-

Quintet Group

Choose your location

- EN

- Contact Us

Choose your location

Menu

-

What we do

Passing on WealthBy thinking about legacy planning now, you can make sure your wealth is passed on to the people and causes close to your heart.

-

Insights

- Insights

- Insights hub

- Markets and investing

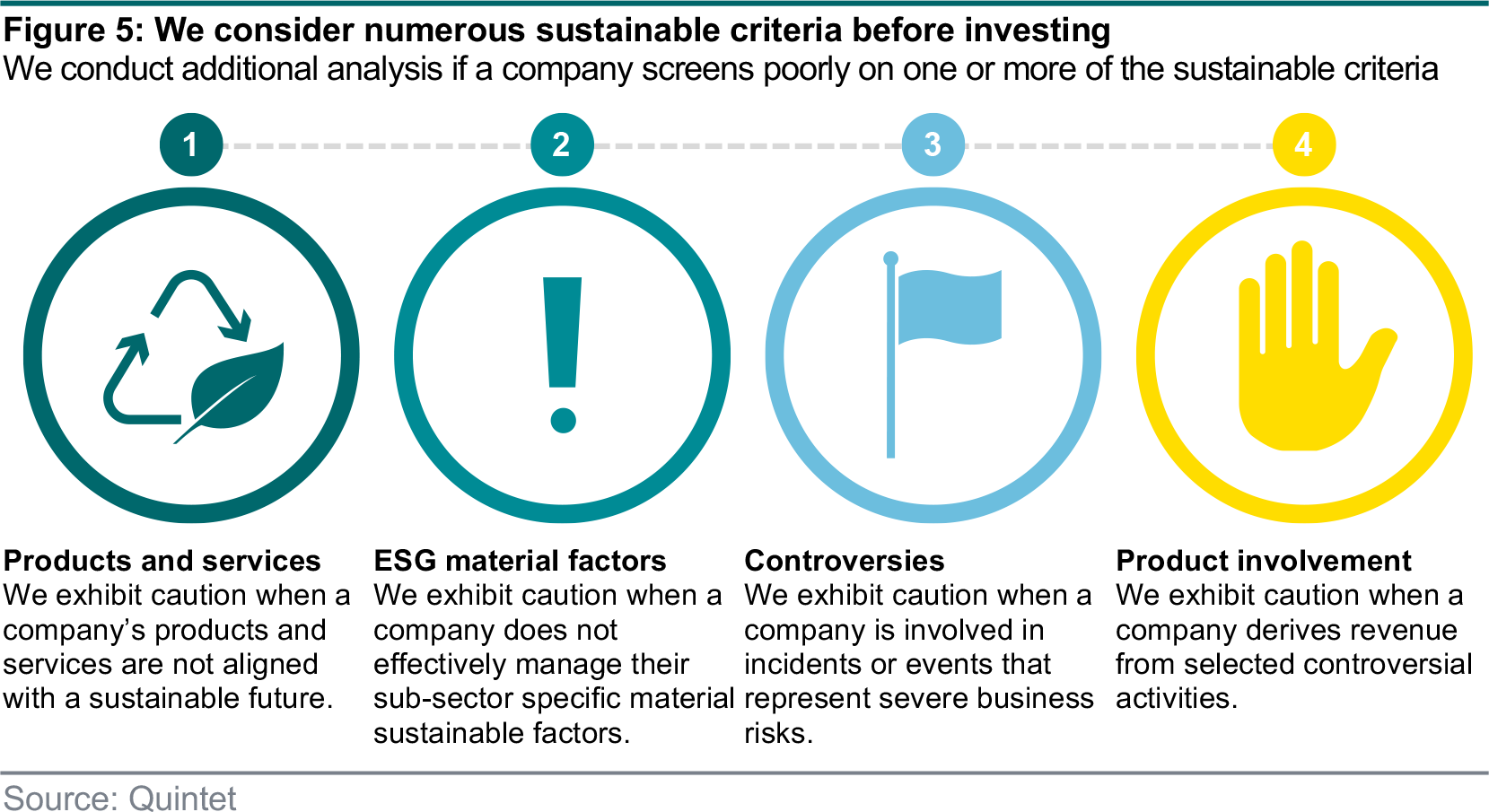

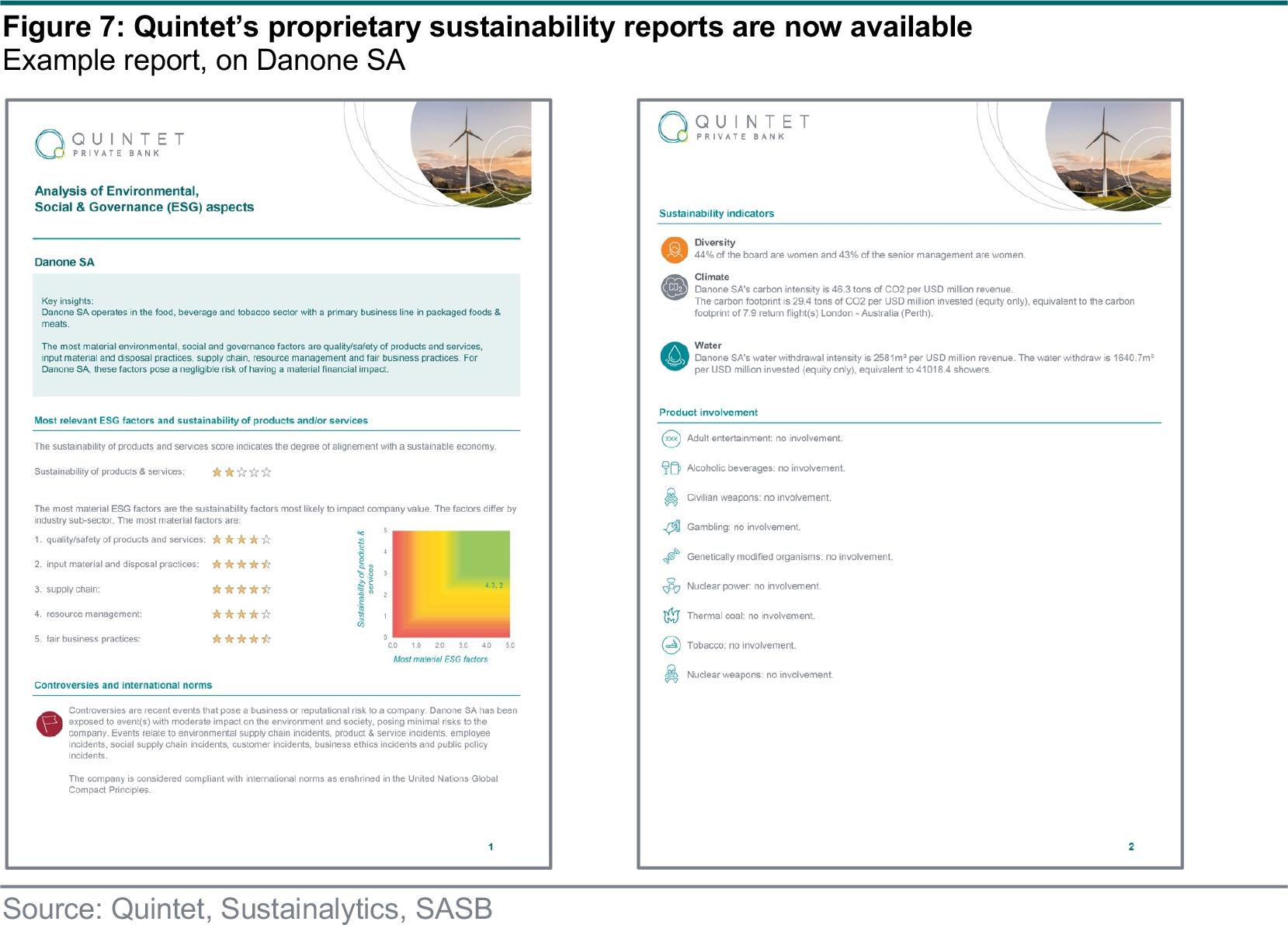

- ESG and Sustainable investing

- Wealth Planning

- Beyond markets

Counterpoint - April 2024: In the balanceOur view on stronger US growth, central banks and geopolitical risks.

-

Sustainability

- Sustainability

- Why sustainability matters

- Embracing sustainability in our practices

- Active Ownership

- Our journey towards corporate sustainability

Sustainability: Seizing the opportunityThe way people think about money and investing has changed.

-

About us

Quintet 2023 net profit rises to €46.9 millionPositive 2023 financial results, including a full-year net profit of €46.9 million, up from €18.1 million in 2022.

-

Careers