In the third quarter of 2021, inflation rose in most countries and the global economy faced ongoing supply chain issues. Despite concerns about how these challenges would impact earnings, the results are better than expected and forecasts have been revised higher across most sectors.

- Inflation continued to rise in Q3 and several sectors faced supply chain disruptions and shortages. However, fears about the negative impact of these challenges on company earnings were overdone.

- Earnings growth has been strong almost across the board and the surprise factor (the proportion of businesses beating estimates) was high in the US and Europe.

- Earnings forecasts have again been revised upwards.

Rising cost inflation and supply chain disruptions have dampened average earnings growth. Nevertheless, Q3 results were robust and again surprised on the upside, albeit at a lower level than in previous quarters (figure 1). On balance, earnings forecasts have increased. We explore key numbers from the reporting season for the US and Europe, the breakdown by sector and the impact of rising cost inflation and logistics issues on sectors and some specific companies within the Quintet Global Sustainable Equity Model.

The absolute EPS growth of Q3 2021 versus Q3 2020 was again very robust at 41% for US companies (S&P 500) and 50% for Europe (Stoxx 600). However, the absolute number is inflated by the fact that earnings in the energy sector are recovering from 2020’s very low levels. Excluding energy, average earnings growth amounted to 33% in the US and 28% in Europe.

These results were approximately 10 percentage points above consensus growth forecasts. This figure is high compared with the five-year average but lower than in previous quarters when the outbreak of Covid-19 caused a large disruption in sales and earnings in the first half of 2020.

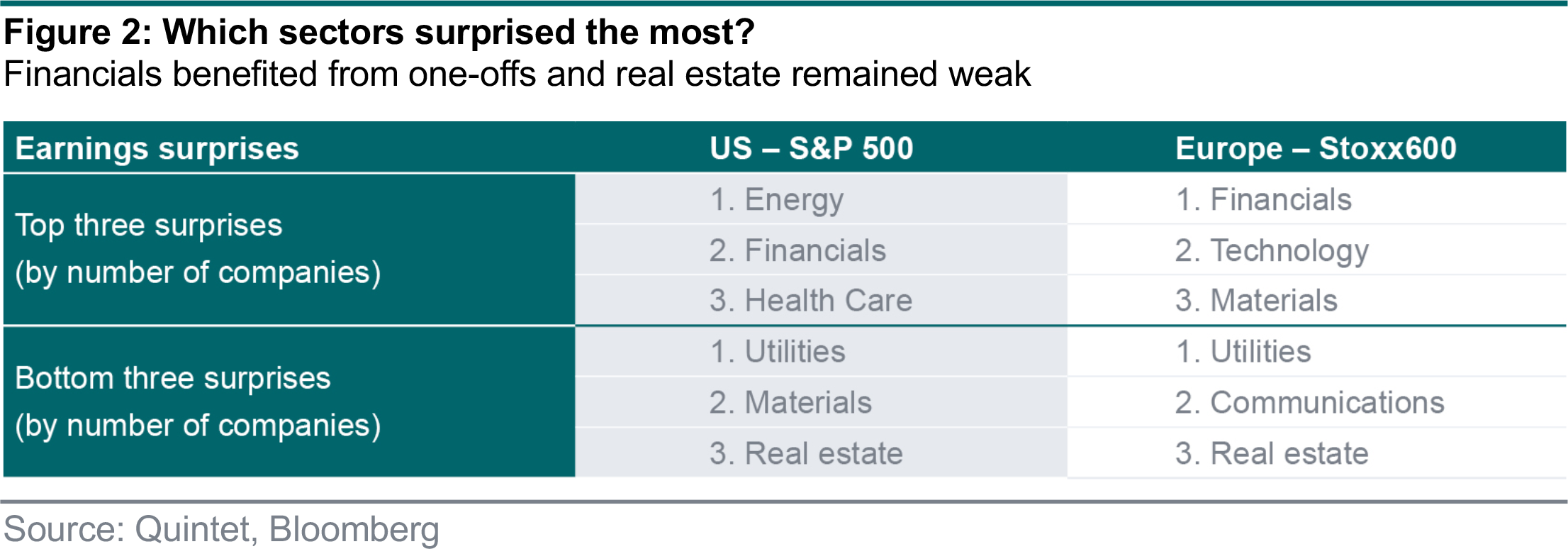

The proportion of companies beating expectations (surprise factor) was 82% for the US and 64% for Europe (figure 2). When considering the level of earnings growth and the surprise factor, it’s important to consider that cost inflation had risen and some supply chains suffered bottlenecks. However, across the board, companies have been able to compensate for these issues by improving operating leverage, and increasing prices and efficiency measures. Pent-up demand has been a significant driver leading to average sales growth of 18% for the US and 13% for Europe.

As in the previous quarter, nearly all sectors (9 out of 11) have surprised against their earnings expectations both in Europe and the US.

Financials: In both regions, the financial sector is in the top three, which is similar to the previous quarter. In our view, the key driver for banks was an accounting issue, namely the release of loan-loss provisions that were taken last year at the beginning of the Covid outbreak. It now appears that banks are not suffering as much as feared from material credit losses. They are reversing part of these provisions and boosting their bottom lines in the process. Many banks have already warned that costs are likely to rise in 2022, mainly relating to wages and technology from rising fintech competition.

Energy: Predominantly owing to sharply rising oil and gas prices over the past 12 months (up around 70%), the oil majors enjoyed a substantial pick-up in earnings. The recovery was broadly based across the sector including exploration, production, refining and marketing. It was amplified by a tight grip on capital expenditure in oil exploration owing to the shift to green energy.

Materials: Despite the diversity of the materials sector, there was strong earnings growth across the board. Metals and mining stocks led the way thanks to higher commodity prices, which were in some cases a negative factor for chemical and construction materials companies. However, the order intake for companies within the construction market is so strong that higher volumes and prices more than made up for higher input costs. Many companies have successfully increased prices, with more to follow, depending on how cost inflation develops. Companies in the ingredients space (such as Givaudan and DSM) were hardly impacted by cost inflation and benefited from higher volumes. Several companies reported surprisingly strong order inflows, which could have been caused by (expected) supply chain disruptions. Companies want to prevent a shortage of components leading to a drop in production.

Healthcare: Due to its nature, the healthcare sector was not materially impacted by rising input costs, such as energy and commodities. Furthermore, last year many elective operations were postponed due to covid patients in hospitals. This had a temporary negative impact on demand for drugs in Q3 2020.

Information technology: The earnings beat in technology was broadly based. First, with flexible working here to stay, the use of hardware and software at home and the Cloud for data storage continues to rise. Second, the shortage of semiconductors due to broadly based higher demand and applications is creating more demand for semiconductor equipment and better pricing. Similarly, semiconductor manufacturers have been able to raise prices given demand exceeding supply. Apple is one of the few large tech companies to suffer from supply constraints in Greater China, an important production base for its hardware.

Consumer discretionary: Within the US, two companies had a dominant impact on the sector – Amazon and Tesla. Their results diverged significantly in Q3 2021 with Amazon suffering an operating miss due to a string of issues, while Tesla enjoyed record deliveries and margins. Other parts of the discretionary sector realised decent earnings growth, such as restaurants and luxury goods. Within the automotive subsector, the shortage of semiconductors forced component manufacturer OEM Automatic to implement another round of production cuts, which resulted in earnings downgrades for the company and its suppliers.

Consumer staples: Earnings growth in this sector is usually stable due to its defensive nature, and was relatively modest in Q3 2021, especially in the US. Last year, food and personal care companies benefited from the lockdowns as supermarkets enjoyed increased demand. Furthermore, food and personal care producers felt the impact of higher commodity and transport prices. The ability to pass these on to their customers varied depending on their positioning. Companies in the premium segments, such as L’Oreal and Estee Lauder, were comfortably able to pass on the inflation to their customers.

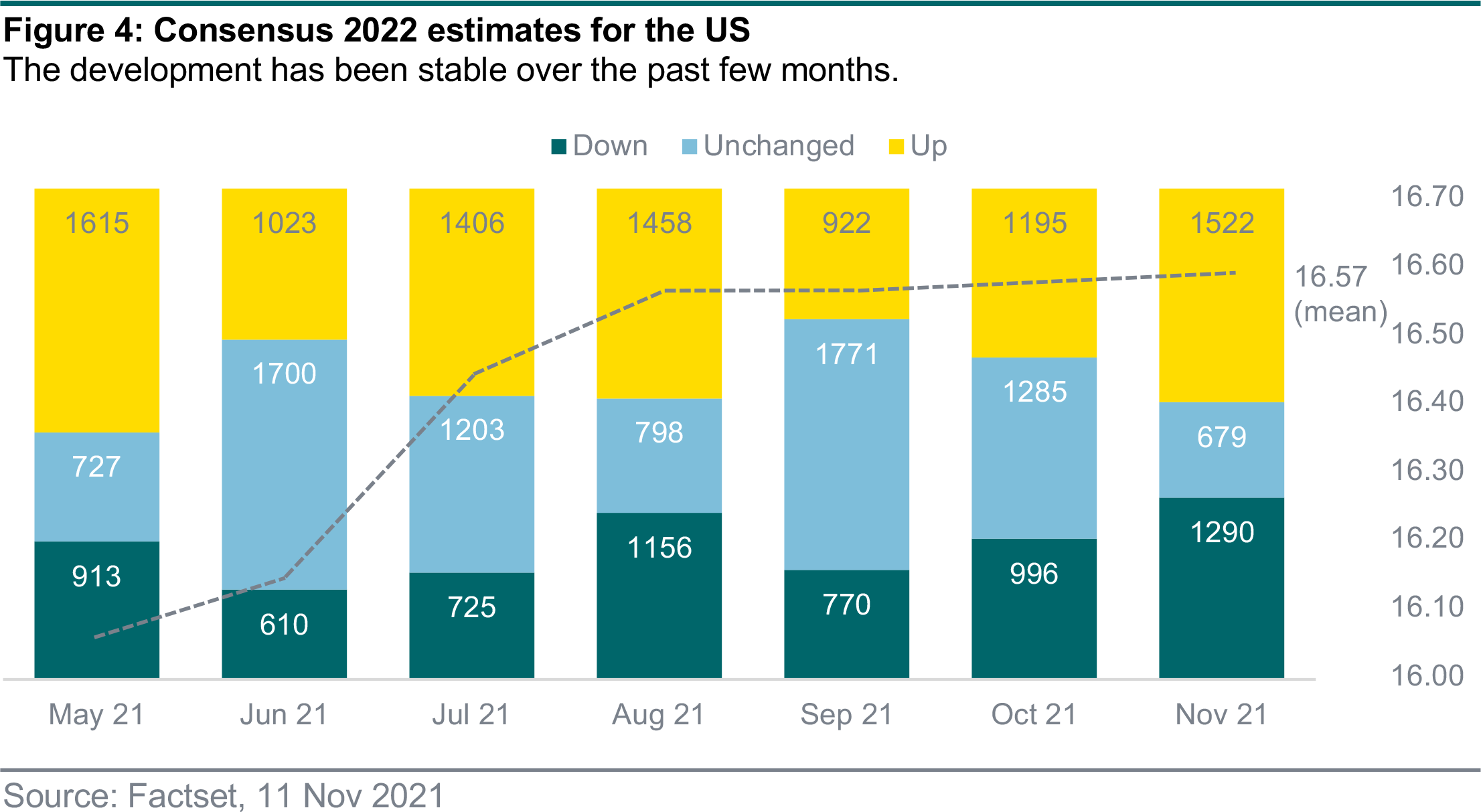

Consensus absolute 2022 EPS estimates for the US market have been stable over the past few months, with average EPS growth forecast at 11% (figure 4). Despite rising inflation, there have been more upward than downward revisions. One of the reasons is ongoing strong prospects for the technology sector, which has the highest sector weighting.

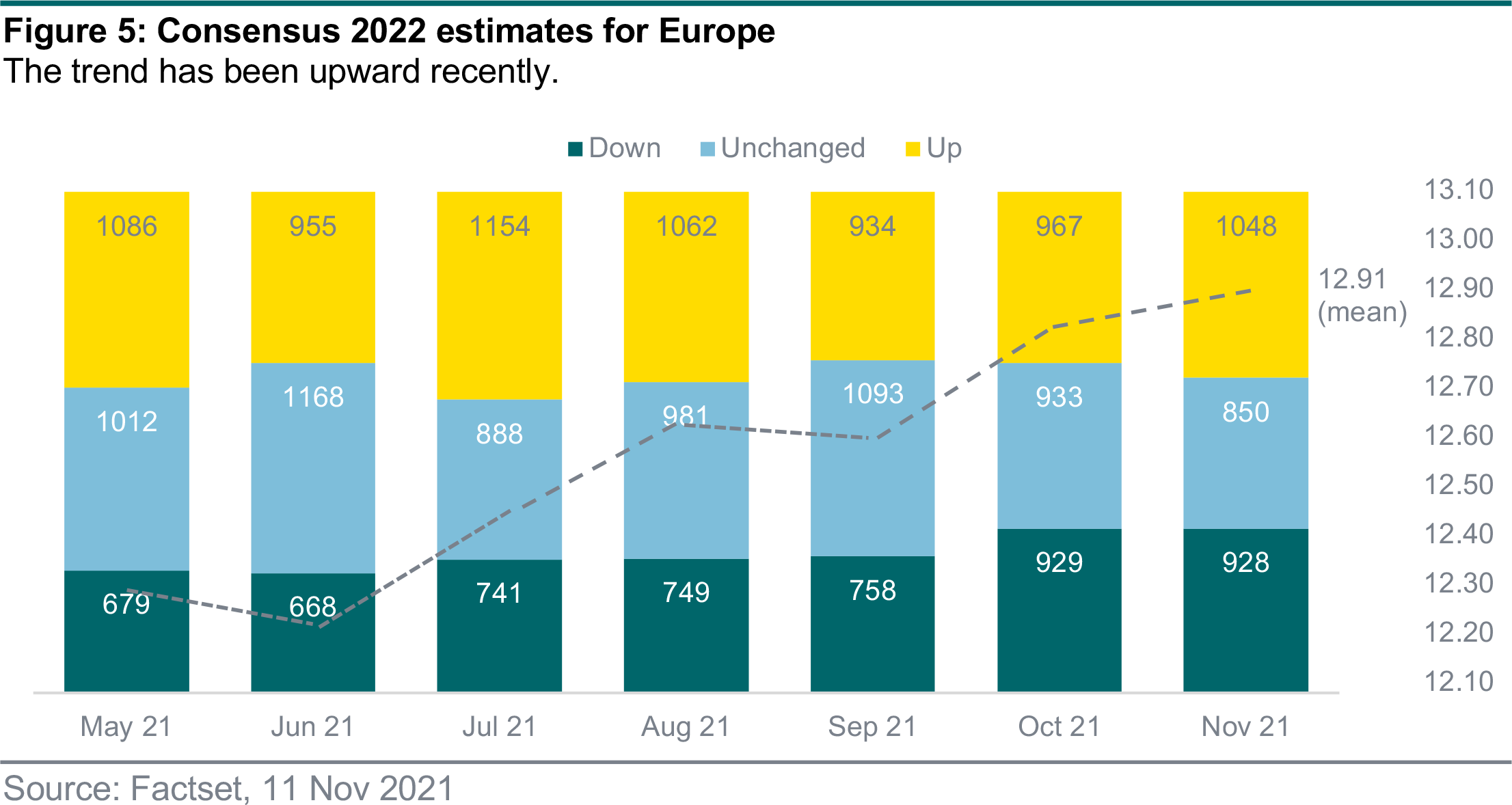

Consensus absolute 2022 EPS estimates for Europe showed an upward trend in October, with average EPS growth forecast at 8% (figure 5). Despite rising inflation, there have been more upward than downward revisions.

Rising cost inflation and logistics bottlenecks were the two greatest challenges for companies in Q3. What was the impact on stocks in the Quintet Global Sustainable Equity Model? Pricing power is a key element, which is a determining factor in our stock selection. Here are some highlights:

Amazon: This company was impacted the most in our Global Sustainable Equity Model. It had to cope with several issues including higher wages, labour shortages and supply chain disruption. These factors had a significant impact on earnings and are likely to continue to do so over the next few quarters. However, Amazon has increased its capital expenditures on the back of confidence that it can build out its online retail market position. The company can easily afford this with its rising earnings (they doubled in Q3), cash inflow from its Cloud services and strong balance sheet.

Procter & Gamble: Higher input prices including transport could not be compensated for by raising selling prices in P&G’s recent quarter. Average pricing rose 1%, leading to a drop in gross margins of 3.7 percentage points to 49%, which was more than expected. Despite having a stronger position in the premium segment than Unilever, Unilever implemented average higher price increases (+4%) in Q3. The flip side is that volume growth at P&G was notably higher, while Unilever suffered a decline and lost market share. P&G was very confident to maintain its EPS growth outlook by implementing price increases and a few clear productivity savings. Based on current insights, both companies expect their cost inflation to peak in Q1 2022.

Michelin: Higher input prices were almost completely compensated for by raising selling prices, with the third increase implemented in October. Despite these increases, Michelin was able to grow its market share in the premium segment and firmly maintained its outlook despite lower tyre demand from car manufacturers.

Estee Lauder: This company is active in the premium cosmetics segment, which is price inelastic, and felt the pinch of higher input and transport costs. Gross margins fell slightly from 77% to 76%, but organic growth was solid at 18%. Given the high product renewal and innovation rate of 30% and an average annual price increase of 2.5%, gross margins are set to expand.

Linde: This industrial gas company is not impacted by rising input (mainly energy) prices because its contracts with customers stipulate that price changes can be passed on. Linde is benefiting from increased industrial production that require its industrial gases. The larger volumes combined with price increases enable the company to raise earnings forecasts.

Authors:

Joost van Beek Senior Portfolio Manager Equities

Kenneth Warnock Head of Direct Equities

Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 15 November 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.