The equity market rally paused last week despite good growth numbers

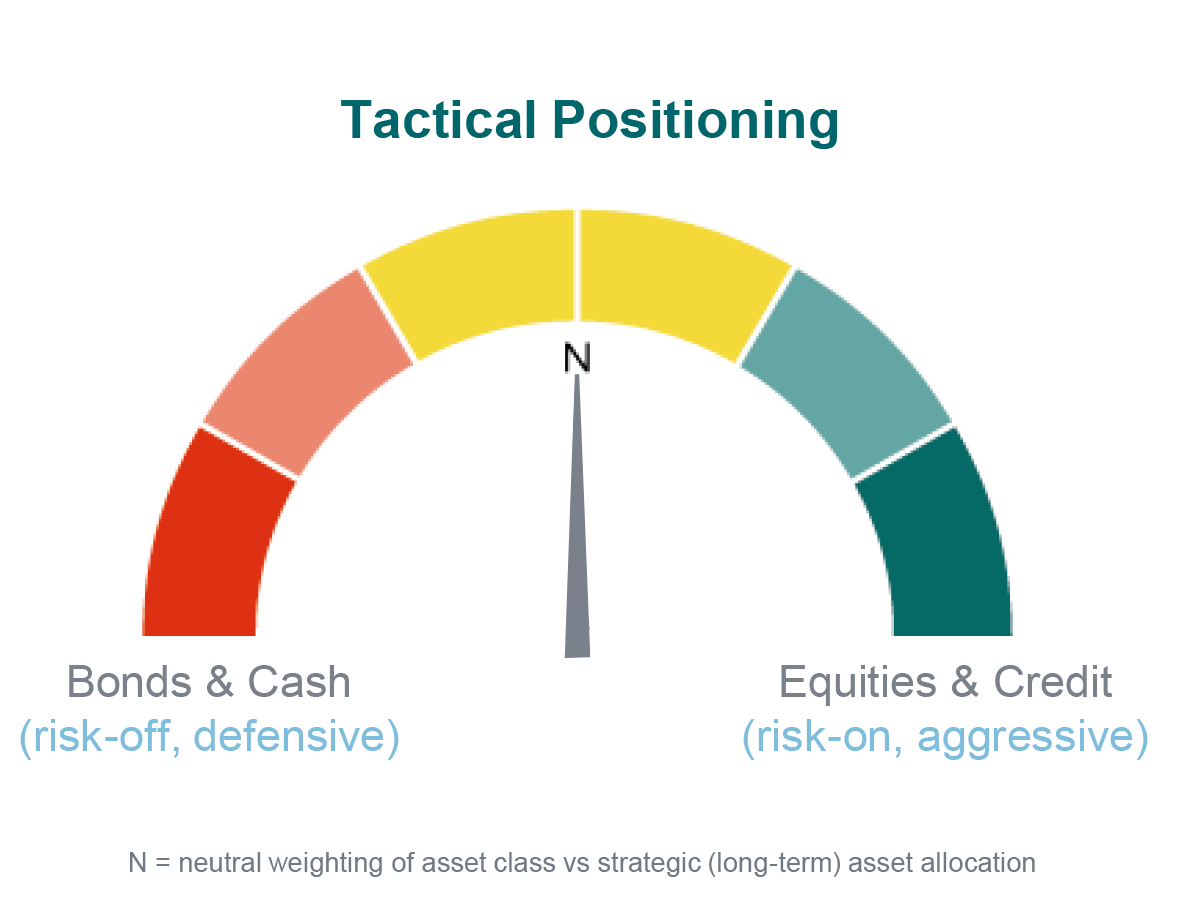

There were contrasting trends in markets last week. On the one hand, Nvidia beating earnings expectations once again and raising guidance for the next quarter supported the AI rally and bolstered tech stock more broadly, with the Nasdaq closing 1.4% higher. On the other hand, central bank commentary weighed on markets. The purchasing managers’ indices (PMIs) were better than expected across the US and the Eurozone, and lower initial jobless claims in the US provided reassurance that the economy is growing at a solid pace. The upside surprises in the data, coupled with the US Federal Reserve (Fed) sticking to its message of keeping interest rates where they are for longer, reduced the prospect of interest rate cuts. As such, bond yields pushed moderately higher (prices fell), the blue-chip S&P 500 index fell slightly by 0.1%% lower, while the US dollar was marginally up. We think the deceleration in inflation will continue, albeit not in a straight line. For instance, despite the occasional inflation miss versus the main polls of forecasters, large retailers such as Walmart, Target and Aldi announced that they are lowering prices of many supermarkets’ staples. This week, the focus is on the Fed’s favourite measure of inflation, the personal consumption expenditure price index (Friday), which is expected to stay at 2.7%, possibly alleviating fears that rate cuts in the US aren’t yet in sight. We still believe interest rates will be lower at the end of 2024 and, with resilient growth, this should support our moderate equity overweight (our somewhat higher allocation to equities vs out long-term, strategic asset allocation).

An early UK election

The prime minister of the UK, Rishi Sunak, called a general election for the 4th of July, earlier than October-November, which is what most political observers expected. The opinion polls show that the ruling Conservative Party is starting the campaign way behind the Labour Party by about 20 percentage points. Recent economic data showed that the UK economy has turned a corner and inflation, which dropped to 2.3% in April, is getting closer to the Bank of England’s (BoE) target. We think this should allow the central bank to start lowering the Bank Rate in August. If Labour wins as the polls suggest, we don’t think this will change the UK’s economic outlook that much as Labour candidate Keir Starmer is more centrist than previous Labour leaders. Some of the Labour policies could support growth, which could be seen positively by the market, but perhaps others could result in extra regulation in some sectors, which could perhaps be seen somewhat negatively. Regardless of the winner, the new government will remain constrained as it will have little fiscal space for major policies. UK stocks fell slightly last week (-1%), in tandem with the moderate setback seen in US equity markets, after reaching new record highs in mid-May. Our UK equity exposure is in line with our long-term asset allocation.

The Eurozone’s economic recovery gains momentum

Following better-than-expected growth numbers in the first quarter, the Eurozone’s economic recovery seems to be continuing in the second quarter. As mentioned above, the all-important purchasing managers’ indices for May improved again. The manufacturing sector is now close to getting out of contraction territory, driven by rising domestic orders. However, services activity came in unchanged from the previous month, but still well in expansion territory. The good news is that input inflation eased, and output price growth slowed, especially in the service sector. The European Central Bank (ECB) will closely watch the inflation figures for May (Friday). Barring a major upside surprise, we think it’s likely to start cutting interest rates in June. We recently added European equities to our tactical asset allocation on the back on the improving economic situation, better earnings momentum and attractive valuations.

Tilting from bonds to equities in Europe

The outlook is improving in Europe and interest rate cuts are likely on the horizon. Earlier this month, we decided to add exposure to Europe ex UK equities. We financed the purchase by slightly reducing our European investment grade bond exposure, where the differential with ‘risk-free’ government bonds, also known as ‘spread’, has tightened further. Elsewhere, we’re keeping our overweight exposure to global small-cap equities as valuations and the economic backdrop are supportive. And our exposure to high-yield credit is lower than normal, as we don’t think valuations compensate adequately for the risks.

Data as of 03/05/2024.