Quintet’s sustainable investing philosophy comprises a toolkit of approaches and dedicated assets. In this primer we deep dive into the thematic approach – the fastest-growing sustainable investing strategy.

- Thematic strategies seek to take advantage of significant secular trends that are underappreciated by the wider market.

- Academic and industry evidence suggests that, in the long-term, thematic strategies may generate excess returns compared to conventional benchmarks.

- Thematic strategies can be applied to both equities and bonds. They can be implemented via active or passive approaches.

Thematic investing seeks to identify companies that are well positioned to take advantage of significant secular growth trends currently underappreciated by the wider market.

What is the investment thesis?

Investors deploying thematic strategies expect that companies exposed to these trends will have the potential to grow their revenues and cashflows faster than their competitors, commanding higher valuation multiples and leading to attractive returns for investors over a multi-year time horizon.

How can themes be identified?

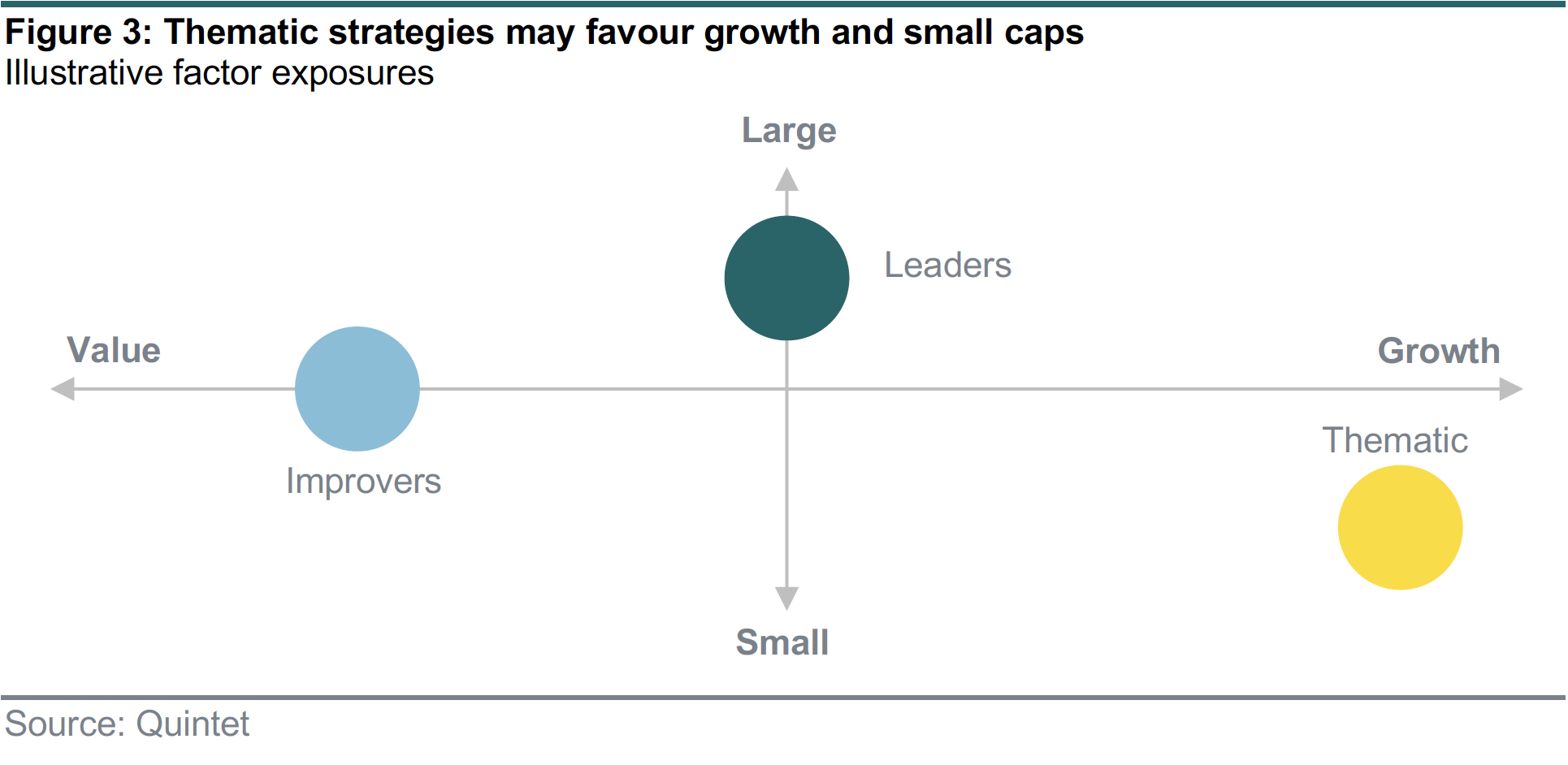

Theme identification relies on recognising which industries and companies are best positioned to monetise and benefit from defined secular trends. It differs from other sustainable investment approaches, such as leaders and improvers, in that it primarily focuses on the company’s products and services, instead of focusing on overall corporate sustainability performance.

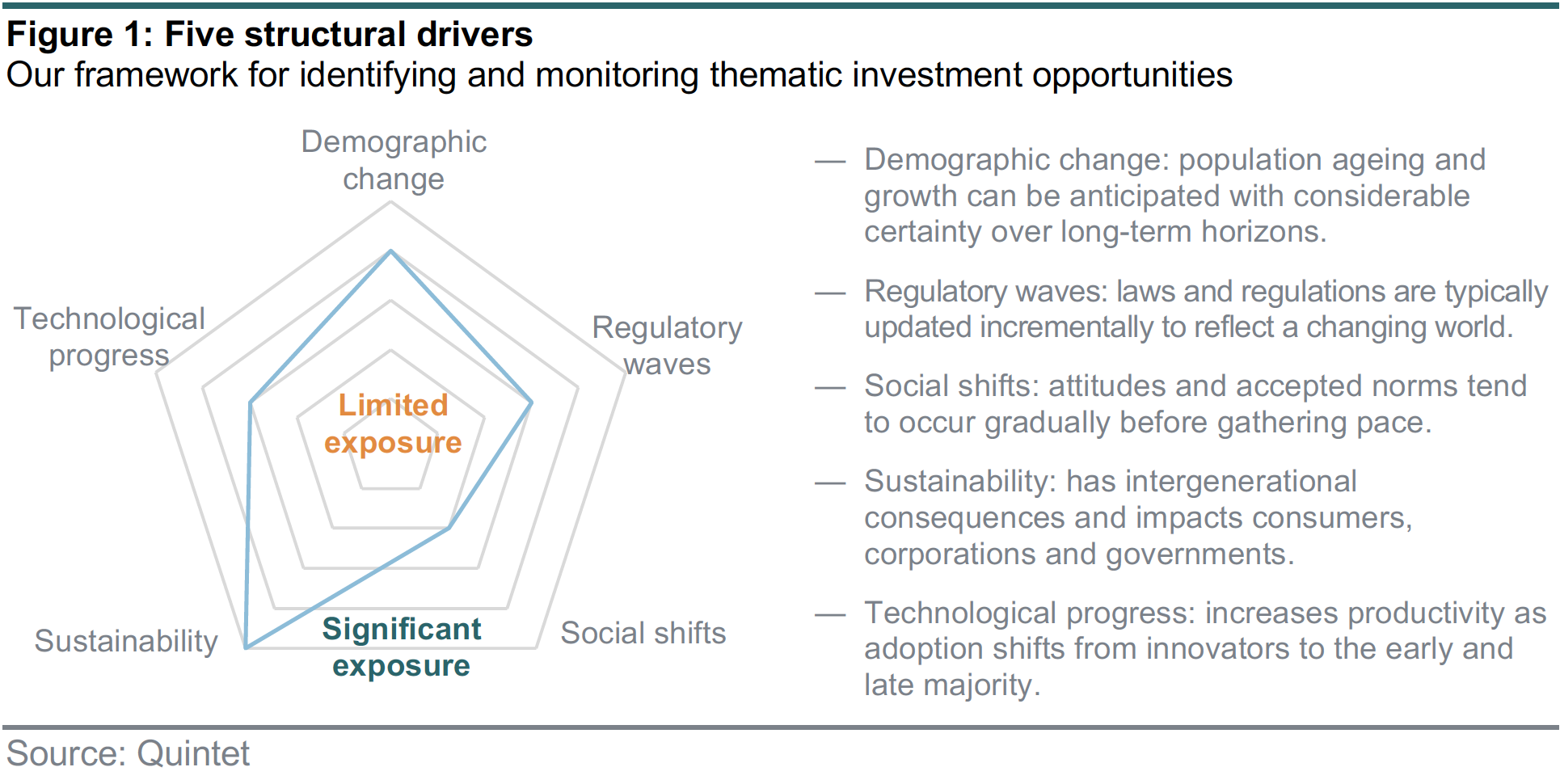

At Quintet we deploy five powerful structural drivers to identify and monitor thematic opportunities: demographic change, regulatory waves, social shifts, sustainability and technological progress. We assess each potential thematic investment using these five drivers (figure 1).

How does one construct thematic strategies?

Thematic investing is typically unconstrained and constructed without reference to sector or regional weights. This approach may lead to large deviations compared with conventional benchmarks as entire portions of the market may not be selected.

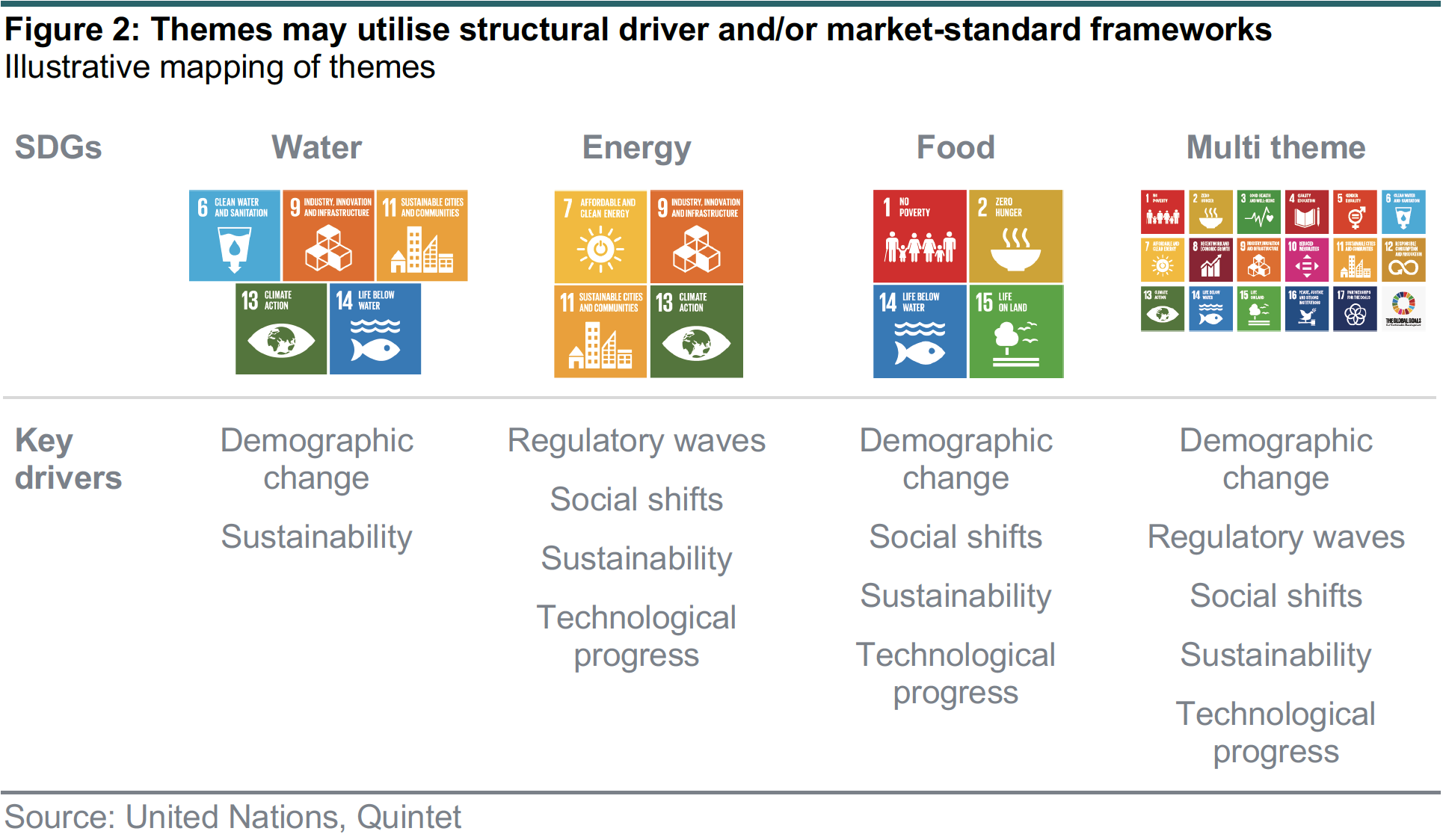

A thematic strategy may contain a single theme or multiple themes. The latter can use a set of structural drivers and seek themes located at the drivers’ intersection. In addition, or alternatively, a multi-theme strategy may adopt a market-standard framework such as the United Nations Sustainable Development Goals (UN SDGs) (figure 2). Following thematic identification, investments are sought that have the significant potential to financially benefit from the desired long-term trends.

Sustainable thematic strategies can help support a transition towards a more sustainable economy and may improve investor returns.

Why are thematic strategies good for people and planet?

Thematic strategies enable investors to align their investments with their personal preferences. By investing via a thematic strategy, investors can signal the importance of companies developing products and services that help the transition to a more sustainable economy. When deployed in private markets, thematic strategies can channel significant new capital to companies and nascent industries, helping them scale and achieve larger positive impact.

Are thematic strategies good for your portfolio?

Academic evidence suggests thematic strategies may be additive to risk and return. A large body of research observes a “conglomerate discount” and suggests specialist companies achieve better long-term economic performance than larger more diversified firms.1

Exposure to structural trends – particularly sustainable trends – may also prove beneficial during cyclical downturns if the structural trends remain intact. A study of 1,000 European mutual funds for the period 2007–17 found that sustainable thematic funds performed better than non-sustainable thematic funds during market turmoil. The study also concluded that thematic funds provided exposure to assets in which direct investment is difficult, such as water.2

Practitioner evidence supports the academic findings. Robeco finds that thematic investing provides an opportunity to exploit systematic behavioural biases and generate outperformance due to people’s tendency to underestimate exponential growth.3 BlackRock agrees with this view: “The market typically underestimates the speed of adoption of disruptive technologies, due to the adoption curves being S-shaped.”4 UBS highlights themes’ portfolio diversification benefits, as their relationship to structural trends may lead to “lower correlation to standard benchmarks”.5

However, these characteristics can also involve risks, and, historically, theme and manager selection have been crucial to investment returns. Analysis of the Morningstar fund database reveals that just 45% of public market equity thematic funds launched before 2010 remained operational in 2020. Of the survivors, just one in four had total returns in excess of global equities.6

What portfolio characteristics do thematic strategies exhibit?

Thematic strategies often have a bias towards smaller, faster-growing companies, this may contribute to portfolio diversification (figure 3).

Are thematic strategies typically active or passive?

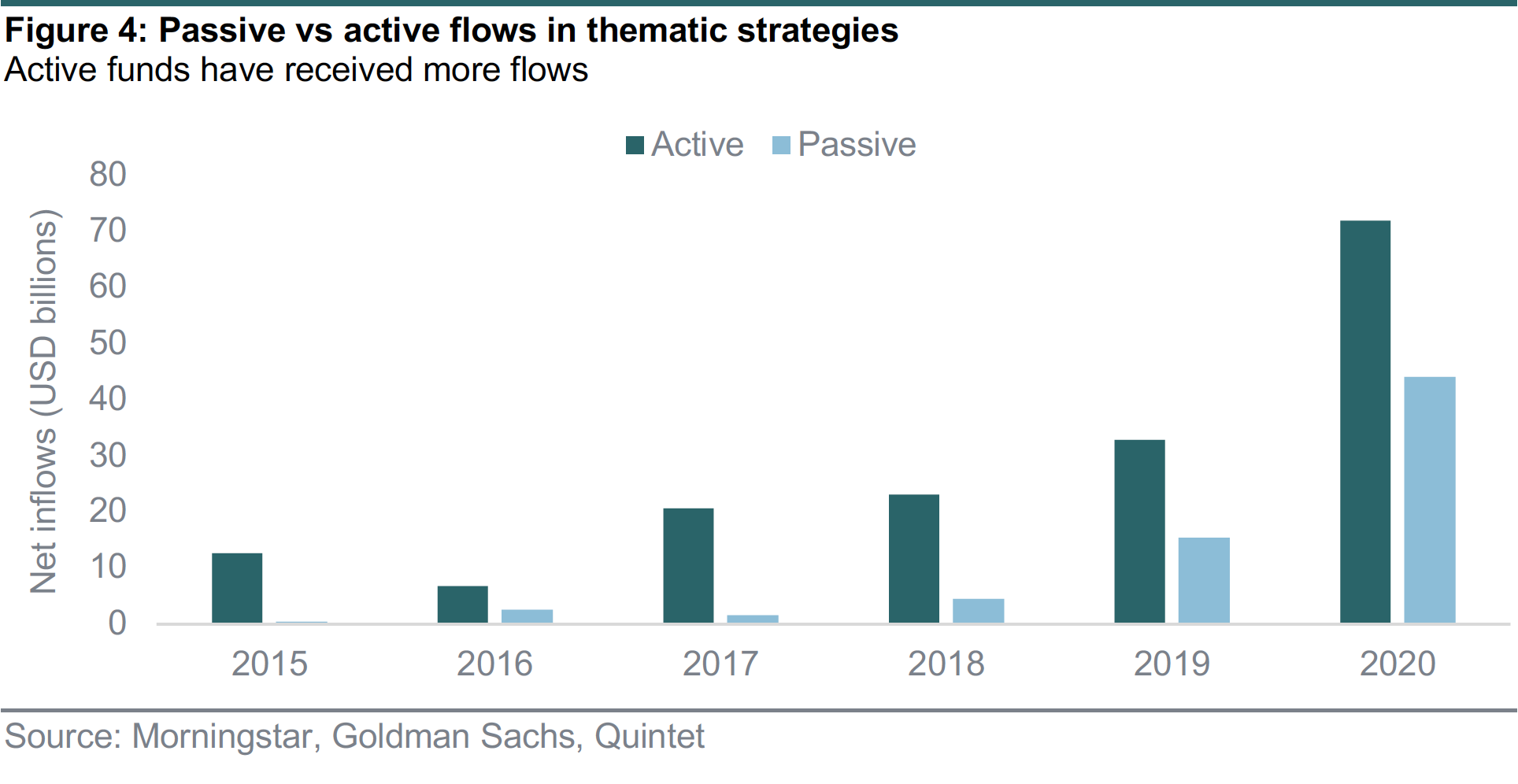

Passive thematic strategies typically use sectoral or revenue data. This creates challenges as such data is not always available, consistently reported, or of a high quality, especially for small and medium-sized companies. Active thematic strategies can incorporate quantitative and / or qualitative assessments. In recent years active funds have received more investor flows than their passive counterparts (figure 4).

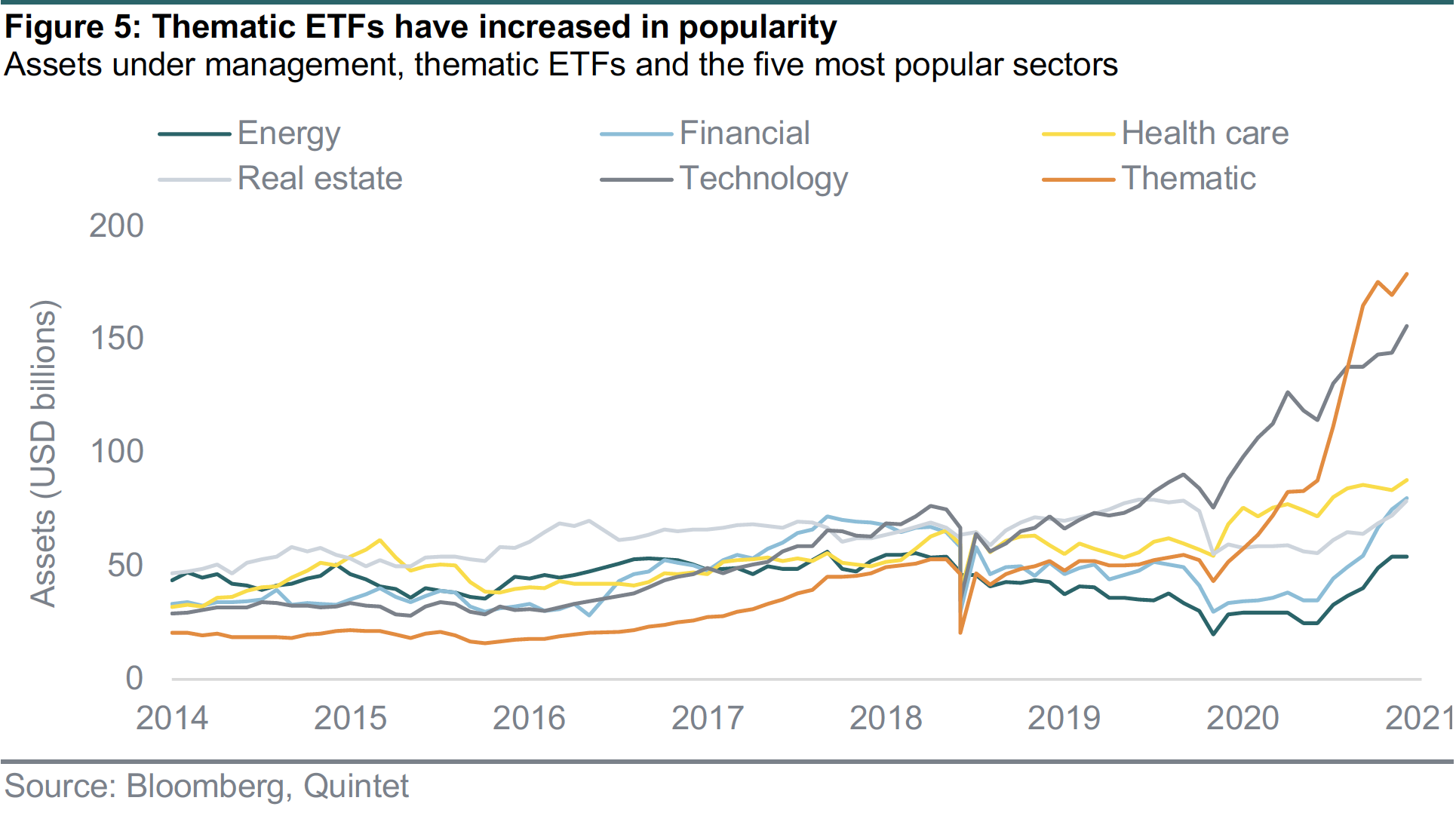

Despite active flows still exceeding passive, thematic exchange-traded-funds (ETFs) are increasingly more popular and have outpaced passive sector ETFs. Figure 5 shows that until 2018 passive thematic ETFs had fewer assets than the five most popular sectors. Subsequentially, their popularity – relative to the more traditional sector investment approach – has surged, amounting to over $180 billion in assets.7

How can one invest in themes?

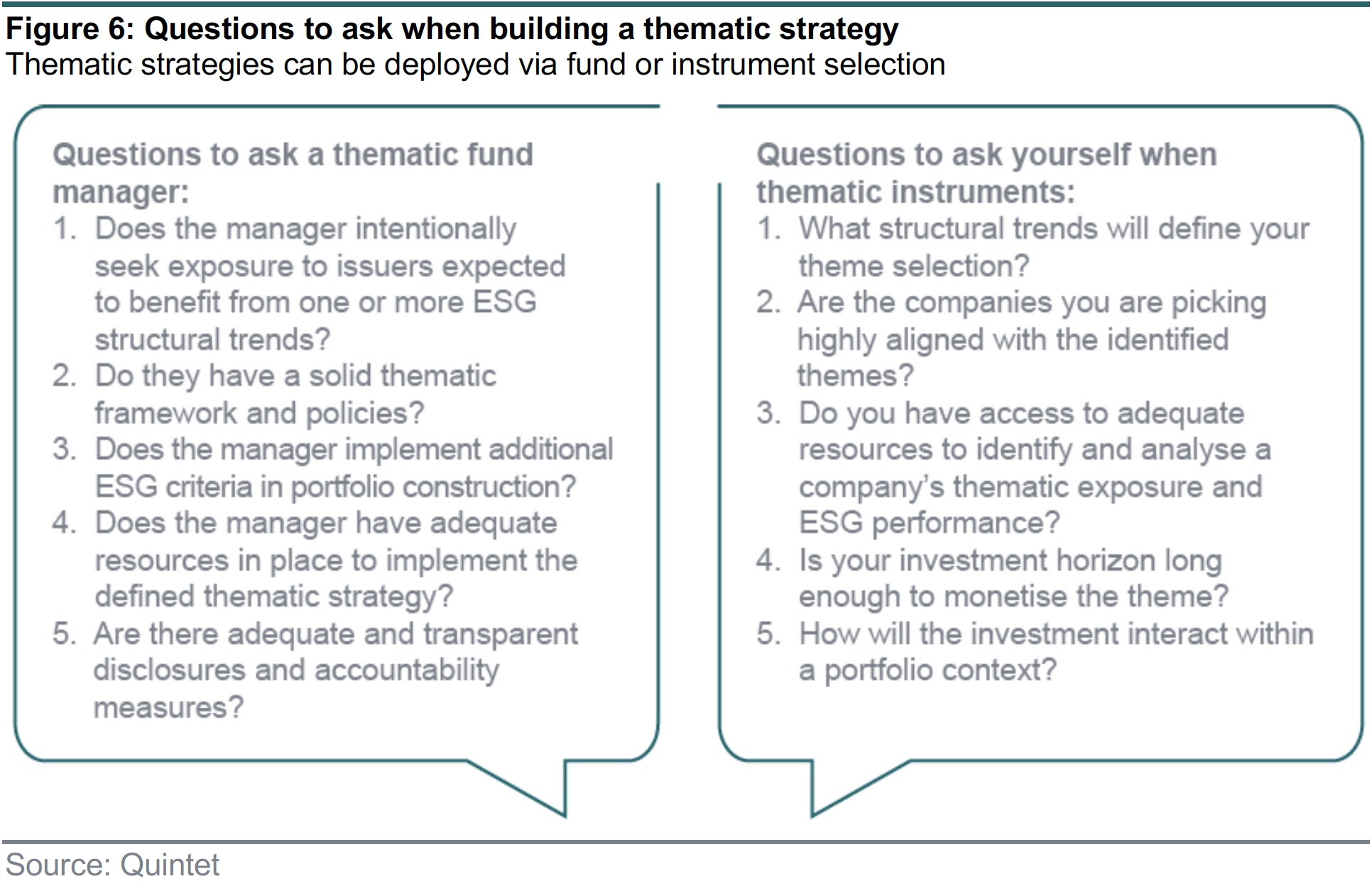

Themes are an investment lens applicable to both equity and bonds yet most commonly deployed within equity strategies, as the potential investment return from correctly predicting a structural shift is uncapped. This strategy can be benchmarked to a conventional index such as MSCI World or Barclays Global Corporate Aggregate or a sustainable index such as MSCI World SRI. Investors can deploy thematic strategies in their portfolios via single instrument selection or via fund selection (figure 6).

What are the key risks?

The risks of investing with a thematic approach mirror conventional risks such as credit, duration or equity. However, there are some specific risks:

- Thematic strategies that focus on individual themes and / or small and mid-sized companies may result in greater idiosyncratic risk, higher volatility, and larger tracking error than conventional strategies.

- Thematic strategies can be vulnerable to sustainability risks. Unless minimum standards are applied, thematic approaches may focus on companies whose products and services are sustainable but whose operational practices are not.

- Thematic strategies can be vulnerable to investor herding or “hype” – leading to the overvaluation of assets and subsequent underperformance. Thematic investing requires a welldefined investment scope and supporting data to evidence the trend.

1 Ammann, M., Hoechle, D., & Schmid, M. (2012). Is there really no conglomerate discount? Journal of Business Finance & Accounting, 39(1–2), 264–288.

2 Ielasi, F., & Rossolini, M. (2019). Responsible or thematic? The true nature of sustainability-themed mutual funds. Sustainability, 11(12), 3304.

3 Bergakker, S. and Van Oerle, J. (2017). The rationale for trends Investing – Moving beyond story telling. Robeco.

4 Foster, A. et al. (2020). Positioning thematic funds in portfolios. BlackRock.

5 Whittaker, R. et al. (2018). Education primer: ESG thematic equities. UBS

6 Morningstar. (2020). Global Thematic Landscape.

7 Bloomberg. (2020). Themes could outgrow sectors as ETFs show sea change in effect. Themes could outgrow sectors as ETFs show sea change in effect | Bloomberg Professional Services

Authors:

AJ Singh Head of ESG & Sustainable Investing

Bas Gradussen Sustainable Investment Strategist

Giang Vu Sustainable Investment Strategist

Martynas Rudavicius Sustainable Investment Strategist

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 03 May 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.