Asian high yield (HY) bonds have experienced a period of elevated volatility and rising spreads since June. The correction has accelerated in recent weeks, with the rapid deterioration of property developer Evergrande’s liquidity situation a major catalyst. We revisit the investment case for Asian HY bonds and confirm our conviction in the asset class over our tactical horizon of 6–12 months, despite near-term risks.

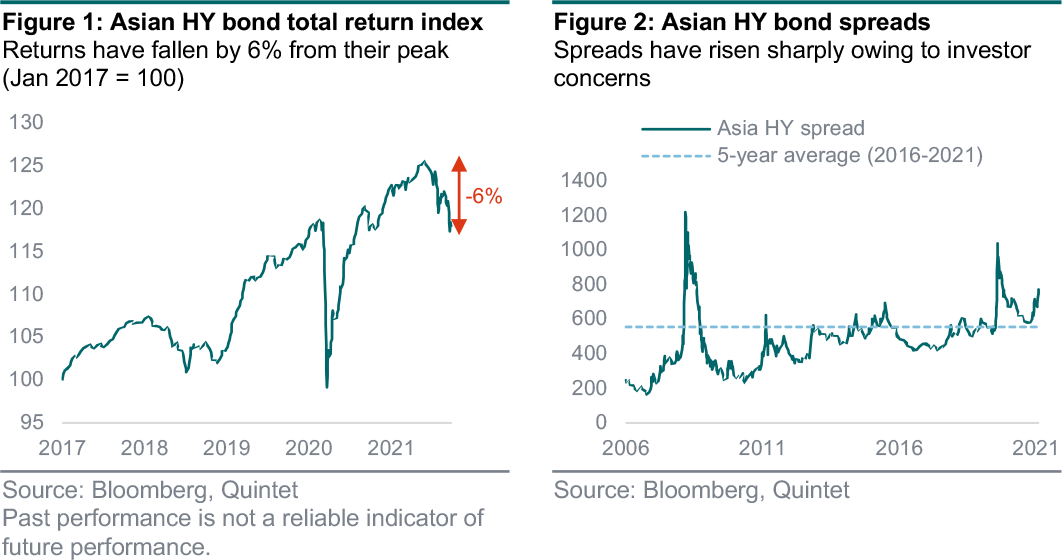

- The average credit spread for Asian HY bonds has widened to its highest level since June 2020, as investor concerns about the all-important Chinese real estate sector deepen. In total return terms, the asset class has now lost 6% from its latest peak in May.

- In particular, the deteriorating situation of Evergrande – the world’s most indebted property company – has unsettled investors. We expect an orderly restructuring of Evergrande’s debt, which should eventually reduce uncertainty for the wider asset class. The biggest risk remains a disorderly default, which could spill over to the rest of the sector and even threaten Chinese economic stability. While we cannot rule out this worst case, we don’t believe it’s likely.

- We confirm our tactical overweight position in Asian HY over USD investment grade bonds. Risks for the asset class are undoubtedly elevated, but we believe the current spread level offers generous compensation. Although market conditions could be volatile over the next few weeks, we expect Asian HY to achieve very appealing risk-adjusted returns over the next 6–12 months.

Pressure on Asian HY bonds increased in September, as the deterioration of Evergrande’s liquidity situation has forced the issuer to suspend interest payments and consider restructuring (see box on page 5 ‘Evergrande: the elephant in the room’). The prospect of China’s second-largest property developer defaulting has caused general investor concern about the wider real estate market, and specifically bond issuers with weak credit profiles.

While Evergrande alone makes up just 1% of the Asian HY index, Chinese property firms account for close to 40% of the exposure, making it the dominant sector in the index. Evergrande’s situation is in many ways idiosyncratic, but its sheer size and importance for China’s property market leaves investors worried about a possible spillover to the wider economy.

While near-term visibility is low and further downside pressure is possible in the coming weeks, we remain convinced of the investment case for Asian HY bonds over the next 6–12 months for two key reasons:

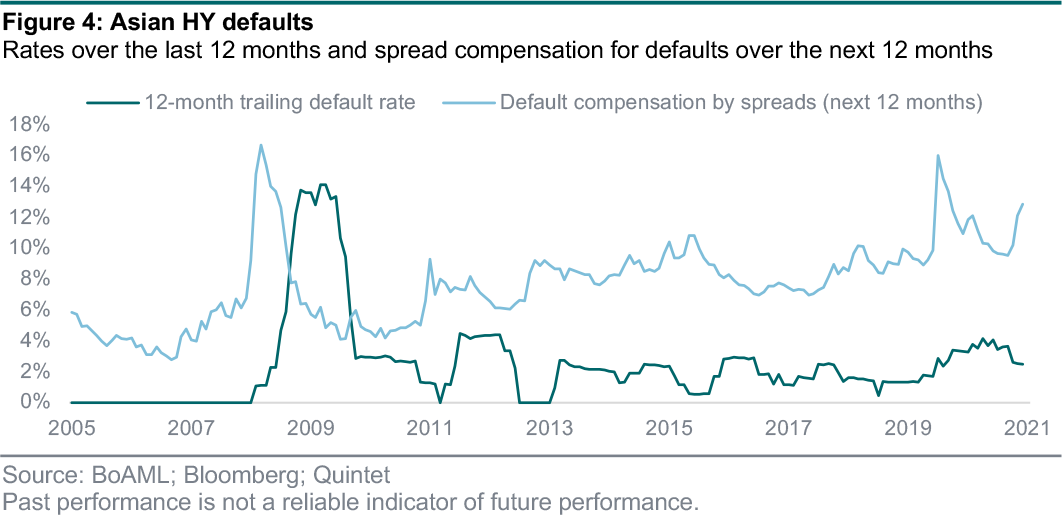

- Valuations: At current levels, Asian HY bond spreads can absorb a default rate of almost 13% over the next 12 months. Even with spread levels unchanged and region-wide default rates picking up moderately, expected total returns are 4–5% over the next 12 months, thanks to the generous yield of 8–9% offered currently. That leaves the risk–return outlook of the asset class positive over our tactical horizon.

- The role of the Chinese government: Policymakers are unlikely to endanger their overarching goals of wider economic stability and social peace. While the timing and scope of any government intervention are impossible to predict, we think the government is fully aware of the systemic risk of disorderly defaults in the property sector. Officials have all the incentives and means to prevent this situation if required – including the provision of liquidity support, facilitating an orderly Evergrande restructuring or even relaxing regulatory measures temporarily.

Rising investor concerns have led to a significant widening of Asian HY spreads. From its 2021 low of 570 basis points (bps) in May, the average spread increased to 755bps. This weighed on total returns, which are down by 6% from their recent peak (figures 1 and 2). The main driver of the spread widening is the Chinese real estate sector, which accounts for almost 40% of Asian HY. Bonds of weaker credit issuers sold off most dramatically.

The average spread for that sector alone has now increased to over 2,000bps, with more than a third of the outstanding bonds trading in distressed territory (i.e. at prices below USD 90). Investor concerns about the sector had been triggered by regulatory measures from the Chinese government to limit longer-term credit and bubble risks (see box below ‘Red lines for the property sector’).

The ‘Three red lines’ – restrictions on banks’ lending to property companies – underlined the willingness of the Chinese government to address stability concerns in the real estate sector. China imposed these guidelines in August 2020 to cope with growing debt levels, rising land prices and booming home sales, aiming to enforce the central government’s position that houses are for living, not for speculation.

Following strong growth in the property sector over the past few years, it was time for the government to ensure stability, as real estate companies are now a systemic risk for both the financial system and domestic economy. The idea behind this initiative is to improve balance sheets and debt coverage capabilities, while increasing the liquidity buffer. To do that the regulators put in place three criteria:

- Liability-to-asset ratio of less than 70%

- Net-debt-to-equity of less than 100%

- Cash-to-short-term-debt ratio of at least 1

Developers are categorized depending on how many of these limits they breach, capping their debt growth accordingly. For companies passing all three, they can increase debt by a maximum of 15% in the next year, while firms reaching the three limits are not allowed to continue to raise their debts. Currently, Evergrande is breaching all three limits.

Contrasting the risks to the asset class with the compensation that Asian HY bonds currently offer with their 755bps credit spread we think that a lot of risk is already priced in. For the entire credit spread to be wiped out, we would have to envisage a dramatic scenario. If we assume recovery rates of defaulted bonds remain in line with their long-term average of 40%, default rates would have to increase towards 13% over the next 12 months (for simplicity this assumes no yield or spread changes in the meantime). Over the past year the default rate has been 2.5%.

Figure 3 shows total returns for the asset class, depending on the spread level as well as realized credit losses over the next 12 months. Assuming spreads stay roughly unchanged around 750bps, while credit losses would increase somewhat to 2–3%, total returns for Asian HY would be 4–5% over the coming year. Any spread tightening towards pre-sell-off levels would improve the outcome.

In a downside scenario, where spreads widen to prior all-time highs of around 1,000bps, while credit loss rates would increase significantly to 5%, a negative return of around -6% would probably result. Temporarily, the mark-to-market loss would be higher, but partially compensated for by carry over the course of 12 months.

This scenario analysis highlights the asymmetry of likely outcomes from current spread levels – positive returns are significantly more likely and higher than negative ones under realistic assumptions. Even in the absence of spread tightening, 12-month returns will likely be attractive thanks to the high carry of 8–9% currently.

While there has been a lot of attention on Evergrande, this single issuer makes up around only 1% of the Asian HY index (down from more than 3% before the correction). So, the most important question at this stage is about spillover risks to the wider property sector and beyond.

We see two main channels for contagion to the wider Chinese economy from the Evergrande case. First, an outright disorderly bankruptcy, where Evergrande’s property operations stop overnight, would likely cause a severe financial and economic shock to the Chinese economy. Homebuyers (who already deposited money with the company), suppliers and around 200,000 employees would face immediate negative consequences. The company is estimated to indirectly generate up to 4 million jobs in China. Furthermore, domestic retail investors holding the company’s wealth management products – the total of which is around USD 6 billion – could face a total loss of their capital.

Such a disorderly default would have far-reaching consequences, which the Chinese government has every incentive to avoid, especially considering the economic and social importance of the real estate sector, which contributes up to 28% to Chinese GDP. While a direct bailout of Evergrande looks unlikely, we think the government has various other options to soothe the situation. They include the facilitation of an orderly restructuring, liquidity provision to other property developers or even temporary relaxations of regulatory measures, if needed.

The second contagion channel is via a debt restructuring, where investors recover significantly less than the market is currently pricing in for Evergrande’s bonds (i.e. less than 25%). This would inflict unexpected losses and might be seen as a sign that property recovery values are generally overestimated. While clearly not our base case, these risks warrant close monitoring. Ultimately, if the worst case of a disorderly default can be avoided, we think a restructuring reduces uncertainty for market participants and should clear the way for more stability. But until then volatility should be expected to stay elevated.

The scope for contagion beyond China is much more limited in our view. The overwhelming majority of Evergrande’s debt – and more generally of Chinese corporates – is held by domestic investors. Neither US nor European banks should be much affected by potential losses on the issuer’s bonds. Ties into international financial markets are marginal, reducing the risk of international contagion.

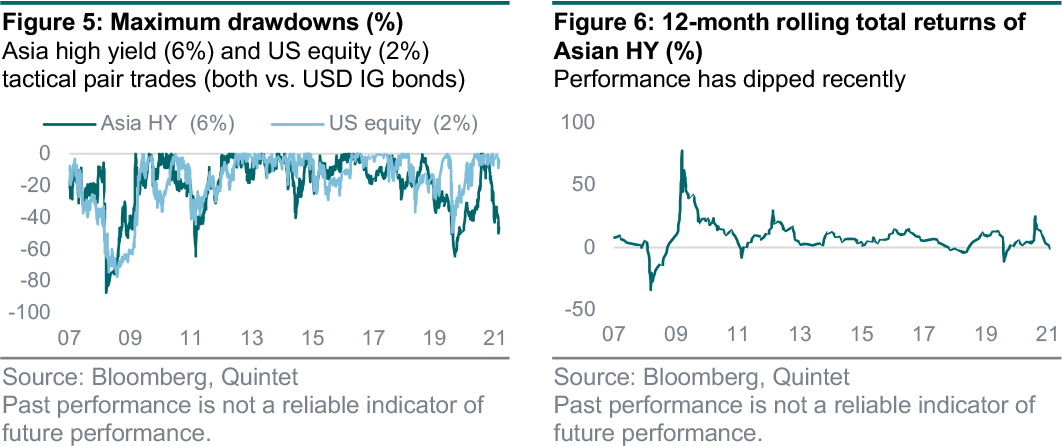

While the risks clearly need monitoring, we believe that the outlook for the asset class on balance looks positive. We increased our tactical overweight in Asian HY over USD investment grade (IG) bonds to 6% in August. Based purely on position size, this is the biggest tactical overweight in our portfolios. But it is not when it comes to risk contribution, as the risk characteristics of credit are substantially different from those of equities.

One why to explain this is by comparing the Asian HY position with our long-standing tactical overweight in US equities over USD IG bonds, which has a size of 2% in portfolios. Figure 5 shows that maximum drawdowns of both tactical pair trades would have been comparable over the past 14 years. Also, the average volatility of both positions has been similar historically. Other risk measures confirm that despite the sizeable position in Asian HY, most of the risk within our tactical strategy is still driven by our equity overweight positions (specifically, US and UK small caps).

Furthermore, the short duration of the asset class (of just three) means it is less sensitive to changing yields and spreads than most other fixed income asset classes. The significant spread widening of almost 200bps since May translated into negative total returns of -6% on Asian HY bonds. In the context of our tactical asset allocation (TAA), the overweight position has so far detracted roughly 0.3% from overall portfolio returns since we opened it in February. While certainly not the outcome we had envisaged, it is well within the usual risk ranges we are comfortable with for our TAA.

We confirm our tactical overweight position in Asian HY over USD investment grade bonds. Risks for the asset class are undoubtedly elevated, but we believe the current spread level offers generous compensation. Looking through the next few weeks, which might still bring further volatility, we expect Asian HY to achieve very appealing risk-adjusted returns over the next 6–12 months.

The story around Evergrande started a year ago, following speculation of a possible cash crunch. Concerns over the property developer’s health resurfaced in mid-2021, causing a severe drop in both its stock and bond prices. Looking at fundamentals, Evergrande was in worse shape than many of its peers, both in terms of leverage and business model explaining why it’s breaching all ‘three red lines’. Even if the company has tried to improve its debt and liquidity position to comply with the regulation, it has been a huge game changer as it has no longer been able to pursue debt expansion.

During summer, the company has been in the spotlight due to multiple negative headlines including the freezing of an onshore bank deposit, pausing sales at two of its residential projects and a lawsuit on unpaid bills. Against this backdrop, rating agencies S&P and Fitch downgraded ratings to CCC+ and CCC respectively, reflecting the weakening funding access and decreasing liquidity buffer. These events further weighed on investor sentiment regarding Evergrande itself and the sector as a whole.

More recently, pressure increased further at a time when market liquidity was low due to a public holiday in China, as the company missed interest payments on US dollar bonds. There’s a grace period of 30 days to find a solution, before the company is considered to be in default. The least disruptive solution would be a managed restructuring of the firm to avoid a disorderly default and potential contagion. The government has already appointed financial and legal advisors to look at the situation, and could intervene to facilitate asset sales or credit access for homebuyers as well as project companies, supporting not only Evergrande, but the sector in a whole.

What recovery to expect?

Uncertainty around the potential recovery value is large. We expect all onshore payables, including bonds, tax and other liabilities, to rank ahead of offshore debt, which could lead to a relatively low recovery value for offshore dollar debt. The ultimate recovery value will likely be very different in a disorderly default compared to an orderly default or an organized restructuring, and could range from as low as 25% to as high as 70%.

Currently, Evergrande’s bonds are on average trading around USD 27, and therefore pricing in an outcome at the low end of this range. While not directly comparable, the default of Chinese property developer Kaisa in 2015 is an example of how ultimate recoveries can be substantially above initial estimates. At the time of default, Kaisa recovery estimates were between 0 and 14%, but ultimately investors recovered a substantially higher portion of their capital.

Authors:

Philipp Schöttler Cross-Asset Strategist

Bill Street Group Chief Investment Officer

Lionel Balle Head of Fixed Income Strategy

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 27 September 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.