- The second-quarter earnings season has again been much better than consensus expectations, with all sectors in the US and Europe beating earnings and sales forecasts.

In the US the S&P500 experienced an earnings revision of more than 80%, which is the highest since 2009. Revenues were up by more than 21% (year over year), which is a record. As has been the case for the last several quarters, analysts have substantially underestimated the extent of the economic recovery. So far earnings have come in 17% above expectations in the US and 31% in Europe and are much higher than the typical

levels of 3% to 5% above expectations. - After a temporary slump on both sides of the Atlantic at the beginning of earning season, stock markets reacted to the excellent corporate results by recovering quickly. We believe it as an underwhelming response, which can be attributed to several factors. They include the Chinese government’s clampdown on the technology sector, rising inflation and the fear of higher government bond yields, as well as the spread of the Delta variant of the coronavirus.

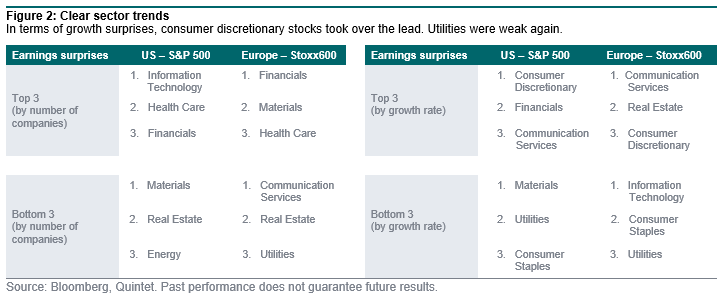

- The market reacted positively to strong beats in more cyclical sectors – especially in consumer discretionary – but those in tech have not been rewarded. This is a sign that the market remains in rotation mode as investors continue to move from Covid winners to recovering Covid losers.

Quintet’s view remains that after an initial re-rating of Covid losers, the market will once again become more selective, favouring companies in industries with attractive competitive dynamics, innovative business models and solid cyclical or structural growth prospects

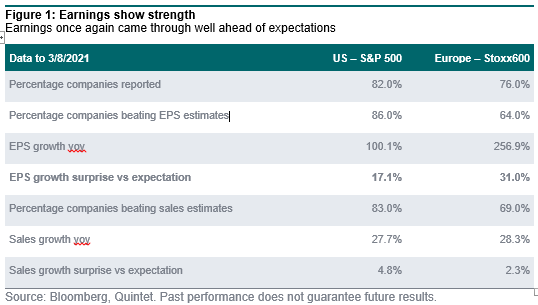

With 82% of companies in the US and 76% in Europe having reported results (as of 05/08/2021), second-quarter growth figures are once again coming in far stronger than expected (figure 1). More than half of the companies that have reported so far have beaten consensus expectations by at least 5%. While the market was rewarding beats at the start of the season, its reaction has moderated recently. At the same time, the few companies that missed expectations have underperformed following the results. Although we’re reviewing quarterly figures, it’s important to remain focused on medium- to longer-term trends rather than assessing companies on such as short timeframe and appreciate that past performance does not guarantee future results.

The percentage of companies beating expectations is among the highest on record both in the US and in Europe. For instance, Europe’s 64% beat ratio compares to an average of 55% since 2009. The aggregate earnings growth rate of around 100% in the US and more than 250% in Europe is higher than in 2010 following the Global Financial Crisis, which shows the extraordinary nature of the shock companies endured at the start of 2020. Note the year-on-year comparisons for this quarter and the coming ones will be distorted by the low starting points of 2020.

In relation to earnings, all sectors have surprised against expectations, both in Europe and in the US. We have shown the best and the relatively worst sectors in figure 2. In the short term, stock markets have discriminated when rewarding strong beats by sector. For instance, strong earnings from autos and industrials have been rewarded with higher share prices, while strong earnings from tech/internet companies have not.

Our view is that much of the current growth success from tech/internet companies was already embedded in share prices and renewed share price strength will require growth to come through in the longer term. Meanwhile, the market continues to reward the more cyclical segments that suffered heavily from the pandemic. As a number of these businesses have recovered to pre-covid levels, further upside will require further improvement in their growth prospects from here. High valuations and seasonal weakness could put pressure on the market in the coming weeks.

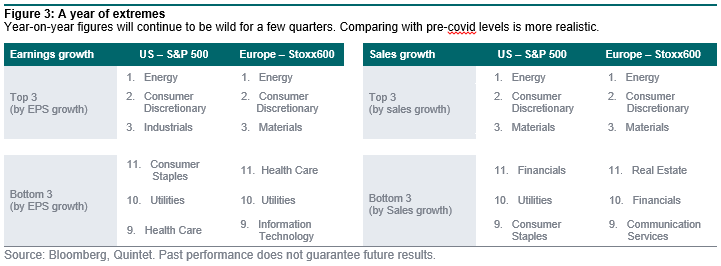

Within the broad equity market, cyclical and value companies reported the largest positive net earnings surprises. It is worth noting that the headline earnings from sectors are sometimes dominated by extreme results from a small number of companies within them (figure 3). We explore key sector trends below.

Information technology: The earnings season has been mixed so far. Any of the companies that have been Covid beneficiaries have reported slower growth in the second half due to tough competition and reopening of economies. This has led to a lack of upgrades, which has been taken poorly by the market (for example Amazon and Zalando). Tech and medtech earnings have been fairly solid.

Consumer discretionary: There have been positive earnings surprises, especially in the auto sub-sector. They are not driven by volumes, which are suffering from chip shortages, but by the shift to selling models with good margins and favourable consumer demand. Furthermore, some companies benefited from higher used-car prices for their owned dealers or own fleet. The outlook generally has increased but much depends on the chip shortage ending (possibly in 2022) and the impact on developing electric vehicles.

Financials: In Europe around 70% of banks have reported, with sales growth slightly negative and impressive earnings growth. In the US, nearly 90% of financial companies have reported, and both sales and earnings growth have been solid. One common characteristic we see across both regions is that the positive surprises on earnings have been much bigger than those on sales. We view these earnings surprises predominantly as a function of lower-than-expected credit loss provisions at major lenders. In many cases we saw large write-backs of credit provisions, leading to net benefits to the bottom line. This type of ‘beat’ might be seen as one-off/non-recurring, and the perception is that a lot of these ‘beats’ are relatively low quality.

Healthcare: Destocking in Q2 20 offered a favourable comparison base (y/y) to EU pharma, paving the way for a strong rebound in Q2 21 or at least above the usual underlying growth rate. Conversely, the Covid pandemic remains a tailwind for diagnostics (such as Roche), while businesses such as Lonza are much immune. 2021 financial guidance was either reconfirmed (Roche, Novartis, GSK and UCB) or revised positively (Lonza and Sanofi).

Industrials: Earnings were characterised by a growth rebound across the board, although from a very low base due to the pandemic. This is true both for sales and even more for profits. We’ve also seen some companies delivering growth over Q2 19 pre-Covid levels. We also note that demand-led growth recovery has materialised in nearly all segments (i.e. verticals) and across all regions.

Consumer staples: Food related companies in particular have reported earnings above expectations, mainly driven by internal measures. But the outlook is impacted by higher raw material prices and logistics costs. The key is whether companies will be able to pass on higher input costs to customers. Resistance from large retailers should be expected. Therefore, margin erosion might accelerate.

Over a multi-year horizon technology and healthcare could benefit from long-term structural themes. Both sectors have reported solid results and we believe they remain well-placed to continue to benefit from their respective structural growth drivers, even though they might fall out of fashion with investors in the short term.

Elsewhere, with our macro view remaining constructive, we continue to see good support for smaller businesses and maintain our tactical overweight to UK smaller companies as communicated previously.

The strong earnings season has led to an acceleration in earnings revisions. For example, the consensus 2021 expected EPS of the STOXX Europe 600 has been revised upwards by 3% since the start of the month.

We are well aware that this pace of positive revenue and earnings adjustments cannot be continued indefinitely. Nevertheless, the figures published to date underline our generally positive view on equity investments and the general good state of the global economy.