Bond yields are rising following a more hawkish tone from central banks around the world. Monetary policy is becoming less accommodative but we don’t believe it’s the end of the game for credit in Europe.

- In September, yields rose following the US Federal Reserve’s meeting, at which Chairman Jerome Powell announced that the pace of asset purchases may begin to taper as soon as November (or shortly after) and end by the middle of next year. Norway’s central bank was the first across developed markets to raise rates.

- We continue to believe that spreads will remain stable or widen slightly in the face of rising rates and less accommodative central banks, providing yields rise gradually and reflect a strengthening economy.

- However, valuations are expensive, leaving less room to absorb rate rises, particularly in Europe where a large part of the market has a negative yield.

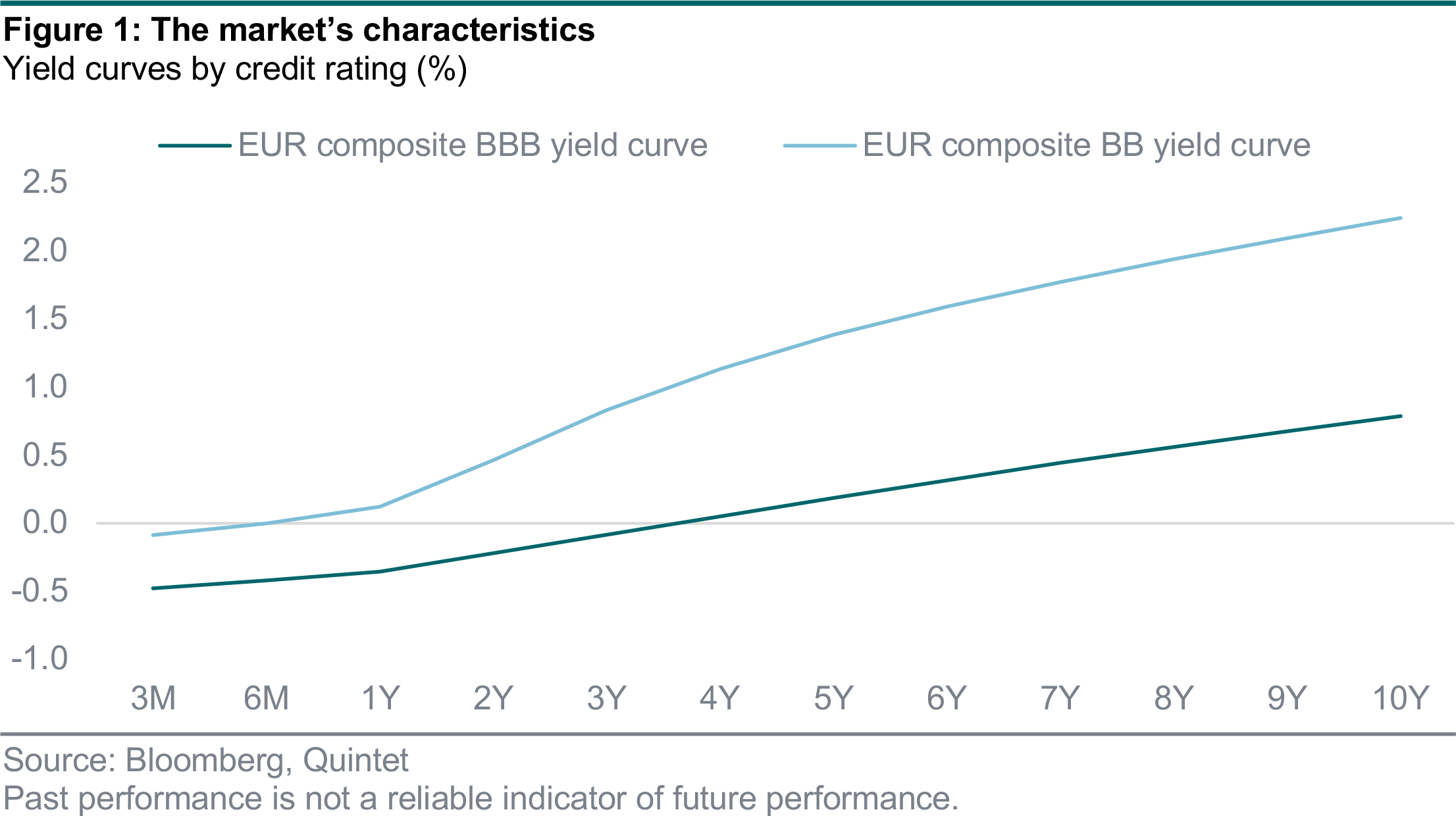

In the current environment, the European credit market raises many questions and most specifically what returns we can expect from the asset class. When looking at the market’s characteristics, bonds with a BBB credit rating have negative yields on average for maturities up to four years, and six months for those with a high yield BB rating (figure 1).

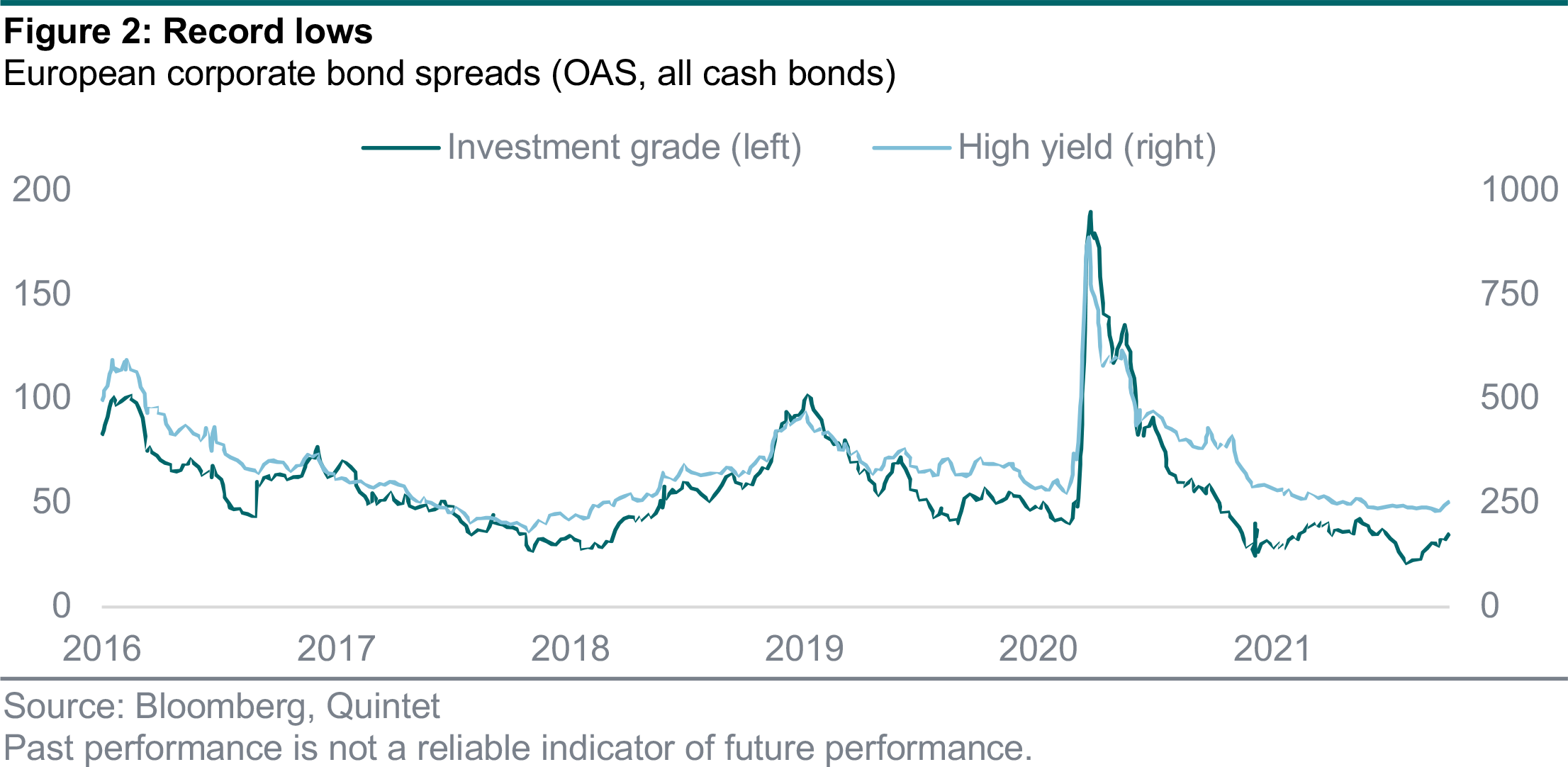

The market does not look attractive at first glance or it is tempting to ‘ride the curve’ and invest in longer maturities to catch the yield pick-up. However, future performance is likely to come from the evolution of either rates or spreads. As we expect the European Central Bank (ECB) to be less accommodative over the next few years and interest rates to rise, the positive contribution from rates looks limited. Additionally, spreads have reached a record low for both investment grade and high yield markets (figure 2 on page 2).

We’ve assessed the potential additional contribution from the spread component and its likely evolution by considering both fundaments and technical aspects of markets.

Not only the search for yield but also strong fundamentals have contributed to the current tight level of spreads. The reopening of economies after numerous lockdowns translated directly into strong second-quarter corporate earnings results. Companies have proven their strength with decent profitability and liquidity profiles. The European investment grade market delivered solid revenues and EBITDA growth, not only year-over-year (supported by weak 2020 figures), but also on a quarterly comparison.

The interest coverage ratio also rose sharply, supported by earnings and reduced interest expenses. This confirms the trend that very low interest rates and access to cheap financing instruments have not only helped companies to manage their short-term liquidity risks but also their most structural financing needs. They have been able to refinance bond issues at lower rates, and sometimes close to zero.

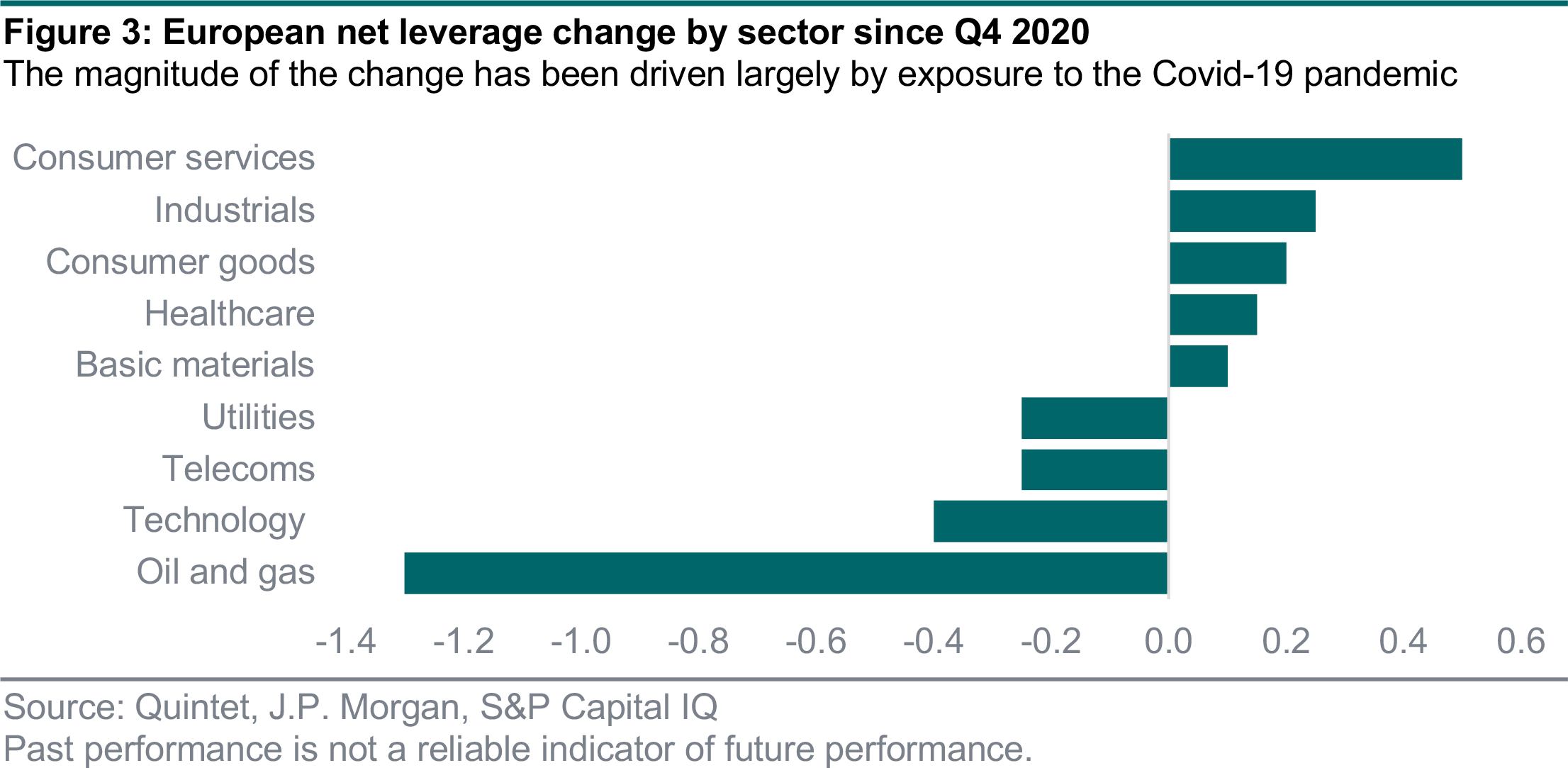

Net leverage decreased for most sectors in the investment grade universe. However, those strongly hit by the Covid crisis for a long time are more impacted because the recovery is likely to be prolonged (figure 3). The consumer services sector saw its net leverage increasing as travel and leisure sectors are far from the pre-crisis level of activity. In contrast, the oil and gas sector benefited directly from strong economic activity and rising energy prices.

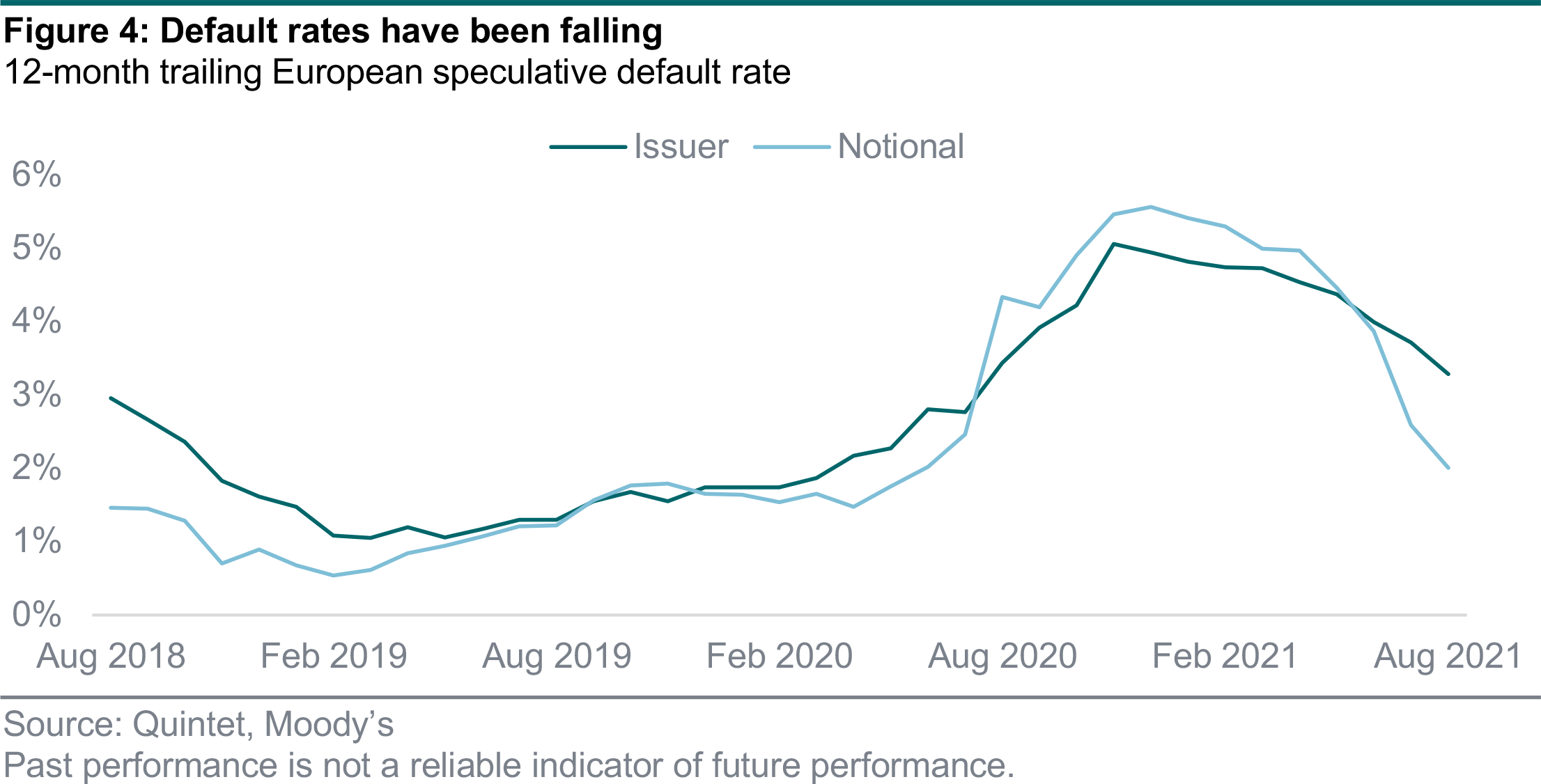

In European high yield markets, access to cheaper financing has also eased liquidity pressure on companies, especially for the higher ratings of the speculative universe and companies not constrained operationally (in contrast to travel, leisure and automobiles). This has translated into lower default rates in Europe and strong rating upgrades (figure 4).

The number of corporate defaults globally remains low in 2021 and has returned to pre-pandemic levels over the summer. It is not the case for European credit markets yet, but the downward path is also visible. The issuer-weighted rate has fallen even faster by declining to 2% from 2.6%. We believe this trend is here to stay despite the latest round of macro weakness as we are at record low level of distressed debt (bonds with spreads of less than 1,000 basis points).

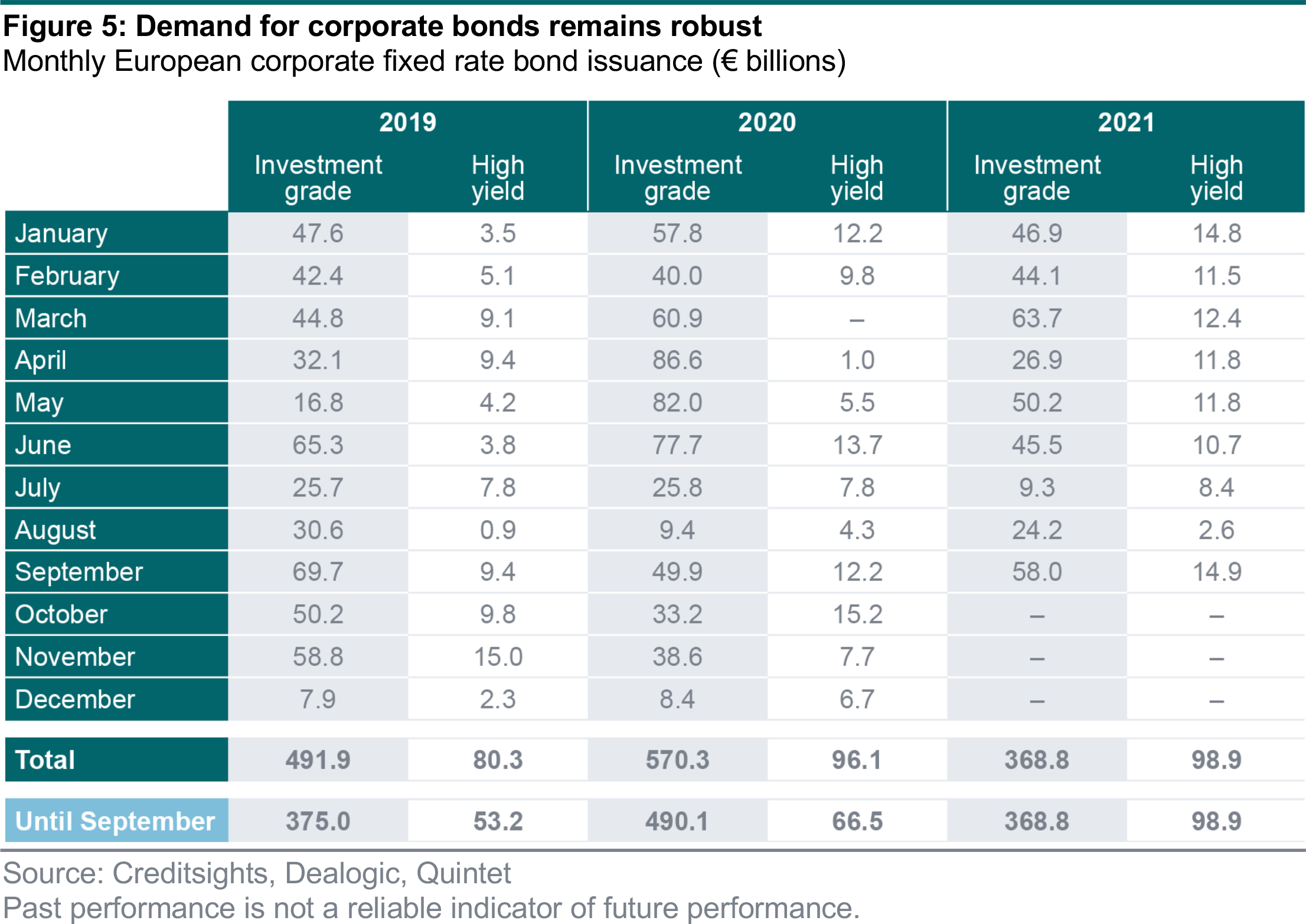

For the European corporate bond market, technicals continue to be supportive, especially for investment grade credit. Companies had issued about €368 billion up to the end of September, which is about a third less than the record volumes of 2020, as activity had been frontloaded during the uncertainty of the Covid fallout.

High earnings and balance sheet conservatism make for high cash balances and therefore relatively low financing needs for the near future. On the other hand, the ECB is still a big buyer in the credit market. In contrast, the Fed sold its $14 billion portfolio of corporate bond holdings recently.

The ECB’s net purchases of about €8 billion per month in combination with cash flow from redemptions and coupons is expected to balance out supply for the rest of the year. Traditionally, September is a month with heavy supply after the summer lull, but the high issuance of €58 billion did not lead to a rise in new issue premia, which even turned slightly negative.

Looking further ahead, the Pandemic Emergency Purchase Programme (PEPP) purchases will probably be tapered next year, so a reduction of approximately €2 billion per month is possible in 2022. However, tapering the bigger Corporate Purchasing Programme is not on the cards yet.

The supply/demand picture is different for European high yield bonds. With €14.9 billion of issuance, September was the biggest month so far this year. By the end of September, supply stood at €99 billion and has already surpassed previous full-year volumes. The heavy issuance did not have an impact on spreads as the market was able to absorb it.

Newly issued bonds continue to perform well, which shows there is robust demand for high yield, despite relatively tight valuations (figure 5 on page 4). Supply is likely to continue to be high and more tilted towards M&A activity. We have seen proof of this during the first week of October, when three companies came to the high yield market to fund €7 billion in takeovers (Brookfield, Iliad Holding and Masmovil Telecom).

We believe all positive news related to fundamentals is already reflected in current spread levels for Europe’s investment grade credit market. Negative corporate news will probably come from the cost side. While companies have made efforts to manage operational costs during the worst of the pandemic, all eyes are now on the pressure from rising input costs (especially energy) and material shortages. The use of liquidity in coming months will also be a key question, potentially for M&A deals or to satisfy shareholder appetite.

Strong free cash flow generation in credit markets tends to be good news for the bondholder who expects the issuing company to use it to reimburse debt and improve its credit profile in a virtuous circle. However, the link is not straightforward as the company can decide to use the cash in many other ways. For instance, there is the internal investment option in materials/equipment to raise productivity and profitability or externally by acquiring a competitor or upstream/downstream business. This would lead to new costs and stable or – often – higher indebtedness levels. Paying dividends to shareholders is also an option for using spare cash.

In contrast, European high yield offers some relative advantages as we believe there remains room for spread tightening in a healthy economic environment and that supply/demand is a powerful driver. We believe high yield is still a better place to invest in than investment grade credit. We expect that high issuance will be matched with ongoing high demand as investors search for yield. Solid fundamentals combined with a healthy economic environment should support the asset class. If interest rates rise moderately, high yield bonds should provide more protection due to higher carry and relatively low interest rate sensitivity.

Authors:

Lionel Balle Head of Fixed Income Strategy

Amélie D’Agostini Fixed Income Strategist

Walter Leering Fixed Income Strategist

Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 11 October 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.