- In our view, commodities, excluding gold, add limited value to a liquid multi-asset portfolio and have a large negative environmental and social footprint.

- Unlike other commodities, gold offers meaningful investment diversification benefits. It can also be infinitely recycled with no degradation in quality, placing it in a unique position to benefit from the trend of moving towards a circular economy.

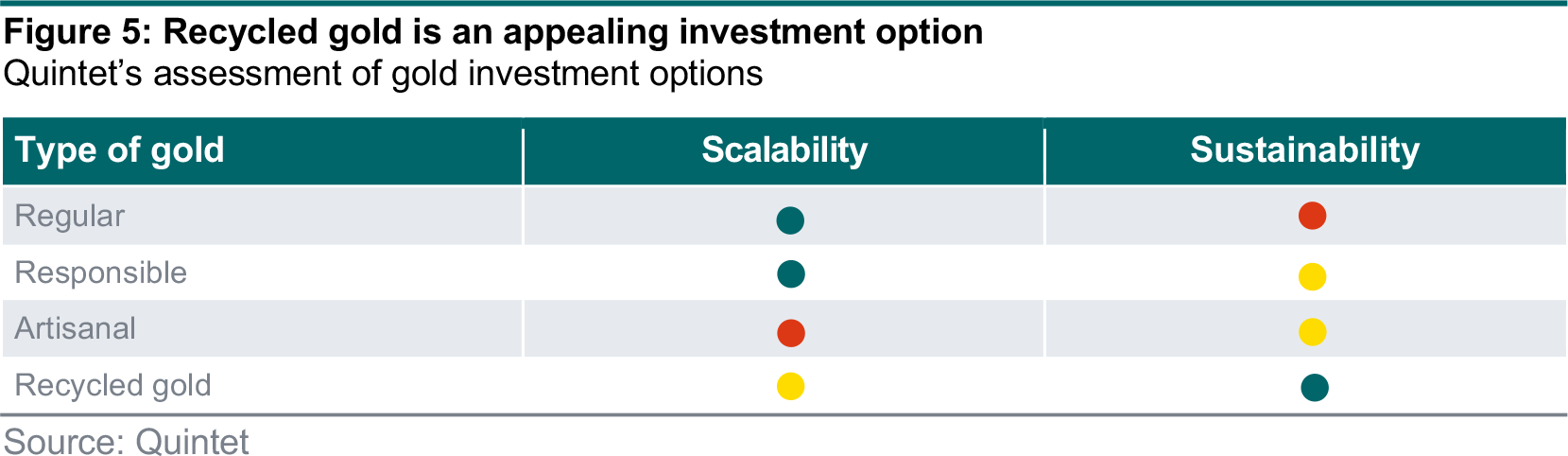

- Recycled gold is an attractive opportunity for sustainable investors. It is highly differentiated, has strong sustainability credentials and enough scale to meet current and future demands.

Commodities are physical goods comprising various sectors: energy (e.g. oil and gas), base metals (e.g. iron and copper) and soft commodities (e.g. wheat and pork). They are tradable and often produced to uniform standards.

What is our view on commodities?

In our view commodities, excluding gold, add limited value to a liquid multi-asset portfolio. Most offer no cash flow, have low Sharpe ratios and, when financially modelled, represent a small weight in a diversified investment portfolio. Our sustainability view is that they typically have a large and negative environmental and social footprint, causing significant ecological damage. For example:

- Agriculture (c.35% of commodity indices) accounts for c.70% of global freshwater withdrawals.

- Oil and gas (c.30% of commodity indices) combustion accounts for c.50% of global greenhouse gas emissions.

- Industrial metals (c.15% of commodity indices) account for c.10% of global greenhouse gas emissions.

How is gold different?

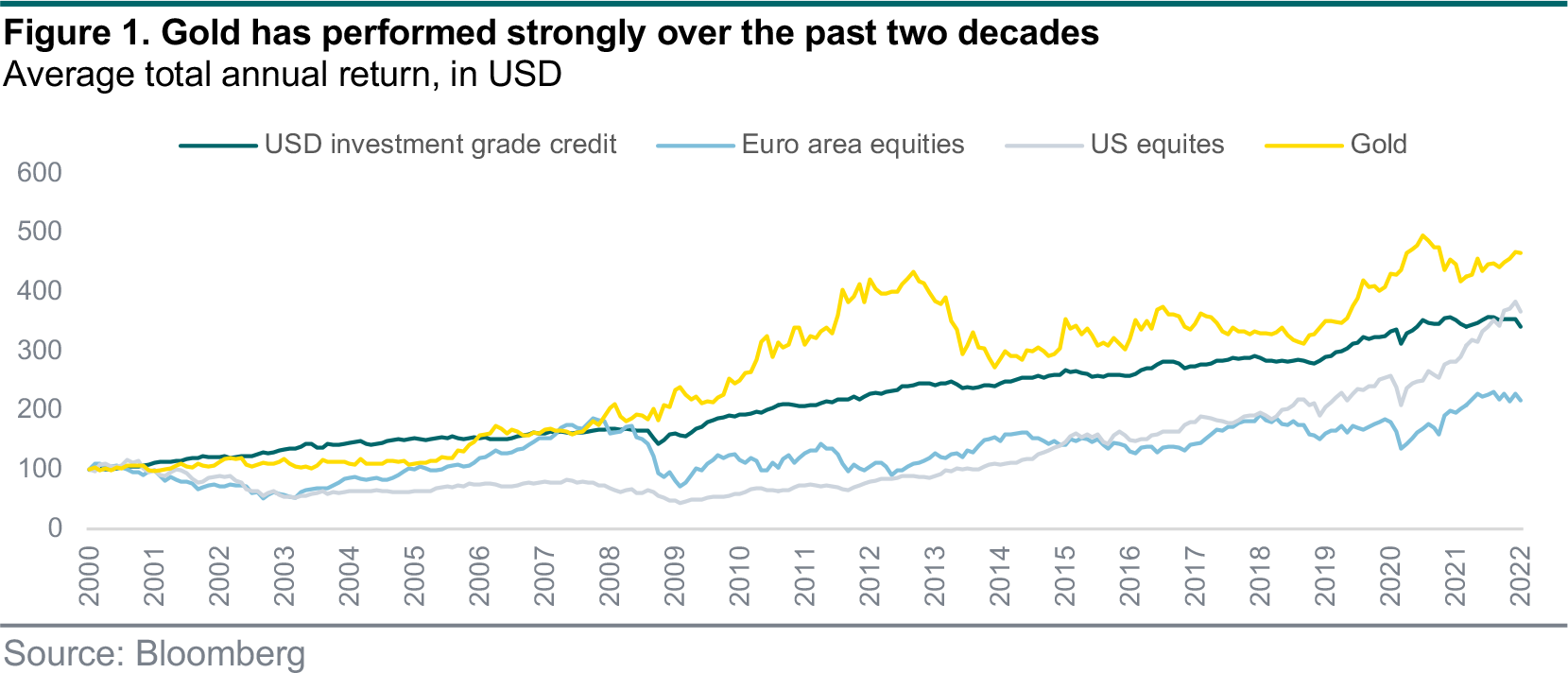

Gold is valuable and rare, historically preserving its value over time. Its price has increased almost five-fold since 2000 (figure 1). It is coveted as a diversifier and store of value, particularly in times of market, socioeconomic and political stress. UBS reports that on average family offices hold 3% of assets in gold and that 49% of them intend to increase their holdings.

Gold strategically differentiates from other commodities, benefiting from diverse sources of demand: as an investment, a reserve asset, jewelry and a technology component. Unlike most other commodities, gold is not consumed by its use and does not degrade over time so it can be infinitely recycled. Consequentially, all mined gold – about 200,000 tons – is still present today in one form or another. If all mined gold was gathered together in its pure form, the resulting cube would measure only around 22 meters on each side.

Where does gold come from?

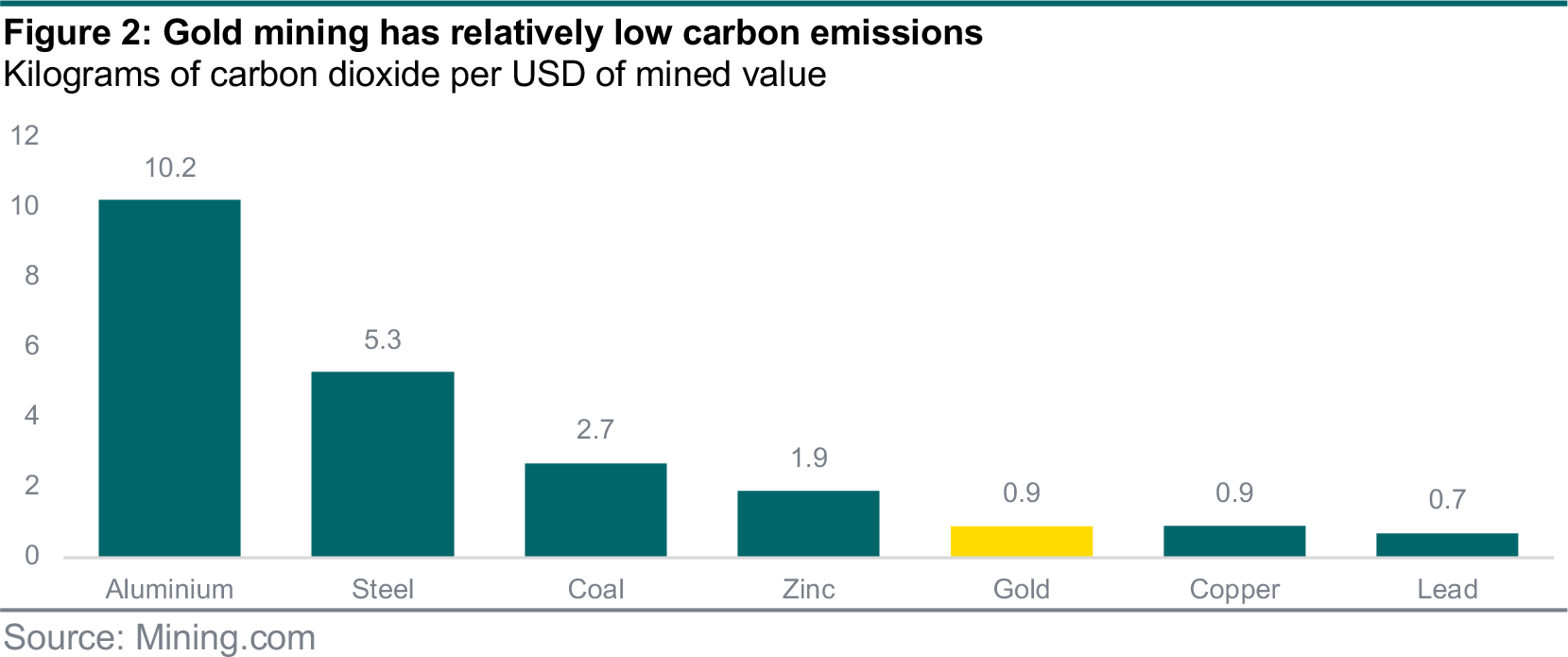

Mining is the dominant source of gold supply, accounting for nearly 75% of annual production.6 Gold extraction relies on controlled detonations and clearing extensive pieces of land, and the process can produce large amounts of toxic waste from sodium cyanide leaching. It is also energy intensive, resulting in significant carbon emissions. Nevertheless, carbon emissions for gold production are smaller than for other major mined materials (figure 2).

The majority of greenhouse gas emissions associated with gold occur during the mining and milling process, primarily from electricity generation and consumption. This makes opportunities to decarbonize gold increasingly accessible and cost-effective compared to other sectors such as agriculture or aviation. The World Gold Council estimates that the emission intensity of power used in gold production will fall by 35% by 2030, mainly due to grid-sourced electricity decarbonization and the increased use of onsite renewables.

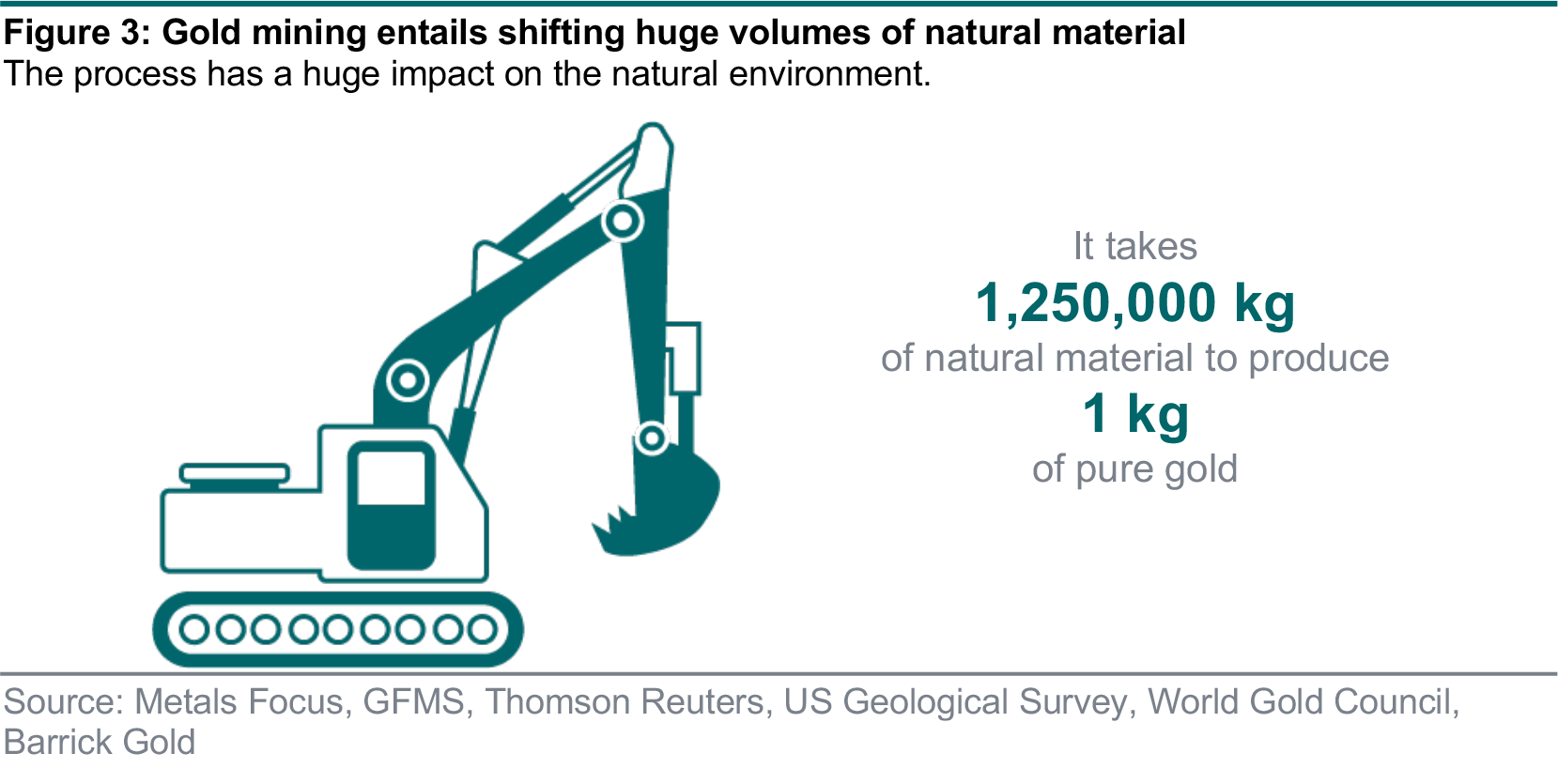

Nevertheless, commercial gold mining entails shifting huge volumes of natural material. With gold grades (the ratio of gold to rock) declining each year, approximately 1,250,000 kilograms of rock must be mined to obtain 1 kilogram of gold (figure 3). This has a significant negative impact on landscapes and natural ecosystems.

Recycled gold accounts for approximately 25% of global supply. It is estimated that the earth’s commercially mineable gold reserves will be exhausted within the next 15 years8, making gold recovery increasingly important. The current above-ground stock of gold is over 200,000 tons. Although part of this stock will not return to the market (for example due its use in religious decoration) the stock equates to approximately 50 years of global demand. The largest above-ground stock – nearly 50% is kept in jewelry, and currently accounts for 90% of recycled gold supply.

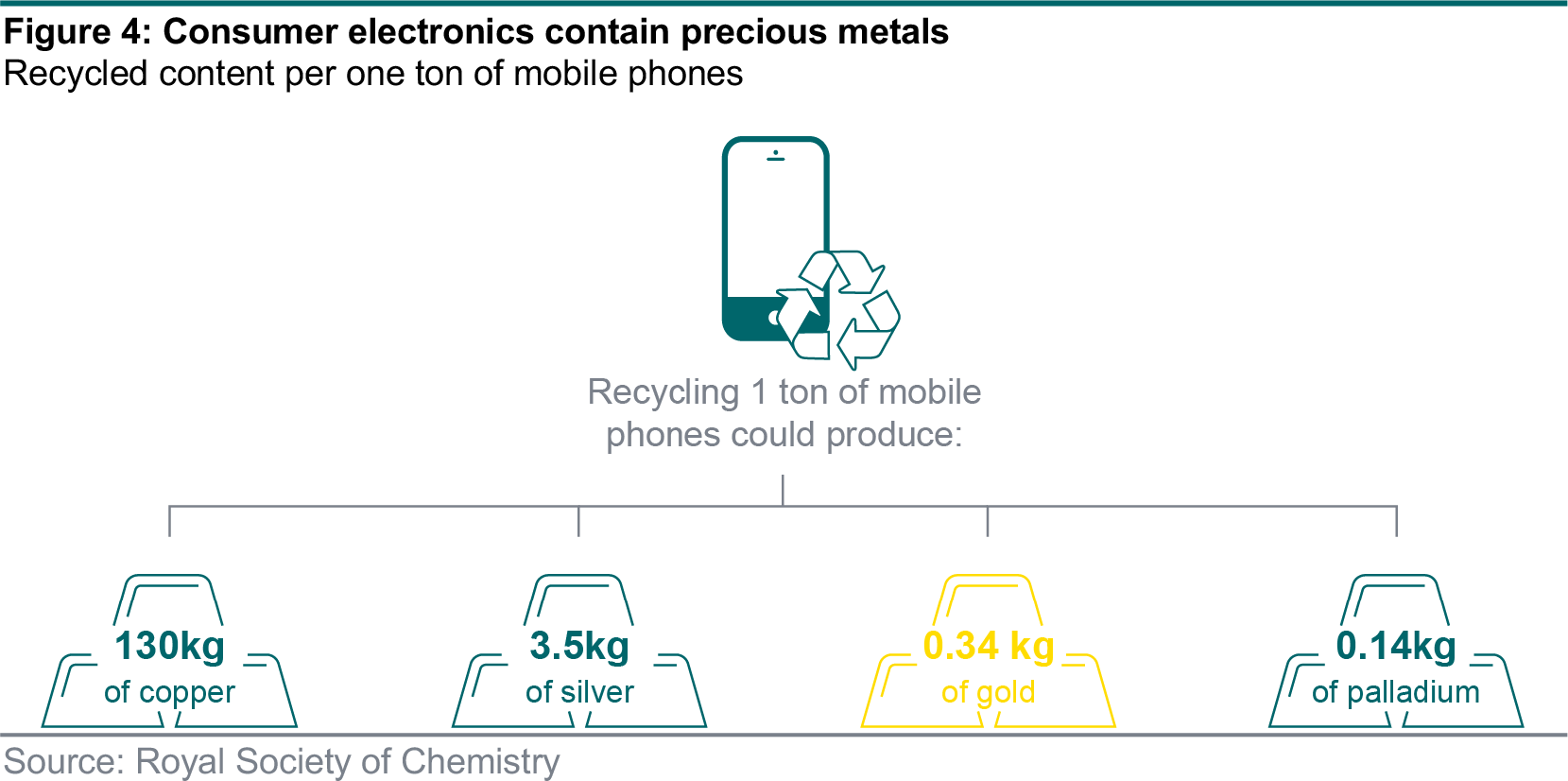

The other 10% comes from electrical waste and electronic equipment. According to the UN’s Global E-waste Monitor 2020, a record of 53.6 million tons of electronic waste was generated worldwide in 2019 but only a sixth was collected and recycled. This means that gold, silver, copper, platinum and other high-value recoverable materials valued at USD 57 billion were mostly dumped or burned rather than collected for treatment and reuse. Converting waste mountains of old electronics into precious metals represents an important opportunity to contribute to the UN’s sustainable development goal 12 “responsible consumption and production” by reducing waste generation, making more efficient use of natural resources and transitioning to a circular economy.

Because recycled gold does not have to be mined, it has significantly lower adverse environmental and social impacts. For example, the carbon footprint of the production of 1 kilo of scrap gold is less than one-twentieth compared to that of traditional mining11. Additionally, toxic waste from leaching and land degradation are avoided.

Many consumer goods companies have been switching to recycled gold, which underlines its widespread appeal. For example, in 2018 Dell became the first personal computer manufacturer to use recycled gold from e-waste in its products. Pandora, the world’s largest jewelry brand by volume, is committed to using 100% recycled silver and gold by 2025 as part of its pledge to become carbon neutral.12

A disadvantage of recycled gold is that, by definition, it must have been mined and thus may have been extracted in a way that created negative environmental or social impacts. While this is undesirable, we recognize that the past cannot be changed but the future can. Sustainability is often defined by the UN’s 1987 Brundtland Commission Report as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”.

Consequentially, it is better to reuse an existing material, even if its provenance cannot be confirmed, than to consume significant resource to create identical virgin material.

How can you invest in gold?

Buying physical gold involves buying bullion as coins or bars. Investors can also obtain exposure through investment vehicles such as exchange traded commodities (ETC) or funds (ETF). In Europe ETCs are the most common structure for gold investing, which are notes underwritten by an issuer and collateralized by physical gold. Depending on the issuer, various audits and assurances affirm the presence of gold. Investment vehicles can be supported by different types of gold, these include responsibly sourced gold, artisanal mining or recycled gold (figure 5).

Typically, gold is termed responsible if it has been recently processed through the London Bullion Metals Association (LBMA) as a “good delivery bar”. The LBMA’s good delivery system sets the standards in terms of metal quality, ethical trading and responsible sourcing. In 2018 the LBMA published a new version of its 2012 Responsible Gold Guidance, expanding it to include additional environmental, social and governance responsibilities. As a result, investing in gold refined from 2019 onwards provides investors with reasonable assurance that the refiner has demonstrated its adherence to the standard. In addition, mining companies may decide to embrace the Responsible Gold Mining Principles to provide further confidence to purchasers. Several gold ETC providers only source post-2012 or post-2019 LBMA good delivery bars.

Artisanal mining can be a crucial economic contributor for some rural communities. However, due to a lack of surveillance by local authorities, human and labor rights violations and environmental degradation are a concern. In response, the industry has developed monitored artisanal schemes focused on traceability using technologies such as blockchain and / or small-scale community- based mining projects that ensure miners are treated fairly. Typically, artisanal mined gold is only available in physical form or through small-scale bank-issued notes.

Until recently, recycled gold has only been available in physical form. However, as recycling volumes have increased, specialized market participants – such as the UK’s Her Majesty’s Royal Mint – have been able to generate enough volume to support ETCs that are partially backed by recycled gold, without materially comprising price or liquidity. Recycled gold material is obtained through verified sourcing, where concerted attempts are made to verify its origin. Thereafter it is refined on a separate manufacturing line to avoid contamination with mined product. It is then certified as recycled.

Authors:

AJ Singh Head of ESG & Sustainable Investing

Bas Gradussen Sustainable Investment Strategist

Giang Vu Sustainable Investment Strategist

Martynas Rudavicius Sustainable Investment Strategist

This document has been prepared by Quintet Private Bank (Europe) S.A. The statements and views expressed in this document – based upon information from sources believed to be reliable – are those of Quintet Private Bank (Europe) S.A. as of 28 February 2022, and are subject to change. This document is of a general nature and does not constitute legal, accounting, tax or investment advice. All investors should keep in mind that past performance is no indication of future performance, and that the value of investments may go up or down. Changes in exchange rates may also cause the value of underlying investments to go up or down.

Copyright © Quintet Private Bank (Europe) S.A. 2022. All rights reserved.