Quintet's incorporation of environmental and social characteristics comprises a toolkit of approaches and dedicated assets. In this primer we deep dive into the improvers approach – arguably the most innovative ESG investing strategy.

- Improver strategies seek to invest in entities that are exhibiting positive environmental, social, governance (ESG) momentum.

- Academic and industry evidence suggests that improver strategies can generate excess returns compared to conventional benchmarks.

- Improver strategies can be applied to both equities and bonds. Typically, improver strategies utilise an active approach. Managers may attempt to catalyse the improvement through active ownership.

Improver strategies seek to identify entities that are demonstrating positive momentum in addressing their environmental, social, governance (ESG) risks and opportunities.

What is the investment thesis?

Investors using improver strategies expect improved ESG performance to correlate to, or cause, improved operational performance. By identifying momentum ahead of other investors, they believe investee entities will deliver improved cash flows and may re-rate to a higher equity multiple, or a tighter credit spread. Investors may attempt to catalyse the improvement through active ownership; engaging company management through dialogue and voting in order to improve business practices and financial performance.

How can improvers be identified?

Improver identification can be the result of ESG data such as those provided by Sustainalytics and MSCI. This approach observes a trend in ESG headline scores during a defined period of time and, while easy to implement, relies upon third-party methodology, may struggle with data latency, and may oversimplify complex sustainability issues.

Alternatively, an investor can identify improvers by assessing the change in individual material ESG topics, aiming to quantify the impact on revenue, risk and profitability. An investor may normalise these metrics by revenue or by gross fixed assets to improve comparability over time and to peers.

For example, carbon intensity is important for the electric utilities industry, as it may indicate operational efficiency and potential risks. Figure 1 illustrates changes in carbon emission intensity.

How does one construct improver strategies?

Improver strategies can be unconstrained and constructed without reference to sector or regional weights. Alternatively, improver identification can be implemented within sectors and regional peer groups, leading to smaller benchmark deviations but with a greater number of unintuitive selections, such as an improving base metal miner.

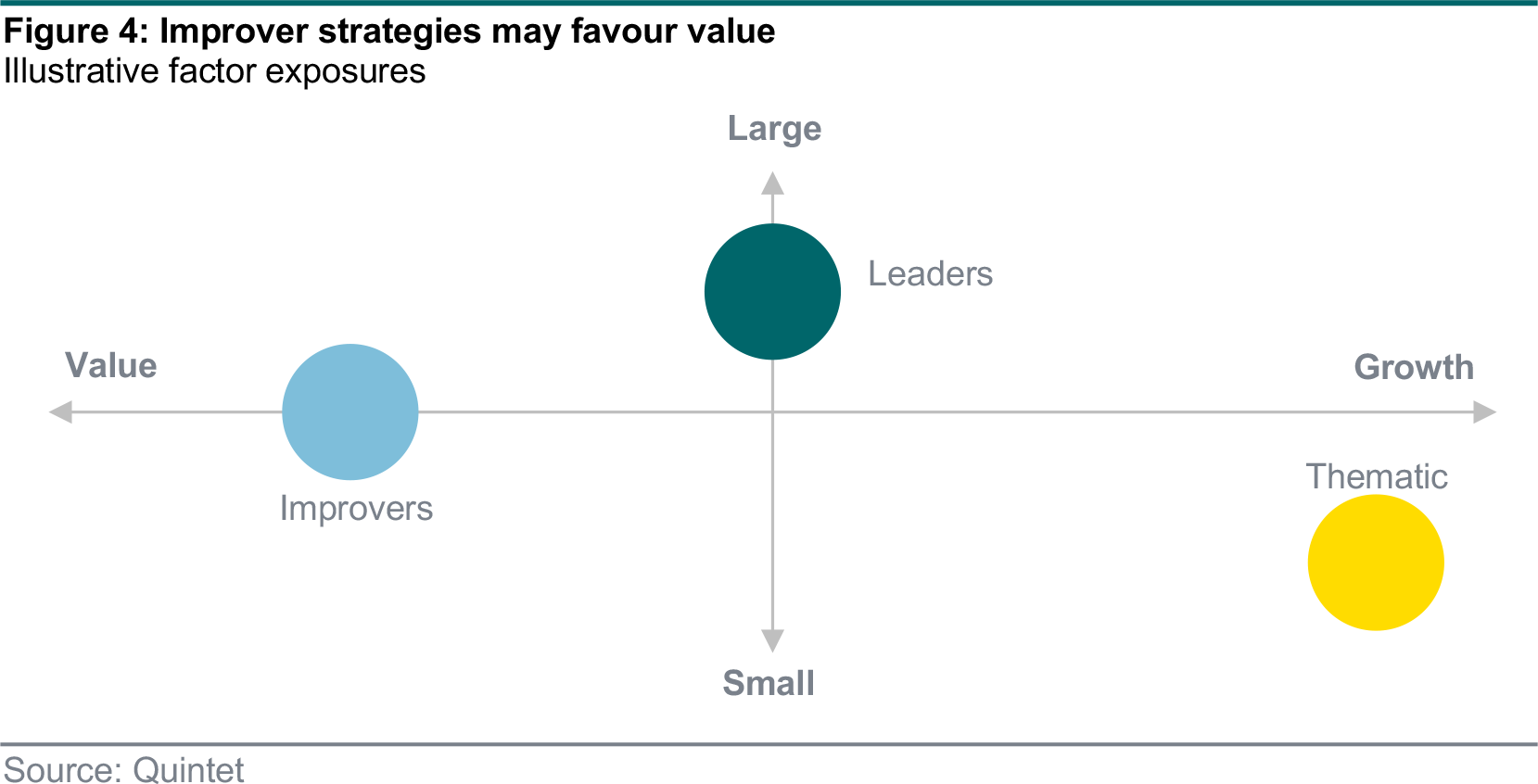

Construction may consider where active ownership is most likely to catalyse ESG improvement. This can create factor biases such as a small capitalisation tilt, as engagement is more likely to have a material positive impact in smaller companies.

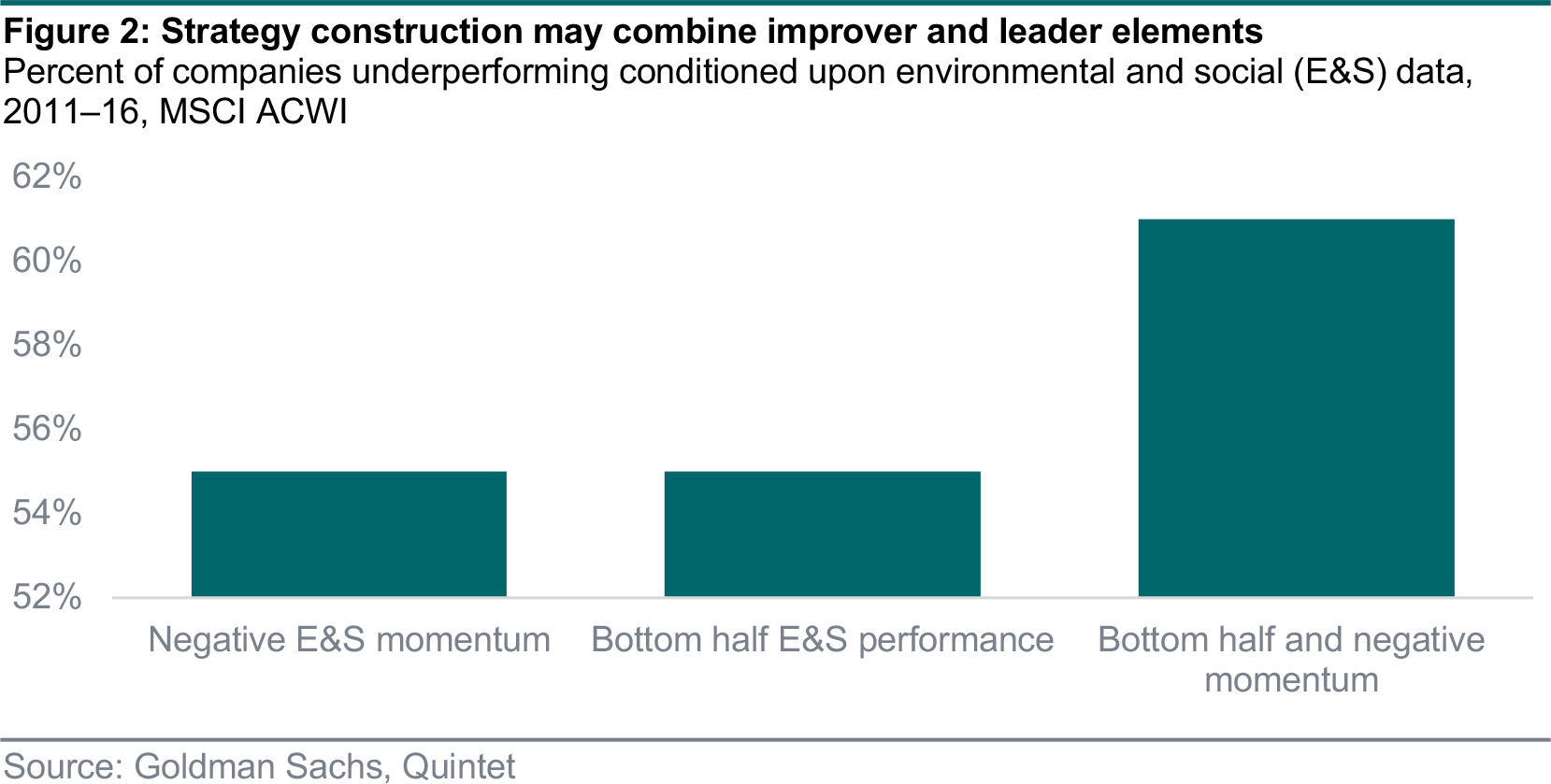

Construction may also draw on elements of the leader strategy and combine absolute ESG improvement with relative peer-performance. For example, Goldman Sachs found that companies that had deteriorating ESG metrics and performed worse than peer average were more likely to underperform their regional sector peers (figure 2).

Improver strategies have been shown to support better activities with ESG impact and may improve investor returns.

Why are improver strategies good for people and the planet?

Improver strategies enable investors to align their investments with their preferences. By investing via an improver strategy, investors can signal the importance of good ESG practices and motivate entities to improve. Improver strategies have the most influence when combined with active ownership.

Successful company engagement often entails specific metrics, benchmarking, well-defined targets and suitable verification, and can change business practices for the benefit of people, planet and profit.

Are improver strategies good for your portfolio?

Academic evidence suggests improver strategies are additive to risk and return. A seminal 2012 paper led by Cambridge University researchers with a dataset spanning more than 600 US companies between 1999 and 2009 found that successful engagement on environmental and social topics triggered a cumulative size-adjusted abnormal return of 7.1% over the subsequent 12 months. The sentiment was echoed by a study of almost 300 companies between 2005 to 2014, which found that value-at-risk was 20% lower for engaged firms compared to a control group.

Practitioner evidence supports the academic findings. A Rockefeller study covering US equities from 2010–20 concluded that top-quintile improvers outperformed bottom-quintile decliners by 3.8% on an annual basis. Goldman Sachs broadly supported the conclusion and found that companies that began in the bottom ESG quartile at the beginning of a three-year period but ended the top half, combined with top-quartile momentum, outperformed by 1.2% on an annual basis. Goldman Sachs researchers have since declared: "We find the strongest alpha signals in laggard-to-leader moves on environmental and social factors and vice versa" (figure 3).

What portfolio characteristics do improver strategies exhibit?

Improvers are making progress on the sustainability journey and may therefore exhibit value characteristics. When engagement is utilised, improver strategies may favour smaller companies as they are more likely to respond to stakeholder input and efforts by a single investor have the potential to make a major difference (figure 4).

Are improver strategies typically active or passive?

Passive improver strategies typically use quantitative ESG scores sourced from data providers such as MSCI or Sustainalytics. This creates challenges when attempting to identify momentum ahead of other investors, as passive improver approaches based on ESG ratings incorporate a large amount of backwards-looking published data.

Improver strategies are most efficient when they are active, as identifying future and material improvements requires deep knowledge of a company’s fundamentals, processes, management and ESG practices. Active improver strategies achieve maximum impact when they incorporate active ownership.

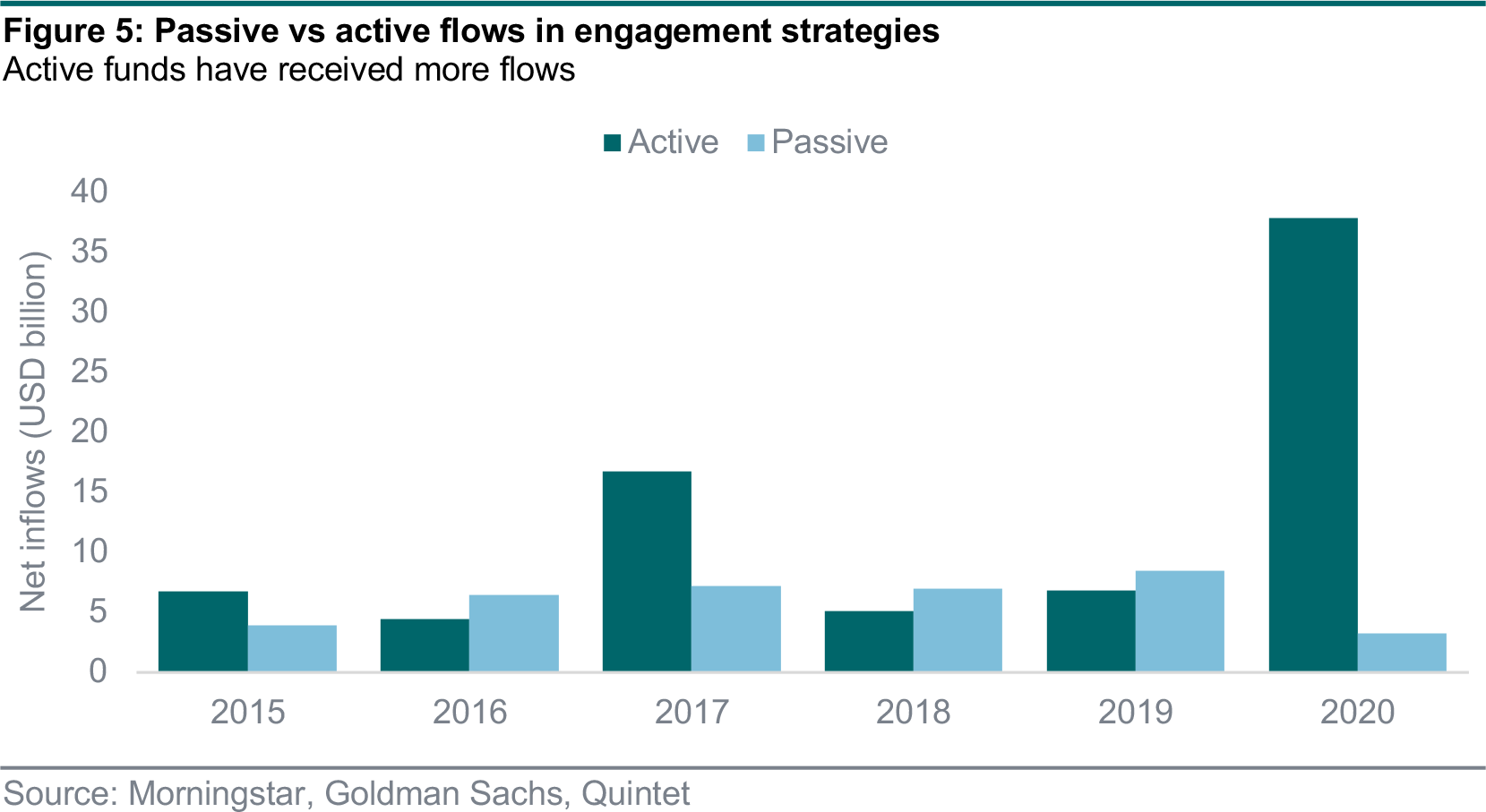

Figure 5 shows fund flows into active and passive engagement strategies for the last five years. Active funds have received more flows than their passive counterparts.

How can one invest in improvers?

Improvers are an investment lens applicable to both equity and bonds. Improver strategies can be benchmarked to a conventional index, such as MSCI World or Barclays Global Corporate Aggregate, or a sustainable index, such as MSCI World SRI. Investors can deploy improver strategies in their portfolios via single instrument selection or fund selection (figure 6). Improver strategies are, arguably, the most innovative sustainable investing strategy, with numerous new product launches. In 2021, Rockefeller Asset Management partnered with Bloomberg to launch a multi-factor ESG improvers index. Also in 2021, Amundi launched a new range of ESG improver funds benchmarked to conventional indices. Both launches incorporate stakeholder engagement to speed up companies’ positive change.

What are the key risks?

The risks of investing with an improver lens mirror conventional risks such as credit, duration or equity. However, there are some specific risks:

- Improver strategies may focus on non-material ESG improvements that do not translate into enhanced financial performance.

- Improver strategies may create unintended portfolio skews such as sector or regional biases, or a tilt to value or small capitalisation factors.

- Improver strategies may seek to enhance the long-term performance of lowly ESG-rated companies, resulting in poor portfolio optics.

- Improver strategies may create downside or reputational risks if investee entities do not improve and sustainable risks materialise.

- When coupled with active ownership, improver strategies can be resource intensive, leading to additional operational fund costs.

Authors:

AJ Singh, Head of Sustainable Investing

Giang Vu, Sustainable Investing Strategist

Bas Gradussen, Sustainable Investment Strategist

Martynas Rudavicius, Sustainable Investment Strategist

Elena Meganck, Analyst

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 5 April 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.