Our flagship investment solution integrates all the expertise of the Quintet Group

Your portfolio will benefit from the research and the views of our analysts and investment teams across our group of boutique private banks and wealth managers operating across over 50 European cities.

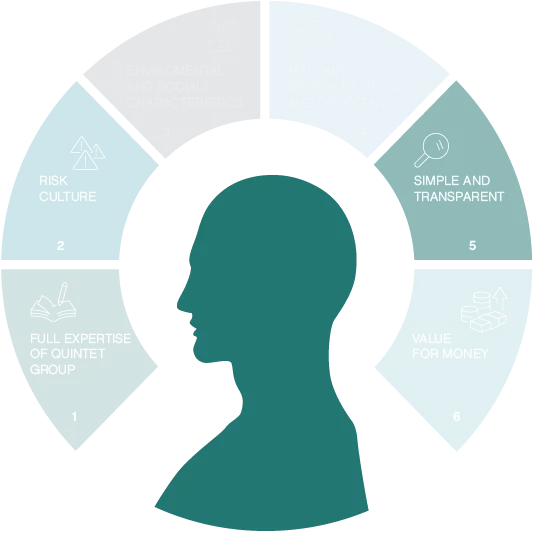

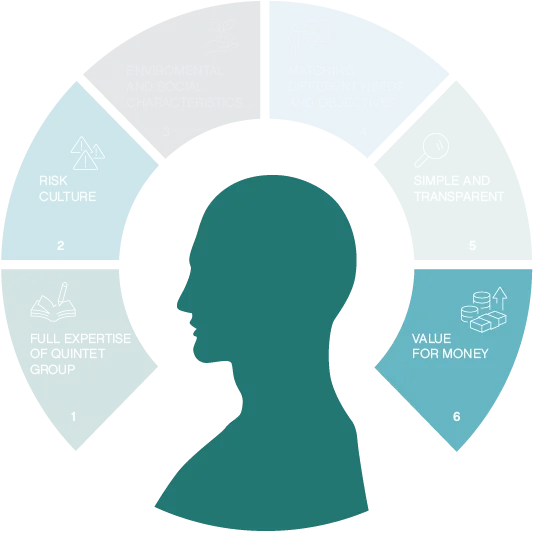

At a glance

Discover how our flagship solution could benefit you.

EXPERTISE

Full expertise of Quintet Group

One solution integrating all the expertise of the Quintet Group.

RISK CULTURE

Risk culture

A diversified portfolio aligned to your risk profile, which our experts will help you define.

ENVIROMENTAL AND SOCIAL

Environmental characteristics at its core

Environmental characteristics integrated into every part of the investment process and portfolio construction.

FIND OUT MORE

NEEDS AND OBJECTIVES

Matching different needs and objectives

Profiled solutions adapted to your immediate and long-term goals and your attitude to risk.

FIND OUT MORE

SIMPLE AND TRANSPARENT

Simple and transparent

A fund wrapped solution with a focus on transparency via monthly reporting in addition to practical and relevant information provided by your dedicated Client Advisor.

VALUE FOR MONEY

Competitive fee structure

A simplified and cost transparent solution weighting real added value of underlying investments.

FIND OUT MORE

Invested in you

The first meeting with your Client Advisor is all about getting to know you, and you getting to know how we work on your behalf. We will then consolidate your investments into a portfolio, which will be aligned to your objectives and risk profile.

Our approach

Investment markets are always evolving and it is crucial that we adapt to prevailing market condition, your portfolio will benefit from the research and analysis of our investment teams across our group of boutique private banks and wealth managers operating across over 50 European cities.

Keeping you informed

You will receive regular reporting on how we interpret the markets and the optimisations we are implementing to your portfolio.

How we build our complete solution

We have defined a robust process that focuses on gathering all the expertise of Quintet investment teams across Europe. We have built this process around these pillars: we first analyze the long-term trends of the market, we then integrate shorter-term views and finally we incorporate refinements, often based on your preferences and appetite to risk.

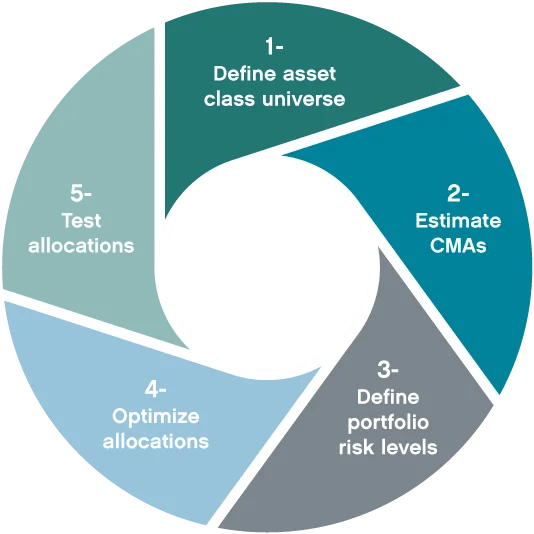

5 steps to build the Strategic Asset Allocation

-

We define which asset classes are in scope for the Strategic Asset Allocation, considering sustainable criteria.

-

Capital Market Assumptions (CMAs) are based on asset-class specific models, a multi-asset factor model and expert judgement.

-

In line with investor risk profiles, appropriate risk levels for different portfolio allocations are defined.

-

For each risk level, we find a diversified allocation that offers the highest expected return.

-

Finally, our SAA undergo a thorough stress test, based on historic data as well as value at risk simulations.

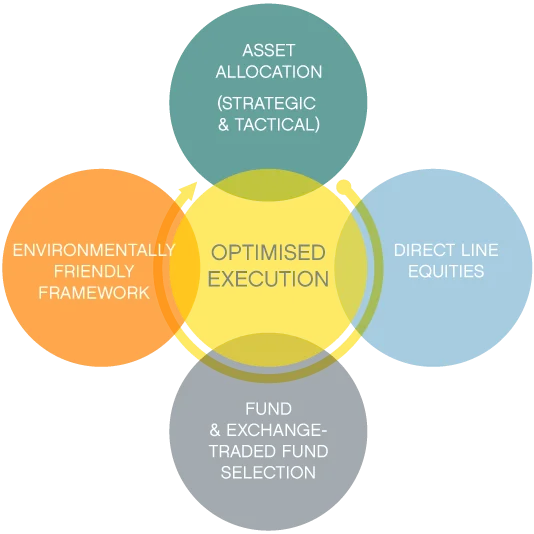

Optimised execution

Asset Allocation

Translation of the level of risk into a sustainable long-term portfolio. Asset Allocation Team may decide to adjust the long-term portfolios when it finds short-term investment opportunities.

Direct line equities

Equity Single Lines Model Portfolios defined by the direct equities team.

Fund & exchange-traded fund selection

Sustainable Model Portfolio defined by the Sustainable & Thematic team supported by the Group Fund Selection Team.

Environmentally friendly framework

Environmentally friendly characteristics embedded in the Investment & Selection Process.

A strategic view

Also known as Strategic Asset Allocation, the approach looks at the overall market trends, long-term investment activities and embeds risk profiles and environmentally friendly elements, which characterize our investment philosophy.

A shorter-term view

Known as Tactical Asset Allocation, we look at shorter-term opportunities focused on a 6 to 12 months horizon bringing flexibility into our approach.

Opportunities for refinement within your portfolio

Fixed income

Equity

Funds

Sustainability

Start your investment journey today

Our flagship solution is available in all our offices across the Quintet group. To get started contact one of our experts in your local office.

Discover more

How we help you

As a private bank for people who see the world differently, we partner with you to help you to invest in the life you want for yourself and your family, providing insight and introducing opportunities – always putting you first.

Insights

Here you will find stories that inspire and inform. Access the latest investment views and financial market insights. News from the world of Quintet and about the topics that matter.

Investment Management

Our investment management service isn’t just designed to help you achieve your financial goals; it’s designed completely around you, your immediate and long-term goals, your attitude to risk and even how comfortable you are with making investment decisions.