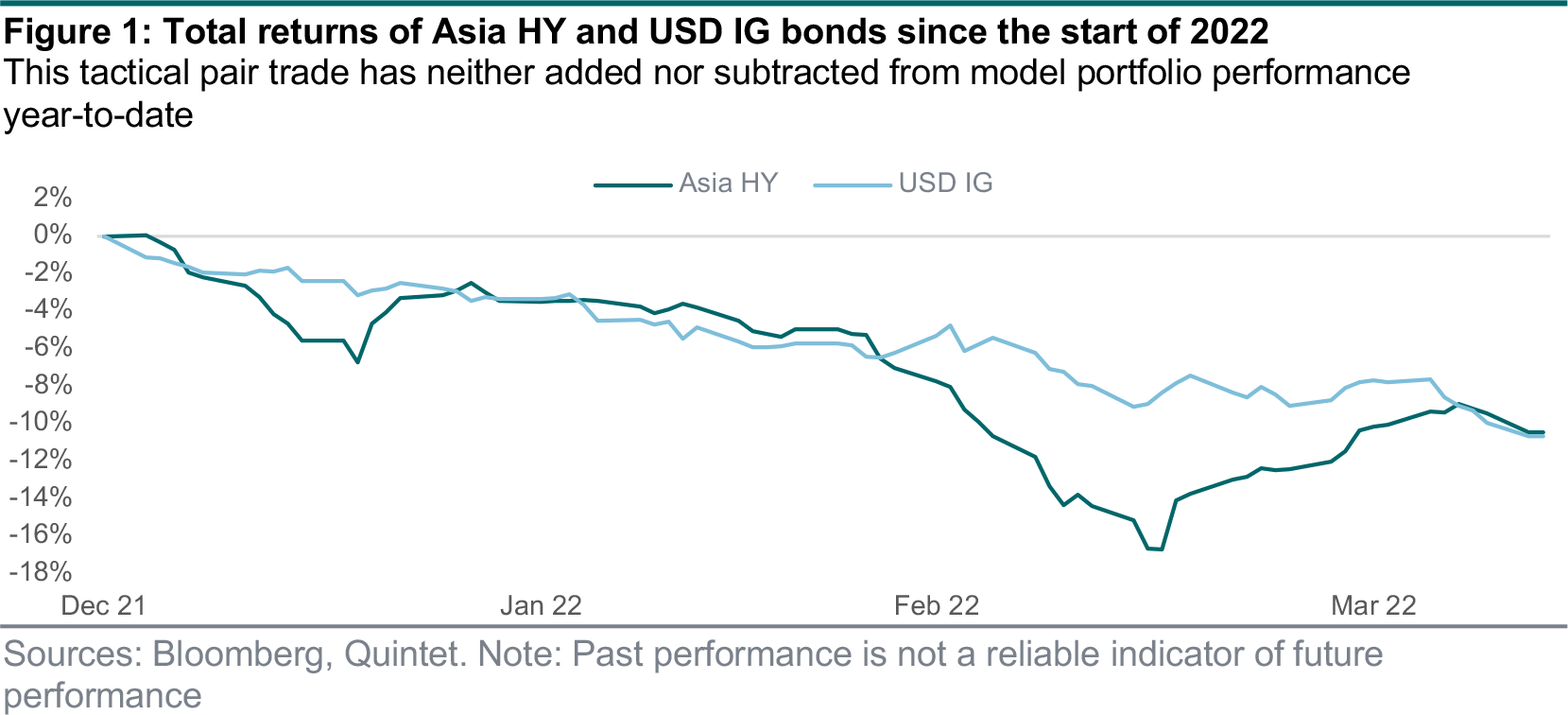

- Since the beginning of 2022, total returns on Asia HY bonds have been -11% as spreads widened, US Treasury yields increased and defaults remained elevated. That is in line with returns from USD IG bonds, thus leaving the performance of our tactical pair trade flat year- to-date. Since inception in March 2021 the pair trade has detracted -0.7% from our model portfolio performance.

- The fundamental backdrop for the asset class remains challenging and the worsening of investor sentiment on the back of the war in Ukraine did not help. But since mid-March expectations of stronger government easing supported the asset class.

- While the return outlook has diminished somewhat over the past weeks, Asia HY is still pricing in a default rate that’s above our expectations. We expect spreads to tighten moderately from here, which together with the yield pickup of 3–4% over USD IG makes for an attractive return outlook.

Based on our benchmark index (JPM JACI Non-Investment Grade) Asia HY bonds lost 11% since the start of the year. Over the same period USD investment grade (IG) bonds, which we reduced in the portfolio to fund the Asia HY overweight position, lost roughly the same (fig. 1). So the tactical pair trade has neither added nor subtracted from model portfolio performance year-to-date (ytd).

Negative absolute returns on Asia HY have been driven by a combination of wider spreads (+130bps ytd), rising risk-free yields (US five-year yield rising from 1.3% to 2.6%) and a persistently high default rate, as the fundamental backdrop for Chinese property developers remains challenging. Following a brief respite between mid-January and mid-February, the asset class was also negatively affected by the worsening in global risk sentiment caused by the war in Ukraine. But from its trough mid-March Asia HY recovered 7%, driven mainly by supportive comments made by Chinese government officials. Thanks to a relatively low sensitivity to yield changes (average duration of just three), the negative impact of the sharp rise in Treasury yields has been far less pronounced for Asia HY than for USD IG bonds, which have an average duration around eight.

We first opened an overweight position in March 2021 and increased the position size in August 2021 after spreads had widened to roughly 700bps. Since then spreads continued to widen and default losses increased, causing Asia HY bonds to underperform USD IG (figure 2). Since its inception the tactical position has subtracted 0.7% from model portfolio returns.

The main headwind for Asia HY bonds since the summer of 2021 has been the large Chinese real estate sector, which over that period declined from ~40% to ~30% of the index’s face value (and to just 20% on current market value). The weakness in real estate came on the back of regulatory tightening by the Chinese government, aiming at deflating the bubble in the housing market and forcing the property sector to deleverage.

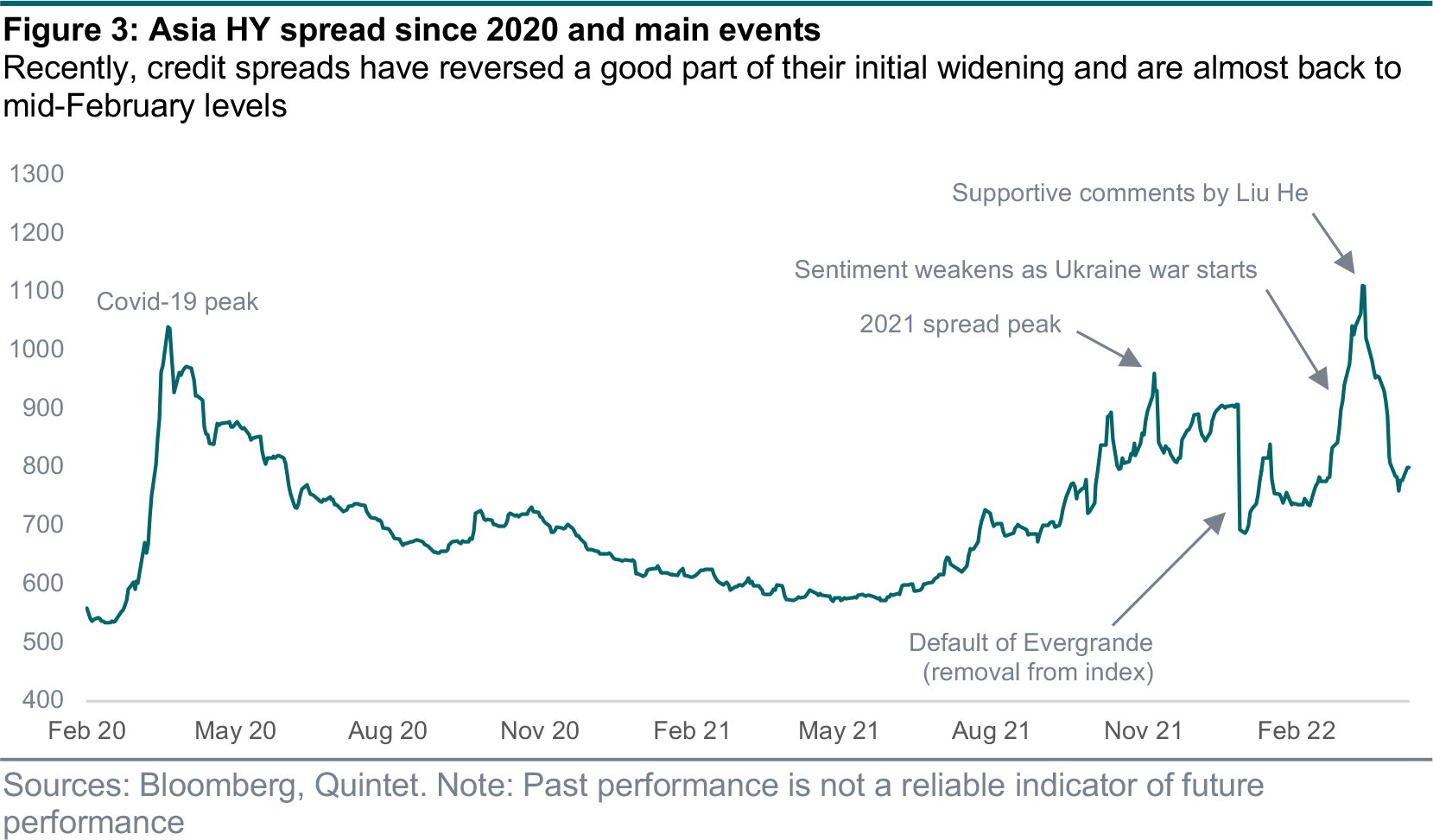

Most importantly the “three red lines” regulation, imposed in August 2020, put strict debt limits on property firms, trying to enforce the government’s directive that “houses are for living in, not for speculation”. As a result, housing market indicators cooled down rapidly, investor sentiment towards the sector worsened and many issuers lost access to funding markets. The default of Evergrande in late-2021 – a property developer which some had considered “too big to fail” representing around 4% of the index before the crisis – highlighted the severity of the situation. Meanwhile, even stronger credit issuers started to feel the pressure on their bonds, raising concerns about widespread contagion. Asia HY defaults increased to around 20% in 2021, entirely driven by the Chinese property sector.

At the beginning of 2022, weak sentiment continued to weigh on the Chinese real estate market with difficulties for lots of developers, including Shimao, Logan and Sunac. In addition, risky assets generally struggled with the Russia–Ukraine war, Fed policy normalization and inflation fears.

On the positive side, since mid-March announced policy changes by Chinese regulators and new easing measures are starting to show a positive impact on sentiment, while real estate indicators have been tentatively stabilizing lately. Many issuers reached an agreement to extend their debt repayments, keeping them afloat for now. Asia credit spreads have reversed a good part of their latest widening and are almost back to mid-February levels (figure 3).

Changing tactical positions based on past performance (e.g. by implementing a ‘stop loss’ strategy) is entirely backward-looking and does not lead to good investment outcomes, in our view. Our process instead assesses the attractiveness of asset classes on a forward-looking basis. Given that there is no perfect foresight, we will at times get it wrong.

In our investment process we deal with this uncertainty in two ways. First, we constantly monitor and review our tactical positions, especially those that are deviating strongly from our initial expectations. In the case of the Asia HY pair trade we repeatedly reviewed the investment thesis and confirmed our conviction that the key drivers for attractive future returns were still in place (most importantly attractive valuation and signs of further government support to stabilize the market).

Second, a comprehensive risk framework ensures that our tactical positions remain within defined and manageable risk thresholds, thus not having an outsized impact on overall portfolio returns. This thorough review and risk process helps us consistently manage tactical positions through times of good and bad performance.

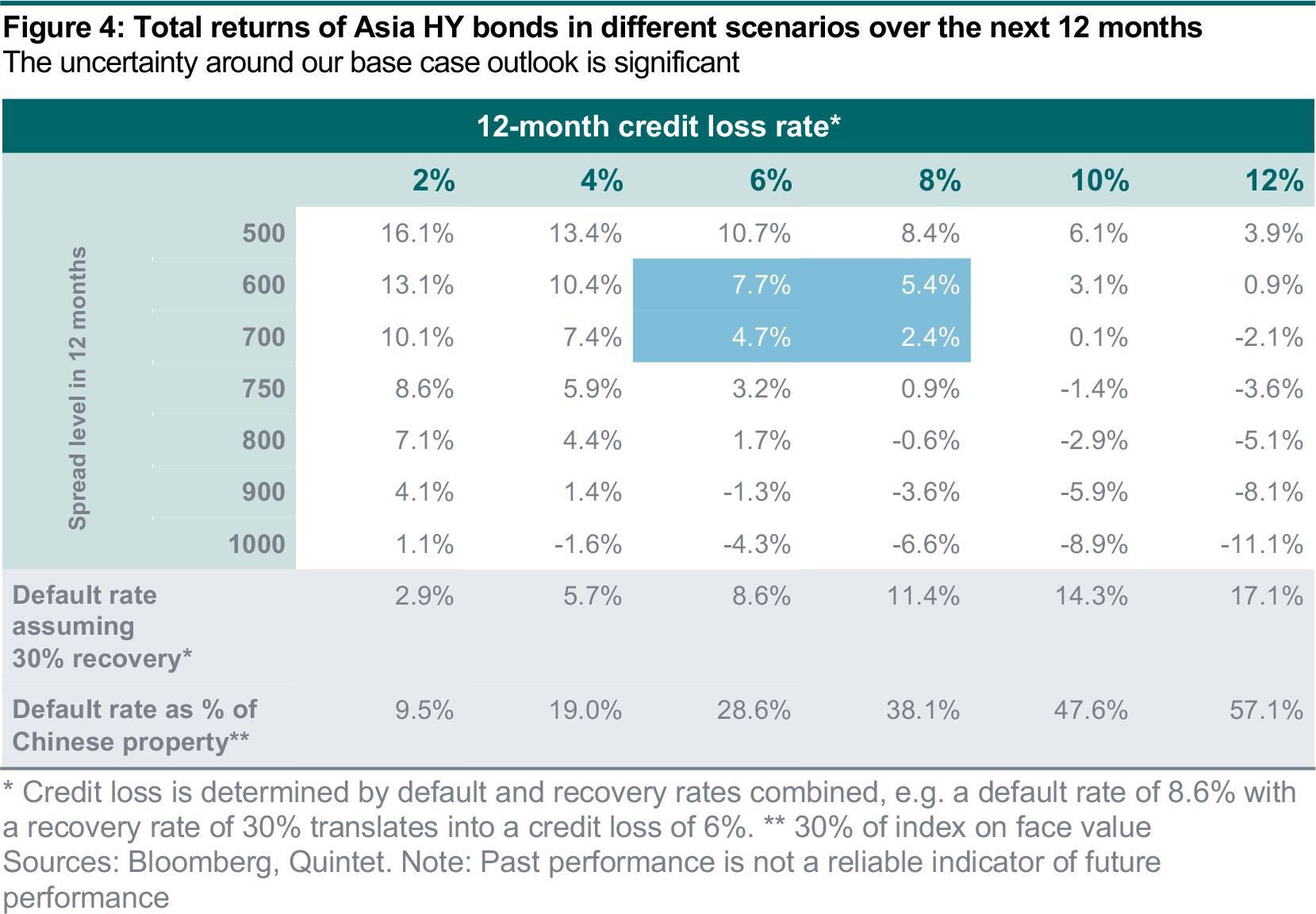

In our base case we expect Asia HY to achieve a total return of 5% to 8% over the next 12 months. Current spreads compensate for a default rate of 12–13% across Asia HY (and around 40% of Chinese property developers). Our outlook is for default rates to remain elevated in 2022, but come down to somewhat below 10%, thus allowing for moderate spread tightening from current levels.

The significant easing measures already put in place by the Chinese government (see next question) are likely to be complemented by further support for the economy and the property sector, which should further lift sentiment and help stabilize the housing market.

Besides moderate price upside, the current carry remains a key performance driver. On an index level the current yield is 11%, of which we estimate 7–8% will be realized (after accounting for missed coupon payments of likely default candidates). That is still 3–4% above the current yield of USD IG bonds. Subtracting our expected credit loss leaves total returns of 5% to 8% over the next 12 months.

The uncertainty around our base case outlook is significant. Figure 4 shows the total return outcome for different scenarios of spreads and credit losses over the next 12 months.

The Chinese government started to ease its stance towards the property sector since late last year, taking a gradual approach, mainly reacting to periods of great stress. Given the importance of the real estate market for the overall Chinese economy, the government has a strong incentive to not let the negative impact grow too large, which would threaten their ambitious growth target for 2022. At the same time, regulators want to avoid a repeat of past housing market excesses. The central bank cut its reserve requirement ratio (RRR) and lending rate, encouraging banks to issue more property project loans. Further rate cuts are likely over the coming months. The government also took the lead on some debt restructurings, in order to ensure an orderly process.

In 2022 the regulator has increased its interventions by easing restrictions on property loans and mortgages, and easing developers’ access to liquidity from down payments. At the same time the PBoC has been injecting liquidity to support the market. March 2022 was a game changer, when Vice Premier Liu He announced explicit support for the economy and specifically property developers as the government will do whatever it takes to support the economy. This triggered a strong rally of Asia HY from its bottom. At the beginning of April, the PBoC unveiled the draft for a proposed Financial Stability Law and a financial stability fund. We expect the government to follow up with more significant support measures in the months to come.

When making forward-looking investment decisions, past returns are not a useful indicator. Obviously, our tactical positions should on aggregate contribute positively to portfolio returns, and did indeed add significant outperformance since we launched the process in 2020. But there will always be single tactical positions that will not perform as expected and might thus detract from performance over their life. At any point the key question is whether the forward-looking outlook remains attractive enough to support a tactical position or not, irrespective of its past performance.

Having said that, in our base case we are expecting total returns of 5% to 8% over the next 12 months, which is attractive in our view compared to lower-yielding USD IG. The return difference between Asia HY and USD IG bonds since March 2021 (when we first opened the position) is -14%. It’s thus unlikely for the pair trade to fully make up its losses over our tactical investment horizon.

Volatility on Asia HY bonds remains elevated for the time being as uncertainty is high. In an adverse scenario, where the support measures by the government fall markedly short of expectations and don’t manage to stabilize the property market, spreads could widen back to prior peaks (around 1,000bps). Property developers would continue to face severe funding shortages and default rates might increase above 50% within the sector (and above 15% for Asia HY).

Consequently, the drawdown on Asia HY could amount to -9% to -11% over a 12-month period.

Such an outcome would severely weigh on the wider Chinese economy, given that the real estate sector contributes up to 25% to Chinese growth. In our view this makes such a ‘worst case’ unlikely.

On the positive side, if spreads were to tighten towards a level that is consistent with our default outlook, thus realizing the price upside we envisage, we would gradually start reducing the position.

On the other hand there are also possible negative catalysts for a review and potential closure of the pair trade. A failure by the Chinese government to follow its recent announcements with more concrete easing steps over the coming months would make us reconsider the investment thesis. Also, a significant worsening of the growth outlook for China or wider Asia would make us revisit our default outlook and could lead to reduced attractiveness of the asset class.

Three key factors support our constructive outlook on Asia HY and thus the tactical overweight:

- Current valuations are still pricing in a somewhat higher default rate than we expect over the next 12 months, thus Asia HY offers moderate price upside potential. Fig. 5 shows that starting from such elevated spread levels in the past led to attractive returns over the next six months.

- The estimated yield pick-up of 3–4% over USD IG bonds remains attractive.

- We expect the Chinese government to follow recent supportive announcements with more concrete steps, accelerating the easing of policy and helping support sentiment and the property market.

Authors:

- Philipp Schöttler Cross-Asset Strategist

- Lionel Balle Head of Fixed Income Strategy

- Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 18 April 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.