Markets mulling Fed cut timing

The release of the March US consumer inflation data, which was hotter than expected, lead markets to rethink when the US Federal Reserve (Fed) would start cutting rates. Markets now expect the Fed will cut rates later and only twice this year. This is down from the seven cuts anticipated just two months ago, which we always thought was too extreme. This repricing in interest rates sent global stocks lower before they temporarily rebounded on a mixed producer inflation report. Mixed big banks earnings eventually sent the S&P 500 and Nasdaq Composite index 1.6% and 0.6% lower respectively. Looking forward, as long as growth is robust (we’ll watch the various regional Fed activity data this week), the downside for equities could be limited. The interest rate repricing was more evident on the bond market, with US Treasury yields rising around 0.15 percentage points as prices fell.

More certainty in Europe

A first rate cut by the European Central Bank (ECB) seems much more likely in June now after the central bank gave markets a nod for a mid-year cut last week. Growth and inflation dynamics in Europe are weaker than in the US (a reason we hold fewer European equities relative to our long-term allocation). In addition, with tight monetary conditions weighing on loan growth and investment, the ECB has room to cut before the Fed does. This would be pretty unusual and could be a risk to our euro view. However, we think the euro – and other currencies of central banks willing to cut rates, e.g. the Swiss franc, the Swedish krona – could only face moderate downside pressure in the short-term vs the US dollar, as the latter would start to weaken gradually when the Fed cuts. In the UK, expectations are for inflation (Wednesday) to ease, which could cement the case for a first cut by the Bank of England during the summer. While we think the Bank Rate will be lower at the end of the year, it may not be as low as consumers hope as the UK economy grew for the second consecutive month in February.

Commodities still in the spotlight

The rally in oil prices has lost some steam and while we could see a consolidation as the tight supply and improving demand seem to be already reflected in market expectations, tensions in the Middle East could cause prices to spike. The impact of geopolitical risks tends to be short-lived on markets without major escalation, but these risks linger. Last week, a Russian attack on Ukrainian gas storage sent natural prices higher. We don’t think this poses a major threat to Europe as storage are still quite full after a mild winter. Meanwhile, gold prices continue to soar, backed by robust demand despite the reduction in interest rates cuts expectations, and geopolitical uncertainty. So far this year, broad commodities, which we hold in our portfolios, are posting positive returns on supportive fundamentals and geopolitical risks.

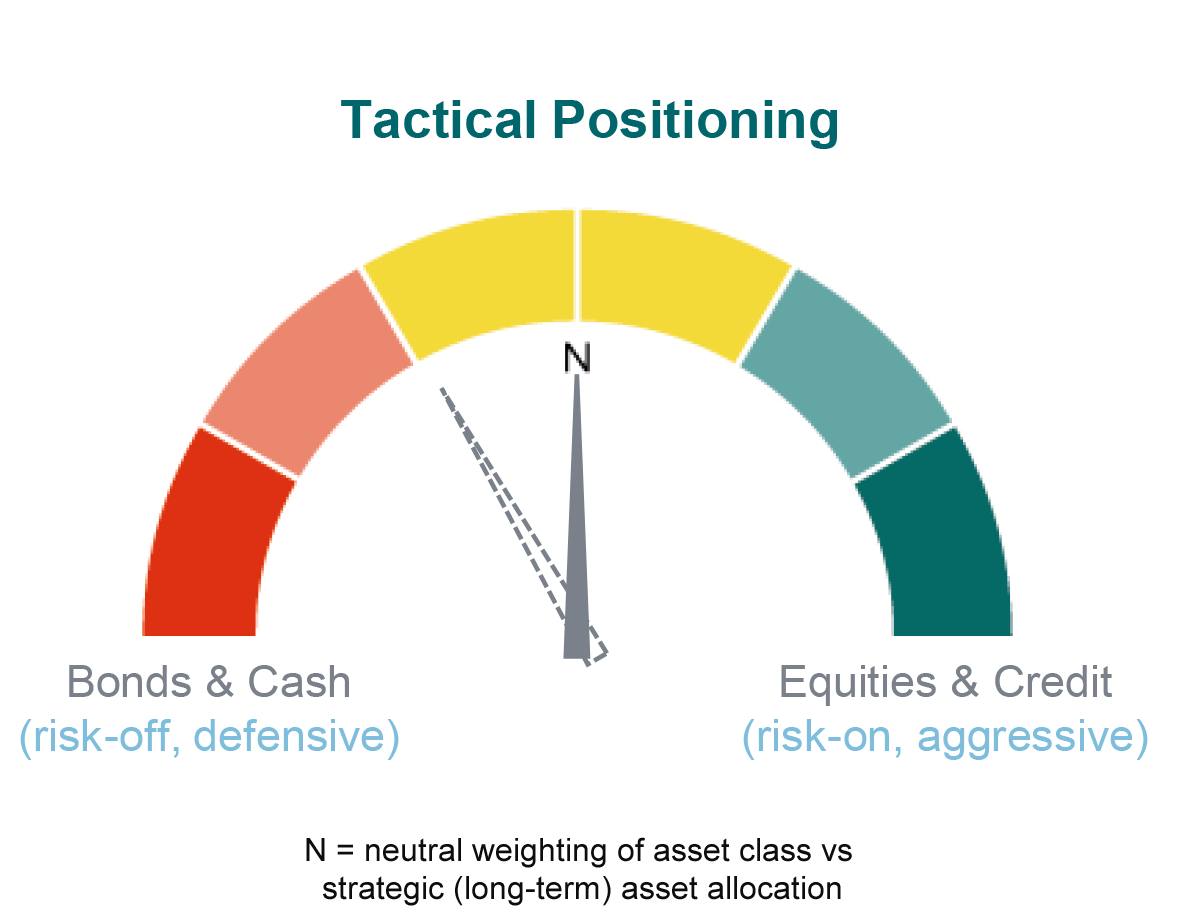

Staying balanced, but with tactical tilts

We are remaining balanced for equities and bonds relative to our long-term strategy. Recently, we brought our US equity exposure back to neutral, while keeping a lower Eurozone equity allocation. We sold our minimum-volatility Eurozone equities position. The reason is that, in Europe, growth has been at or near zero for some time, but it’s not getting worse and appears to have bottomed out. Therefore, we think it’s unlikely that Eurozone minimum-volatility sectors (which do comparatively well when the economy is worsening) will outperform the broader European market. Later this week, we’ll expand on what else we’ve been up to in our investment strategy.

Data as of 12/04/2024.