Fewer interest rate cuts on the cards in the US

Thursday’s US GDP growth print revealed more inflationary pressures in the first quarter than expected. As such, the market now only expects the US Federal Reserve (Fed) to cut interest rates once or twice, in September and/or December. Although the rise in prices was stronger than expected, this wasn’t entirely a surprise given that we had three consecutive inflation numbers, from January to March, that exceeded expectations. The volatility in interest rate expectations is nothing new either. At the end of last year, markets were expecting six to seven rate cuts with inflation at the same level as currently – now it’s only one-to-two cuts. We’ve been expecting this uneven inflation path. Our view is that the easing in inflation has been delayed, with inflation likely stabilising above the central bank’s 2% target, as discussed in our 2024 investment outlook. Since then, though, we’ve revised our Fed view and expect the central bank to cut rates twice in 2024, acknowledging the strength of the economic and job data, plus the slower decline in inflation. It will likely take several softer inflation and job market (Friday) reports for the Fed, and markets, to have more certainty on the path to lower rates. Investors will dissect the tone of the Fed at this week’s monetary policy meeting (Wednesday), where we expect the central bank to leave interest rates unchanged. In the meantime, government bond, but also equity, prices could remain volatile.

US growth slowed in the first quarter, but domestic demand and corporate earnings look stronger

The US economy continued to grow in Q1 2024, albeit at a slower rate than the consensus had expected (1.6% vs 2.5%). This was driven largely by a big swing in exports net of imports, which weighed on the overall growth number (the growth in imports was much stronger than export growth in Q1 this year). Overall, import growth looks robust, which underpins sustained domestic demand growth. The labour market is still strong and supports consumer spending, which will likely continue to do the heavy lifting for growth in the coming months. While the weaker-than-expected growth number and sticky inflation initially caused equity markets to fall, they quickly rebounded after strong earnings by tech giants Microsoft and Google. Both companies showed investors that significant investment in artificial intelligence (AI) can pay off with rising revenue, allaying concerns raised by Meta, which said its expensive foray into AI was not immediately paying off. The S&P 500 and Nasdaq Composite equity indices ended last week 2.6 and 4% higher, bolstered by these earnings and a still robust underlying domestic spending narrative.

The Eurozone (and UK) economy gets better and interest rates are likely to come down

The April data show that the Eurozone economy is gearing up for an acceleration after 18 months of broad stagnation. Like in the US, the services sector is playing the main role in leading this tentative recovery. But, unlike in the US, where manufacturing activity seems more resilient, the Eurozone manufacturing sector continues to be in recessionary conditions, although there are some signs of bottoming out. The ailing Chinese economy has weighed on export-dependent countries, such as Germany, which has somewhat offset the improvement in domestic real wages. This week, we expect GDP growth (out Tuesday) to confirm that the Eurozone economy has nearly stagnated in the first quarter. Unlike the Fed, we think the European Central Bank (ECB) will start cutting interest rates in June as inflation (Tuesday) is now lower than in the US. However, there are risks: if the Fed was to decide that it’s not yet ready to cut this year, then the ECB (and the Bank of England) would likely cuts less than expected to prevent a depreciation of the euro (pound sterling), which would raise inflation again. Overall, the expectation of improving growth and incoming rates cuts in the Eurozone, and the UK too, have supported equities. The pan-European STOXX 600 rose 1.7% and the FTSE 100 reached a record high level of 8,140 (+3.1%).

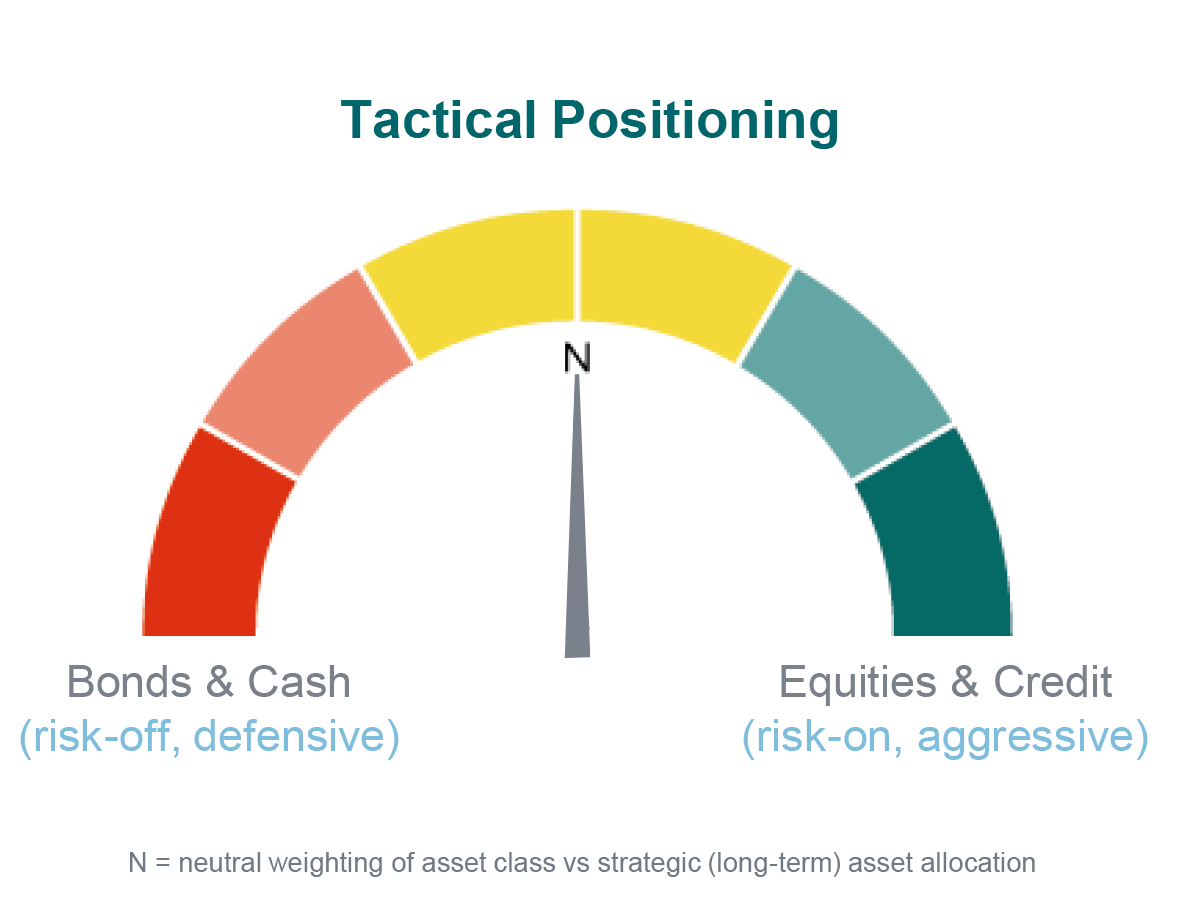

A well-diversified approach

We are staying balanced for equities and bonds, mirroring our long-term strategy. Recently, we brought our US equity exposure back to neutral, given the strength of the US economy, while keeping a lower Eurozone equity allocation. We sold our minimum-volatility Eurozone equities position. The reason for that is growth in Europe has been at or near zero for some time, but it’s not getting worse and appears to have started to recover. Therefore, we think it’s unlikely that Eurozone minimum-volatility sectors (which do comparatively well when the economy is worsening) will outperform the broader European market.

Data as of 27/04/2024.