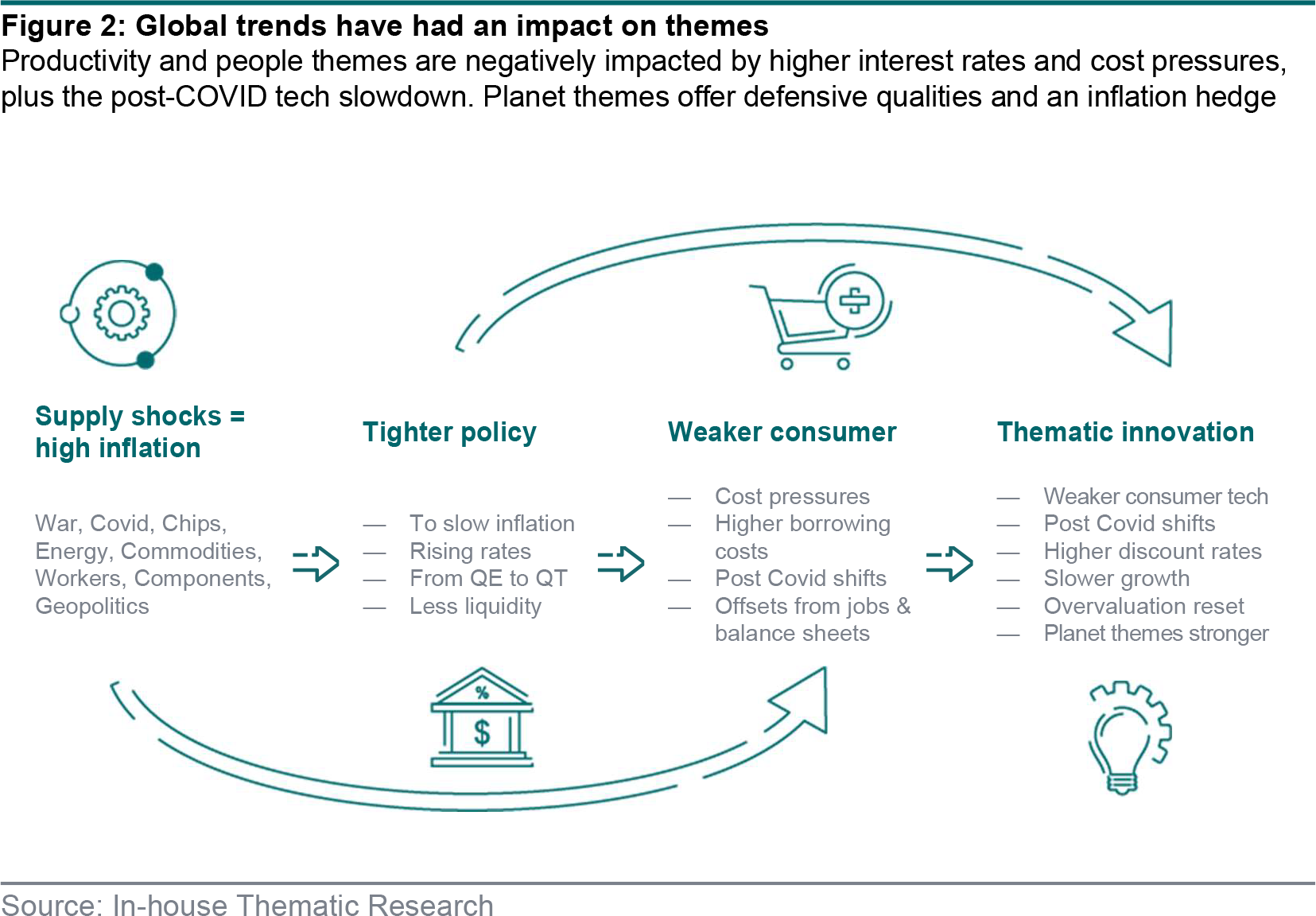

- Rising borrowing costs from record lows, the Ukraine War, supply shortages, cost of living pressures and corporate guidance together have driven down risk assets in 2022. At the same time, central banks have turned less supportive for financial markets to tame inflation.

- Against this backdrop of higher risks and volatility, defensive planet themes seem better placed than high-growth productivity or consumer-focused people themes. Innovation and structural themes can thrive over the long term, but company fundamentals matter during a resetting period, especially to assess which trends and companies have more solid support.

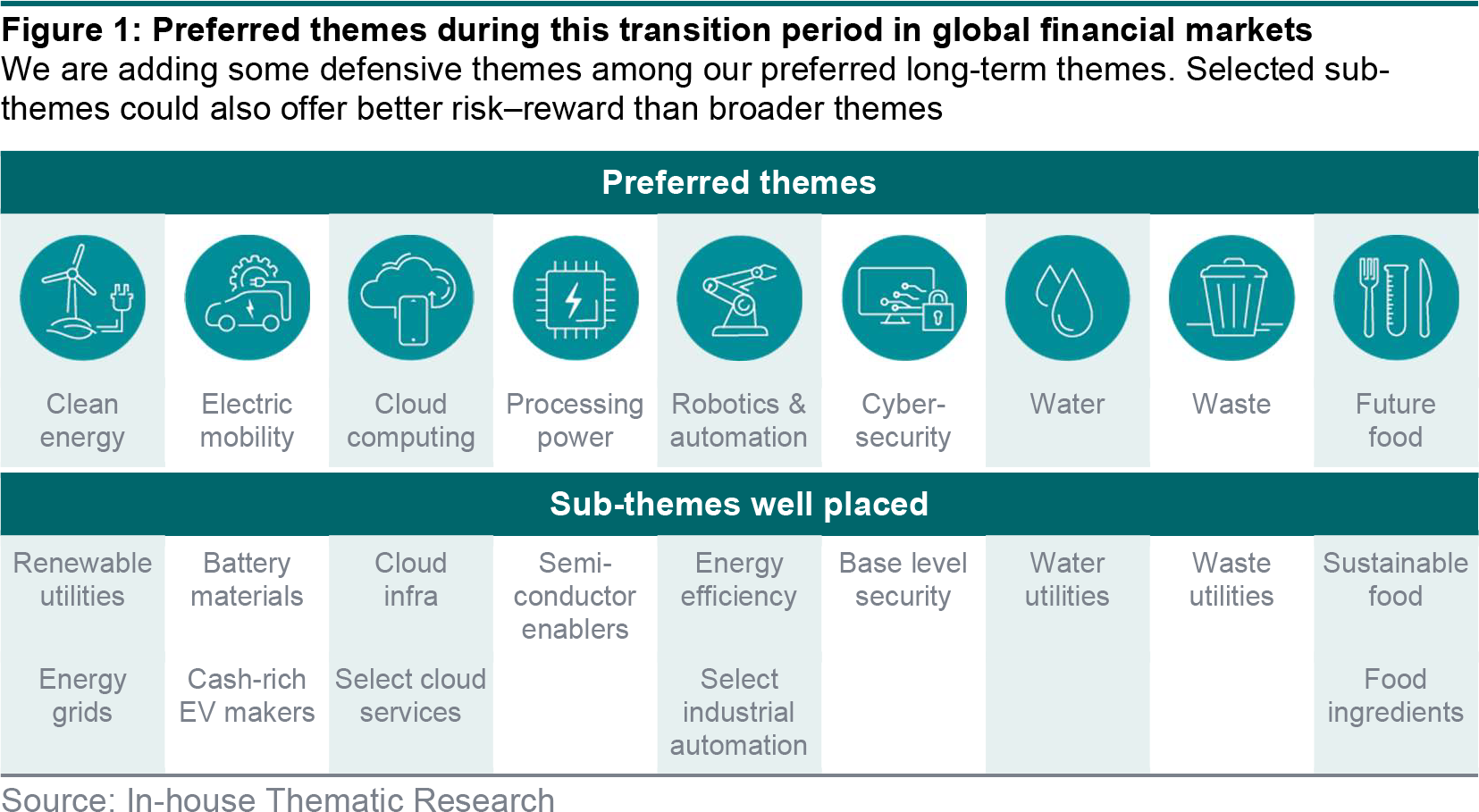

- Our thematic playbook considers long-term structural themes but during this transition phase, defensive qualities, earnings trends and valuations could also be important. We already prefer segments within themes like clean energy, electric mobility, cloud computing, processing power, cybersecurity, and robotics and automation. We now think certain segments in themes like water, waste and future food look well-placed too.

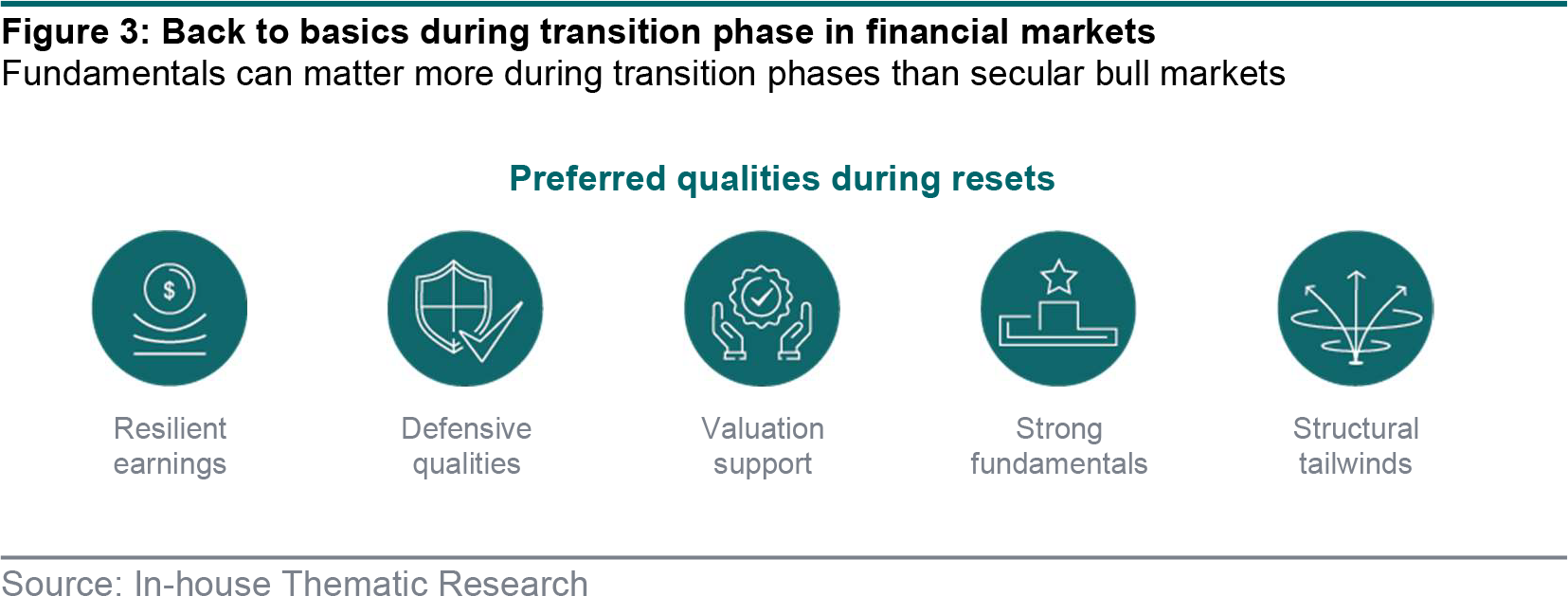

A long-term approach to investing tends to be the best approach, especially when it comes to structural themes. But during transition phases like the one we are experiencing now – economies past the peak, post-COVID shifts, central bank policy normalising and a major war causing supply shocks – it is important to consider some near-term fundamentals like earnings and valuations in addition to long-term growth.

We are adding water, waste and future food to our list of preferred themes as segments within them can offer investors exposure to inflation and defensive qualities. High-growth disruptive innovation themes are undergoing a period of outlook resets, which ought to offer some interesting long-term opportunities in future. Visible productivity and planet themes including certain segments in cloud computing, processing power, clean energy and electric mobility. We are now cautious on many People themes that are exposed to a weaker consumer and risks on earnings/valuation resets.

Themes are not immune to broader macro and market moves. This year has been especially challenging for high-growth themes as inflation has pushed up interest rates (though from record lows), which is key for discounting future cash flows. At the same time, post-COVID shifts and cost of living pressures are limiting growth rates for high-growth thematic stocks even if for the broader economy, this may be more like a normalisation after super-strong growth than outright recession.

Our economists expect inflation to begin to normalise – at least partly – later this year, which could help central bank policy turn less hawkish. As this normalisation happens, companies in any theme with defensive qualities, better earnings and stronger fundamentals as well as visible growth and lower valuations could offer a better risk–reward profile. Selected sub-themes may be more resilient than broader themes. As expectations reset in 2022, especially for disruptive innovation themes, long- term opportunities could arise as strong business models and structural trends shine through.

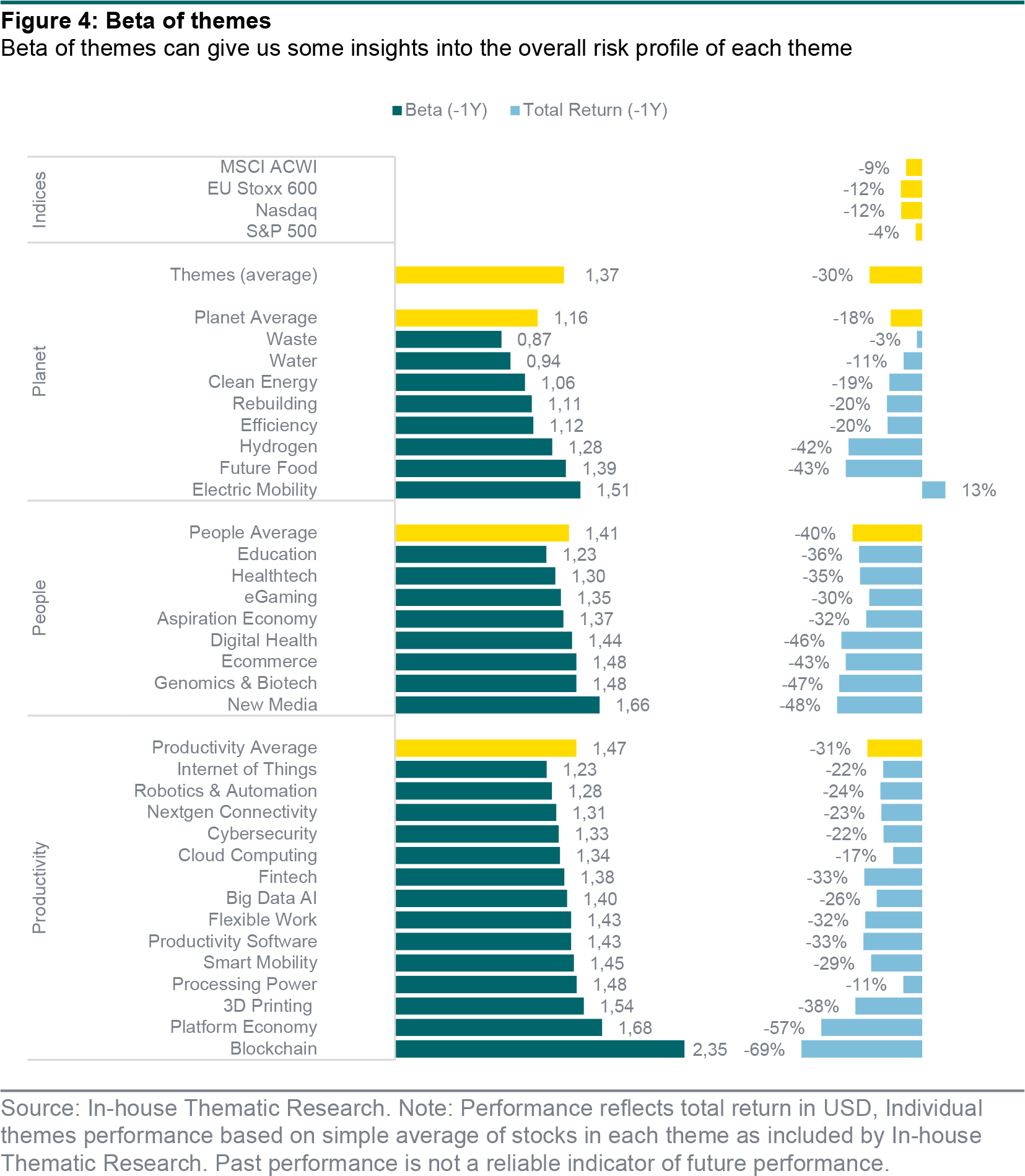

The beta of companies within each theme can give us a good idea of a theme’s risk profile. Companies in themes like water, waste and clean energy on average have betas close to the market, while blockchain, platform economy and new media are high beta (i.e. higher risk).

Most structural themes are growth orientated and tend to be higher beta. Even within themes, there can be differences in risk profiles. Utilities exposure in waste, water and clean energy are defensive, while equipment suppliers have higher beta. Food ingredients within future food would be more defensive than food delivery. Overall, planet themes have a lower beta than people and productivity themes.

Beta does not always strongly correlate with performance though. For example, water and waste are low beta and have held up better during the past year. However, electric mobility, processing power and cloud computing are high beta, yet have also held up better than most themes.

Therefore, other factors such as earnings and structural profile could also be key.

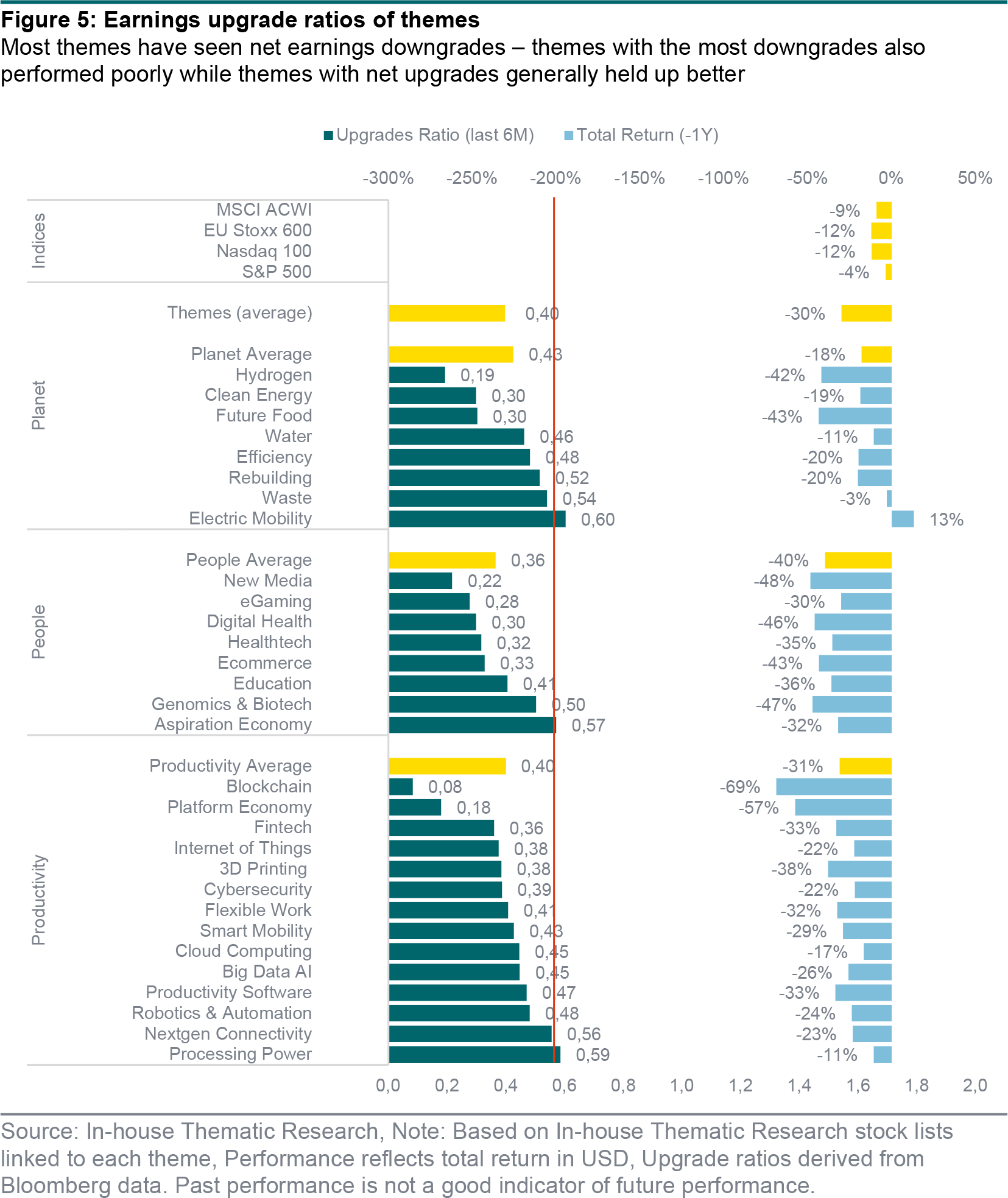

The earnings trends of companies in each theme can provide valuable insights. Themes with the most earnings downgrades in the last six months (i.e. low upgrades ratios) have performed the worst during the last year. Themes with net positive upgrade ratios (i.e. above 0.5) have performed better, with some even enjoying positive performance in an otherwise volatile market.

Overall, most themes have experienced net downgrades (average 0.40 upgrade ratio). Where the earnings upgrades ratios of themes fall between 0.35 and 0.50, performance is generally negative but varies a lot. People themes have seen the most downgrades, highlighting the rising cost of living pressures on consumers, as well as other factors like the post-COVID tech slowdown and competition in certain segments. The big question is when will most themes start to see net positive upgrades? We think the ‘great reset’ could continue over the next couple of quarters, especially in themes linked to consumers and in high-growth disruptive innovation.

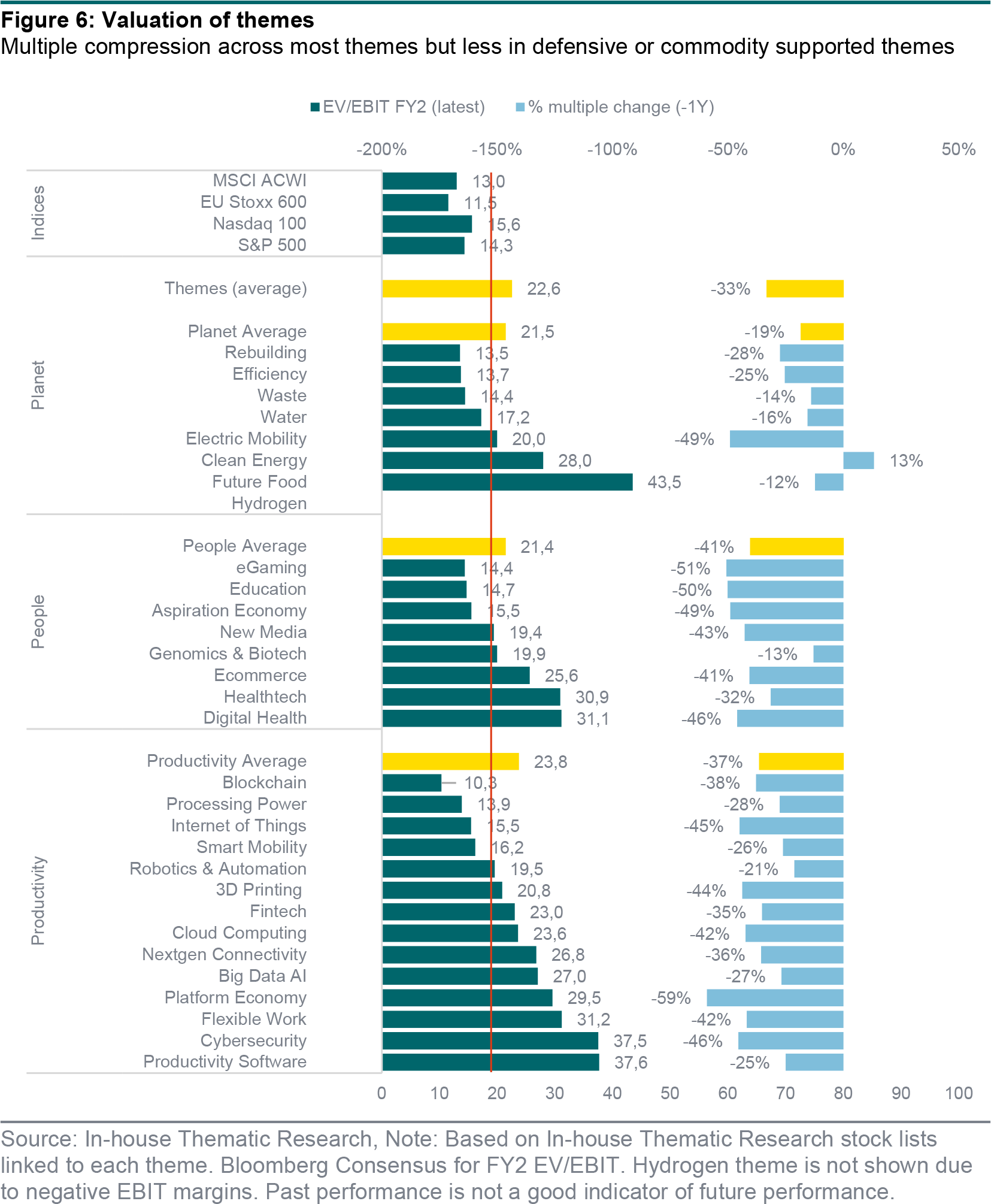

As risk assets and growth themes have corrected, unsurprisingly, valuation multiples for companies in most themes have compressed versus a year ago (EV/EBIT of themes shown in figure 6). In the past, high-growth themes have tended to trade at high multiples, reflecting their growth potential, while defensive themes have traded at multiples closer to broad market indices.

With growth rates across themes under reassessment, the risk of multiple compression is higher in expensive themes. The absolute level of multiples matter though, not just the past correction. In most cases, it makes sense to prefer lower multiples during volatile markets to reduce risks as market participants reset earnings outlooks. Some themes like clean energy and cybersecurity could get extra support due to external factors like the energy crisis and the Ukraine War, even if these themes are trading at above-market multiples for now.

There is likely to be a lot of variability among companies and sub-segments within each theme when it comes to characteristics such as beta, earnings changes trends, growth rates, financial strength and valuation multiples.

Secular and structural trend investing is likely to come back into vogue once the outlook becomes clearer after the great reset in 2022 and as global macro conditions stabilise. However, in this transition phase in the broader markets, we think it is important to consider the characteristics of themes and fundamentals at a more granular level rather than just taking a blanket approach to themes.

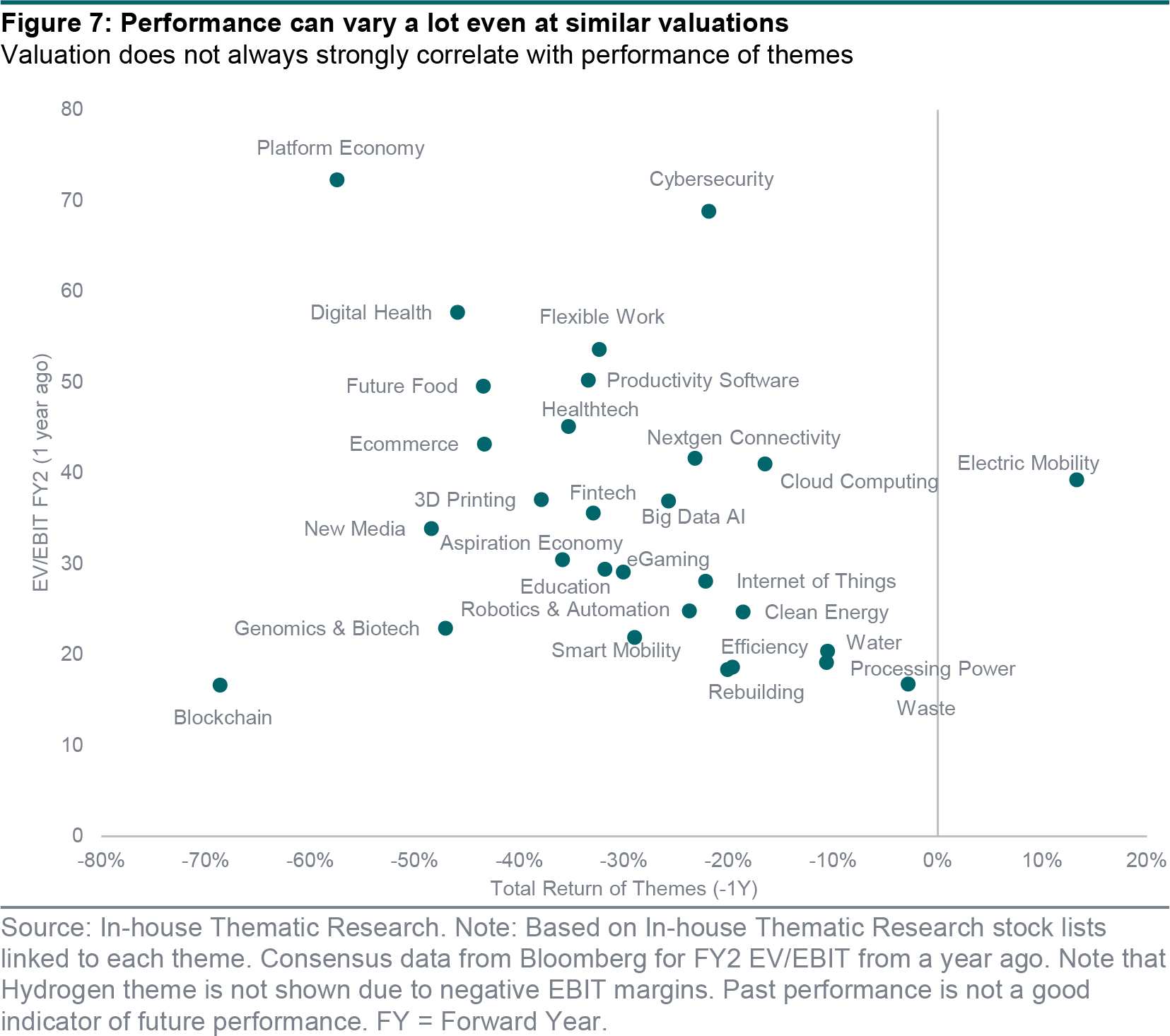

A good example is to look at valuation multiples a year ago and the performance since then. A number of themes at different valuation levels have performed equally badly, suggesting there is more to investing in themes than just a broad approach.

We may be in a phase when it is important to take a selective approach via sub-themes that offer defensive profiles and better earnings/valuation resilience than broader themes. For example in the nextgen connectivity theme, the telecom tower sub-theme could offer a more defensive profile.

We are turning cautious on many People themes such as new media, ecommerce, platform economy, eGaming and flexible work as earnings reset during 2022 due to post COVID shifts, rising competition in certain segments and cost of living pressure on consumers.

Authors:

- Pinaki Das Head of Thematic Research

- Aminah Tariq Sustainable Investing Analyst

- Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 30 May 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.