Quintet's incorporation of environmental and social characteristics comprises a toolkit of approaches and dedicated assets. In this primer we deep dive into dedicated assets – arguably an investing strategy considering ESG factors which is designed to deliver a real-world impact.

- Dedicated asset investors seek to identify financial instruments that are explicitly designed with ESG (environmental, social and governance) factors as a defining characteristic.

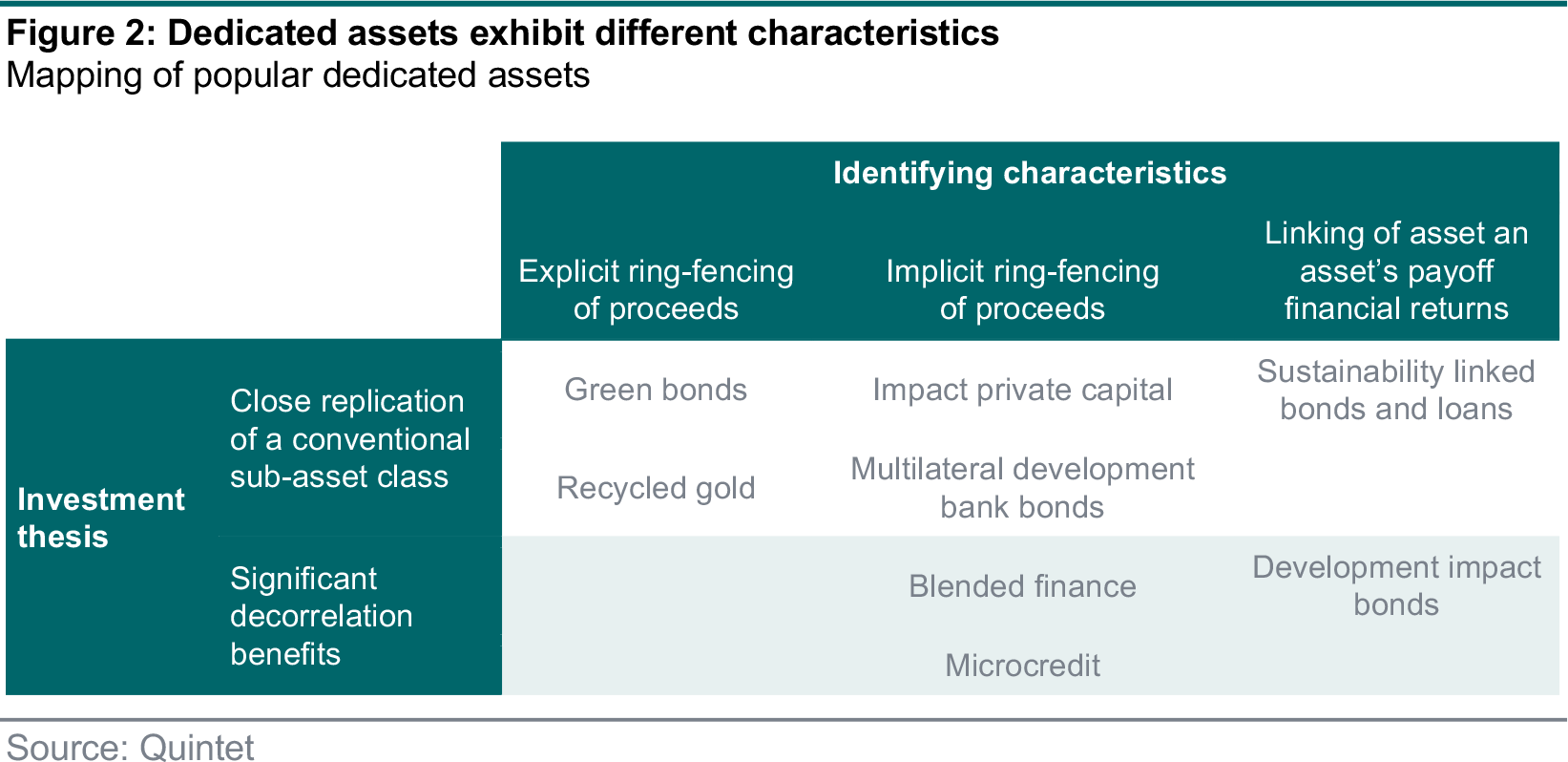

- Investors who deploy dedicated assets typically seek either close replication of a conventional sub-asset class or significant decorrelation benefits with an exposure not found in other financial instruments.

- Dedicated assets typically have a large primary market component. When deployed in primary markets dedicated asset strategies can channel significant new capital to individuals, companies and nascent industries, helping them scale and achieve larger positive impact.

Dedicated asset investors seek to identify financial instruments that are explicitly designed with ESG factors as a defining characteristic. Examples of popular dedicated assets are green bonds, multilateral development bank debt and microcredit (figure 1).

What is the investment thesis?

Investors deploying dedicated asset strategies typically seek either:

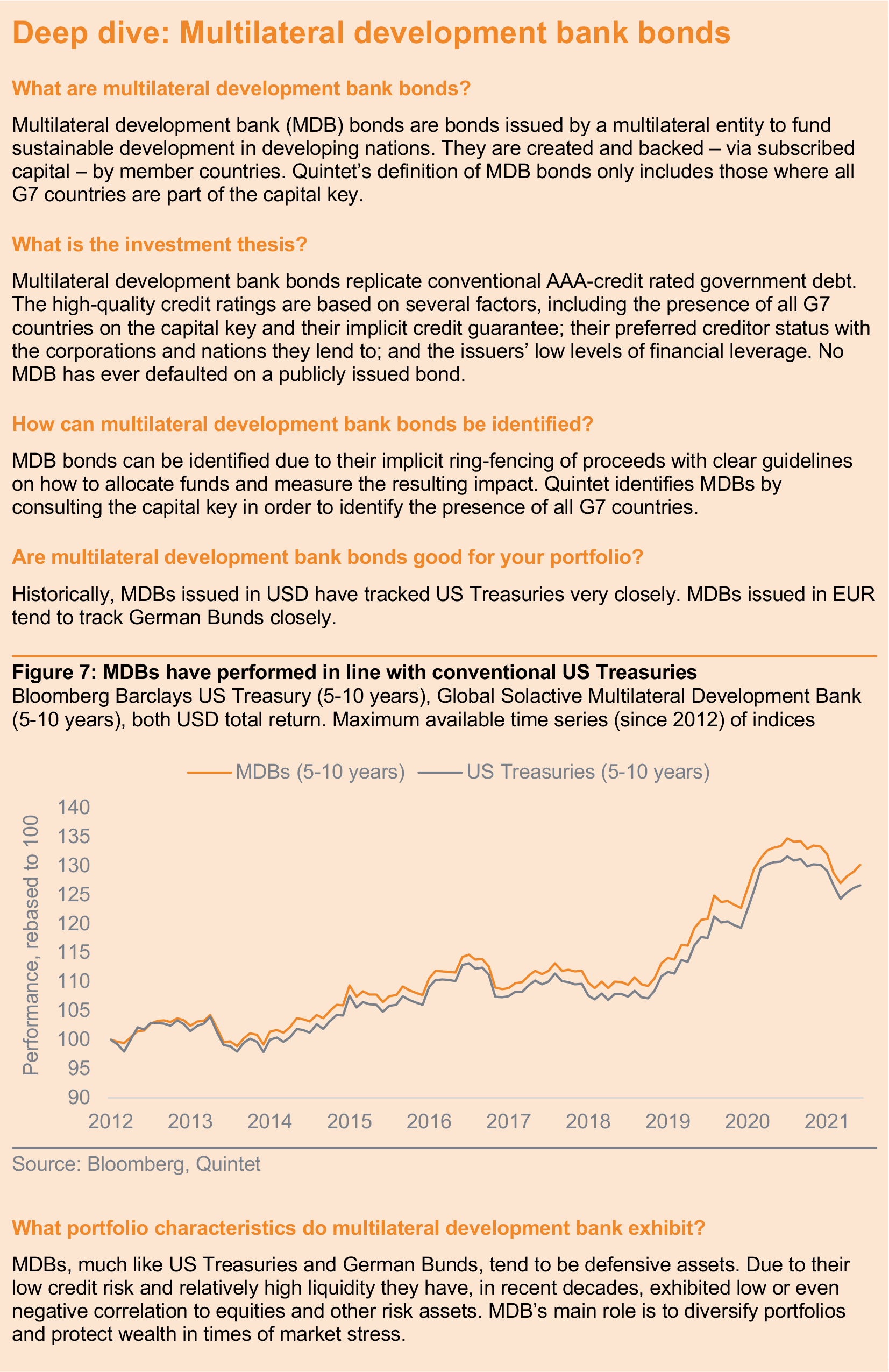

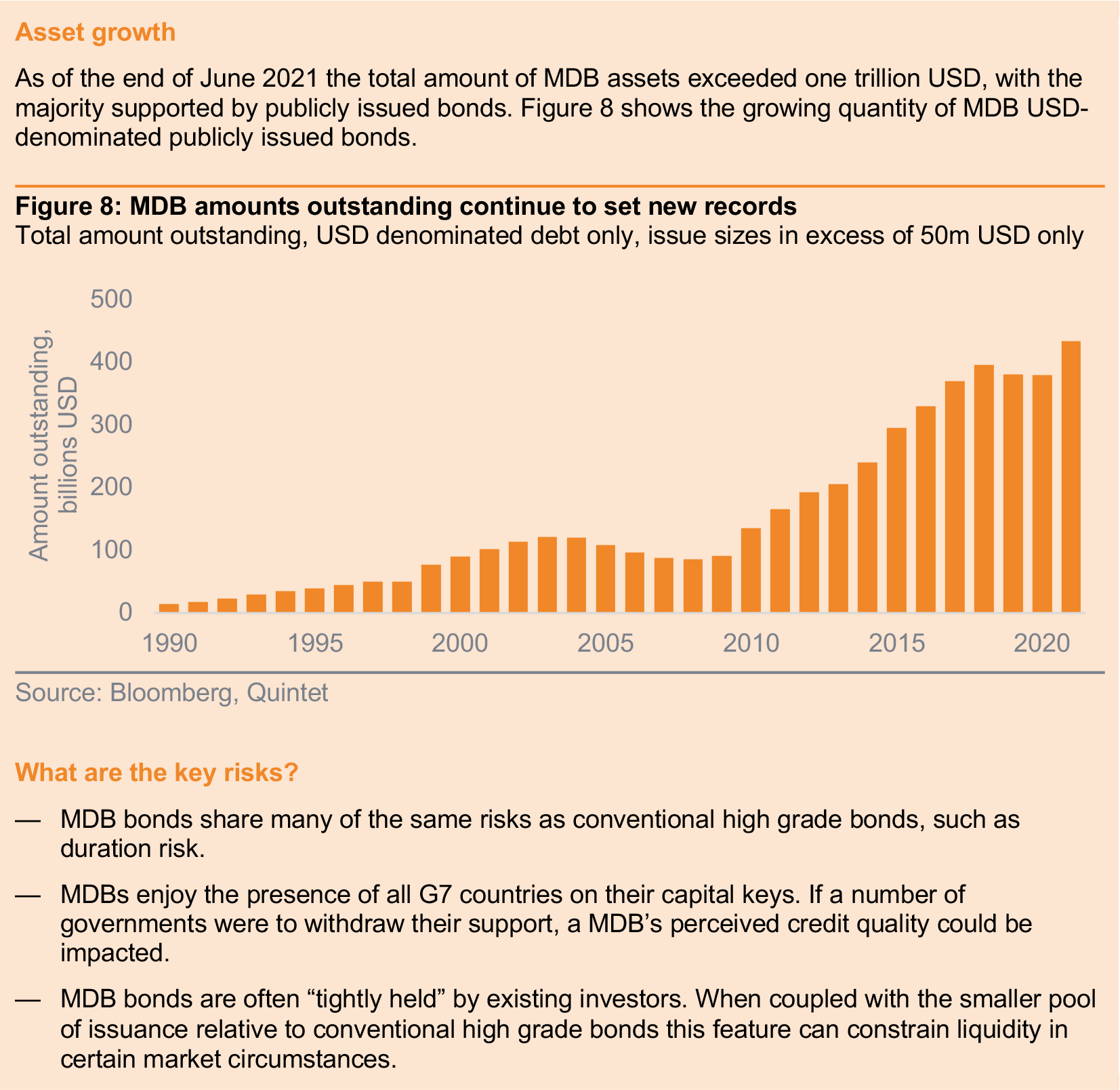

- the close replication of a conventional sub-asset class. An example is multilateral development bank debt which replicates conventional AAA-rated government debt; or

- significant decorrelation benefits with an exposure not found in other financial instruments. An example is microcredit, as small-scale loans to individuals in frontier markets are relatively insulated from the global economy.

How can dedicated assets be identified?

Dedicated assets are typically easy to identify as they are explicitly designed with ESG factors as a defining characteristic. The proceeds of dedicated assets can often be closely traced and there can be a direct link between sustainable outcomes and investment returns. Common dedicated asset characteristics include:

- the explicit ring-fencing of proceeds to be used solely for sustainable purposes. An example is green bonds.

- the implicit ring-fencing of proceeds to be used solely for sustainable investment purposes. Examples include sustainable mission driven investors, such as multilateral development banks and impact private capital.

- the linking of an asset’s financial returns to sustainable outcomes. An example is sustainable linked loans where the cost of the loan will decrease or increase if sustainability targets are met or missed.

How does one construct dedicated assets strategies?

Dedicated asset construction will vary depending on whether the asset seeks to closely replicate a conventional sub-asset class or whether the dedicated asset delivers an exposure not found in other financial instruments.

For those dedicated assets that seek to closely replicate a conventional sub-asset, the dedicated asset’s construction may be constrained and constructed with reference to conventional methodologies. For example, green bond indices largely mirror the conventional index criteria for minimum issue size, currency and legal structure. In order to facilitate broad investor adoption such dedicated assets may also seek to replicate, to the extent possible, the conventional asset’s costs and legal structures.

For those dedicated assets that deliver an exposure not found in other financial instruments, their construction may be unconstrained and be a function of a unique set of circumstances. The construction may reference to local standards, regulations and commercial opportunities and can therefore lead to a higher cost of ownership and / or a more complex or innovative legal structure, which may restrict certain investor groups from investing.

Dedicated assets strategies can fund the transition towards a more sustainable economy, creating significant real-world impact. They may also diversify a portfolio and improve investor returns.

Why are dedicated assets strategies good for people and planet?

Dedicated assets enable investors to explicitly allocate capital to reflect their personal preferences, and typically have a large primary market component. When deployed in primary markets dedicated asset strategies can channel significant new capital to individuals, companies and nascent industries, helping them scale and achieve a larger positive impact.

Are dedicated assets good for your portfolio?

Dedicated assets that seek close replication of a conventional sub-asset class by definition closely mirror that sub-asset’s investment characteristics. They therefore provide broadly equivalent risk and return characteristics and can substitute for the conventional sub-asset with relative ease.

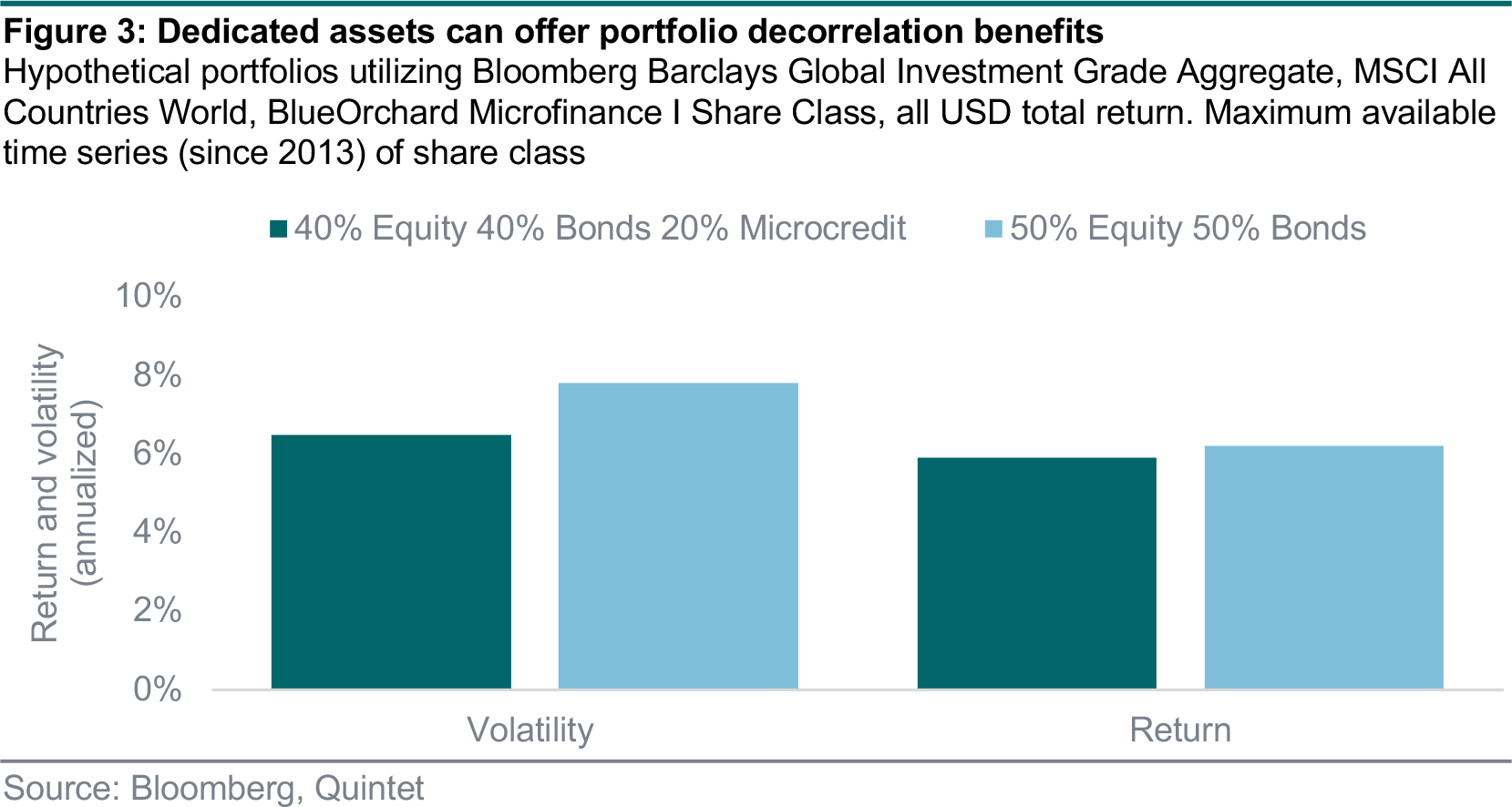

Dedicated assets that deliver an exposure not found in other financial instruments can offer significant portfolio decorrelation benefits. Figure 3 shows the change in historic risk-adjusted return for a simple equity–bond portfolio with the addition of microcredit.

What portfolio characteristics do dedicated asset strategies exhibit?

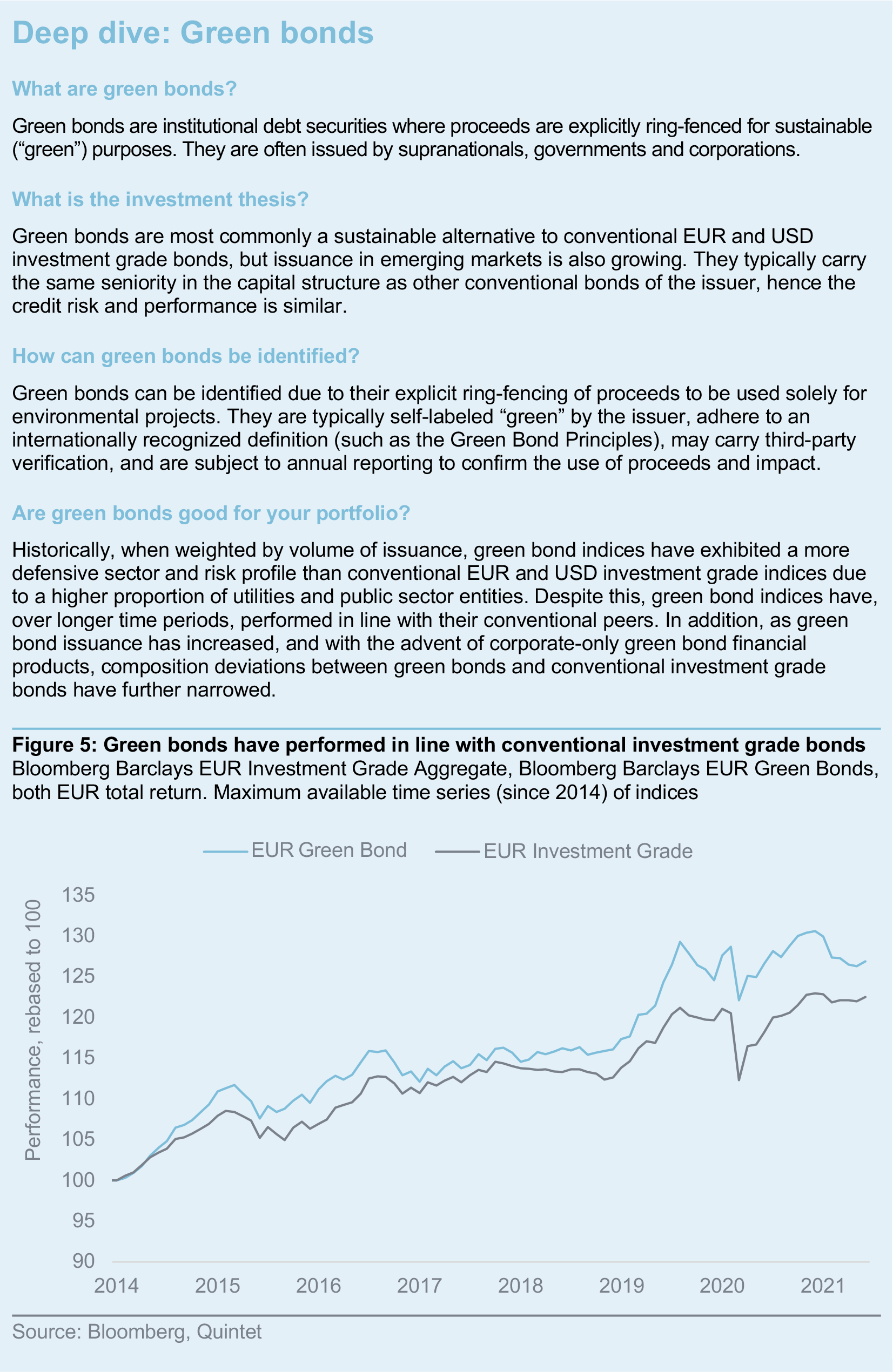

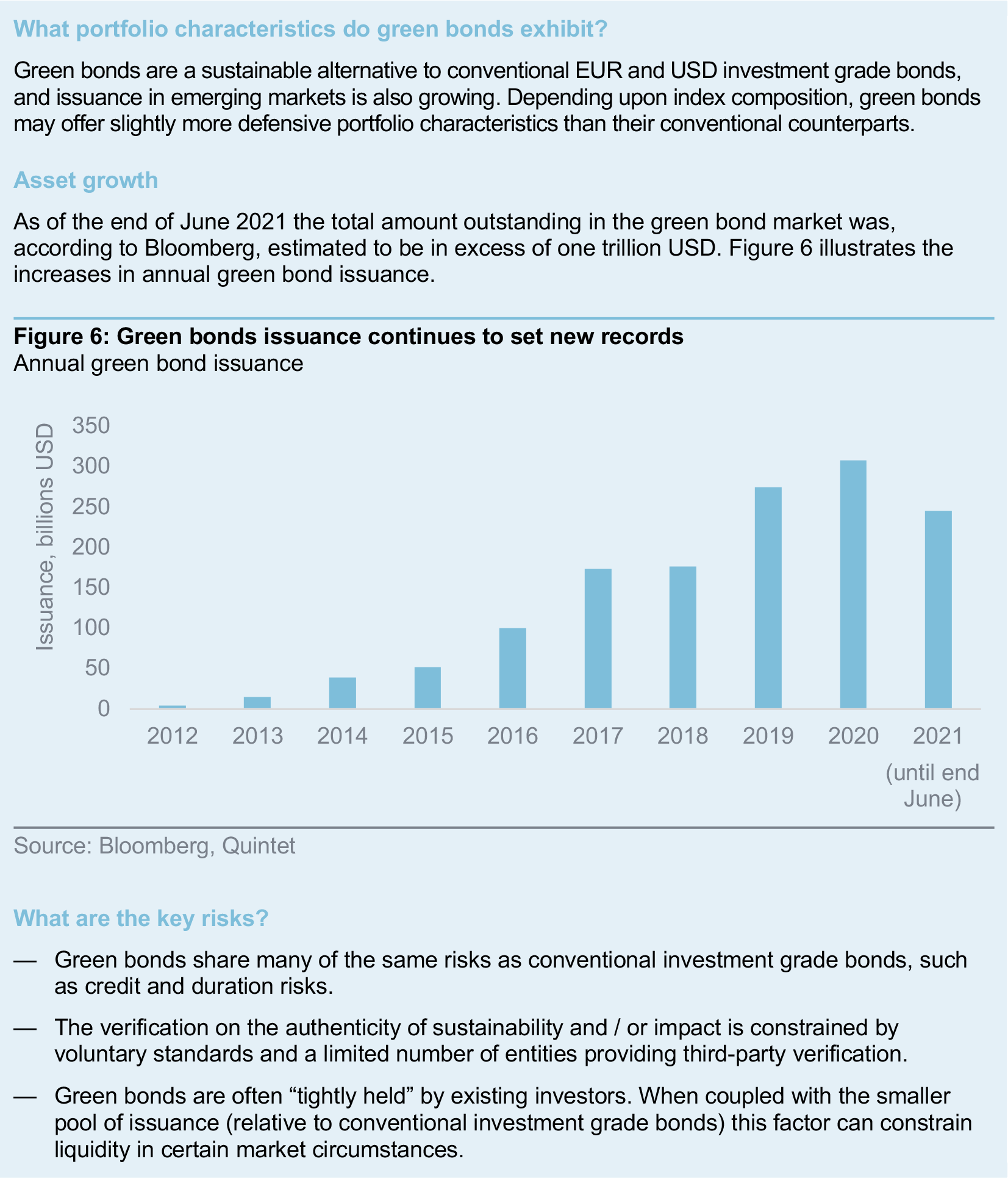

Dedicated assets that seek close replication of a conventional sub-asset class will predominantly exhibit the same portfolio characteristics as the conventional sub-asset class. However, deviations and tracking errors may still be present. For example, USD and EUR green bond indices have historically offered a more defensive issuer profile due to the greater prevalence of supranationals and agencies in the green bond market, relative to the conventional investment grade market.

Dedicated assets that deliver an exposure not found in other financial instruments can offer a range of idiosyncratic portfolio characteristics. While these will differ between dedicated assets, a frequent commonality is an illiquidity factor, as these investments may involve more complex or innovative legal structures.

Are dedicated asset strategies typically active or passive?

Dedicated assets that seek close replication of a conventional sub-asset class may be active or passive. When the dedicated asset is clearly defined and largely homogenous, index creation and passive tracking is possible.

Dedicated assets that deliver an exposure not found in other financial instruments are almost exclusively actively managed. This is because they are often complex and heterogenous, and may have a degree of illiquidity.

How can one invest in dedicated assets?

Dedicated assets that seek close replication of a conventional sub-asset class can be benchmarked to an equivalent sub-asset class benchmark, either conventional or sustainable. For example, green bonds can be benchmarked to the Bloomberg Barclays Global Corporate Aggregate or a sustainable index, such as Bloomberg Barclays MSCI Global Green Bond Index.

Dedicated assets that deliver an exposure not found in other financial instruments often have no comparative benchmark or will target an absolute return in excess of the risk-free rate.

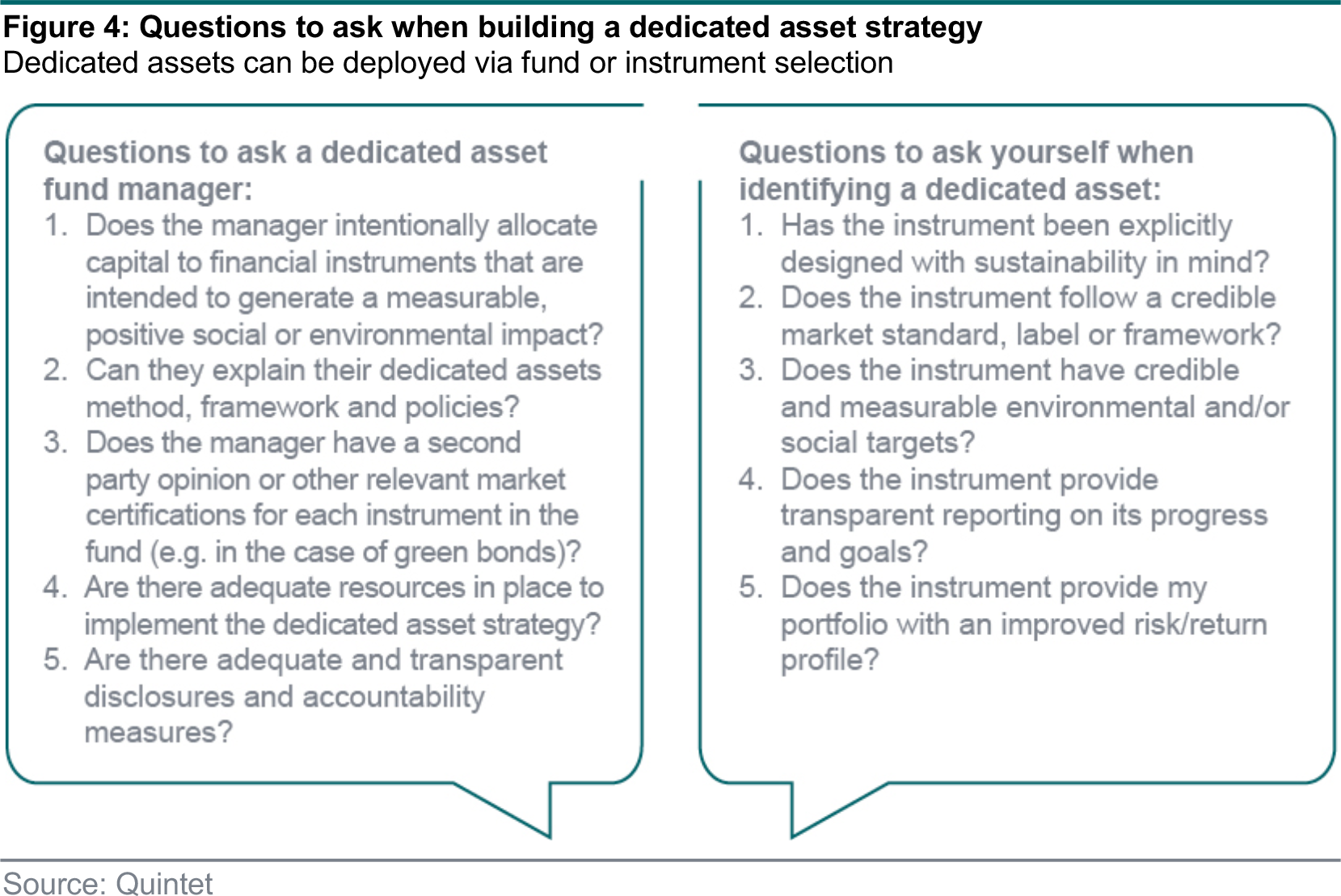

Investors can deploy dedicated assets strategies in their portfolios via single instrument selection or via fund selection (figure 4).

What are the key risks?

The risks of investing in dedicated assets that seek close replication of a conventional sub-asset class mirror many of the conventional sub-asset class’ risks. For example, dedicated fixed income securities will experience credit and duration risks, while dedicated impact private equity strategies will be affected by liquidity, cash flow and solvency risks.

However, there are additional specific risks:

- Dedicated assets may require additional verification on the authenticity of sustainability, impact or certification. Standards are often voluntary and only a limited number of entities provide third- party verification.

- Dedicated assets that deliver exposure not found in other financial instruments may have additional idiosyncratic risks. For example, the risk of entrepreneur default in microcredit or the lack of transparency in blended finance.

- Dedicated assets may fail to achieve their initially set targets, resulting in a poor positive contribution to the environment and / or society.

Authors:

AJ Singh, Head of ESG and Sustainable Investing,

Giang Vu, Sustainable Investing Strategist

Bas Gradussen, Sustainable Investment Strategist

Martynas Rudavicius, Sustainable Investment Strategist

Elena Meganck, Analyst

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 12 July 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.