A dent in market optimism

Major equity indices fell last week, likely concerned by escalating tensions in the Middle East, which pushed oil prices above 90 US dollars per barrel for the first time since October 2023. The S&P 500 equity index fell 1% and the pan-European Stoxx 600 1.2%. The protection instrument we recently bought (in the portfolios where client knowledge and experience, and regulations, permitted) cushioned the fall in equity prices as intended. Government bond yields rose as prices fell, given the uptick in oil prices and solid US economic data (see below). However, we think concerns on the Middle East could prove short-lived for markets, as has been the case recently, unless there was an unforeseen, significant escalation in the region. For the coming days or weeks, the releases of economic data will likely return to the forefront, and the US banks will kick off the earnings season for the first quarter on Friday. Markets will continue to fine tune their expectations for a first rate cut by the US Federal Reserve (Fed), which has somewhat turned into a cat-and-mouse game.

The US exceptionalism persists

US data that came out last week was strong. Notably, the manufacturing sector exited a 16-month-long contraction while the services industry continued to grow, albeit at a weaker pace. Once again, there was a blockbuster labour report, with job growth far outstripping market expectations. In addition, there were some pushbacks on early rate cuts by some Fed members. Forecasters still see a June rate cut, but it’s in the balance and investors seem less convinced. All of the above came ahead of the key inflation report in the US due on Wednesday. Markets are expecting a higher headline inflation reading but a lower core reading (stripping out energy and food prices), which could spur additional volatility around the case for a first Fed rate cut in June. Given the resilience of the US economy, a slightly deeper setback in equity prices could provide some opportunities to adjust our positioning and add slightly to this asset class, to get aligned to our long-term asset allocation.

The Eurozone is likely to see lower rates in June

Although oil prices are up around 17% in 2024, natural gas prices are down by the same amount after an unusually mild and rainy winter, mitigating risks from the energy front. Last week, inflation in the Eurozone eased more than expected, drifting towards the European Central Bank (ECB) 2% target. The economy has stabilised but continues to fluctuate between mild recessionary conditions and zero growth, which gives the ECB room to lower borrowing costs from June onwards. We think it’s unlikely that the ECB will move rates lower at its policy meeting on Thursday. For now, we prefer to hold fewer European equities compared to our long-term allocation, as growth is still sluggish.

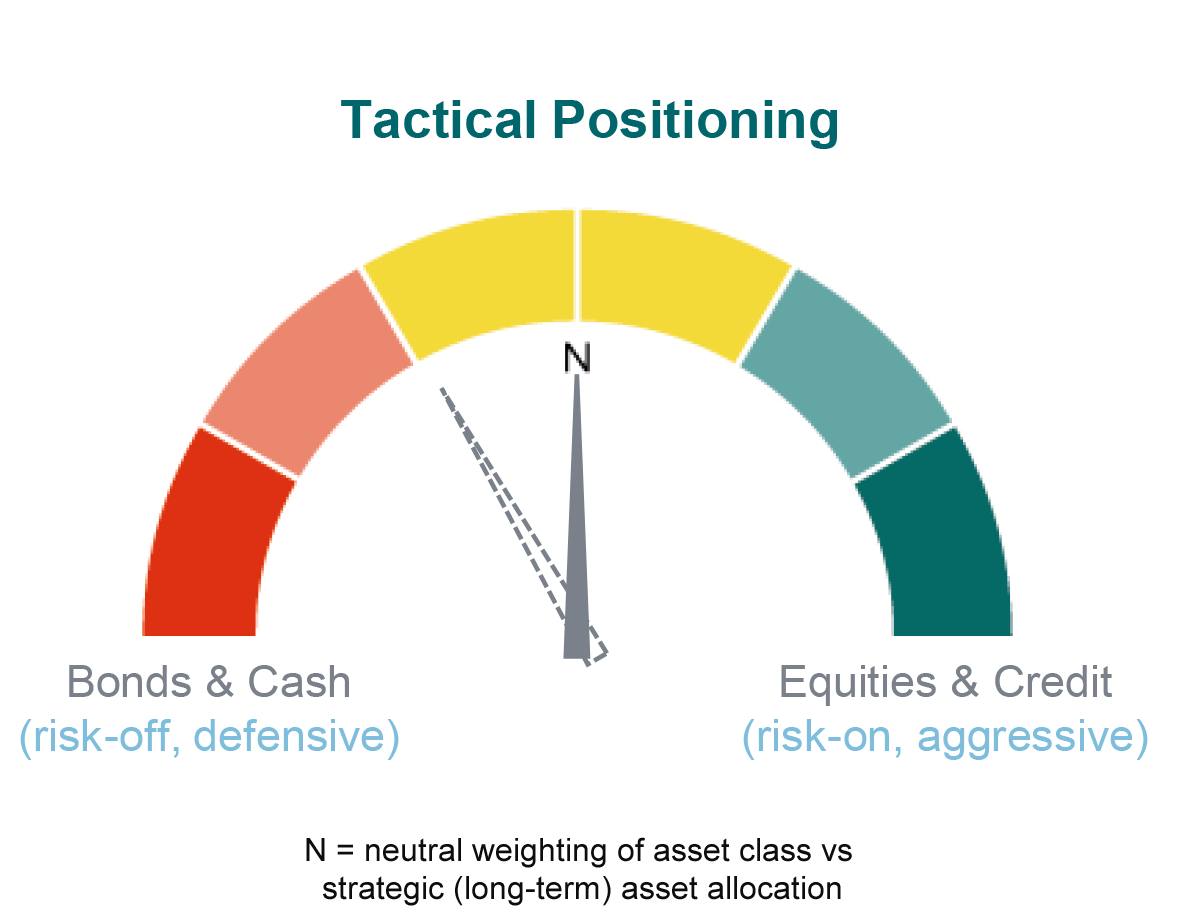

Staying balanced

For about a year and a half, we’ve held fewer equities and more bonds in portfolios compared to our long-term strategy. In February, given better US economic prospects and interest rate cuts from mid-year, we brought both back to neutral. As such, we increased our equity holdings and reduced bonds.

For a detailed overview of our allocation in flagship portfolios, please visit our latest Counterpoint.

Data as of 02/04/2024.