We’re often asked this question when discussing our current tactical overweight in equities over bonds, and understandably so. Many measures of equity valuations are high compared with history. But that doesn’t mean global stock markets can’t continue to rise.

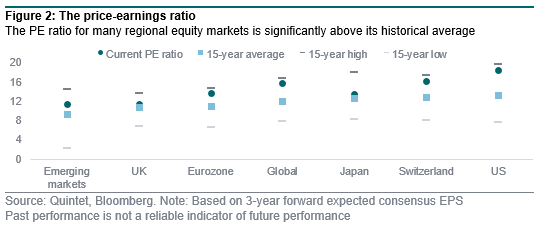

- Across many equity markets the most commonly used valuation measures, such as price-earnings ratios, are elevated compared to history, and in some cases they are not far from all-time highs. This is causing doubts about their return prospects.

- Are equities too expensive? We don’t think so. Equity valuations in isolation have been a poor guide to tactical investment decisions in the past. We think it’s important to put valuation measures into a wider context to make sense of them.

- When taking into consideration the global low-yield environment, changes in the sector composition and the current stage of the business cycle, we find valuations are not a valid reason to shy away from equities at this point. We are tactically overweight US equities over low-yielding ds.

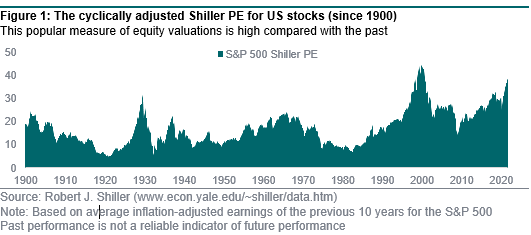

Commonly used valuation measures, such as the price-earnings (PE) ratio, suggest equity markets are expensive (figure 1). There are different ways to measure equity values, and many of these statistics are currently high compared with history. Meaningful differences exist between regions, but most equity markets seem expensive from that perspective (figure 2).

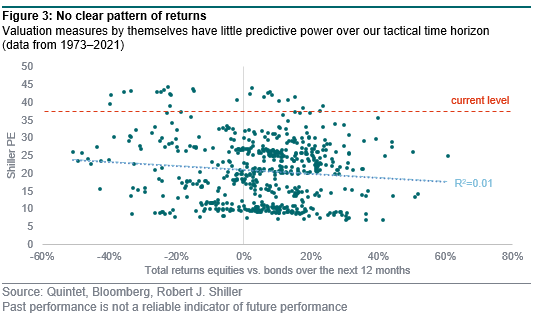

However, valuations on their own tell us little about future returns – at least over our tactical six- to 12-month horizon. Figure 3 shows the cyclically adjusted Shiller PE since 1973 on the vertical axis and the returns from US equities over US Treasuries over the subsequent 12 months on the horizontal axis. There has been no consistent relationship. At valuation levels similar to today’s, equity excess returns over the subsequent year have ranged from -40% to +40%, with roughly as many instances of negative and positive outcomes – not exactly a clear-cut projection. We are using Shiller PEs here as an example, mainly because it’s a popular measure and has a long time series. But many alternative valuation measures give similar results.

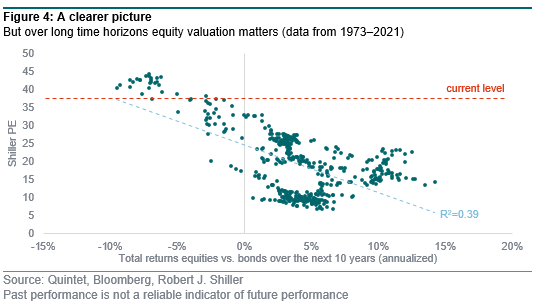

Over longer time horizons, such as 10 years, valuations have more predictive power, as figure 4 shows. Current valuations suggest that equity returns over the next decade are likely to be lower than during most of the past 50 years. The same holds true for most other asset classes as well, in particular for fixed income markets, which are also trading at historically expensive levels. But valuations are less meaningful when looked at in isolation, particularly over a shorter time horizon. We think that just looking at a single aspect of markets, such as valuation relative to history, narrows the focus. As for most other indicators, it is important to put valuation into a wider context. Read on to find out more.

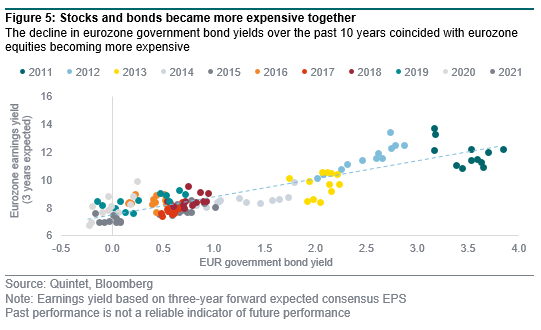

One of the most impactful market developments over the past few decades has been the secular trend lower in interest rates. Figure 5 shows how the decline in eurozone government bond yields over the past 10 years coincided with eurozone equities becoming more expensive. (The vertical axis shows the earnings yield, which is the inverse of the price-earnings ratio. The lower the earnings yield, the more expensive the equity market). So, it’s not just equities that are trading near record-high valuations. Many fixed income assets are as well. And there are good reasons to believe that there is a direct relationship.

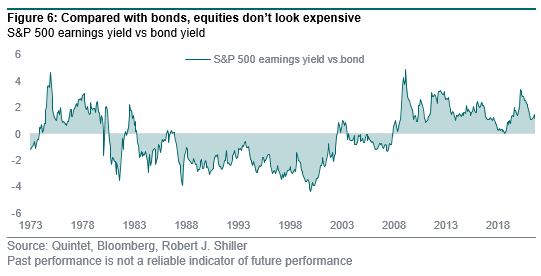

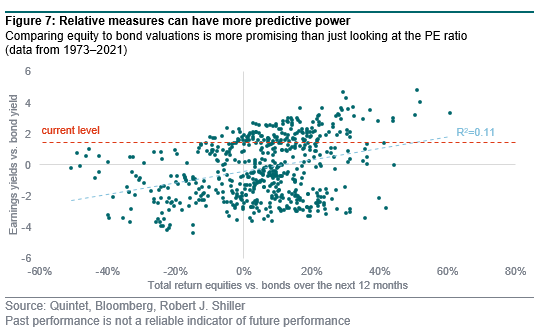

When constructing their portfolios, investors weigh the relative attractiveness of different asset classes. As interest rates fall, bond prices rise and the asset class becomes relatively less attractive. Investors reallocate money to equities, driving up their prices too, until relative attractiveness is more balanced again. Currently US equities are rather cheap compared to US Treasuries. Their earnings yield is higher than the 10-year bond yield (figure 6). This is a highly simplified measure and we are not suggesting it’s a good idea to base any investment decisions on it. However, figure 7 shows that such a relative measure has more predictive power for equity excess returns over the subsequent 12 months than looking at equity valuation in isolation.

The second key reason for why lower interest rates should translate into higher equity valuation is the importance of the discount rate (see boxout ‘The importance of the discount rate’).

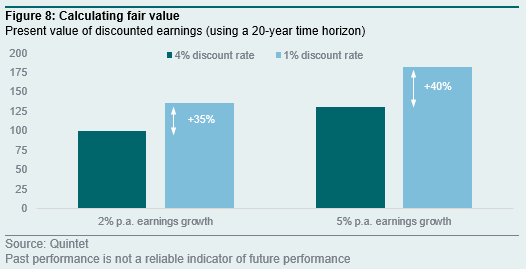

In essence, a stock gives its owner a claim on the future earnings of the respective company. In order to judge a fair price for that claim, an investor needs to estimate what the expected company earnings are worth today. To estimate this present value, we discount expected future earnings by the anticipated interest rate. In this highly simplified model a company’s fair price would increase for two reasons: 1) higher expected earnings growth, or 2) a lower discount rate.

As figure 8 shows, a significantly lower interest rate than in the past – here 1% instead of 4% – increases the fair value of equities significantly. The effect is more pronounced the higher the expected earnings growth is (as more earnings are generated further out in the future, when the discount rate matters most).

Rising interest rates would be a serious threat to equity returns. Our outlook is for major central bank rates to stay very low for at least the next two years and for longer bond yields to rise only mildly, as the US Federal Reserve and ECB will probably start reducing their bond purchases soon. It’s not an imminent risk in our view, but one that warrants close monitoring

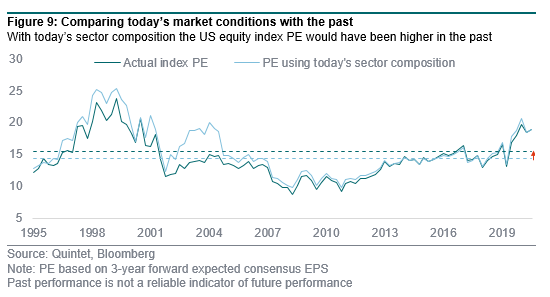

When comparing current equity valuations to the past, we need to ensure we are comparing apples to apples. Today’s market is not the same as yesterday’s. The composition of equity indices changes over time. Some sectors grow in importance, while others shrink.

For instance, during the first decade of the 2000s the combined weight of the information technology (IT) and communication sectors in major US equity indices was hovering around 20%. It has since doubled to 40%. Meanwhile, the weight of commodity-related and financial sectors has shrunk meaningfully. Admittedly, these sector shifts have been particularly pronounced among US stocks (which currently make up 60% of the global equity market).

Sector shifts matter because different sectors typically trade at different average valuations. Companies that are expected to generate superior earnings growth usually trade at higher PE ratios than the wider market. For instance, the average PE ratio of IT and communication firms since 1995 has been 16 to 17x. For financials, energy and materials companies it has been 11 to 14x. Simply put, investors are usually willing to pay higher (relative) prices for fast-growing and innovative firms than for companies in the later stages of the product lifecycle or in saturated markets.

Figure 9 shows that for the US equity market the average PE ratio, assuming today’s sector weights, would have been higher by 1.2x on average since 1995.

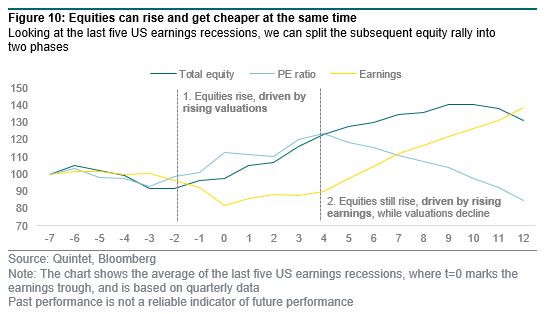

It’s important to acknowledge that attractive equity returns can be brought about by either rising valuations or company earnings (or a combination of both). In the past there has been a pattern to the way in which these two drivers interact during equity market upswings. Looking at the last five US earnings recessions, we can split the subsequent equity rally into two phases (figure 10):

- First phase: while company earnings decline and the economy is still in recession, investors anticipate the turnaround. Equity prices start to rise rapidly, driven by a strong rise in the PE ratio.

- Second phase: at some point into the rally, earnings bottom and earnings growth starts to kick in. Eventually, earnings growth takes over as the main driver. Equity prices continue to rise, while the PE ratio starts to decline (as earnings grow more rapidly than stock prices).

There are two important takeaways. First, it is usual to see high equity valuations after the initial stage of recovery, which is roughly where we think we are in the current cycle. Second, for equities to generate attractive returns, ever-increasing valuations are not necessary. Indeed, the global PE ratio is actually roughly unchanged since the beginning of this year, while global stock markets are up more than 15%.

We don’t think so. We don’t see current valuations as a reason to shy away from stocks. Taking profits and awaiting a more attractive entry point may seem appealing, but historically, valuation alone hasn’t been a very useful guide for investment decisions over the subsequent six to 12 months. Putting current equity valuations into context leads to a more favourable take on the topic.

We don’t dismiss equity valuations entirely. Rather, valuation is one of many market drivers we consider in our tactical investment framework. For our current overweight in US equities versus investment grade bonds, earnings and price momentum are more crucial factors supporting the position at this stage of the cycle. Furthermore, the macroeconomic backdrop still provides a tailwind to equity markets.

Last but not least, highly rated bonds, which we currently underweight in favour of equities, are trading at historically elevated valuations too. We have also added credit carry as an alternative source of returns to our tactical mix, and have an eye on the diversifying properties of each position for our overall tactical stance.