Before we determine a fund to be sustainable, we assess its investment process against a range of factors to make sure it meets our high standards.

- We’ve embedded a sustainability-oriented approach throughout our fund selection process.

- We consider five factors when assessing the sustainability of funds – intentionality, portfolio characteristics, research, active ownership and transparency.

- The three-step process comprises interviews, questionnaires and holdings analysis, and we use the information to assess a fund’s sustainability.

The Quintet investment universe includes traditional and sustainable funds. Before selecting a fund we conduct due diligence on various elements including the robustness of the investment process, the individuals running the strategy, the risk-adjusted return characteristics, the asset manager and the fund’s sustainability practises.

All funds – whether traditional or sustainable – have to demonstrate basic responsible practises. They include understanding environmental, social and governance (ESG) factors as well as a willingness to engage with the companies they invest in. Sustainable funds must fulfil not only investment risk-adjusted return criteria but also a more rigorous assessment of sustainability.

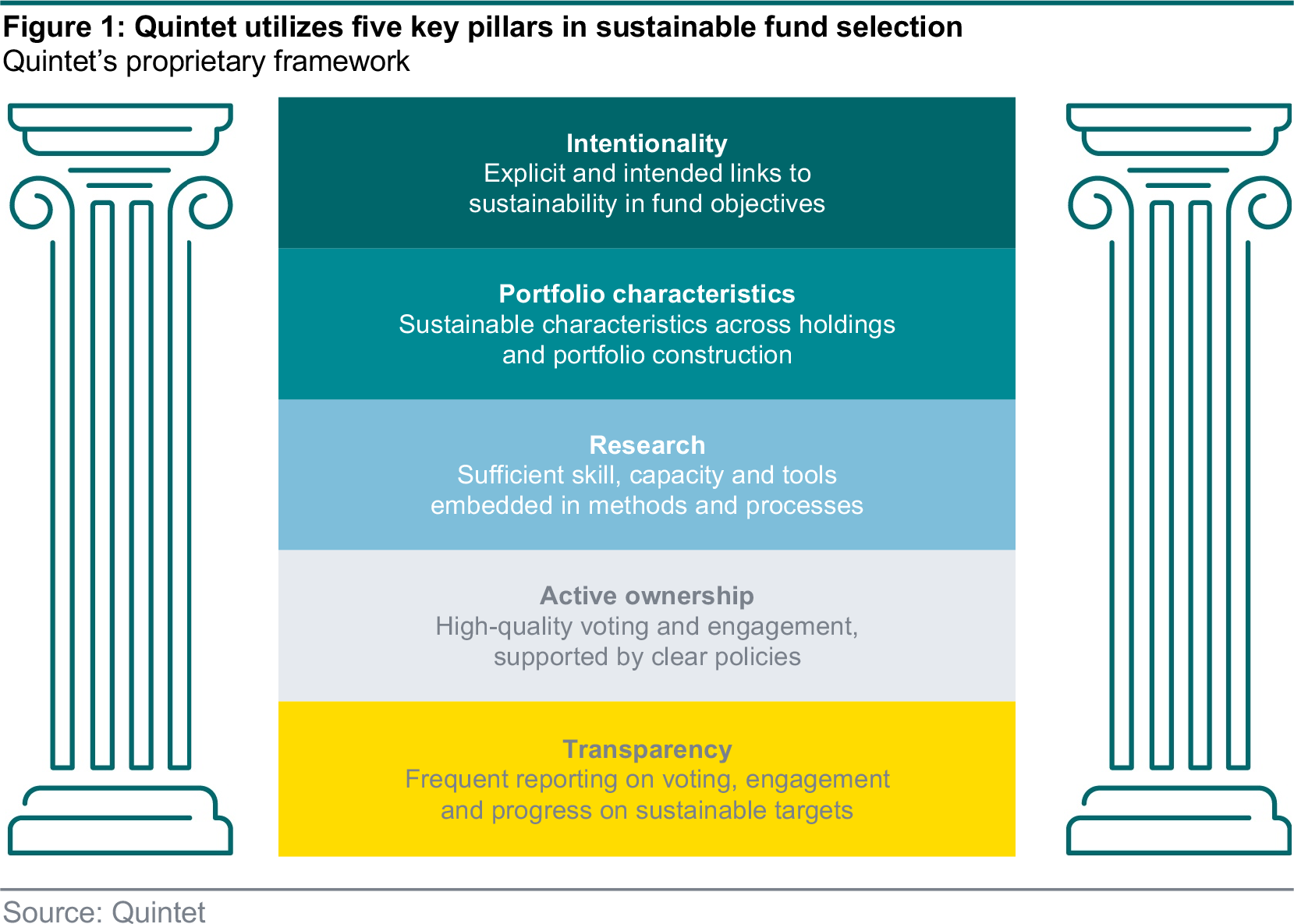

Our sustainable fund selection process is built on a robust principles-based philosophy. We have identified five key pillars that determine how sustainable a fund is (figure 1).

Investors interested in sustainability acknowledge that material ESG factors influence investment returns. We believe that for a fund to be considered as sustainable it has to commit to adhere to good governance principles and either makes sustainable investments or promotes environmental or social characteristics. However, good intentions alone are not enough. The fund’s holdings and its portfolio construction methods have to demonstrate clearly that sustainable characteristics align with the manager’s intentions.

To achieve sustainable portfolio characteristics and fulfil intent, the manager has to have adequate resources and methods in place to make sure that sustainable factors can be fully embedded.

Furthermore, the evaluation of a sustainable investment doesn’t stop when a security is purchased. We believe engagement and proxy voting for equity funds are crucial elements to assess and influence the behaviour of investee entities. Finally, we urge sustainable funds to be transparent about the way they have implemented sustainability into their portfolios and how they have executed their sustainable fiduciary responsibilities.

To assess the five key pillars, we operate a three-step process comprising interviews, questionnaires and holdings analysis.

This process generates a multi-dimensional analysis. It provides both depth and flexibility and enables a full assessment of a fund’s sustainability. This detailed analysis, in our view, is a superior investment process than relying on a single third-party indicator – often derived solely from holdings analysis.

Interview: an interview with the fund manager enables us to understand how sustainability is embedded in the fund. We ask them a number of questions, such as:

- How does the sustainable selection process work. Is it only focused on sustainable risks or is sustainability also seen as an investment opportunity?

- To what extent do the fund managers rely on quantitative data and what is the quality of that data?

- To what extent is the asset manager undertaking fundamental sustainable research and how does this factor into the portfolio?

- Are the skills and resources sufficient given the sustainable selection process?

- What are the key beliefs of the fund managers regarding sustainability?

- How and on which subjects is the asset manager engaging with the companies they are (considering) investing in, and how are the outcomes of the engagement factored into the sustainable investment process?

- If the fund claims to invest in instruments that have a positive influence on sustainability, how do they define positive impact, measuring and reporting?

Questionnaire: asset managers answer a questionnaire about sustainability. There are 120 questions on subjects such as United Nations (UN) Global Compact compliance, the fund’s investment process, the use of exclusions, the availability of resources and transparency of reporting.

Holdings: we analyse the fund holdings using both quantitative and qualitative methods. Considerations include whether the holdings have links to the UN Sustainable Development Goals (SDGs) or are exposed to substantial sustainability risks, controversies and carbon intensity.

With passive funds or exchange-traded-funds there is no need to interview the manager as the fund is following a specified index. The questionnaire is partly answered by the asset manager and partly by the underlying index provider.

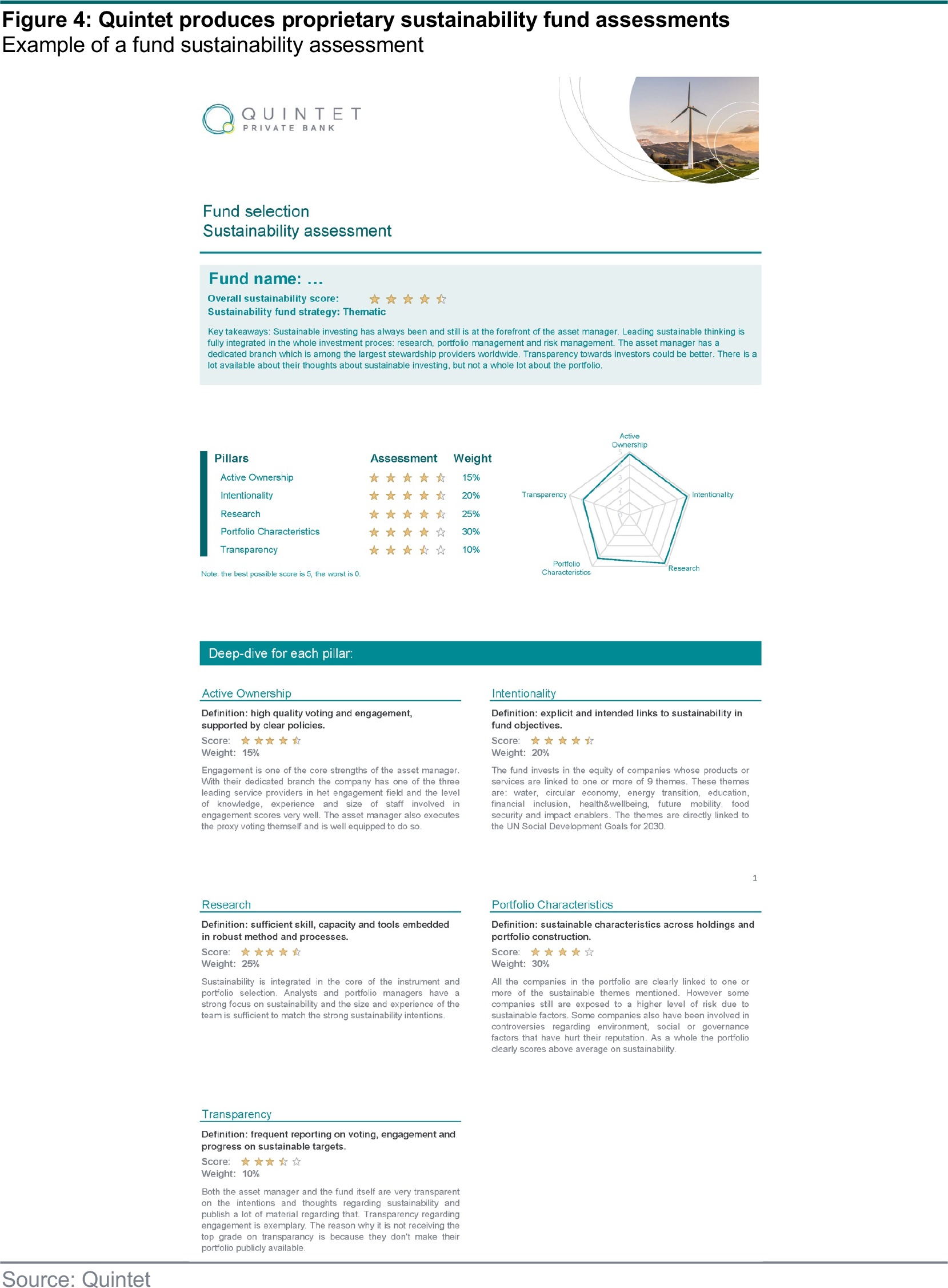

Based on the three-step process all five key pillars are awarded a Quintet sustainability score between 0 (low) and 5 (high).

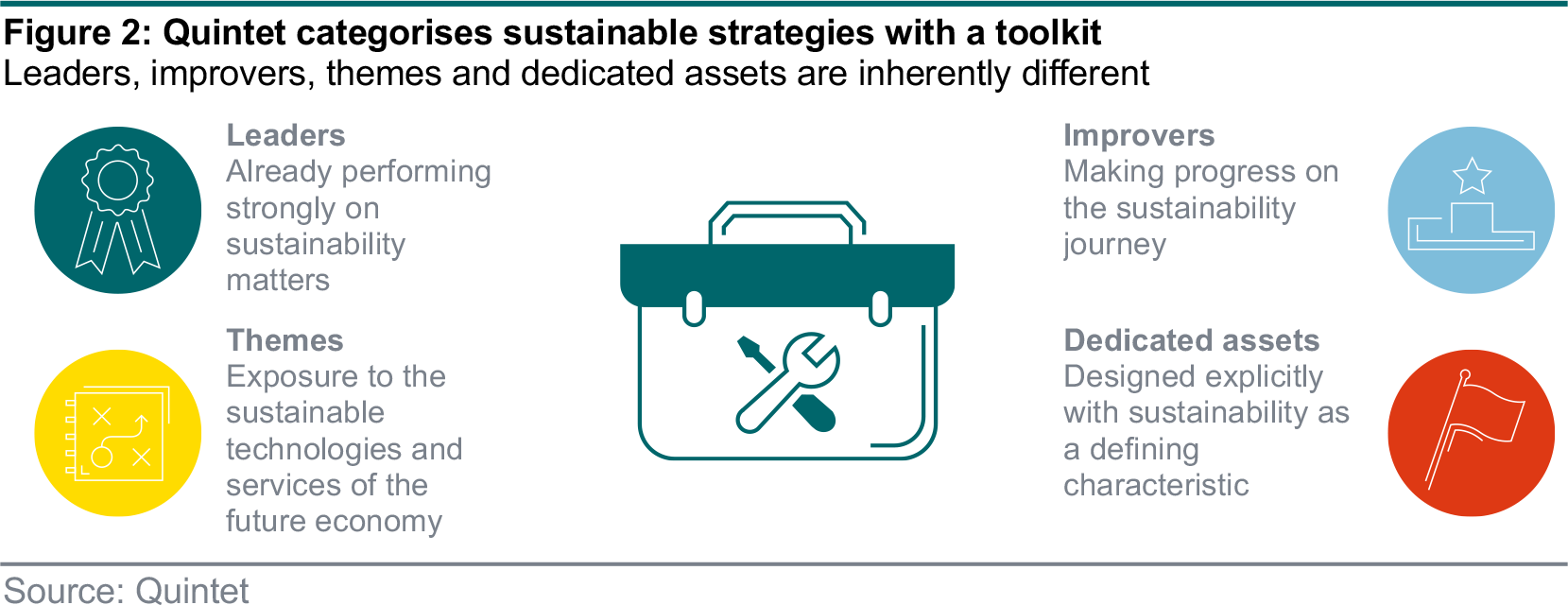

We understand that sustainable investing strategies can be heterogenous – and fund managers may use different elements of a sustainable toolkit in pursuit of competitive risk-adjusted returns (figure 2).

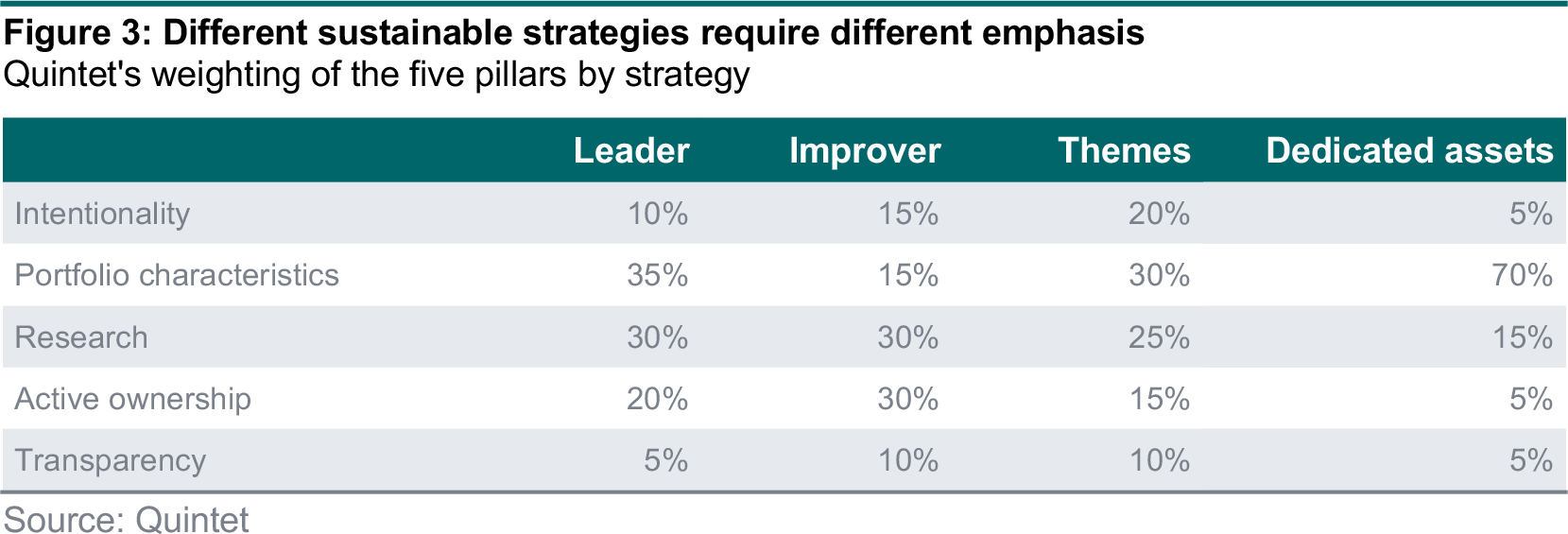

The relative emphasis we place on the five pillars depends on the sustainability strategy we are assessing (figure 3).

Leader strategies seek to identify entities that are already performing strongly on sustainability matters. They are the most common sustainable investing strategy among fund providers. In our assessment we pay particular attention to the portfolio characteristics, research and active ownership. Intentionality and transparency are important additions.

Improver strategies seek to identify entities that are making progress on the sustainability journey. The focus on improving sustainability leads to a reduced emphasis on the portfolio characteristics and the sustainability of holdings. However, manager intentionality is very important as the manager is deliberately seeking to identify improving sustainable practises of investee companies. Active ownership is also emphasized as this can be deployed to catalyse the desired sustainable improvements. Transparency is needed to explain the efforts and progress made.

Thematic strategies seek to identify entities that have exposure to the sustainable technologies and services of the future economy. Our assessment criteria has similarities with the leader weighting scheme. However, we emphasise intentionality as the fund is deliberately targeting an exposure – often linked to UN SDGs. There is a stronger focus on transparency as communication on how investments fit the theme and how they contribute to sustainability is important in these types of funds.

Dedicated assets are financial assets explicitly designed with sustainability as a defining characteristic. Consequentially, the portfolio characteristics are strongly emphasized in the assessment. Research and active ownership are less prominently weighted due to the inherent sustainability of the instruments selected.

Once the analysis has been finalised, a short written summary accompanies the final score of the fund. Each of the scores of the five key pillars that played a role in the final analysis receive individual comments. Figure 4 shows an example summary.

If deemed attractive from a risk-adjusted return perspective and from the sustainability assessment, the fund may be added to our investment universe and / or model portfolios.

Authors:

AJ Singh Head of ESG & Sustainable Investing

Bas Gradussen Sustainable Investment Strategist

Giang Vu Sustainable Investment Strategist

Martynas Rudavicius Sustainable Investment Strategist

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 16 August 2021, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2021. All rights reserved.