On 26 September, Germany will elect a new Bundestag. The outcome will set the stage for the next coalition, headed by a new chancellor, with Angela Merkel set to step down after 16 years. The next government is likely to have a greener tilt.

- Germany is heading for the most open elections in recent history. Polls suggest the current ‘grand’ coalition could be followed by a three-party combination, most likely headed by the socialist SPD or Merkel’s CDU/CSU (the Union). The Greens are polling third. Other coalition candidates are the liberal FDP and the left-wing party Die Linke.

- In recent weeks the SPD’s chancellor candidate, current Finance Minister and Vice Chancellor Olaf Scholz, has clearly overtaken the Union’s candidate, North Rhine- Westphalia’s Prime Minister Armin Laschet, in approval ratings for succeeding Merkel.

- All these parties support the EU and want more climate-friendly initiatives. If the Green party participates in the coalition, climate-related investments could increase.

- Forecasts of how financial markets might react depend on the outcome. In our base scenario, markets should be relatively unmoved by a coalition comprising three of the four more centrist parties (SPD, CDU/CSU, Greens and FDP). Should the more left-wing Die Linke be part of the next coalition, this could lead to more uncertainty and therefore volatility in financial markets, not least on the equity side.

Angela Merkel became chancellor in 2005. She has been ruling Germany supported by a coalition of her CDU/CSU party and socialist SPD, then with the liberal FDP and since 2013 in a further ‘grand’ coalition with the SPD. Following her decision not to run for a fifth term, on 26 September the Bundestagswahl elections will set the stage for the next coalition and her succession. Until recently the polls suggested Merkel’s CDU/CSU would receive the most votes, but the outcome is now uncertain.

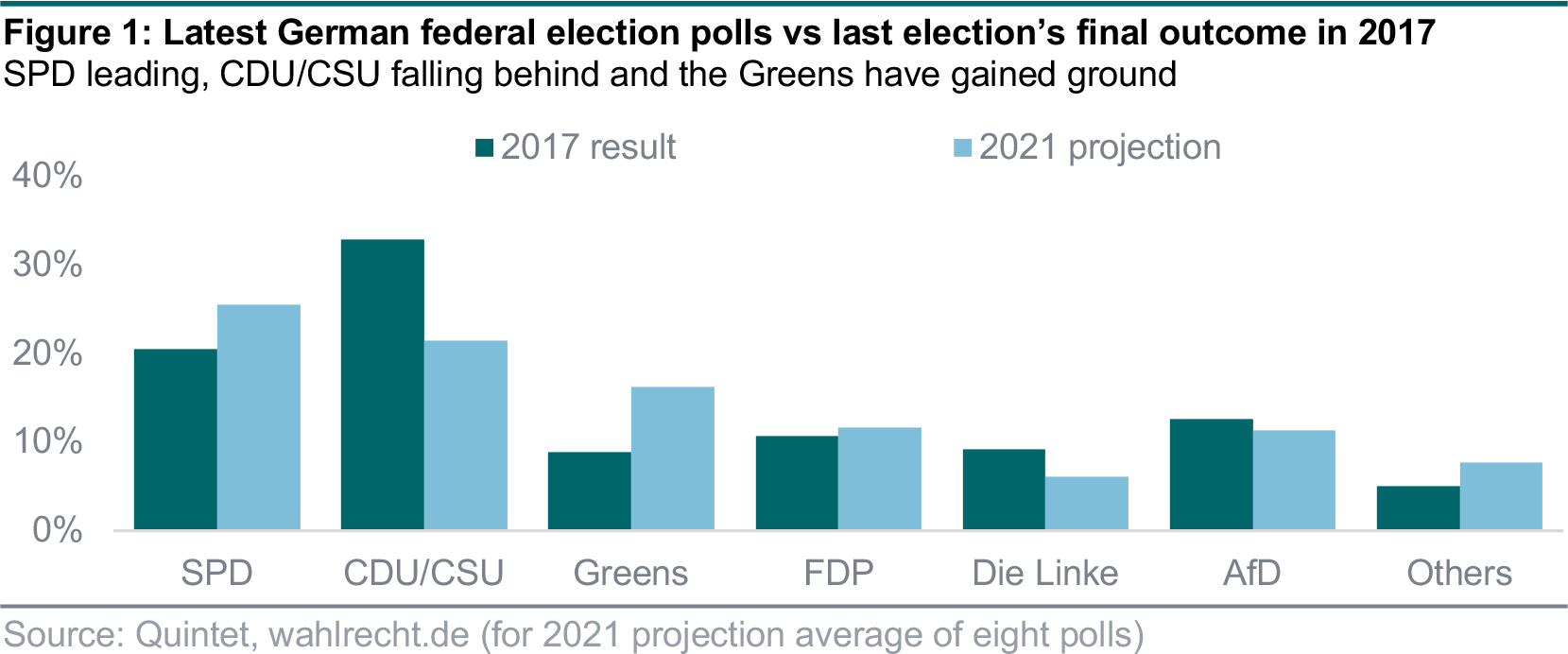

The latest polls-of-polls (figure 1) show that the SPD is ahead of the Union. Both are interested in a coalition with third-placed Greens. However, to achieve a majority with the Greens, both the SPD and Union are likely to need a third party – such as the FDP. All these parties rule out coalitions with the non-mainstream AfD (Alternative für Deutschland or Alternative for Germany). The remaining possibility, should a renewed grand coalition not be possible, is the left-wing party Die Linke. However, the Union, in contrast to the SPD, has ruled out such a coalition. Therefore, only a SPD-led socialist coalition with Die Linke and the Greens, a so-called ‘red–red–green’ combination, would be an alternative.

We believe a red–red–green coalition is unlikely for various reasons. They include the pragmatic positioning of Scholz and the Green Party’s candidate for chancellor, Annalena Baerbock, and in particular the latter’s appeal to the middle classes, as well as the lack of commitment to a basic foreign and security policy position, including Nato, by Die Linke. However, we can’t rule out this result. Although there are concerns that a coalition with Die Linke could introduce a new wealth tax or aim to cancel the German debt limit, any policies would require majorities in Germany’s second chamber, the Bundesrat.

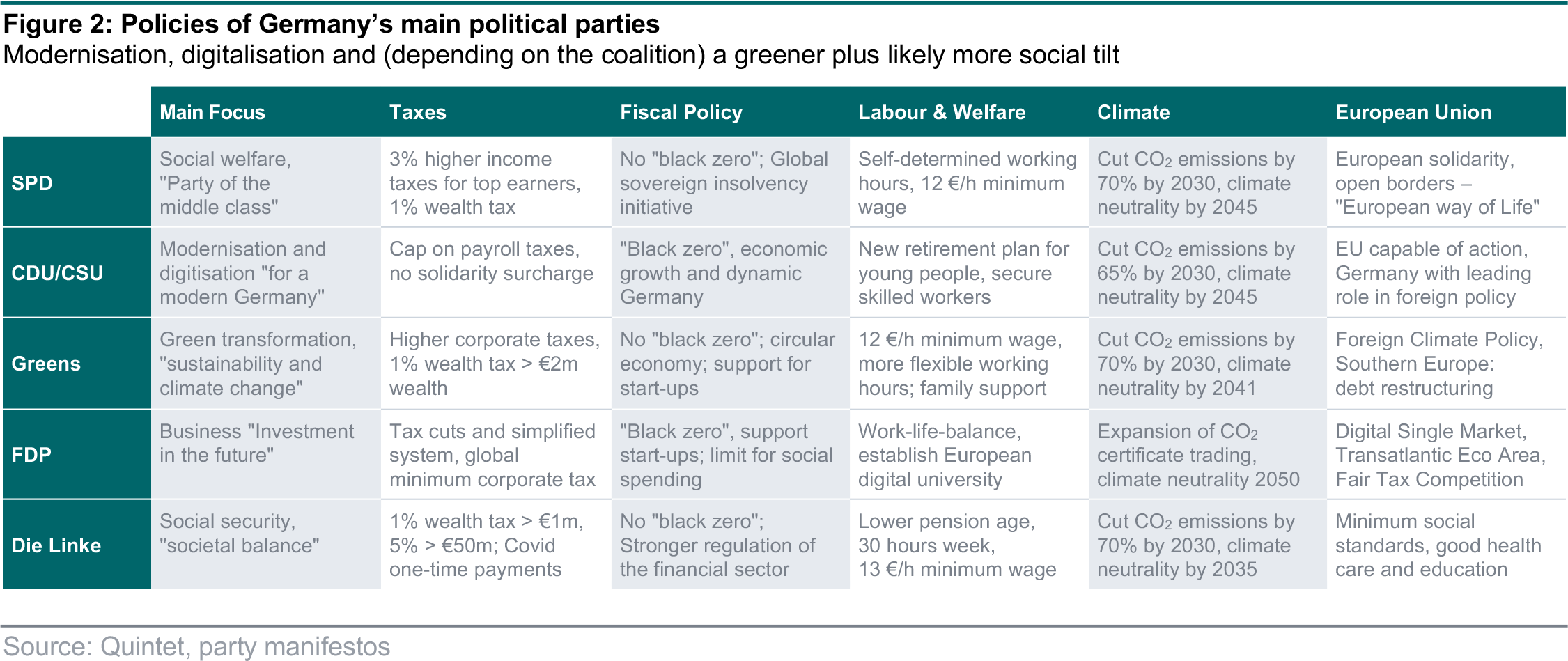

Instead, based on party policies (figure 2), a three-party coalition consisting of a subset of the four other parties looks most likely to us, which would be a first for Germany.

Based on the manifestos of the likely new coalition partners, the probability of overall policies remaining widely stable seems to be high, in particular if Die Linke is not part of Germany’s future government. While the SPD favours more social welfare, a wealth tax and moving away from the ‘black zero’ commitment, the Union prefers modernisation and digitalisation within a ‘black zero’ environment. Further EU-integration and a focus on fighting climate change also look likely.

Widespread damage caused by July’s floods has put environmental concerns in the spotlight even more, which could move up the political agenda if the Greens become part of the new coalition.

We believe the most likely outcome is a three-party coalition, led by the either the SPD or CDU/CSU and supported by the Greens and FDP. This could be a combination of the SPD with the pro-economic and tax-cut oriented FDP and the Greens (red–yellow–green, called ‘Traffic light’) or of the Union with those (black–yellow–green, ‘Jamaica’ alliance’). Another possible result is a coalition comprising of the currently ruling CDU/CSU with the SPD, likely joined by the FDP (black– red–yellow, ‘German flag’). If the SPD receives the most votes as indicated in the latest polls, it would begin coalition talks, which its candidate Olaf Scholz outlined would probably start with the Greens and then with other parties. However, Armin Laschet could start coalition talks in parallel, as there’s no fixed process for this in Germany.

Depending on the election results, coalition negotiations could take weeks or months and will set the stage for Angela Merkel’s successor. Merkel’s caretaker government will remain in place until the newly formed government takes over. Remarkably, she still enjoys the greatest approval rating among Germany’s top politicians even though she is no longer standing for election. This suggests no one has yet filled Merkel’s shoes and her successor has yet to prove him/herself. However, among the three candidates Scholz, Laschet and Baerbock, based on polls the SPD’s Vice Chancellor Olaf Scholz is the most popular one for taking over from Merkel, while the other two candidates have lost considerably in approval ratings in recent weeks.

Let’s now look at the latest polls and betting markets.

The strength of the German economy is not least due to its Mittelstand comprising small and medium-sized companies, especially in sectors like automotive and engineering, its strong export sector and a low unemployment rate, which was just 5.5% in August. Political stability and support, which we expect to persist after the Bundestagswahl in our base scenario, is the economy’s backbone. Further key factors include strong transport infrastructure and well-trained professionals. Given the gaps in digital infrastructure, the need for more investment became clear during the pandemic. The ongoing expansion of renewables is progressing and should be further supported by the next government.

Germany is setting itself more ambitious climate goals than the EU, which aims to be climate- neutral by 2050. Events such as recent flooding have increased the pressure on politicians to take action. The Greens and SPD have set themselves the goal of reducing CO2 emissions by 70% by 2030 and achieving climate neutrality within 20 years. The Greens want to phase out coal by 2030. The left-wing party Die Linke has a more ambitious target to reach climate neutrality by 2035. In contrast, the more conservative and industry-oriented CDU/CSU has set itself the target of being climate neutral by 2045, like the SPD, not least by reducing CO2 emissions by 65% by 2030.

A major factor for successfully implementing Germany’s energy transition is the expansion of renewables by extending sustainable electricity production to reduce the dependence on fossil fuels – not least from Russia. By 2025, the current German government aims to generate 40–45% of electricity consumed with renewable sources, compared to 35% at present. The prerequisite for this goal is that the economy is not negatively affected. Increasing demand for electricity, an important factor for industry, is to be met by more renewable energy, without risking surging electricity prices, shocks and, in the worst case, de-industrialisation and the relocation of companies in foreign countries. The technologies to achieve a successful energy transition (solar, wind and biogas energy) must replace the combined share of fossil fuels (nuclear energy, lignite and hard coal) with currently 47% of the electricity generated. Because Germany plans to phase out nuclear power by 2022 and coal by 2038, more investment is needed to make the transition. Germany’s global share of investment in wind energy reached 2.6% in 2019 and in biomass 10%, but in photovoltaic plants only 0.3% – leaving room for considerable increases.

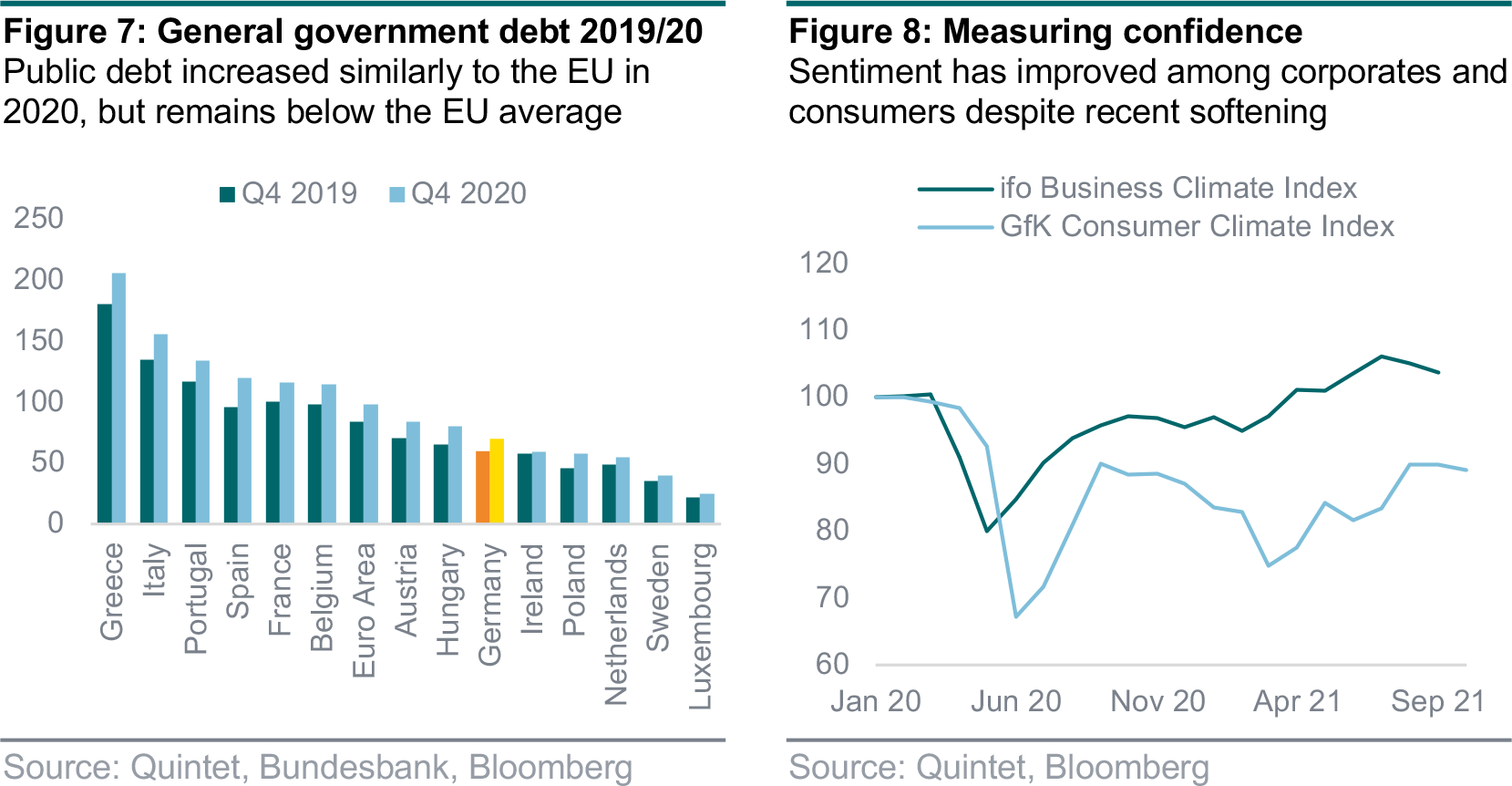

Like in other countries, German public debt has risen considerably due to cushioning measures against the pandemic – albeit from a solid starting point. In 2020, total public debt rose by 14.4% to €2.3trn, raising 2019’s share of GDP from 59.7% to 70%. Therefore, debt per capita increased by €3,306 over the previous year to in total €28,090. Germany’s expansionary fiscal policy to raise government spending and to promote the economy with countercyclical measures have been paying off.

The Covid-19 related uncertainties and lockdowns led to a 4.6% decline in Germany’s GDP in 2020, after rising for 10 consecutive years. In order to cushion the effect of declining growth and to avoid insolvencies, like other countries Germany raised debt and supported the EU’s €750bn recovery fund. European debt rules, according to which member states are only allowed to take on 60% of their GDP and 3% of new debt per year, have been suspended due to the pandemic. Compared to other countries, Germany’s 70% debt level is still low (EU average: 90.5%).

As in Europe as a whole, Germany’s economy has recovered, largely driven by both domestic and export demand. Leading early indicators including the ifo Institute’s business climate survey and GfK’s consumer confidence index suggest ongoing optimism, with activity indicators improving in recent months. However, there is also evidence that supply bottlenecks are clearing, such as for semiconductors where orders are still rising.

Overall, the next governing coalition is likely to lead a strong economy based on ongoing high export demand not least from China. While in our base scenario for coalition outcomes several minor changes in German policies look likely, we believe the most significant one could be more climate-friendly investments and initiatives to spur them. Companies involved in these projects are likely to benefit.

Due to the uncertain election outcome, forecasts on market reactions depend on the scenarios. In our base case, a coalition comprising three of the four SPD, CDU/CSU, Greens and FDP is likely to result in a muted reaction. If the more left-wing Die Linke is part of the coalition, it could trigger more uncertainty and volatility. Possibly due to the CDU/CSU slipping in the polls and an increasing likelihood of a left-wing-led government, the German DAX recently underperformed the Euro Stoxx 50 (figure 9), though it’s not entirely clear that political uncertainty was the main driver.

Due to the generally increasing importance of more climate-friendly policies – irrespective of the climate policy commitment of the Greens and a corresponding election outcome – we assume that climate-friendly business models and technologies will receive additional funding after the elections. As a result, certain business models are likely to come to the fore – either positively or negatively. In general, the spotlight should be on the utilities, infrastructure, autos and real estate sectors (figure 10).

Among utilities, a more friendly framework for the expansion of renewable energies can be expected. The large utilities have accepted the transition to renewable energies and are actively shaping it. They include RWE, which shifted its strategy to low-carbon generation a few years ago. This is already taking place in Europe through the carbon pollution rights, which are forcing utilities and, in future, all industries to switch to low-carbon or carbon-free generation and production. Regarding legal regulations, utilities may receive compensation. If the Greens are involved in the ruling coalition it would probably be positive, as the Greens would try to bring forward a coal phase-out. Due to pollution rights, this could even help power plant operators to shut down unprofitable coal-fired plants faster at government expense. Looking at the general Green Deal for Europe, while it is a good thing to push towards carbon neutrality, it will no doubt have an impact on both the energy and materials sectors.

In terms of the auto industry, the transition to electric vehicles is progressing. For example, VW committed itself by 2030 to equip 70% of its cars sold with electric engines. Corresponding government support is likely to intensify, regardless of the outcome of the election. A coalition including the Greens would probably be more negative for car manufacturers than a conservative government. This may lead to even stricter CO2 regulation requirements and put more pressure to shift to EVs. Furthermore, the SPD and Greens want to impose speed limits on Germany’s Autobahn, which could reduce demand for sports cars and premium cars.

We do not believe in the forced sale of portfolios of large private housing companies to state-owned housing companies or a splitting of these private entities if a red–red–green government would be formed. As an aside, the total market share of large private housing companies is only 5%. Policies such as rent control and rent caps are possible, though housing companies should not be greatly affected by what are likely to be mild interventions. Housing companies are already investing heavily in modernisation and energy-efficient refurbishments, thereby also increasing the value of their properties. Regardless of the election outcome, the environment should be supportive for building materials, as well as machinery and electrical companies active in the field of energy efficiency, as well as green mobility.

Authors:

Robert Greil Senior Macro Strategist

Marc Decker Head of Equity Research

Bill Street Group Chief Investment Officer

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 13 September 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.