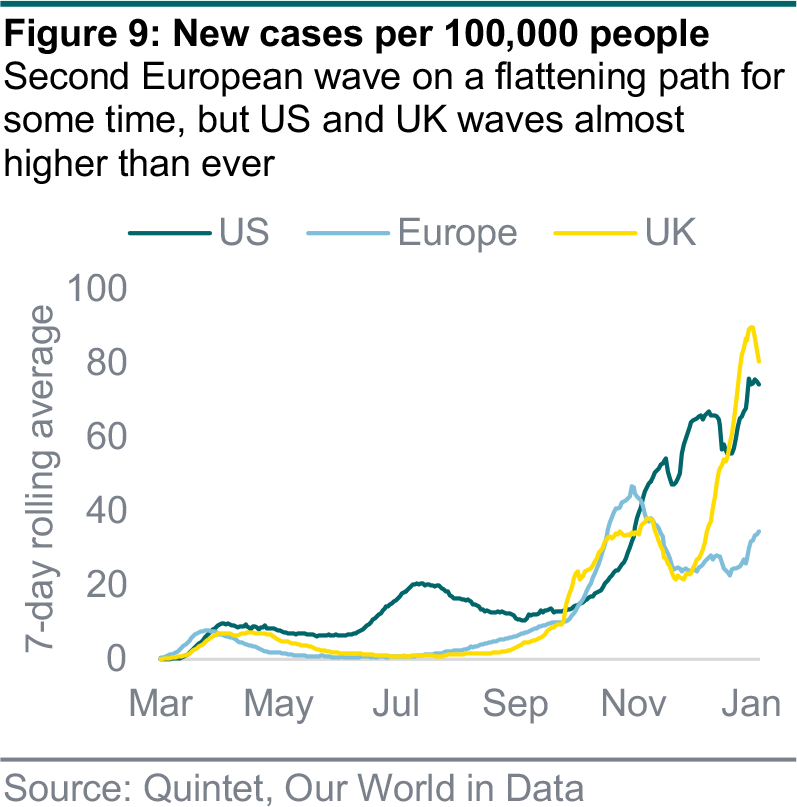

New infections worldwide have increased by 11 million since the beginning of the year and the total figure is now above 94 million. New infection rates in the euro area have remained at the same level over the past two months, although there is significant cross-country variation. For example, infection numbers are rising in Spain but the situation is still reasonably under control compared with the US and UK. The latter recently recorded its highest figure of more than 68,000 daily new infections. This development might be due to the new mutation of the virus, which seems to be spreading faster. The US also reported a record peak of more than 292,000 infections in a single day. This catapulted the US to 90 infections per 100,000 population – a national record so far.

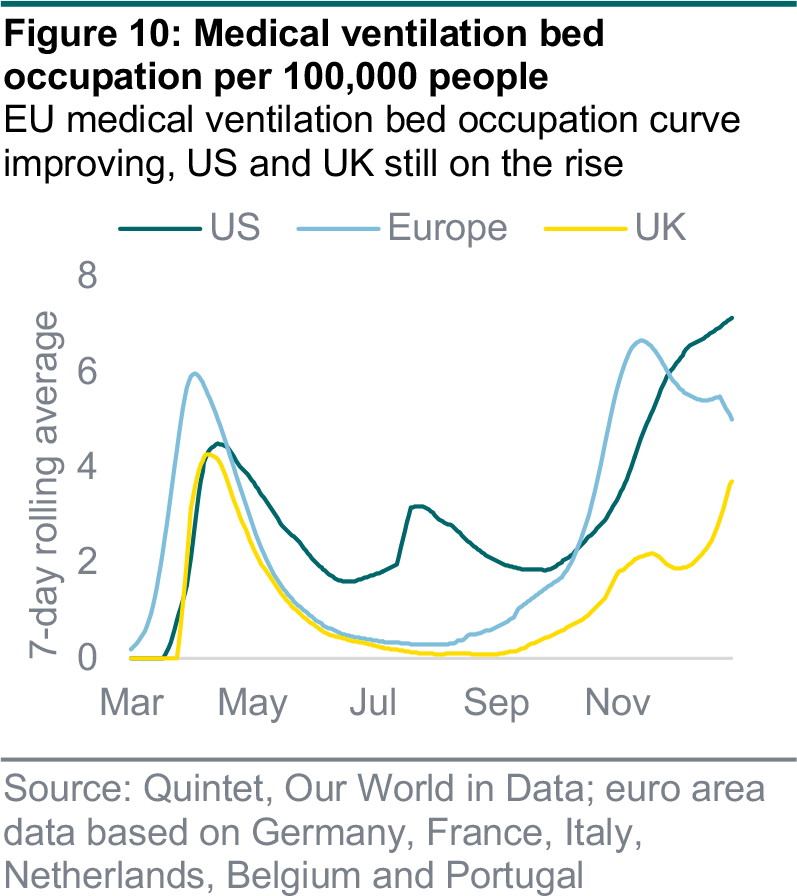

Overall, hospitalisation rates reflect the new infection numbers. While the occupation rates of intensive care units (ICUs) in Europe are getting better, patient numbers in the US and the UK are still increasing – and fast. In both countries, occupation of ICUs has reached critical levels. Although the situation looks slightly better in the euro area, the numbers still look alarming and are forcing governments to react.

In recent weeks, governments have responded to the increase in infection rates with tougher lockdown measures. The UK and Germany have tightened and prolonged restrictions on movement. The outbreak of the mutation – which already makes up around one third of new UK infections – and the associated fear of the virus spreading faster have contributed to the tighter measures. It’s important that hospitals are not overloaded since they are already in a critical state.

Despite the grim statistics, there is a glimmer of light on the horizon. The vaccination programmes started at the end of last year and the number of people receiving vaccines is increasing. In addition, at least 20 vaccines are already in the final ‘phase 3’ of testing. This means that production and availability should increase considerably from here.

As a consequence, herd immunity can be expected around the summer, most likely first in the UK, then in the US and finally in the euro area. Notably, the vaccines appear to be effective against mutations of the virus. Although some sections of the population are reluctant to be vaccinated, we believe this resistance is likely to fade as the programmes are rolled out.

Authors:

Daniele Antonucci Chief Economist & Macro Strategist

Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 18 January 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.